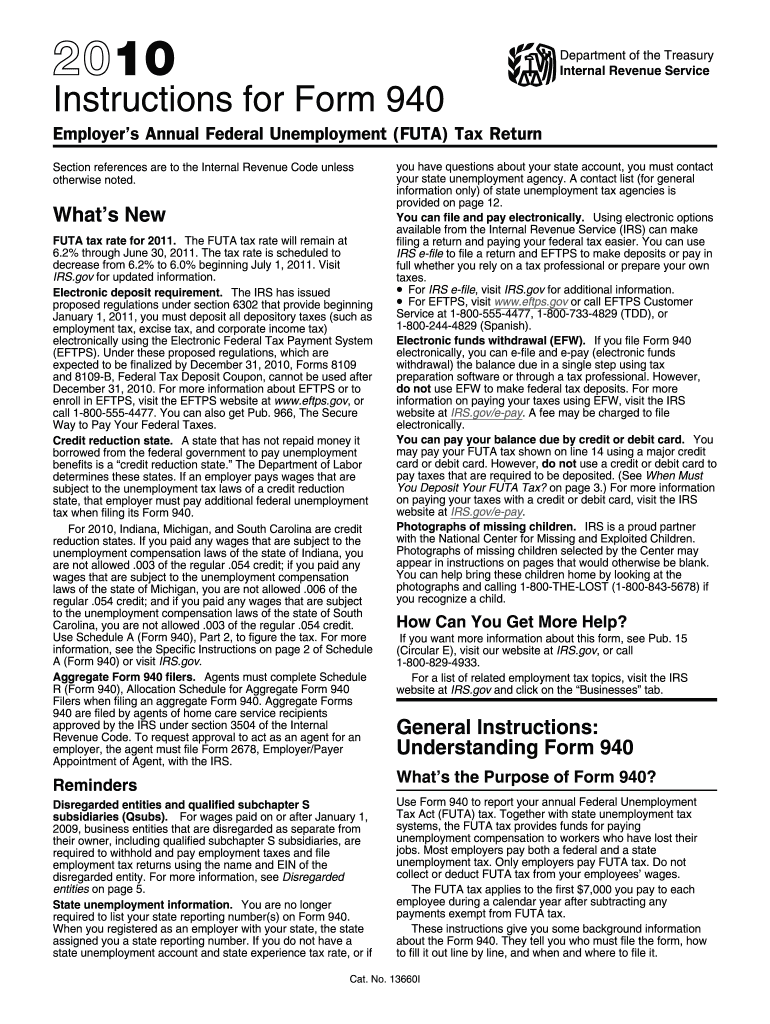

Fillable Form 940

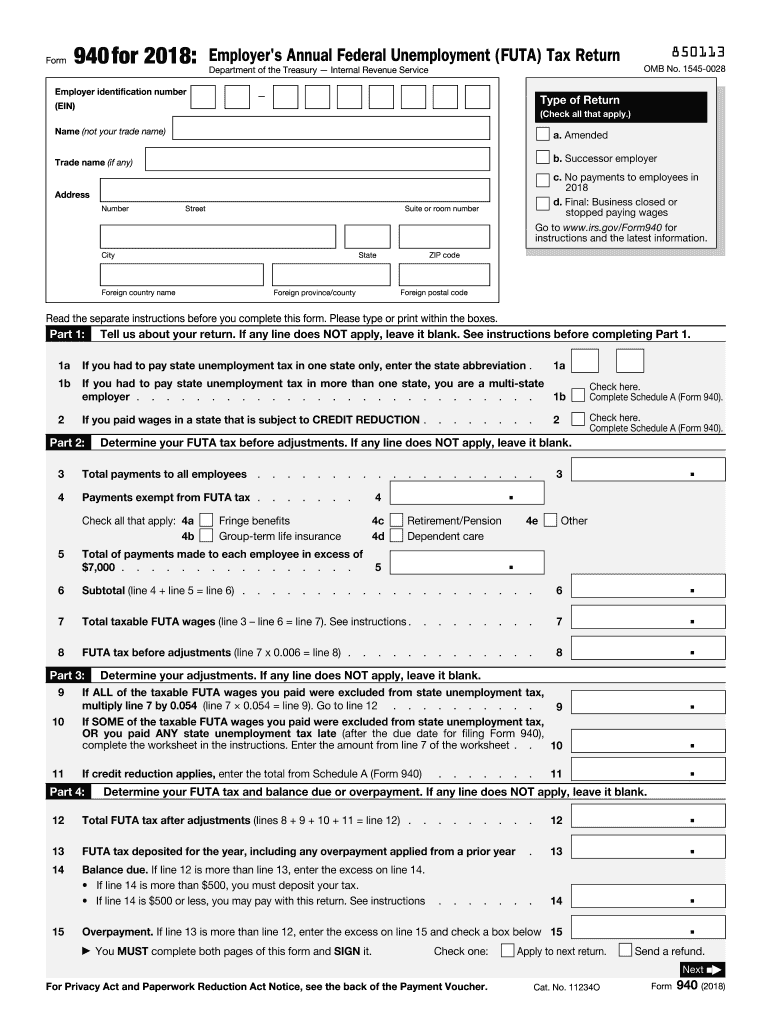

Fillable Form 940 - The due date to file form 940 is january 31st of the year following the calendar year being reported. Web to get the printable version of the 940 form, employers can visit the irs website and download the form. Use form 940 to report your annual federal unemployment tax act (futa) tax. 940, 941, 943, 944 and 945. See the instructions for line 9 before completing the schedule a (form 940). Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web form 940 needs to be filed annually by employers if they paid wages of $1,500 or more in any quarter of a calendar year, or if they had one or more employees working for 20 or more different weeks. Web file this schedule with form 940. Web city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.) amended successor employer no payments to employees in 2022 final: You receive acknowledgement within 24 hours.

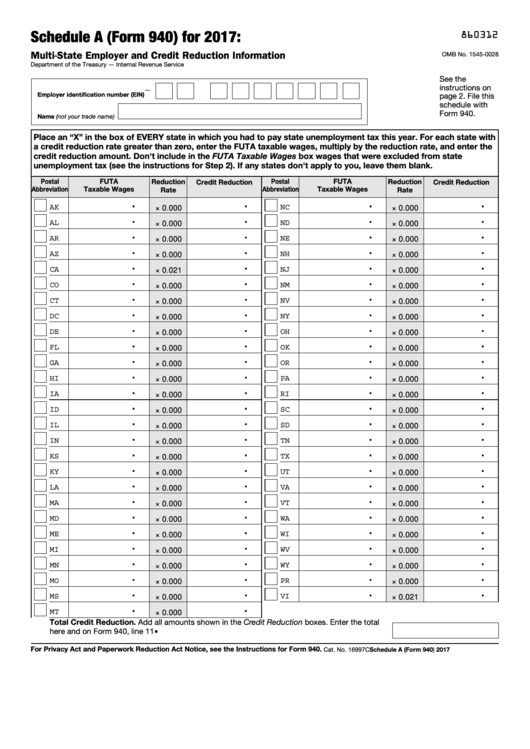

Employers can also get the form from. Place an “x” in the box of every state in which you had to pay state unemployment tax this year. Web city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.) amended successor employer no payments to employees in 2022 final: Web file this schedule with form 940. The due date to file form 940 is january 31st of the year following the calendar year being reported. Web employment tax forms: Web for tax year 2022, there are credit reduction states. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. It is secure and accurate. Form 941, employer's quarterly federal tax return.

Web for tax year 2022, there are credit reduction states. 940, 941, 943, 944 and 945. Employers can also get the form from. Form 940, employer's annual federal unemployment tax return. Web city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.) amended successor employer no payments to employees in 2022 final: See the instructions for line 9 before completing the schedule a (form 940). Web form 940 needs to be filed annually by employers if they paid wages of $1,500 or more in any quarter of a calendar year, or if they had one or more employees working for 20 or more different weeks. Web employment tax forms: For each state with a credit reduction rate greater than zero, enter the futa taxable wages, multiply by the reduction rate, and enter the credit reduction amount. Web the due date for filing form 940 for 2021 is january 31, 2022.

2010 Form 940 Fill Out and Sign Printable PDF Template signNow

Web employment tax forms: Web the due date for filing form 940 for 2021 is january 31, 2022. See the instructions for line 9 before completing the schedule a (form 940). Employers can also get the form from. Use form 940 to report your annual federal unemployment tax act (futa) tax.

