Example Of Form 8824 Filled Out

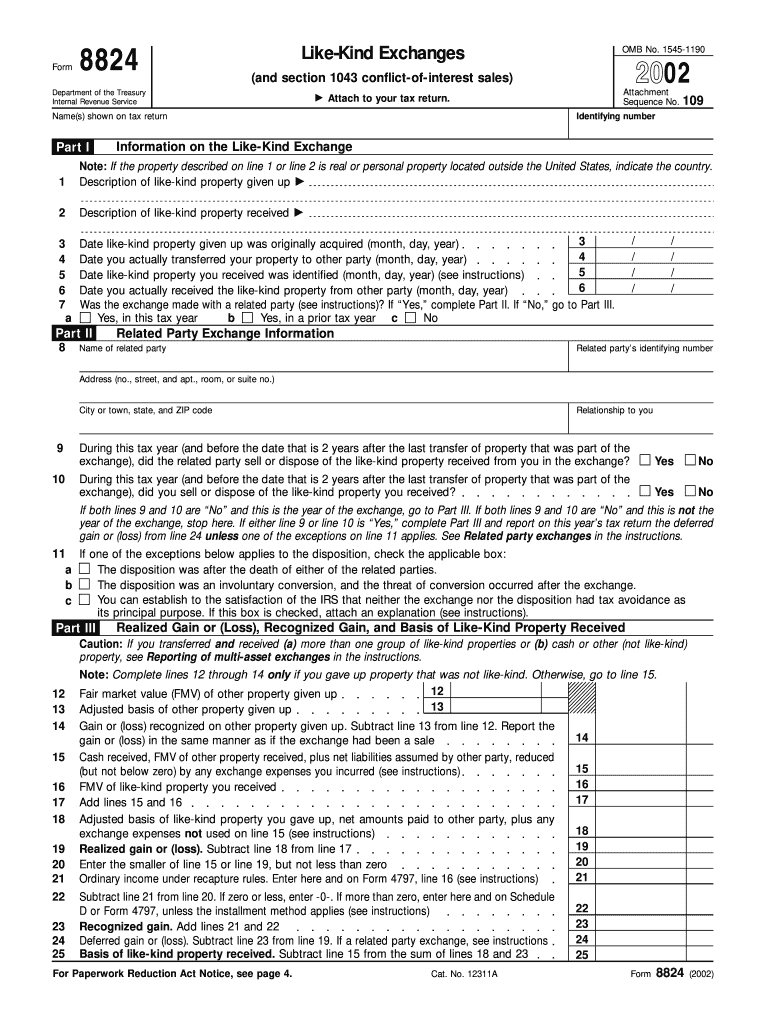

Example Of Form 8824 Filled Out - Web common questions for form 8824 in proseries. Web gain figured on form 8824. Web irs form 8824 is used to report a 1031 exchange for the tax year in which you complete it. Utilize the circle icon for other yes/no. Section iii of the form determines the net results of the transaction (gain or loss). Fill in all appropriate information in parts i and ii. Adjusted basis of relinquished property (property given up). For review, we are dealing with the following scenario. This section is the 1031 exchange transaction and how the irs receives information about the transaction’s gain or loss for tax reasons. Alan adams bought a duplex ten years ago for $200,000 cash.

Web irs form 8824 is used to report a 1031 exchange for the tax year in which you complete it. If the answer is no, go to part iii. To learn more, see publication 544: Subtract line 18 from line 17. Web gain figured on form 8824. Fill of 288 fill in: You might give up a rental home in need of repairs in exchange for another rental home that’s well maintained. Web what happens in an exchange? Utilize the circle icon for other yes/no. The irs considers the deal completed in the tax year that you sell the initial relinquished property, and the exchange period begins.

Below are the most popular support articles associated with form 8824. On the worksheet form 8824 for the part of the property used as a home, follow steps (1) through (3) above, except that instead of Complete lines 12 through 14 of part iii if. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. 8824 (2022) form 8824 (2022) page. Web form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Web include your name and identifying number at the top of each page of the statement. He assigned a value of. Next to line 11c, you may link (f9) to attach an explanation. The irs considers the deal completed in the tax year that you sell the initial relinquished property, and the exchange period begins.

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Exchanger settles on relinquished property on dec. Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for business or investment. Enter • 2020 instructions for form 8824. Below are the most popular support articles associated with form 8824. Web gain figured on form 8824.

Form 8824 Example Fill Out and Sign Printable PDF Template signNow

If the answer is yes, go to part ii. Web optiona form 288 rev. How do we report the exchange? Web first, you must complete and file irs form 8824 along with your tax returns at the end of the year in which you sold the relinquished property and began the 1031 exchange process. Fill in all appropriate information in.

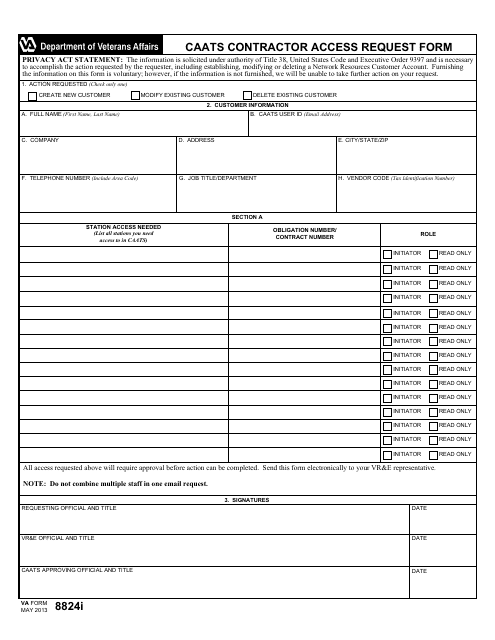

VA Form 8824i Download Fillable PDF or Fill Online Caats Contractor

2 name(s) shown on tax return. How do we report the exchange? Web first, you must complete and file irs form 8824 along with your tax returns at the end of the year in which you sold the relinquished property and began the 1031 exchange process. Check out how easy it is to complete and esign documents online using fillable.

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Purpose of form use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of a like kind. On the worksheet form 8824 for the part of the property used as a home, follow steps (1) through (3) above, except that instead of Enter t, s, or j (taxpayer,.

Publication 544 Sales and Other Dispositions of Assets; Example

Web completing form 8824. Section iii of the form determines the net results of the transaction (gain or loss). You can quickly make and fill out legal forms with the help of the pdffiller app on your phone. 14, 2015, and then settles on replacement property may 1, 2016. Web common questions for form 8824 in proseries.

How can/should I fill out Form 8824 with the following information

Web include your name and identifying number at the top of each page of the statement. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web first, you must complete and file irs form 8824 along with your tax returns at the end of the year in which you sold.

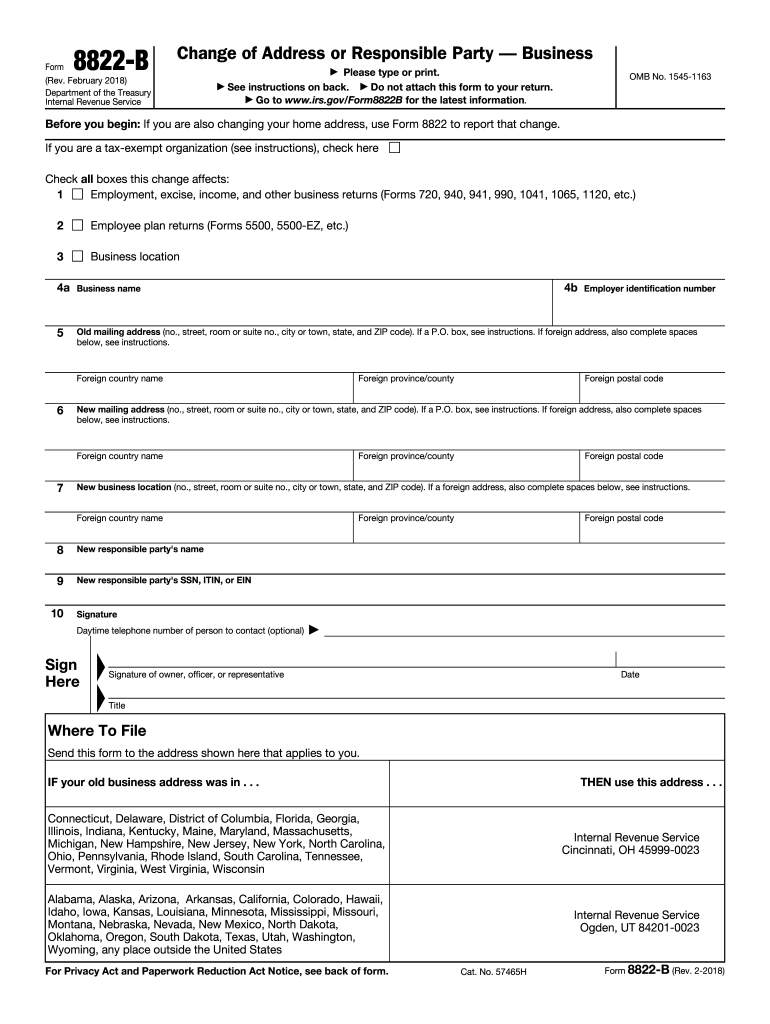

IRS 8822B 2018 Fill out Tax Template Online US Legal Forms

For details on the exclusion of gain (including how to figure the amount of the exclusion), see pub. Also file form 8824 for the 2 years following the year of a related. This is true whether you’ve actually completed the 1031 exchange or not. Fill out only lines 15 through 25 of each worksheet form 8824. Form popularity of 288.

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

If the answer is no, go to part iii. Fill out only lines 15 through 25 of each worksheet form 8824. Do not enter name and social security number if shown on other side. Web quick steps to complete and design form 888 online: Web form 8824 worksheetworksheet 2 tax deferred exchanges under irc § 1031 analysis of cash boot.

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

If the answer is no, go to part iii. Also file form 8824 for the 2 years following the year of a related. Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for business or investment. Get, create, make and sign pdf 288 form. Web example of form.

Complete And Sign Form 288 And Other Documents On Your Mobile Device Using The.

Fill out only lines 15 through 25 of each worksheet form 8824. Next to line 11c, you may link (f9) to attach an explanation. You can quickly make and fill out legal forms with the help of the pdffiller app on your phone. Web form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information.

Web Form 8824 Worksheetworksheet 2 Tax Deferred Exchanges Under Irc § 1031 Analysis Of Cash Boot Received Or Paid Sale Of Exchange Property Sale Price, Exchange Property $ 13 Less Debt Relief (Line 25 Below) ( ) 14 Less Exchange Expenses Paid (Worksheet 3) ( ) 15 Total Cash Received (Line 13 Minus Lines 14 & 15) 16 Purchase Of.

Fill of 288 fill in: Sales and other dispositions of assets at www.irs.gov. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Completing a like kind exchange in the 1040 return.

If The Answer Is Yes, Go To Part Ii.

Web completing form 8824. Adjusted basis of relinquished property (property given up). For details on the exclusion of gain (including how to figure the amount of the exclusion), see pub. Do not enter name and social security number if shown on other side.

On The Worksheet Form 8824 For The Part Of The Property Used As A Home, Follow Steps (1) Through (3) Above, Except That Instead Of

For review, we are dealing with the following scenario. Alan adams bought a duplex ten years ago for $200,000 cash. Get everything done in minutes. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange.