Fillable Form 941 Schedule B

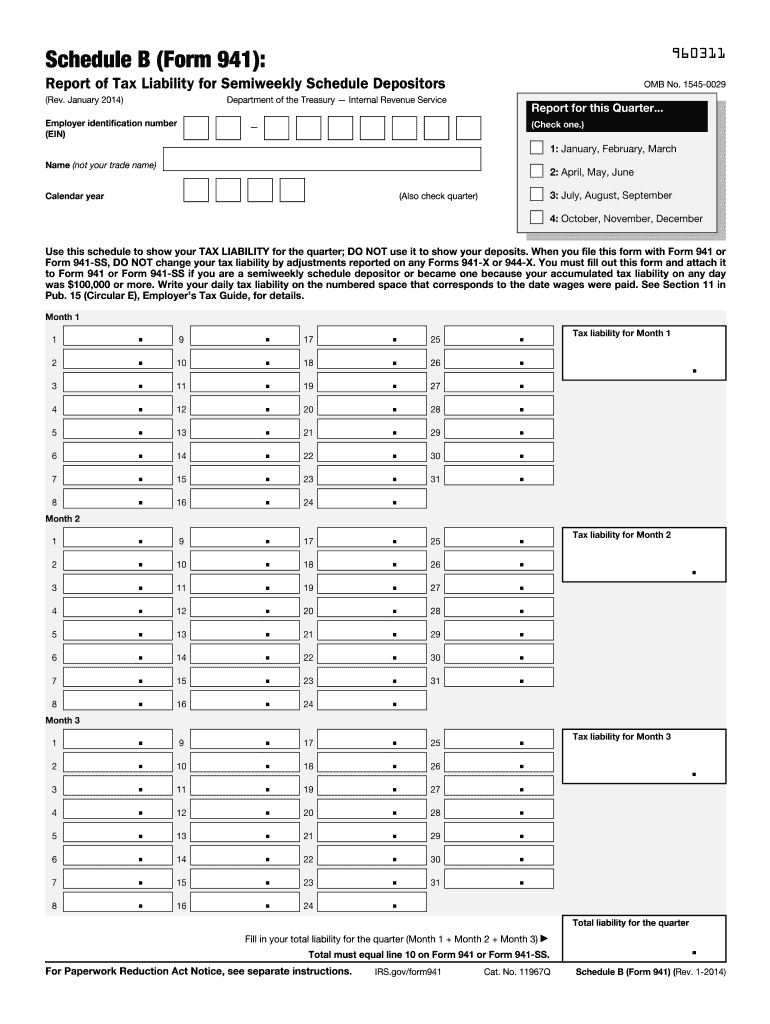

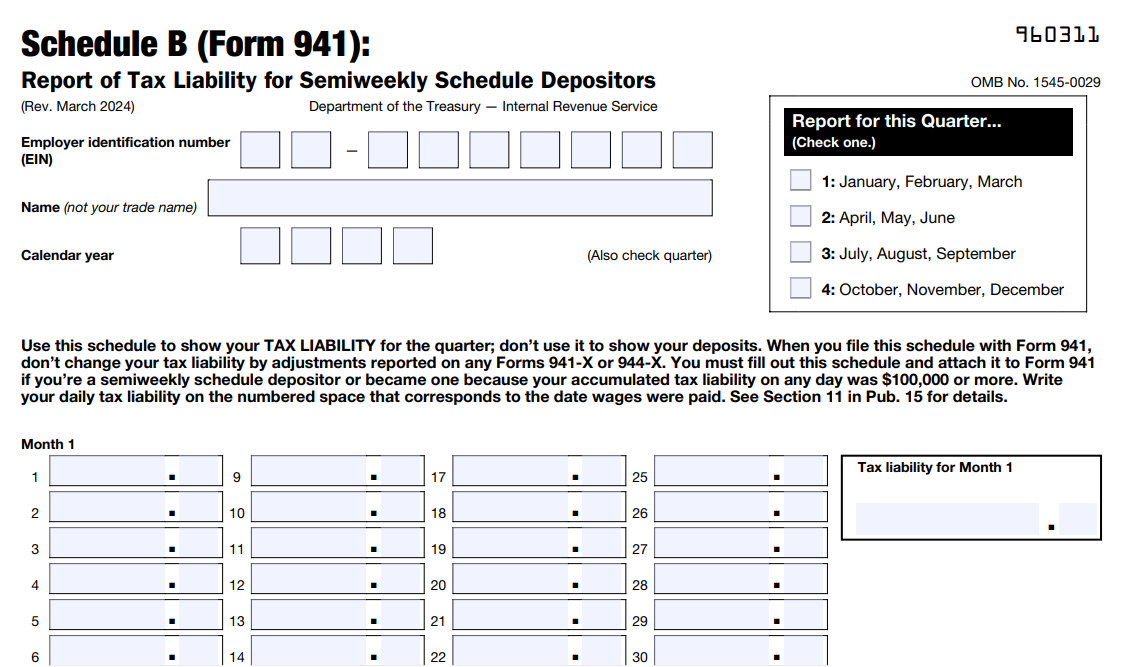

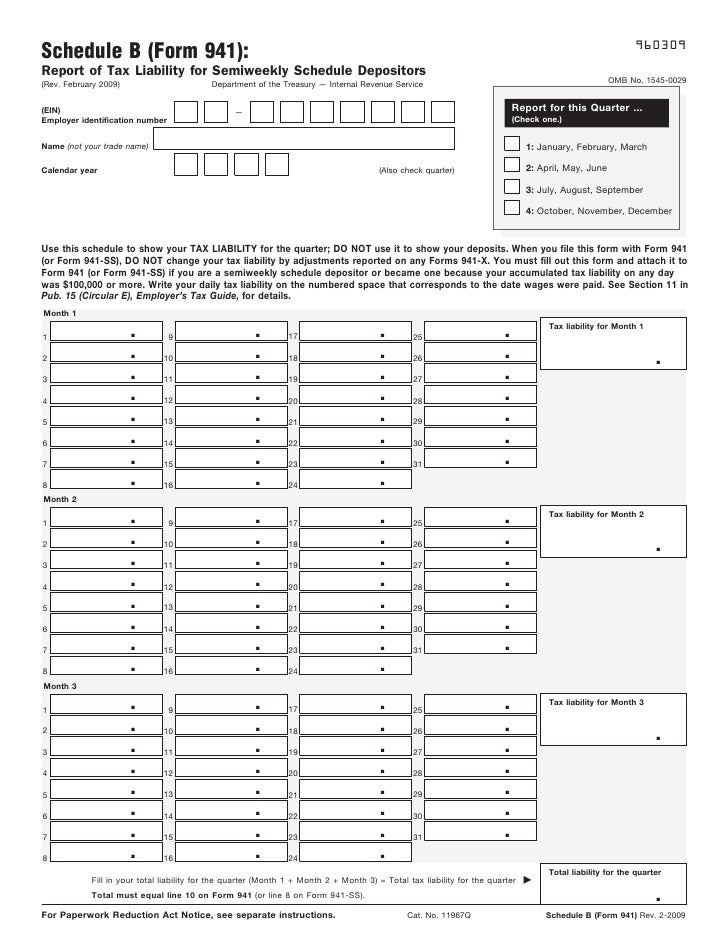

Fillable Form 941 Schedule B - Use get form or simply click on the template preview to open it in the editor. You are a semiweekly depositor if you: Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the Report of tax liability for semiweekly schedule depositors (rev. Web schedule b (form 941): Reported more than $50,000 of employment taxes in the lookback period. This form must be completed by a semiweekly schedule depositor who reported more than $50,000 in employment taxes or acquired more than $100,000 in liabilities in a single day in the tax year. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web file schedule b (form 941) if you are a semiweekly schedule depositor.