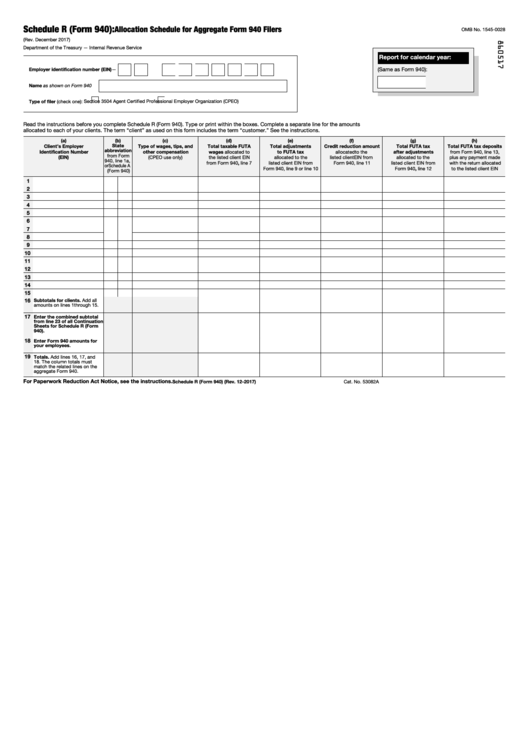

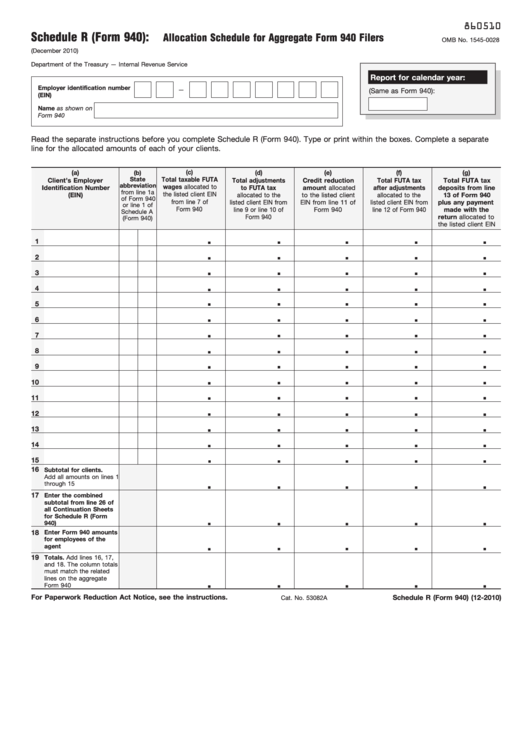

Fillable Schedule R (Form 940) Allocation Schedule For Aggregate Form

Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. It is secure and accurate. If you paid wages subject to the unemployment tax laws of these states, check the box on line 2 and fill out schedule a (form 940). (however, if you’re up to date on all your futa.

Fill Free fillable form 940 for 2018 employer's annual federal

For each state with a credit reduction rate greater than zero, enter the futa taxable wages, multiply by the reduction rate, and enter the credit reduction amount. Form 940, employer's annual federal unemployment tax return. Web file this schedule with form 940. Web form 940 needs to be filed annually by employers if they paid wages of $1,500 or more.

Fillable Schedule R (Form 940) Allocation Schedule For Aggregate Form

Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.) amended successor employer no payments to employees in 2022 final: If you paid wages subject to the unemployment tax laws of these states, check the box on line.

Fill Free fillable IRS form 940 schedule A 2019 PDF form

940, 941, 943, 944 and 945. Place an “x” in the box of every state in which you had to pay state unemployment tax this year. Web for tax year 2022, there are credit reduction states. While you can fill out the form by hand, the pdf form has editable fields you can fill out using. (however, if you’re up.

Form 940 For 2018 Fill Out and Sign Printable PDF Template signNow

The due date to file form 940 is january 31st of the year following the calendar year being reported. Web the due date for filing form 940 for 2021 is january 31, 2022. If you paid wages subject to the unemployment tax laws of these states, check the box on line 2 and fill out schedule a (form 940). It.

940 Form 2023 Fillable Form 2023

Web file this schedule with form 940. For each state with a credit reduction rate greater than zero, enter the futa taxable wages, multiply by the reduction rate, and enter the credit reduction amount. Form 940, employer's annual federal unemployment tax return. While you can fill out the form by hand, the pdf form has editable fields you can fill.

