Federal Tax Form 8862

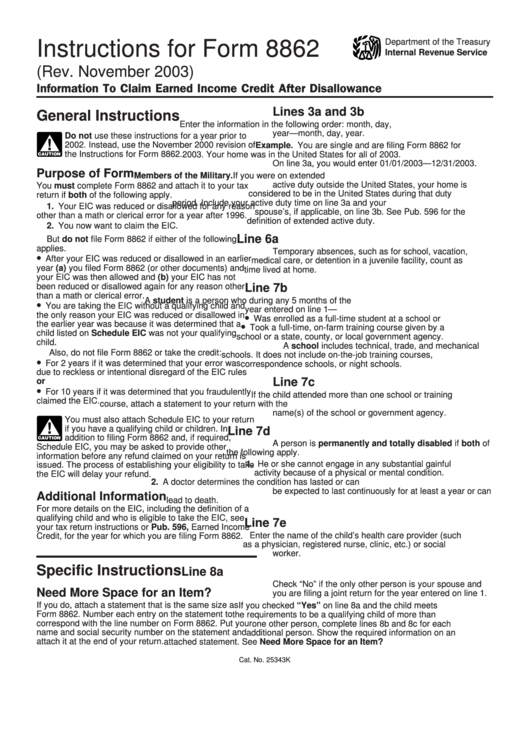

Federal Tax Form 8862 - Web attach to your tax return. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. This form is for income earned in tax year 2022, with tax returns due in. Try it for free now! If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web instructions for form 8862 (rev. Child 1 and child 2 are the same children you listed as child 1 and child 2 on schedule eic for the year shown on line 1 above. Web march 26, 2020 7:26 am. March 23, 2022 6:03 pm.

Web if aptc was paid on your behalf, or if aptc was not paid on your behalf but you wish to take the ptc, you must file form 8962 and attach it to your tax return (form 1040, 1040. Web you'll need to add form 8862: December 2021) department of the treasury internal revenue service. December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web form 8862 is a federal individual income tax form. Complete, edit or print tax forms instantly. Ad download or email irs 8862 & more fillable forms, try for free now! Specific instructions need more space for an item? Web how do i file an irs extension (form 4868) in turbotax online?

Web if aptc was paid on your behalf, or if aptc was not paid on your behalf but you wish to take the ptc, you must file form 8962 and attach it to your tax return (form 1040, 1040. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/actc/odc, or aotc if both of the following apply. Complete, edit or print tax forms instantly. Web taxpayers complete form 8862 and attach it to their tax return if: Web you'll need to add form 8862: For instructions and the latest information. October 2017) department of the treasury internal revenue service information to claim certain refundable credits after disallowance earned income. Ad access irs tax forms. Web form 8862 is a federal individual income tax form. Try it for free now!

Turning in U.S. tax cheats and getting paid for it Don't Mess With Taxes

Get ready for tax season deadlines by completing any required tax forms today. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. December 2021) department of the treasury internal revenue service. Information to claim earned income credit after disallowance to your return. In the earned income.

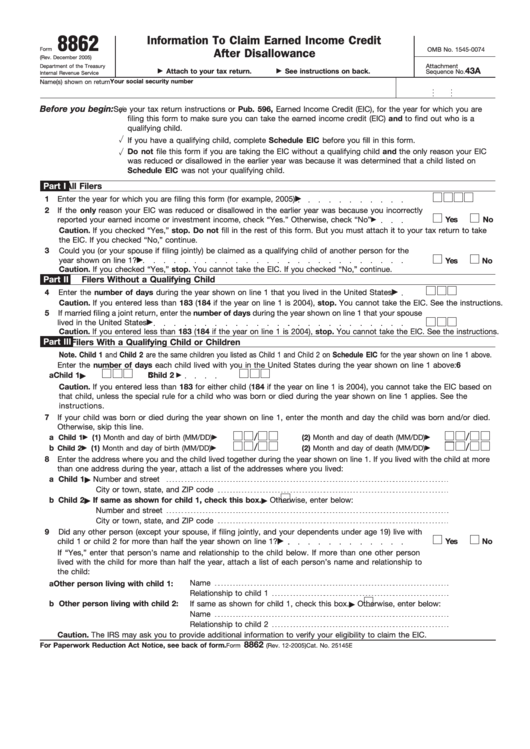

Form 8867*Paid Preparer's Earned Credit Checklist

Web the year for which you are filing form 8862. Web march 26, 2020 7:26 am. December 2021) department of the treasury internal revenue service. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Try it for free now! March 23, 2022 6:03 pm. Web taxpayers complete form 8862 and attach it to their tax return if: Web how do i file an irs extension (form 4868) in turbotax online? Web we last updated federal form 8862 in december 2022 from the federal internal revenue service.

Form 8862 Information to Claim Earned Credit After

Go to the input returntab. Information to claim certain credits after disallowance. Complete, edit or print tax forms instantly. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. For instructions and the latest information.

