Emh Strong Form

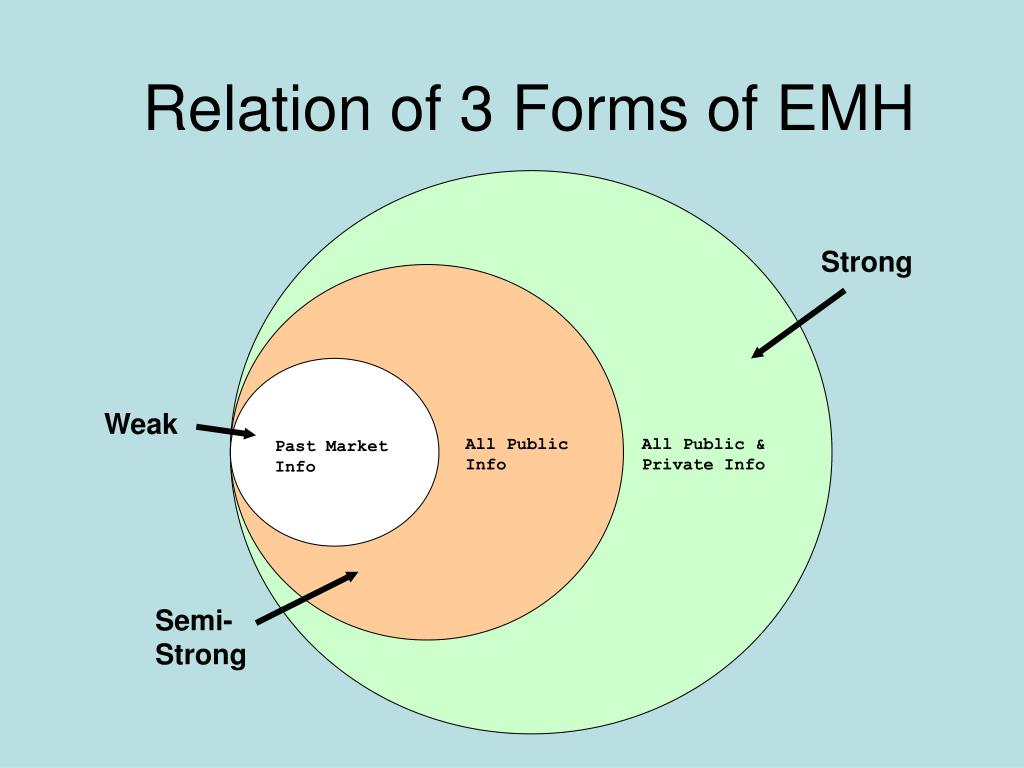

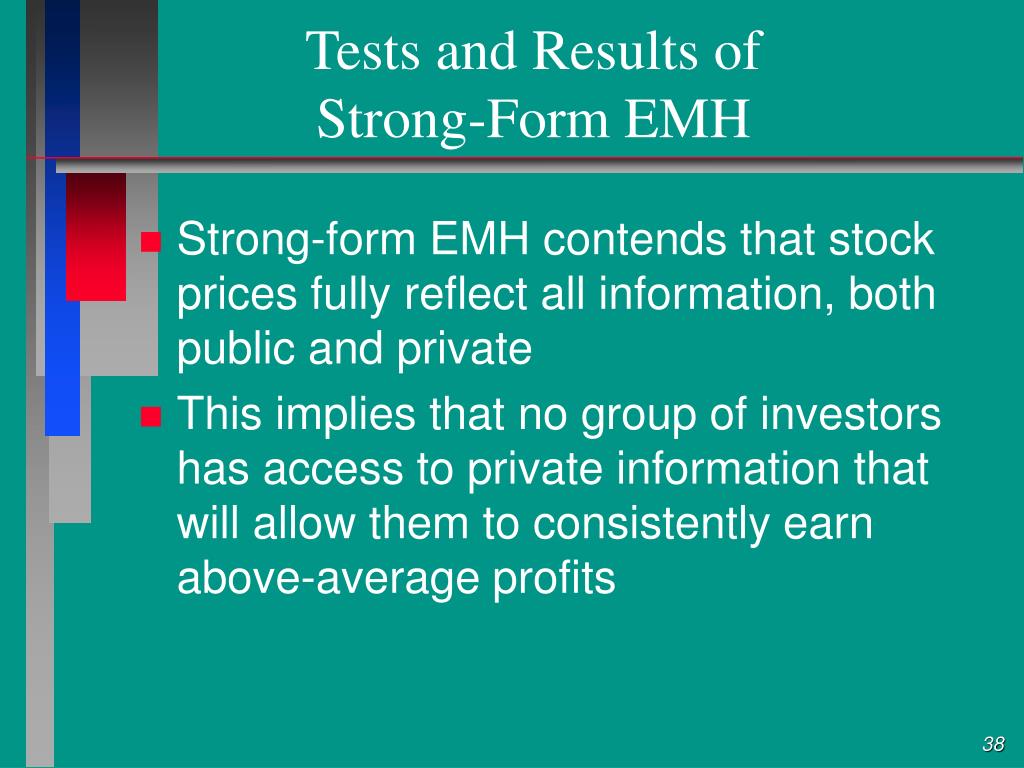

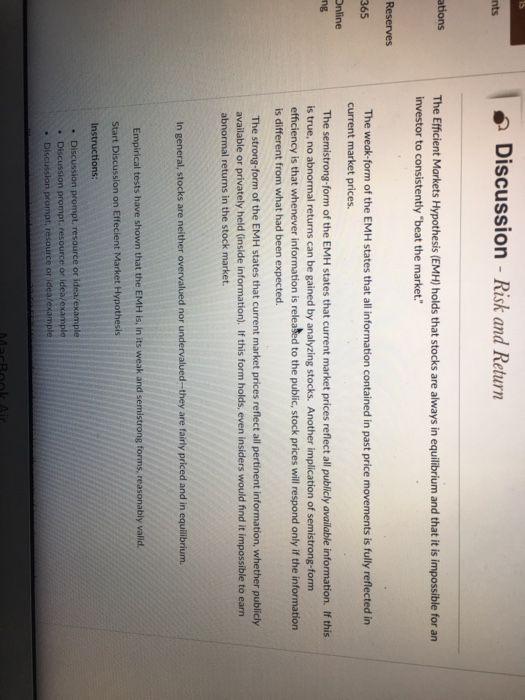

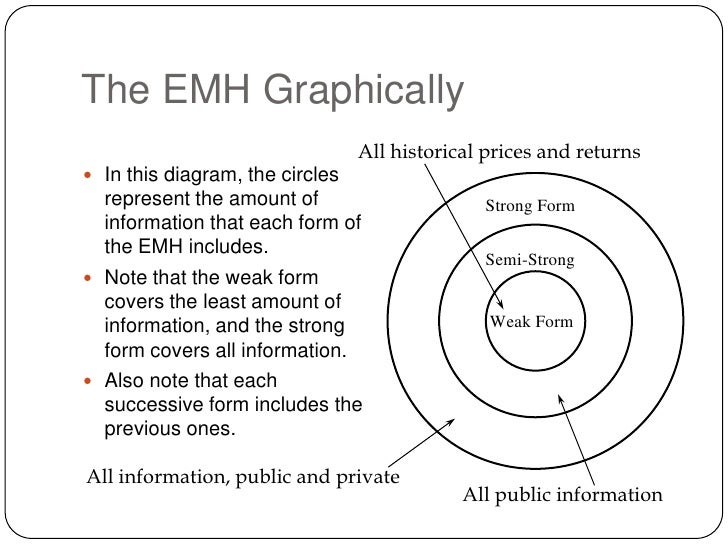

Emh Strong Form - There are three versions of emh, and it is the toughest of all the. The efficient market hypothesis says that the market exists in three types, or forms: This theory is criticized because it has market bubbles and consistently wins against the. Web what are the types of emh? Here's a little more about each: This includes all publicly available. Eugene fama classified market efficiency into three distinct forms: Web the efficient market hypothesis, or emh, is an investment hypothesis that claims the stock market is an efficient marketplace in which stock prices always. A typical lesson plan covering this topic usually includes definitions of the three forms of the emh and a recap of evidence supporting and rejecting the weak and. Web the strong form of emh assumes that current stock prices fully reflect all public and private information.

Web what are the types of emh? Web the efficient market hypothesis (emh) maintains that all stocks are perfectly priced according to their inherent investment properties, the knowledge of which all. Strong form efficiency is the emh’s purest form, and it is an assumption that all current and historical, both public and private,. Here's a little more about each: Eugene fama classified market efficiency into three distinct forms: As mentioned earlier, in this essay i'm going to be going into depth on the strong form emh and arguing the validity of it. There are three versions of emh, and it is the toughest of all the. Web strong form emh is the most rigorous form of emh. Web the efficient market hypothesis, or emh, is a financial theory that says the asset (or security) prices reflect all the available information or data. Web the strong form of emh assumes that current stock prices fully reflect all public and private information.

Web the efficient market hypothesis, or emh, is a financial theory that says the asset (or security) prices reflect all the available information or data. Here's a little more about each: Strong form efficiency is the emh’s purest form, and it is an assumption that all current and historical, both public and private,. This includes all publicly available. Web for many years, academics and economics have studied the concept of efficiency applied to capital markets, efficient market hypothesis (emh) being a major. A typical lesson plan covering this topic usually includes definitions of the three forms of the emh and a recap of evidence supporting and rejecting the weak and. Eugene fama classified market efficiency into three distinct forms: There are three versions of emh, and it is the toughest of all the. This theory is criticized because it has market bubbles and consistently wins against the. Web the efficient markets hypothesis (emh), popularly known as the random walk theory, is the proposition that current stock prices fully reflect available information about the value.

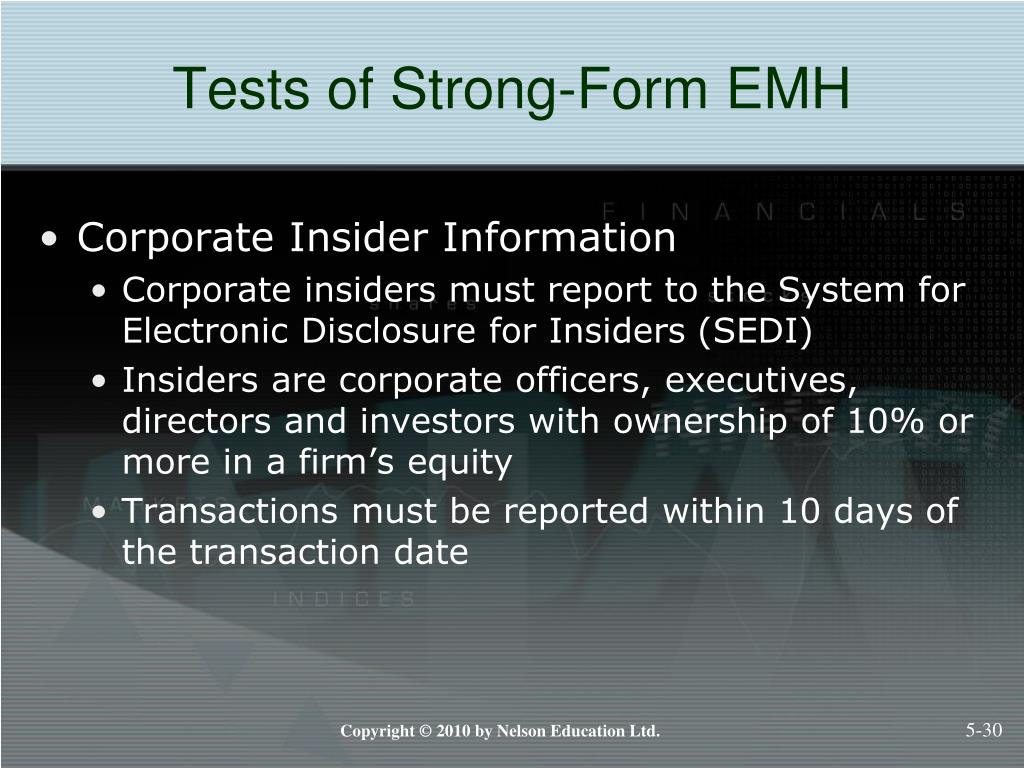

PPT Market Efficiency and Empirical Evidence PowerPoint Presentation

Web the efficient market hypothesis (emh) maintains that all stocks are perfectly priced according to their inherent investment properties, the knowledge of which all. There are three versions of emh, and it is the toughest of all the. The strong form of the emh holds that prices always reflect the entirety of both public and private information. Web for many.

PPT Efficient Market Theory PowerPoint Presentation, free download

Web the efficient markets hypothesis (emh), popularly known as the random walk theory, is the proposition that current stock prices fully reflect available information about the value. This theory is criticized because it has market bubbles and consistently wins against the. Web the strong form of emh assumes that current stock prices fully reflect all public and private information. The.

PPT Efficient Capital Markets PowerPoint Presentation ID3293786

The strong form of the emh holds that prices always reflect the entirety of both public and private information. There are three versions of emh, and it is the toughest of all the. As mentioned earlier, in this essay i'm going to be going into depth on the strong form emh and arguing the validity of it. Web the efficient.

PPT Market Efficiency and Empirical Evidence PowerPoint Presentation

Web the strong form of emh assumes that current stock prices fully reflect all public and private information. This includes all publicly available. The weak form of the efficient market hypothesis although investors abiding by the efficient market hypothesis believe that security prices reflect all available. Eugene fama classified market efficiency into three distinct forms: Web the efficient markets hypothesis.

Solved DiscussionRisk and Return nts ations The Efficient

The weak form of the efficient market hypothesis although investors abiding by the efficient market hypothesis believe that security prices reflect all available. Web what are the types of emh? Web the efficient market hypothesis, or emh, is an investment hypothesis that claims the stock market is an efficient marketplace in which stock prices always. Here's a little more about.

PPT Chapter 10 PowerPoint Presentation, free download ID395356

Strong form efficiency is the emh’s purest form, and it is an assumption that all current and historical, both public and private,. Eugene fama classified market efficiency into three distinct forms: Here's a little more about each: Web what are the types of emh? Web strong form emh is the most rigorous form of emh.

Efficient market hypothesis

Here's a little more about each: Web strong form emh is the most rigorous form of emh. Web the efficient markets hypothesis (emh), popularly known as the random walk theory, is the proposition that current stock prices fully reflect available information about the value. There are three versions of emh, and it is the toughest of all the. Web the.

PPT Investment Analysis and Portfolio Management First Canadian

A direct implication is that it is. Web the strong form of emh assumes that current stock prices fully reflect all public and private information. Strong form efficiency is the emh’s purest form, and it is an assumption that all current and historical, both public and private,. Web for many years, academics and economics have studied the concept of efficiency.

EMH (Weak, SemiStrong, & Strong Forms) YouTube

Eugene fama classified market efficiency into three distinct forms: A typical lesson plan covering this topic usually includes definitions of the three forms of the emh and a recap of evidence supporting and rejecting the weak and. Web the strong form of emh assumes that current stock prices fully reflect all public and private information. The efficient market hypothesis says.

PPT Investment Analysis and Portfolio Management First Canadian

Because the accidental walk hypothesis is. There are three versions of emh, and it is the toughest of all the. A direct implication is that it is. A typical lesson plan covering this topic usually includes definitions of the three forms of the emh and a recap of evidence supporting and rejecting the weak and. Web the strong form of.

Web The Strong Form Of Market Efficiency Is A Version Of The Emh Or Efficient Market Hypothesis.

There are three versions of emh, and it is the toughest of all the. Web for many years, academics and economics have studied the concept of efficiency applied to capital markets, efficient market hypothesis (emh) being a major. This includes all publicly available. The strong form of the emh holds that prices always reflect the entirety of both public and private information.

Web The Efficient Market Hypothesis (Emh) Maintains That All Stocks Are Perfectly Priced According To Their Inherent Investment Properties, The Knowledge Of Which All.

A direct implication is that it is. Web the efficient markets hypothesis (emh), popularly known as the random walk theory, is the proposition that current stock prices fully reflect available information about the value. Web strong form emh is the most rigorous form of emh. Web the strong form of emh assumes that current stock prices fully reflect all public and private information.

The Efficient Market Hypothesis Says That The Market Exists In Three Types, Or Forms:

Here's a little more about each: The weak form of the efficient market hypothesis although investors abiding by the efficient market hypothesis believe that security prices reflect all available. As mentioned earlier, in this essay i'm going to be going into depth on the strong form emh and arguing the validity of it. Web what are the types of emh?

A Typical Lesson Plan Covering This Topic Usually Includes Definitions Of The Three Forms Of The Emh And A Recap Of Evidence Supporting And Rejecting The Weak And.

This theory is criticized because it has market bubbles and consistently wins against the. Because the accidental walk hypothesis is. Eugene fama classified market efficiency into three distinct forms: Web the efficient market hypothesis, or emh, is an investment hypothesis that claims the stock market is an efficient marketplace in which stock prices always.