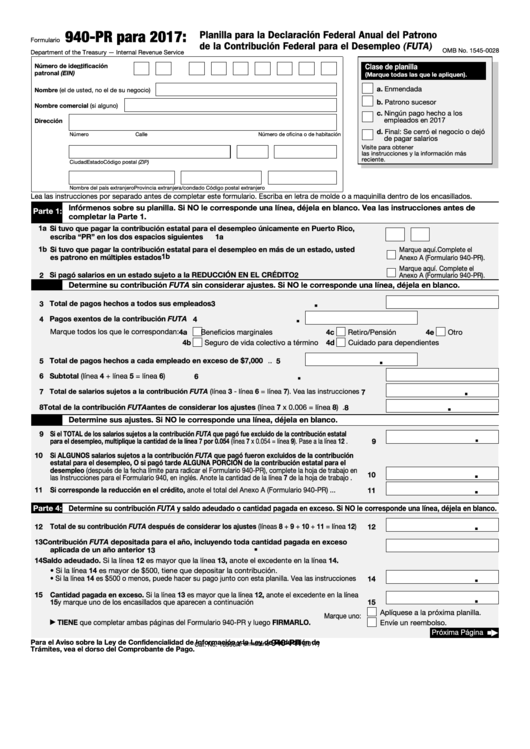

Fillable Form 940 (Pr) Planilla Para La Declaracion Federal Anual Del

You receive acknowledgement within 24 hours. While you can fill out the form by hand, the pdf form has editable fields you can fill out using. The due date to file form 940 is january 31st of the year following the calendar year being reported. It is secure and accurate. Web employment tax forms:

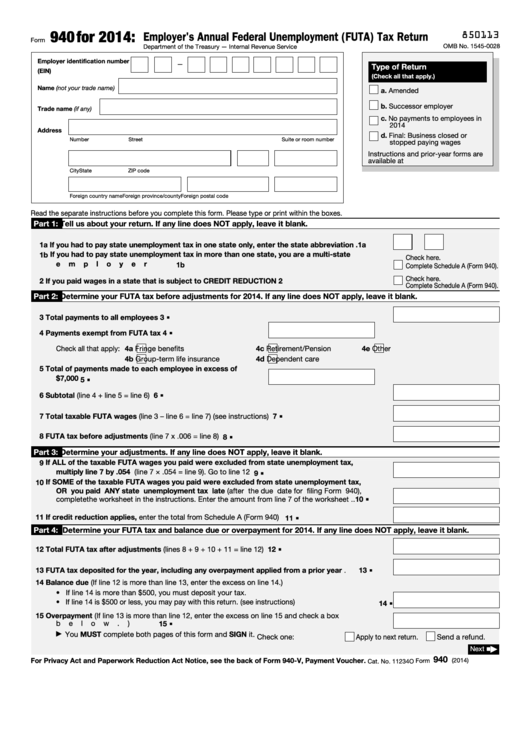

Fillable Form 940 Employer'S Annual Federal Unemployment (Futa) Tax

Web for tax year 2022, there are credit reduction states. Business closed or stopped paying wages go to www.irs.gov/form940 for instructions and the latest information. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Web the due date for filing form 940 for 2021 is january 31, 2022. Form 940,.

Fillable Schedule A (Form 940) MultiState Employer And Credit

The due date to file form 940 is january 31st of the year following the calendar year being reported. You receive acknowledgement within 24 hours. Employers can also get the form from. Web employment tax forms: Business closed or stopped paying wages go to www.irs.gov/form940 for instructions and the latest information.

Web Form 940 Needs To Be Filed Annually By Employers If They Paid Wages Of $1,500 Or More In Any Quarter Of A Calendar Year, Or If They Had One Or More Employees Working For 20 Or More Different Weeks.

Form 941, employer's quarterly federal tax return. The due date to file form 940 is january 31st of the year following the calendar year being reported. 940, 941, 943, 944 and 945. Web the due date for filing form 940 for 2021 is january 31, 2022.

Web File This Schedule With Form 940.

Employers can also get the form from. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. See the instructions for line 9 before completing the schedule a (form 940). Business closed or stopped paying wages go to www.irs.gov/form940 for instructions and the latest information.

Web Employment Tax Forms:

(however, if you’re up to date on all your futa payments, you can take an additional ten days and file form 940 by february 10, 2022.) how bench can help the deadline for filing form 940 is one of many tax form filing deadlines that can make the start of your year stressful. Form 940, employer's annual federal unemployment tax return. It is secure and accurate. Web to get the printable version of the 940 form, employers can visit the irs website and download the form.

Schedule R (Form 940), Allocation Schedule For Aggregate Form 940 Filers Pdf.

While you can fill out the form by hand, the pdf form has editable fields you can fill out using. You receive acknowledgement within 24 hours. Use form 940 to report your annual federal unemployment tax act (futa) tax. Place an “x” in the box of every state in which you had to pay state unemployment tax this year.