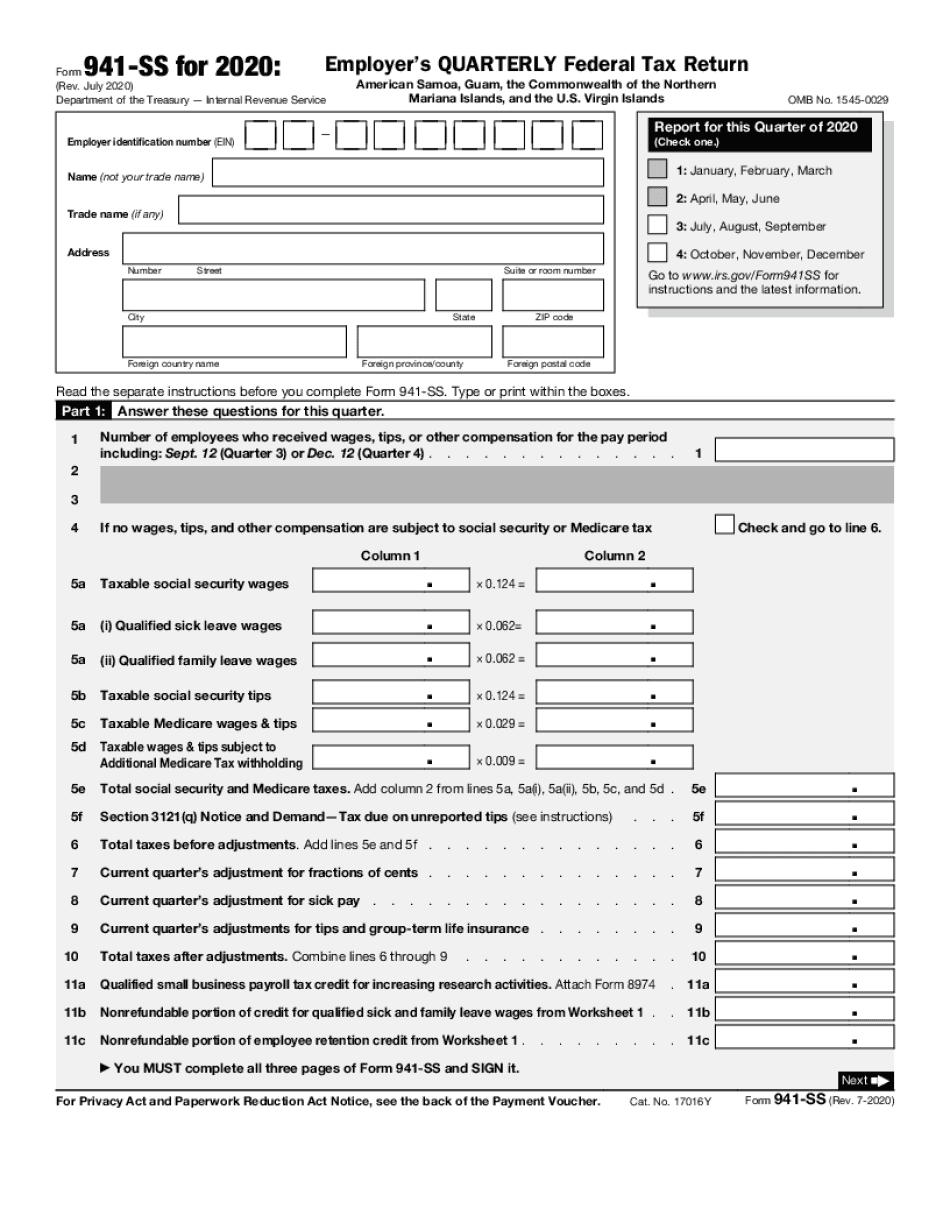

Share your form with others send 2019 form 941 schedule b via email, link, or fax. When you pay your employees, you are required to manage the applicable employee deductions and employer contributions for federal, state, and local payroll taxes. Web file schedule b (form 941) if you are a semiweekly schedule depositor. 15 or section 8 of pub. (check one.) employer identification number (ein) — 1: January 2017) department of the treasury — internal revenue service 960311 omb no. Web schedule b is filed with form 941. Income tax, medicare, social security, and unemployment insurance are all included under this umbrella. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Use get form or simply click on the template preview to open it in the editor.

Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web what is form 941 schedule b? Web when to send schedule b form 941. File schedule b if you’re a semiweekly schedule depositor. (check one.) employer identification number (ein) — 1: Report of tax liability for semiweekly schedule depositors (rev. January 2017) department of the treasury — internal revenue service 960311 omb no. Web schedule b is filed with form 941. Share your form with others send 2019 form 941 schedule b via email, link, or fax. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the

What is Form 941 Schedule B, Who Should Complete It? Blog TaxBandits

Start completing the fillable fields and carefully type in required information. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web a schedule b form 941 is used.

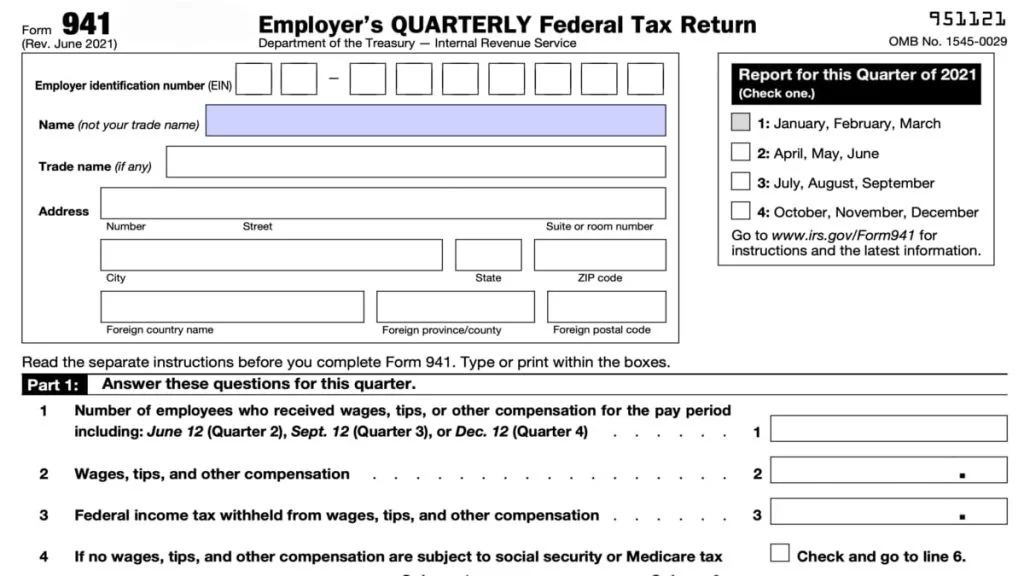

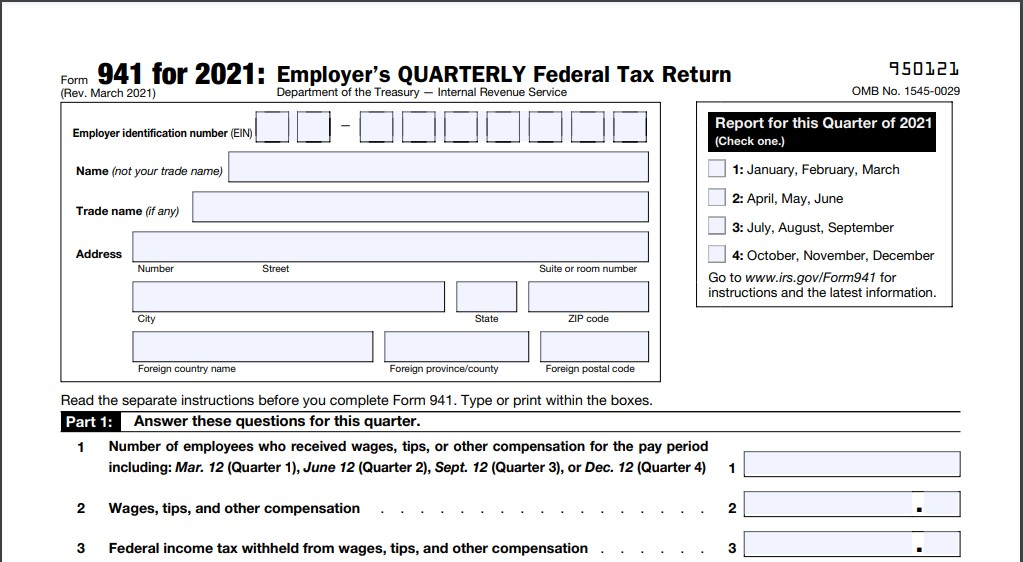

941 Form 2023

Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Reported more than $50,000 of employment taxes in the lookback period. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Schedule b (form 941) pdf instructions for.

schedule b form 941 2020 Fill Online, Printable, Fillable Blank

(check one.) employer identification number (ein) — 1: January 2017) department of the treasury — internal revenue service 960311 omb no. Use get form or simply click on the template preview to open it in the editor. Web schedule b is filed with form 941. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in.

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. Web what is form 941 schedule b? You are a semiweekly depositor if you: Share your form with others send 2019 form 941 schedule b via email,.

Fill Free fillable Form 941 schedule B 2017 PDF form

Reported more than $50,000 of employment taxes in the lookback period. January 2017) department of the treasury — internal revenue service 960311 omb no. Start completing the fillable fields and carefully type in required information. Edit your form 941 schedule b 2019 online type text, add images, blackout confidential details, add comments, highlights and more. Income tax, medicare, social security,.

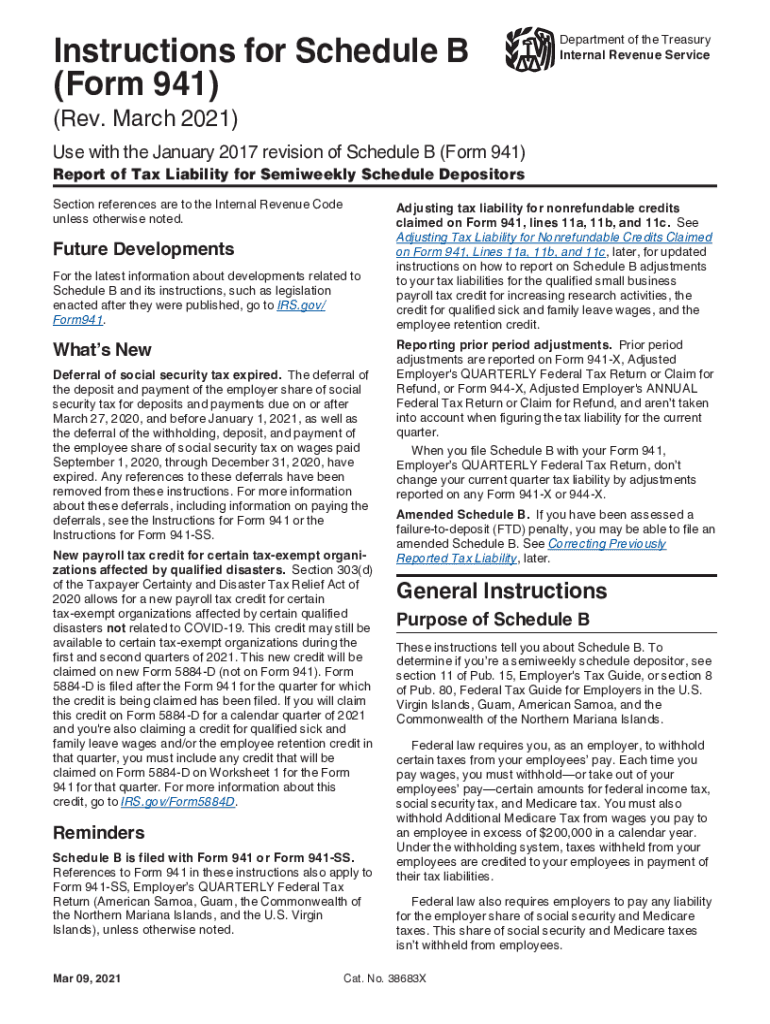

IRS Instructions 941 Schedule B 20212022 Fill and Sign Printable

Web file schedule b (form 941) if you are a semiweekly schedule depositor. Share your form with others send 2019 form 941 schedule b via email, link, or fax. (check one.) employer identification number (ein) — 1: Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. 15 or section 8 of pub.

Printable 941 Form 2021 Printable Form 2022

You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. January 2017) department of the treasury — internal revenue service 960311 omb no. You are a semiweekly depositor if you: You have to attach this.

File 941 Online How to File 2023 Form 941 electronically

Income tax, medicare, social security, and unemployment insurance are all included under this umbrella. Web schedule b is filed with form 941. Web when to send schedule b form 941. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web what is form 941 schedule b?

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

Use the cross or check marks in the top toolbar to select your answers in the list boxes. You are a semiweekly depositor if you: Start completing the fillable fields and carefully type in required information. Reported more than $50,000 of employment taxes in the lookback period. 15 or section 8 of pub.

2018 Schedule 941 Fill Out and Sign Printable PDF Template signNow

Web schedule b is filed with form 941. Web when to send schedule b form 941. This form must be completed by a semiweekly schedule depositor who reported more than $50,000 in employment taxes or acquired more than $100,000 in liabilities in a single day in the tax year. 15 or section 8 of pub. Don’t file schedule b as.

Income Tax, Medicare, Social Security, And Unemployment Insurance Are All Included Under This Umbrella.

Web when to send schedule b form 941. You are a semiweekly depositor if you: Web schedule b (form 941): File schedule b if you’re a semiweekly schedule depositor.

(Check One.) Employer Identification Number (Ein) — 1:

It means that you have approximately 30 days to send recordings of your tax liabilities for the ended quarter. Web what is form 941 schedule b? Start completing the fillable fields and carefully type in required information. Use get form or simply click on the template preview to open it in the editor.

Report Of Tax Liability For Semiweekly Schedule Depositors (Rev.

Web schedule b is filed with form 941. Share your form with others send 2019 form 941 schedule b via email, link, or fax. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes.

15 Or Section 8 Of Pub.

Use the cross or check marks in the top toolbar to select your answers in the list boxes. Edit your form 941 schedule b 2019 online type text, add images, blackout confidential details, add comments, highlights and more. When you pay your employees, you are required to manage the applicable employee deductions and employer contributions for federal, state, and local payroll taxes. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.