Fidelity Hardship Withdrawal Form

Fidelity Hardship Withdrawal Form - Web the irs defines six areas of need that qualify for a hardship withdrawal: Web establish, change, or cancel an automatic rebalancing program for your fidelity personal retirement annuity ® and fidelity retirement reserves® annuity. Web use the 401(k) plan application for hardship withdrawal—safe harbor if the requested withdrawal from your 401(k) shared savings plan account is for: Web schedule automatic withdrawals from your fidelity accounts, including withdrawal plans for rmds and earnings. To request a withdrawal greater than $100,000, you must complete a paper form. Establish, change, or cancel an earnings automatic withdrawal plan for your nonretirement account. Payments necessary to prevent eviction or foreclosure; Transfer assets to fidelity transfer investments or retirement plans currently held by another institution to fidelity. Every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. Unreimbursed medical expenses for you or your family;

Web key takeaways explore all your options for getting cash before tapping your 401 (k) savings. Payments necessary to prevent eviction or foreclosure; Purchase of your principal residence (excluding mortgage payments). Automatic withdrawal nonretirement earnings plan. And certain expenses for the repair of. Web distribution request form fidelity advisor 403(b) distribution request form note: Unreimbursed medical expenses for you or your family; The purchase of a primary residence; Web retirement accounts such as a 401(k) or an ira allow you to take hardship or early withdrawals from your account. Uninsured medical expenses for yourself, your spouse, or your dependents.

Unreimbursed medical expenses for you or your family; Your employer/plan sponsor or tpa must authorize this distribution request. A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. Web establish, change, or cancel an automatic rebalancing program for your fidelity personal retirement annuity ® and fidelity retirement reserves® annuity. Establish, change, or cancel an earnings automatic withdrawal plan for your nonretirement account. Transfer assets to fidelity transfer investments or retirement plans currently held by another institution to fidelity. To get your plan number(s), log into your workplace retirement savings plan at www.netbenefits.com and under quick links, select summary 1. Web key takeaways explore all your options for getting cash before tapping your 401 (k) savings. Web use the 401(k) plan application for hardship withdrawal—safe harbor if the requested withdrawal from your 401(k) shared savings plan account is for: Please use this form if you wish to request a distribution from your fidelity advisor 403(b) account.

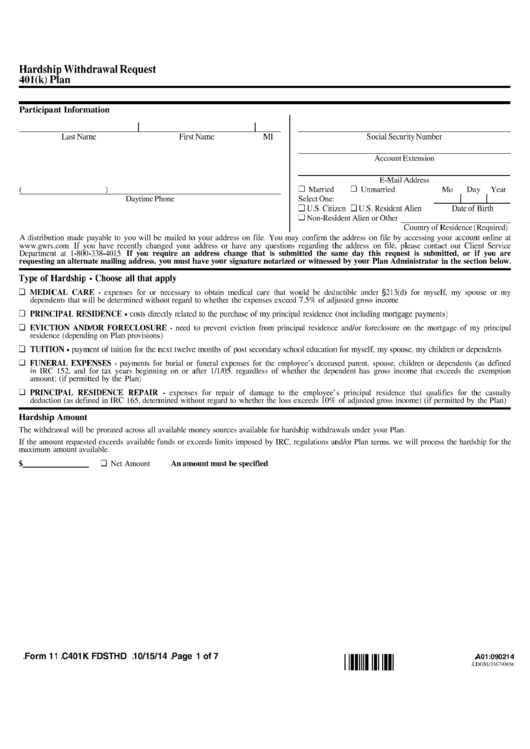

Form 11 Hardship Withdrawal Request 401(K) Plan printable pdf download

Web the irs defines six areas of need that qualify for a hardship withdrawal: The purchase of a primary residence; Every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. Web use the 401(k) plan application for hardship withdrawal—safe harbor if the requested withdrawal from your 401(k) shared savings plan account.

Metlife Hardship Withdrawal Form Fill Online, Printable, Fillable

Web the irs defines six areas of need that qualify for a hardship withdrawal: Your employer/plan sponsor or tpa must authorize this distribution request. To get your plan number(s), log into your workplace retirement savings plan at www.netbenefits.com and under quick links, select summary 1. Transfer assets to fidelity transfer investments or retirement plans currently held by another institution to.