IRS Publication Form 8867 Earned Tax Credit Irs Tax Forms

Web attach to your tax return. In the earned income credit section when you see do. Web instructions for form 8862 (rev. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. For instructions and the latest information.

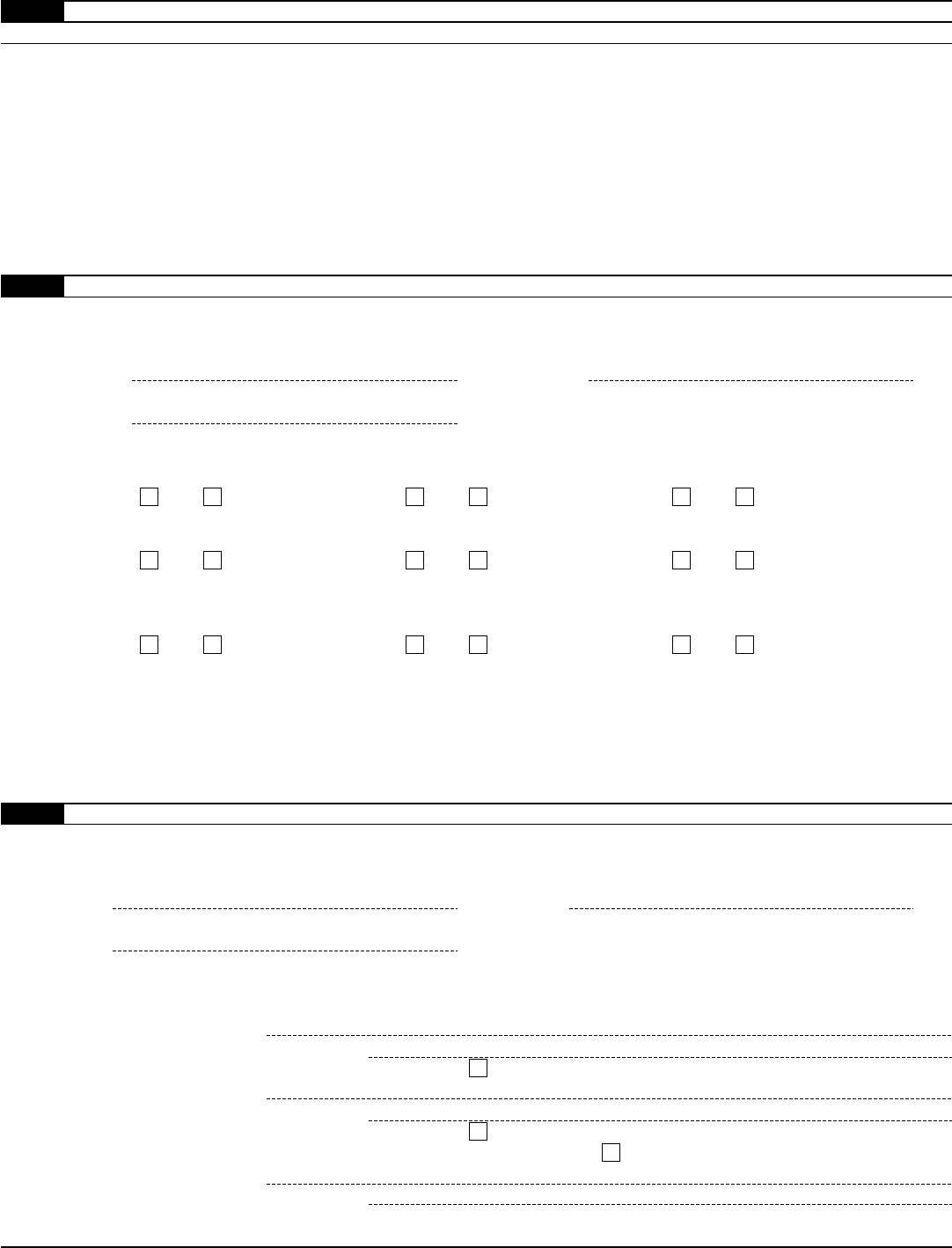

Form 8862Information to Claim Earned Credit for Disallowance

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Child 1 and child 2 are the same children you listed as child 1 and child 2 on schedule eic for the year shown on line 1 above. Web filers with a qualifying child or children note. Click on eic/ctc/aoc after disallowances. Complete, edit or print tax forms.

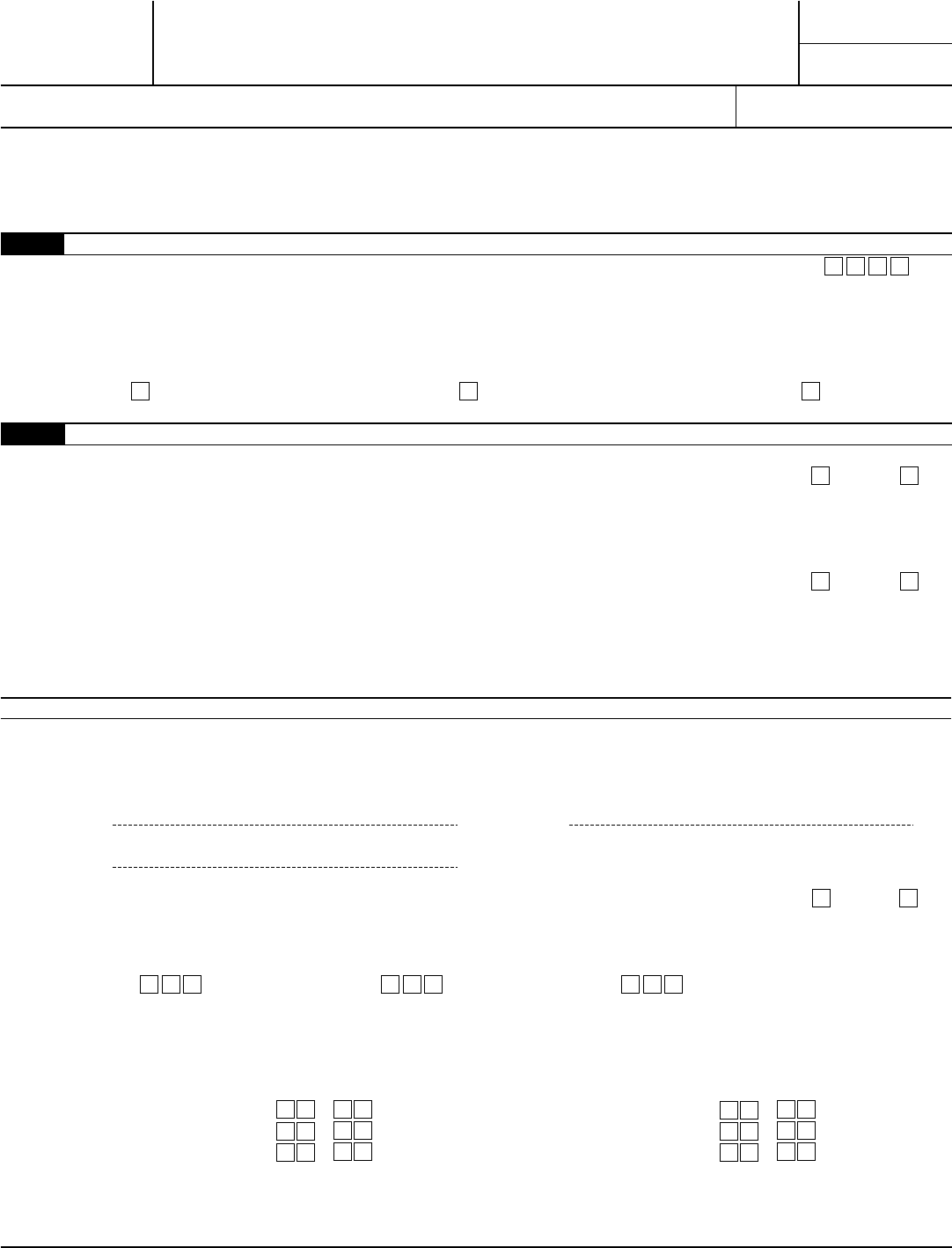

Instructions For Form 8862 Information To Claim Earned Credit

Web you'll need to add form 8862: Get ready for tax season deadlines by completing any required tax forms today. Information to claim certain credits after disallowance. Go to the input returntab. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service.

Form 8862 Information To Claim Earned Credit After

Ad download or email irs 8862 & more fillable forms, try for free now! Web follow these steps to generate form 8862: Specific instructions need more space for an item? Web attach to your tax return. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for.

20192022 Form IRS 886HDEP Fill Online, Printable, Fillable, Blank

Upload, modify or create forms. Web attach to your tax return. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. Ad download or email irs 8862 & more fillable forms, try for free now! Their earned income credit (eic), child tax credit (ctc)/additional child tax credit.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Web the year for which you are filing form 8862. Web form 8862 is a federal individual income tax form. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. October 2017) department of the treasury internal revenue service information to.

Web You Must Complete Form 8862 And Attach It To Your Tax Return To Claim The Eic, Ctc/Actc/Odc, Or Aotc If Both Of The Following Apply.

Web attach to your tax return. For instructions and the latest information. Web the year for which you are filing form 8862. Web you must have a taxpayer identification number issued on or before the due date of the return to claim the earned income credit (eic), child tax credit (ctc)/ refundable child.

Web How Do I Enter Form 8862?

March 23, 2022 6:03 pm. Upload, modify or create forms. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. December 2021) department of the treasury internal revenue service.

December 2022) Department Of The Treasury Internal Revenue Service Information To Claim Certain Credits After Disallowance Section.

If you do, attach a statement that is the same size as form 8862. Specific instructions need more space for an item? Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Try it for free now!

Web Form 8862 Information To Claim Certain Credits After Disallowance Is Used To Claim The Earned Income Credit (Eic) If This Credit Was Previously Reduced Or Disallowed By The.

Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web taxpayers complete form 8862 and attach it to their tax return if: Web follow these steps to generate form 8862: