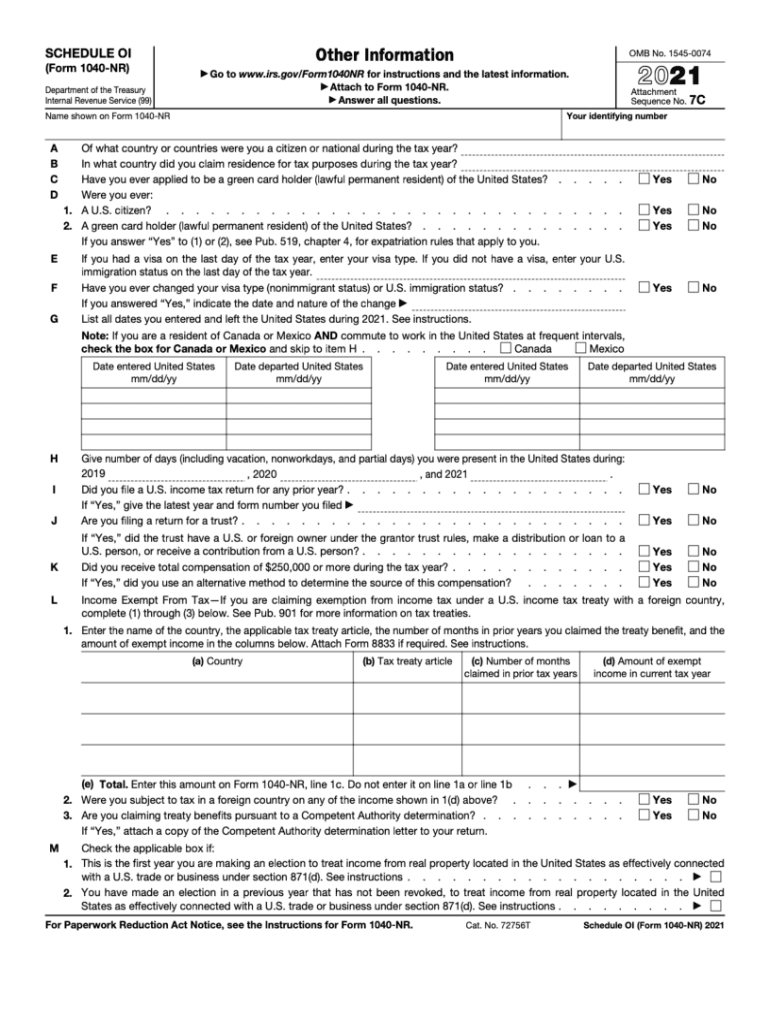

Form 1040-Nr Schedule Oi

Form 1040-Nr Schedule Oi - Department of the treasury internal revenue service. Schedule 2 (form 1040), part i owe other taxes, such as self. Edit your irs 1040 nr online. Web this determination means you are required to report your u.s. Please print or type apt. Save or instantly send your ready documents. Send schedule oi via email, link, or fax. This form is an important. Nonresident alien income tax return 2022 omb no. Web see irc § 6072(c) if an nra receives wages subject to chapter 24 withholding, the return is due on april 15th following the close of the calendar year.

Edit your irs 1040 nr online. Choose the get form button to. Get everything done in minutes. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Save or instantly send your ready documents. Web share your form with others. There are a schedule a (form 1040. Save or instantly send your ready documents. Nonresident alien income tax return (99)2021 omb no. Send schedule oi via email, link, or fax.

Web enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the treaty benefit, and the amount of exempt income in the columns. Please print or type apt. Choose the get form button to. Web complete 1040nr schedule oi instructions online with us legal forms. Nonresident alien income tax return 2022 omb no. Save or instantly send your ready documents. Web 1040 nr schedule oi form. Save or instantly send your ready documents. There are a schedule a (form 1040. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.

1040 Nr Schedule Oi Form Fill Out and Sign Printable PDF Template

This form is an important. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web identifying number (see instructions) present home address (number and street or rural route). Web enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the.

1040nr instructions schedule oi Canada Guid User Tutorials

Web schedule 1 (form 1040), part ii owe amt or need to make an excess advance premium tax credit repayment. Nonresident alien income tax return. Web see irc § 6072(c) if an nra receives wages subject to chapter 24 withholding, the return is due on april 15th following the close of the calendar year. Please print or type apt. Web.

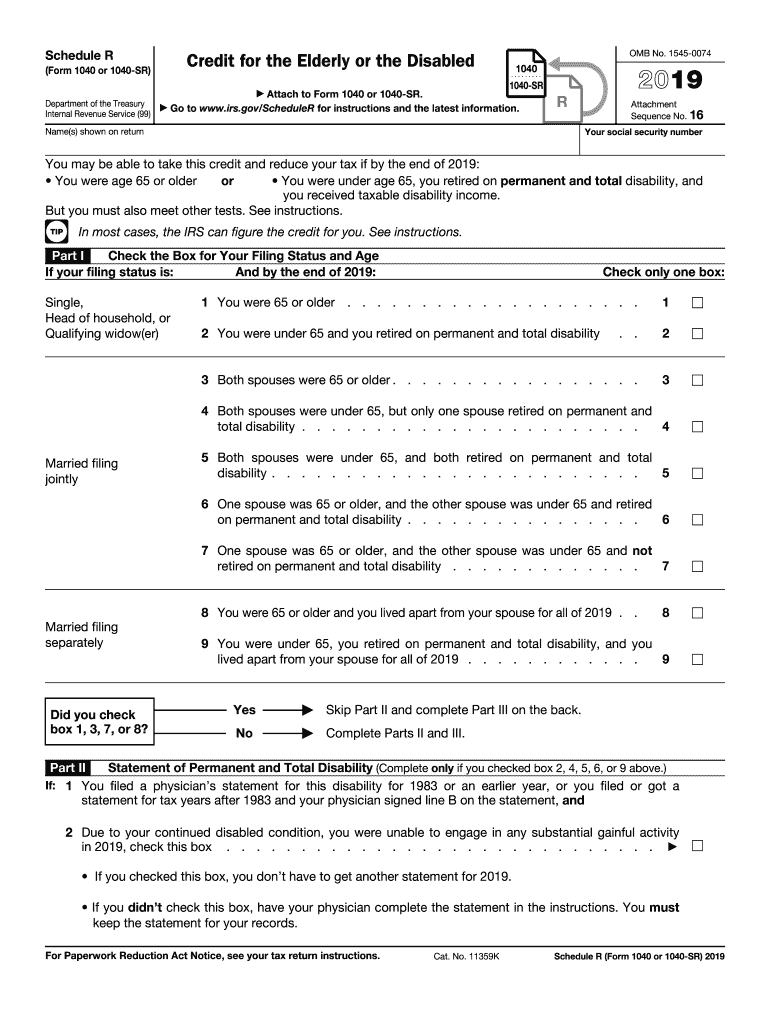

2019 1040A Schedule Fill Out and Sign Printable PDF Template signNow

Pick the template you want in the library of legal forms. Choose the get form button to. Easily fill out pdf blank, edit, and sign them. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web enter the name of the country, the applicable tax treaty article, the number of.

留学生报税如何利用 Tax Treaty 轻松省下1000刀? Tax Panda

Save or instantly send your ready documents. Nonresident alien income tax return (99)2021 omb no. Web 1040 nr schedule oi form. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Web see irc § 6072(c) if an nra receives wages subject to chapter 24 withholding, the return is due on april 15th following the close of.

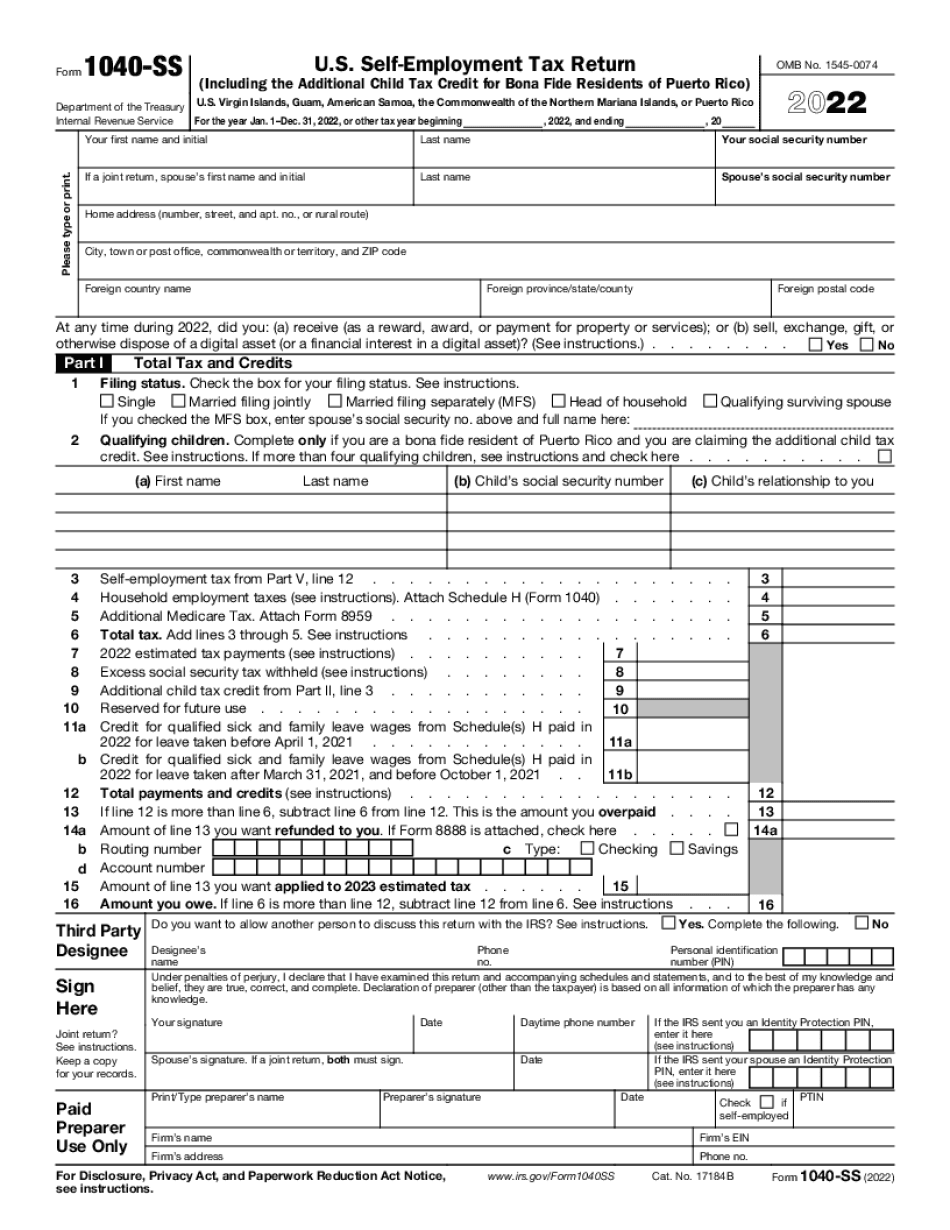

Irs 1040 Ss 20222023 Fill online, Printable, Fillable Blank

Nonresident alien income tax return 2022 omb no. Save or instantly send your ready documents. Web complete 1040nr schedule oi instructions online with us legal forms. Web schedule 1 (form 1040), part ii owe amt or need to make an excess advance premium tax credit repayment. Web 1040 nr schedule oi form.

1040nrez Tax Table

Web share your form with others. There are a schedule a (form 1040. Income only and must file special forms: Save or instantly send your ready documents. Nonresident alien income tax return (99)2021 omb no.

Do you need to file sch oi with form 1040nr?

Nonresident alien income tax return. Save or instantly send your ready documents. Edit your irs 1040 nr online. Web see irc § 6072(c) if an nra receives wages subject to chapter 24 withholding, the return is due on april 15th following the close of the calendar year. Please print or type apt.

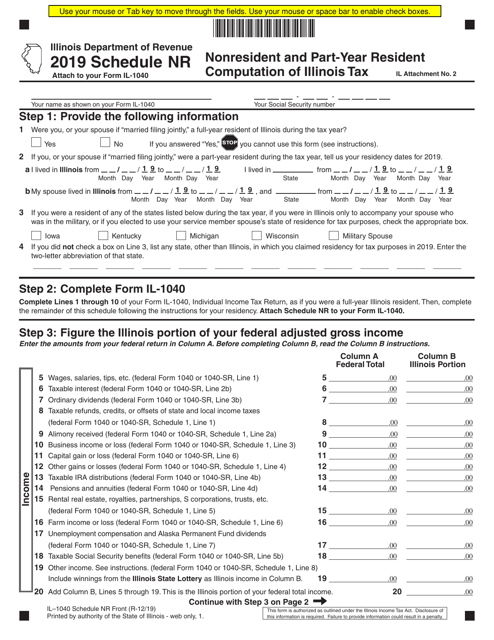

Form IL1040 Schedule NR Download Fillable PDF or Fill Online

Web enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the treaty benefit, and the amount of exempt income in the columns. Web see irc § 6072(c) if an nra receives wages subject to chapter 24 withholding, the return is due on april 15th following the close of the.

What is Form 1040NR? All you wanted to know about NonResident Alien

Please print or type apt. Save or instantly send your ready documents. Choose the get form button to. Web schedule 1 (form 1040), part ii owe amt or need to make an excess advance premium tax credit repayment. Web identifying number (see instructions) present home address (number and street or rural route).

Income Only And Must File Special Forms:

Web see irc § 6072(c) if an nra receives wages subject to chapter 24 withholding, the return is due on april 15th following the close of the calendar year. Department of the treasury internal revenue service. Web 1040 nr schedule oi form. There are a schedule a (form 1040.

Choose The Get Form Button To.

Web enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the treaty benefit, and the amount of exempt income in the columns. If you have a p.o. Edit your irs 1040 nr online. Pick the template you want in the library of legal forms.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Nonresident alien income tax return (99)2021 omb no. Send schedule oi via email, link, or fax. Easily fill out pdf blank, edit, and sign them. You can also download it, export it or print it out.

Web Share Your Form With Others.

Save or instantly send your ready documents. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web this determination means you are required to report your u.s. Nonresident alien income tax return.