Fidelity 401k Hardship Withdrawal Form Universal Network

Web use the 401(k) plan application for hardship withdrawal—safe harbor if the requested withdrawal from your 401(k) shared savings plan account is for: Please use this form if you wish to request a distribution from your fidelity advisor 403(b) account. Every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. Automatic.

Hardship Withdrawals

Payments necessary to prevent eviction or foreclosure; Establish, change, or cancel an earnings automatic withdrawal plan for your nonretirement account. To request a withdrawal greater than $100,000, you must complete a paper form. A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. To get your plan number(s), log into your workplace retirement.

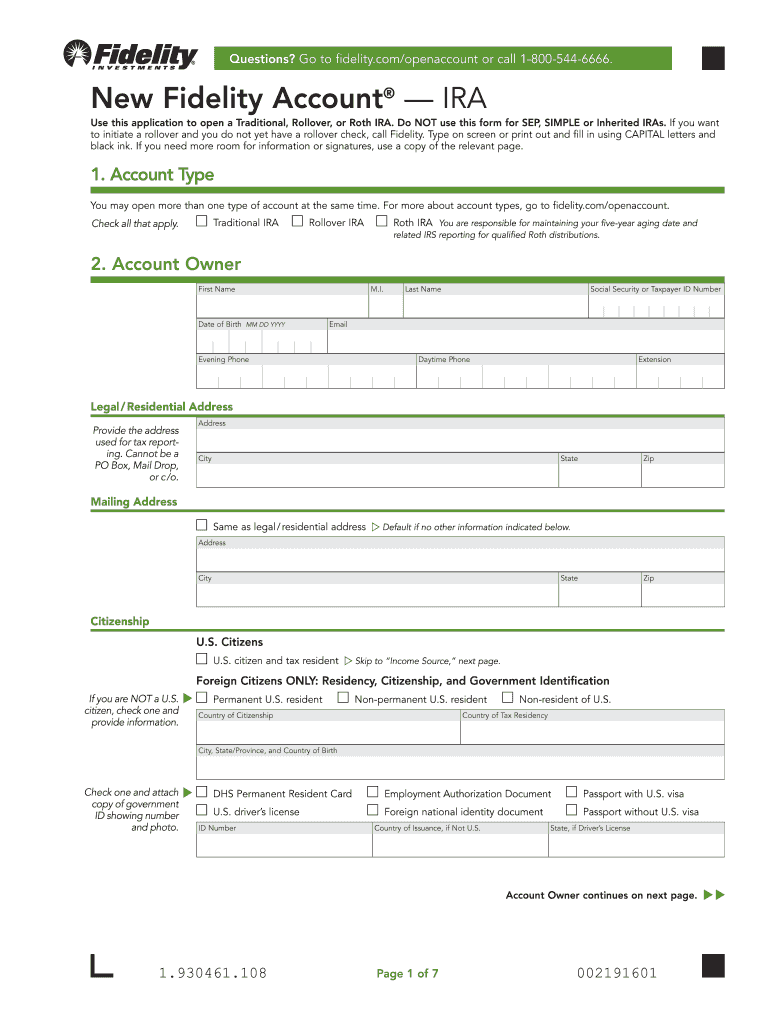

Fidelity Application Form Fill Online, Printable, Fillable, Blank

And certain expenses for the repair of. Every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. Web the maximum you can request to withdraw from your account online or by telephone is $100,000 per account. Automatic withdrawal nonretirement earnings plan. Please use this form if you wish to request a.

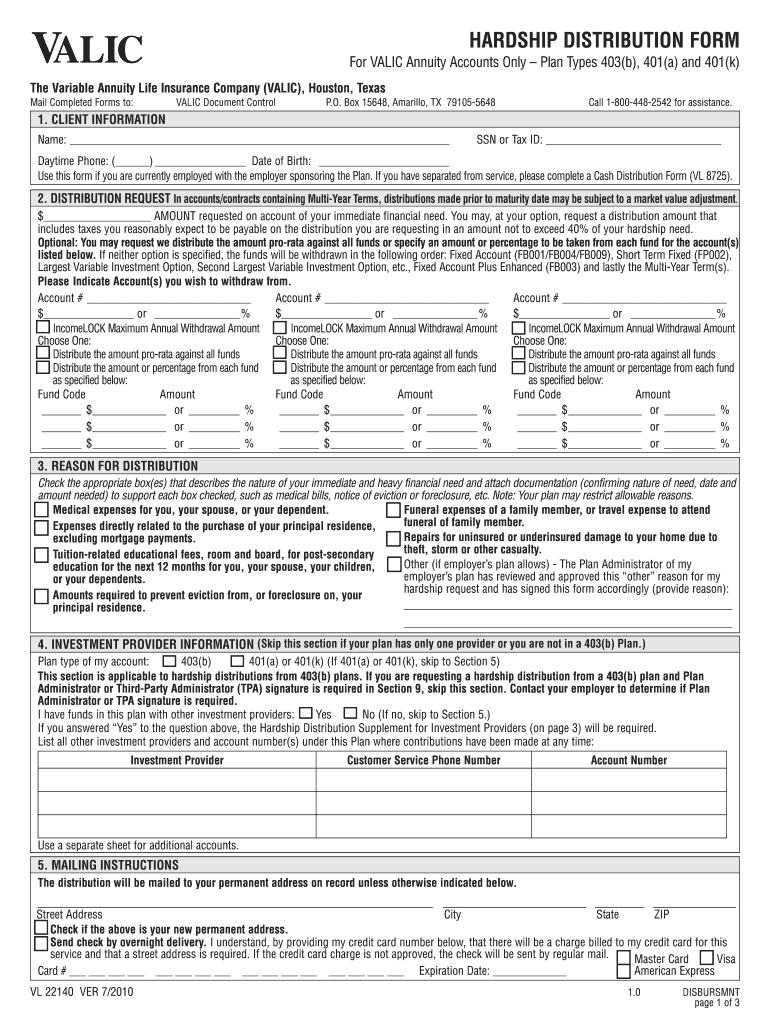

Valic Hardship Withdrawal Fill and Sign Printable Template Online

Web distribution request form fidelity advisor 403(b) distribution request form note: To request a withdrawal greater than $100,000, you must complete a paper form. Please use this form if you wish to request a distribution from your fidelity advisor 403(b) account. Payment of college tuition and related costs for family members; Web key takeaways explore all your options for getting.

Top 6 Fidelity Forms And Templates free to download in PDF format

Web use the 401(k) plan application for hardship withdrawal—safe harbor if the requested withdrawal from your 401(k) shared savings plan account is for: Unreimbursed medical expenses for you or your family; Payments necessary to prevent eviction or foreclosure; Your employer/plan sponsor or tpa must authorize this distribution request. Web distribution request form fidelity advisor 403(b) distribution request form note:

Fidelity 401k Hardship Withdrawal Form Universal Network Free Nude

Please use this form if you wish to request a distribution from your fidelity advisor 403(b) account. Web the irs defines six areas of need that qualify for a hardship withdrawal: Establish, change, or cancel an earnings automatic withdrawal plan for your nonretirement account. Unreimbursed medical expenses for you or your family; Web use the 401(k) plan application for hardship.

Top 6 Fidelity Forms And Templates free to download in PDF format

Uninsured medical expenses for yourself, your spouse, or your dependents. Here's how hardship withdrawals work and some ways to avoid penalties for using them. Payment of college tuition and related costs for family members; Automatic withdrawal nonretirement earnings plan. Web use the 401(k) plan application for hardship withdrawal—safe harbor if the requested withdrawal from your 401(k) shared savings plan account.

Pentegra 401k Withdrawal Form Universal Network

Purchase of your principal residence (excluding mortgage payments). Transfer assets to fidelity transfer investments or retirement plans currently held by another institution to fidelity. Please use this form if you wish to request a distribution from your fidelity advisor 403(b) account. Web use the 401(k) plan application for hardship withdrawal—safe harbor if the requested withdrawal from your 401(k) shared savings.

Purchase Of Your Principal Residence (Excluding Mortgage Payments).

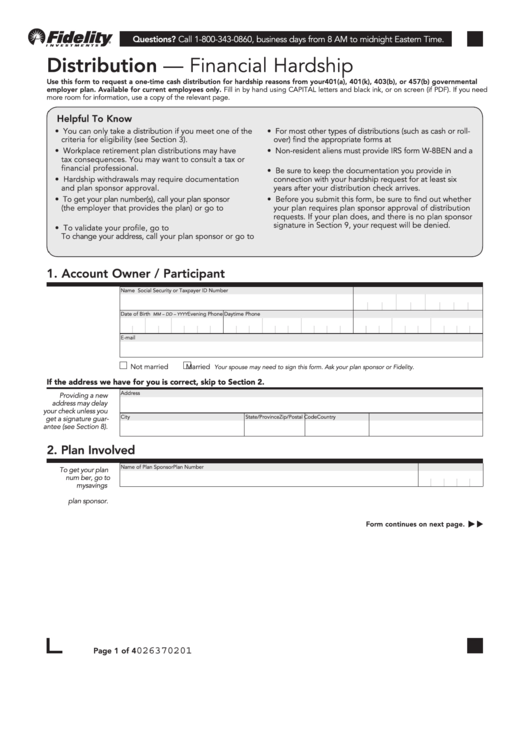

Web the maximum you can request to withdraw from your account online or by telephone is $100,000 per account. To get your plan number(s), log into your workplace retirement savings plan at www.netbenefits.com and under quick links, select summary 1. Web use the 401(k) plan application for hardship withdrawal—safe harbor if the requested withdrawal from your 401(k) shared savings plan account is for: Web hardship withdrawals may require documentation and plan sponsor approval.

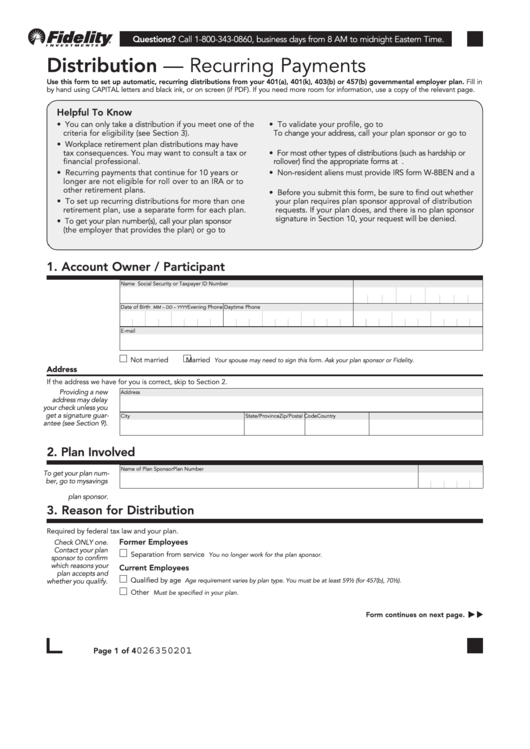

Automatic Withdrawal Nonretirement Earnings Plan.

Web retirement accounts such as a 401(k) or an ira allow you to take hardship or early withdrawals from your account. Web schedule automatic withdrawals from your fidelity accounts, including withdrawal plans for rmds and earnings. Payment of college tuition and related costs for family members; Unreimbursed medical expenses for you or your family;

Web The Irs Defines Six Areas Of Need That Qualify For A Hardship Withdrawal:

A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. Uninsured medical expenses for yourself, your spouse, or your dependents. And certain expenses for the repair of. Web establish, change, or cancel an automatic rebalancing program for your fidelity personal retirement annuity ® and fidelity retirement reserves® annuity.

Web Key Takeaways Explore All Your Options For Getting Cash Before Tapping Your 401 (K) Savings.

Please use this form if you wish to request a distribution from your fidelity advisor 403(b) account. Establish, change, or cancel an earnings automatic withdrawal plan for your nonretirement account. Payments necessary to prevent eviction or foreclosure; To request a withdrawal greater than $100,000, you must complete a paper form.