Examining Your Credit Report Chapter 4 Lesson 3

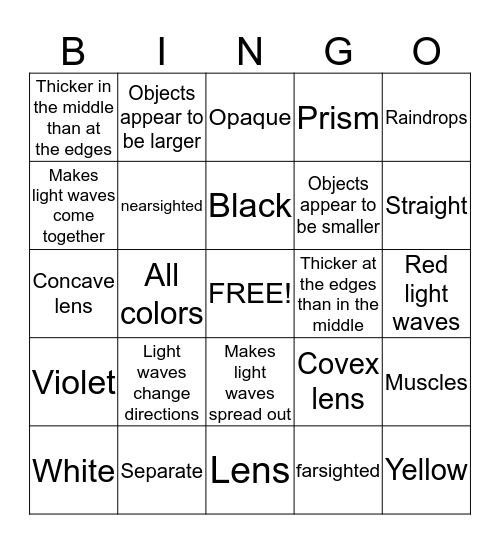

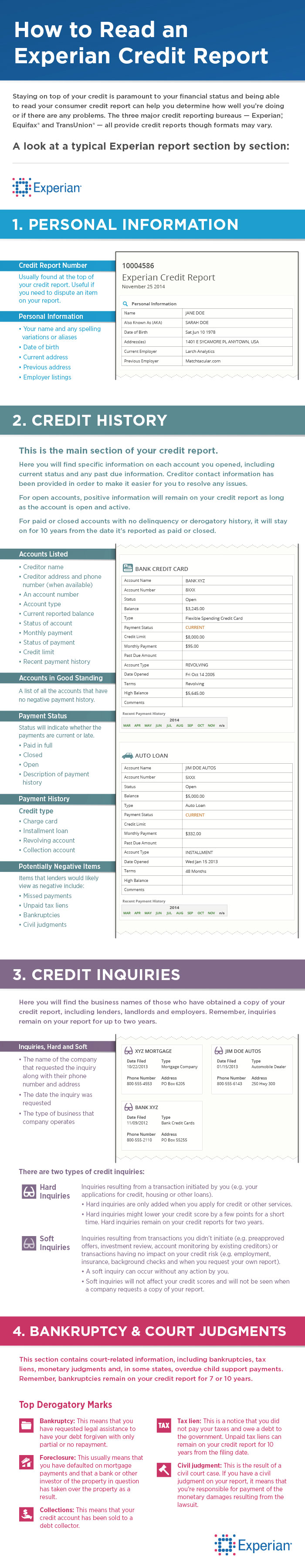

Examining Your Credit Report Chapter 4 Lesson 3 - Take note that if you rent your home, rental payments don’t typically show up on credit. Name examining your credit report chapter 4, lesson 3. Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in. D) taking out a mortgage on a. This factors into the lender’s understanding of how you manage. • the date you opened any credit accounts or took out any loans • the current balance on each account • your payment history • the credit limits and total loan amounts • any bankruptcies or tax liens • your identifying information (name, address, social security number) a credit. Web credit reports will also include a complete list of your credit inquiries from the past 2 years. Web page 7 of 8 examining your credit report chapter 4, lesson 3 1. Name examining your credit report chapter 4, lesson 3. Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in.

It showswhen you took out a loan or opened any accounts ,. You need to take out a credit card or car loan to build up your credit. Web credit reports will also include a complete list of your credit inquiries from the past 2 years. Web the information listed on your credit report summarizes how you manage credit, including payment history and account balances. Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in. Web then, read the article “how to read your credit report.” use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions. Minimum payments are made to all debts except for the smallest, which is attacked with the largest possible payments. And because it measures “reliability,” credit reports are also often referenced in a variety of situations beyond getting a credit. It is a report card for your credithistory. Which of the following is not a factor in determining a fico score?

Web examining your credit report chapter 4, lesson 3 1. Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in. Web a credit report all about you can tell them: Then, read the article “how to read your credit report.” use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions. Web page 7 of 8 examining your credit report chapter 4, lesson 3 1. Nameexamining your credit report chapter 4,lesson 3. Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in. Credit reporting companies, also known as credit. What is a credit report? You need to take out a credit card or car loan to build up your credit.

P2 Chapter 4 Lesson 3 Adding On Sets YouTube

Minimum payments are made to all debts except for the smallest, which is attacked with the largest possible payments. But one thing you still need to pay attention to is your credit report. Web the information listed on your credit report summarizes how you manage credit, including payment history and account balances. Web chapter 4 (dave ramsey) get a hint..

Chapter 4 Lesson 3 Word Search WordMint

A credit report will also specify whether each inquiry was a hard or soft credit. Web a credit report all about you can tell them: Name examining your credit report chapter 4, lesson 3. Web chapter 4 (dave ramsey) get a hint. Click the card to flip 👆.

Science Chapter 4 lesson 3 Bingo Card

This is where you’ll find specific details on your accounts, which could include mortgages, student loans, car loans, lines of credit, and other types of credit accounts. It showswhen you took out a loan or opened any accounts ,. Web read john’s story and review the sample credit report. A credit report is a detailed account of your credit history.

Credit Report on the Luxury Men Wristwatch Mechanism. 3D. Stock

It showswhen you took out a loan or opened any accounts ,. Web a credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts. This is where you’ll find specific details on your accounts, which could include mortgages, student loans, car loans,.

How to Read Your Credit Report Experian

What information does it provide? Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions. Credit reporting companies, also known as credit. Web a credit report all about you can tell them: And because it measures “reliability,” credit reports are also often referenced in a variety.

What to Look for on Your Credit Report

• the date you opened any credit accounts or took out any loans • the current balance on each account • your payment history • the credit limits and total loan amounts • any bankruptcies or tax liens • your identifying information (name, address, social security number) a credit. Click the card to flip 👆. This factors into the lender’s.

McGraw Hill My Math Grade 1 Chapter 4 Lesson 3 Answer Key Use Doubles

Web then, read the article “how to read your credit report.” use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions. Web a credit report all about you can tell them: This is where you’ll find specific details on your accounts, which could include mortgages, student loans,.

go math fourth grade chapter 4 lesson 3 interpret the remainder

What information does it provide? Web then, read the article “how to read your credit report.” use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions. The fico score is an i love debt score fair i·saac cor·po·ra·tion click the card to flip 👆 myth: Then, read.

Additional Teacher Background Chapter 4 Lesson 3, p. 295

This factors into the lender’s understanding of how you manage. Web chapter 4 (dave ramsey) get a hint. Web preferred method of debt repayment; What information does it provide? And because it measures “reliability,” credit reports are also often referenced in a variety of situations beyond getting a credit.

Minimum Payments Are Made To All Debts Except For The Smallest, Which Is Attacked With The Largest Possible Payments.

What is a credit report? A credit report is a detailed account of your credit history that lenders, businesses, and credit card companies use to assess your financial reliability. Nameexamining your credit report chapter 4,lesson 3. Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in.

A Credit Inquiry Occurs When A Company Or Individual Requests Access To Your Credit File.

Web read john’s story and review the sample credit report. Web use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions.nameexamining your credit report chapter 4,lesson 3 foundations in. Web chapter 4 (dave ramsey) get a hint. • the date you opened any credit accounts or took out any loans • the current balance on each account • your payment history • the credit limits and total loan amounts • any bankruptcies or tax liens • your identifying information (name, address, social security number) a credit.

Which Of The Following Is Not A Factor In Determining A Fico Score?

Web a credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts. Why is it important to check your credit report? Web then, read the article “how to read your credit report.” use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions. This factors into the lender’s understanding of how you manage.

It Is A Report Card For Your Credithistory.

Web examining your credit report chapter 4, lesson 3 by now, you know exactly how we feel about credit scores (hint: What information does it provide? Then, read the article “how to read your credit report.” use the information in your textbook (chapter 4, lesson 3), on the sample credit report, and from the article to answer the questions. Includes a list of all debts organized from smallest to largest balance;