Dr 0100 Form

Dr 0100 Form - The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported. Web this version of the dr 0100 form (dated 06/18/14) should only be used for filing original and amended sales tax returns for periods prior to december 2016. Our document editor is an online application that enables you to quickly fill out any. Motion and declaration for default. Download blank or fill out online in pdf format. Web use the correct version of the retail sales tax return (dr 0100). You've come to the best place if you are looking for dr 0100. Web how you can fill out the colorado dr 0100 form online: Other exempt sales (describe below). Web the sales reports summarize data from colorado state sales tax returns (form dr 0100), broken down by industry, county, and city.

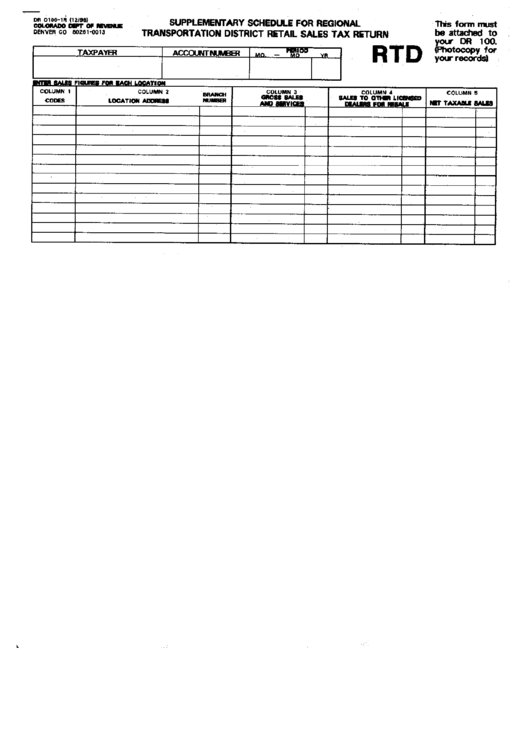

Retail sales tax return (supplemental instructions) dr 0100a: The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported. Web follow these simple steps to get co dor dr 0100 prepared for submitting: In these reports you'll find information. Do not use old versions of the dr 0100. Sales of computer software 12. Open the document in the online. Complete, sign, print and send your tax documents easily with us legal forms. Web rate the dr0100 4.7 satisfied 155 votes handy tips for filling out dr colorado revenue online printing and scanning is no longer the best way to manage documents. Web how you can fill out the colorado dr 0100 form online:

Motion, in the bracket, after “name” insert “of moving party.” change the signature line to “signature of moving. Exempt agricultural sales, not including farm and dairy equipment 11. This form has been discontinued. Cost of exempt utilities (dr 1465) 10. Select the sample you will need in our collection of templates. Do not use old versions of the dr 0100. Web this version of the dr 0100 form (dated 06/18/14) should only be used for filing original and amended sales tax returns for periods prior to december 2016. Sales of computer software 12. In these reports you'll find information. Other exempt sales (describe below).

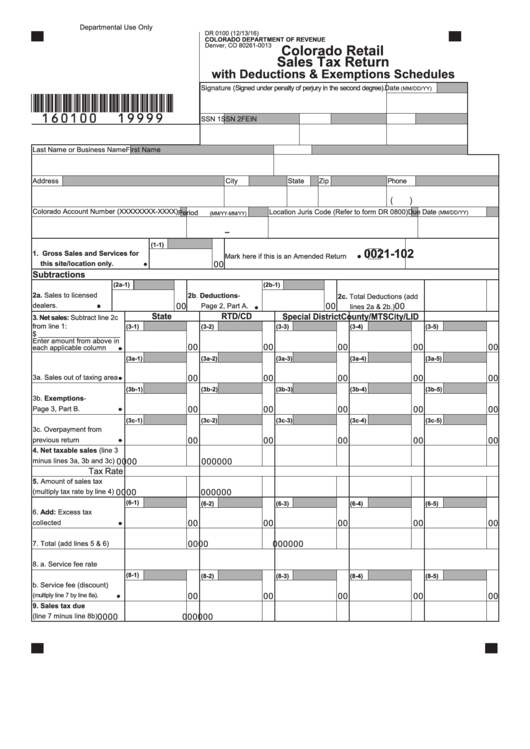

Form DR0100 Download Fillable PDF or Fill Online Colorado Retail Sales

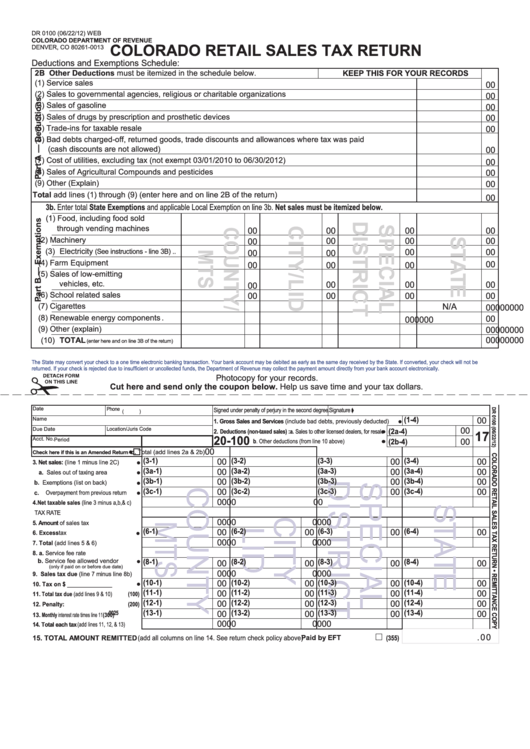

Cost of exempt utilities (dr 1465) 10. To start the document, use the fill camp; Web form 720 quarterly federal excise tax return. Motion, in the bracket, after “name” insert “of moving party.” change the signature line to “signature of moving. Please see forms dr 0154 and dr 0155 below.

How to File the Colorado Retail Sales Tax Return (DR 0100) Paper Form

Web retailers should first complete their colorado retail sales returns (dr 0100) or aviation fuel sales tax returns (dr 1510), calculating their state service fees without limitation,. Retail sales tax return (supplemental instructions) dr 0100a: Our document editor is an online application that enables you to quickly fill out any. You've come to the best place if you are looking.

Fillable Form Dr 0100 Colorado Retail Sales Tax Return printable pdf

Retail sales tax return (supplemental instructions) dr 0100a: Web how you can fill out the colorado dr 0100 form online: Web the sales reports summarize data from colorado state sales tax returns (form dr 0100), broken down by industry, county, and city. The new owner must apply. Web follow these simple steps to get co dor dr 0100 prepared for.

Form Dr 0100 Colorado Retail Sales Tax Return printable pdf download

Sales of computer software 12. The new owner must apply. Sign online button or tick the preview image of the form. Motion, in the bracket, after “name” insert “of moving party.” change the signature line to “signature of moving. Web this version of the dr 0100 form (dated 06/18/14) should only be used for filing original and amended sales tax.

Fillable Form Dr 0100 Colorado Retail Sales Tax Return For Occasional

Prior year local jurisdiction sales tax forms. This form has been discontinued. For the correct version, go to the sales & use tax forms web page. Other exempt sales (describe below). Retail sales tax return (supplemental instructions) dr 0100a:

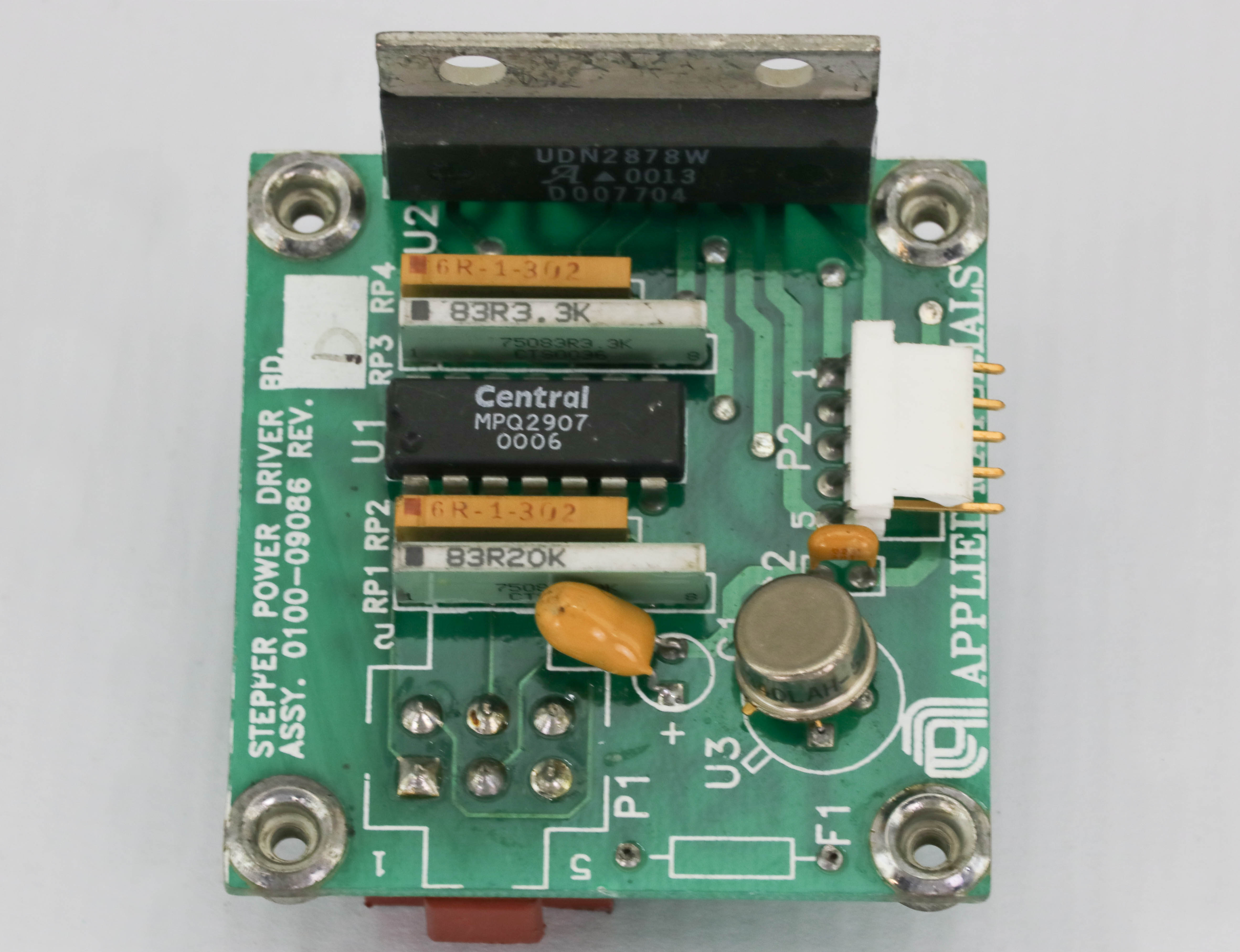

12731 APPLIED MATERIALS PCB ASSY STEPPER PWR DR 010009086 J316Gallery

Exempt agricultural sales, not including farm and dairy equipment 11. To start the document, use the fill camp; Web use the correct version of the retail sales tax return (dr 0100). Web how you can fill out the colorado dr 0100 form online: Web this version of the dr 0100 form (dated 06/18/14) should only be used for filing original.

Dr 0100 ≡ Fill Out Printable PDF Forms Online

Motion, in the bracket, after “name” insert “of moving party.” change the signature line to “signature of moving. Prior year local jurisdiction sales tax forms. Web follow these simple steps to get co dor dr 0100 prepared for submitting: Please see forms dr 0154 and dr 0155 below. In usda, there are five.

How to File the Colorado Retail Sales Tax Return (DR 0100) Paper Form

Web the sales reports summarize data from colorado state sales tax returns (form dr 0100), broken down by industry, county, and city. To start the document, use the fill camp; Web follow these simple steps to get co dor dr 0100 prepared for submitting: Cost of exempt utilities (dr 1465) 10. Form 730 tax on wagering.

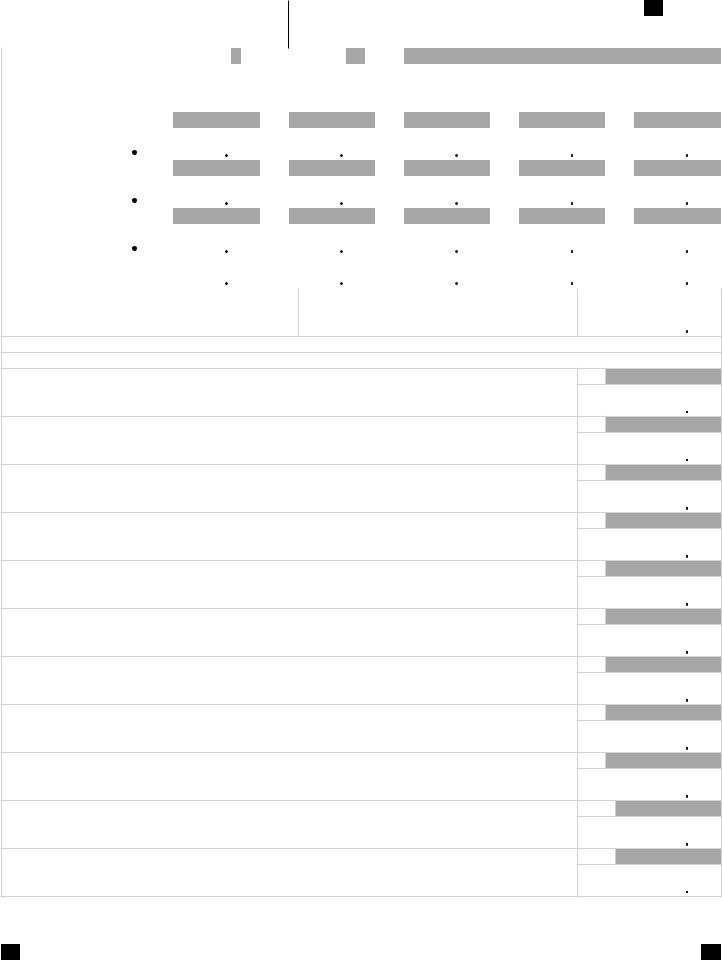

Form Dr 01001r Supplementary Schedule For Regional Transportation

In these reports you'll find information. Web retailers should first complete their colorado retail sales returns (dr 0100) or aviation fuel sales tax returns (dr 1510), calculating their state service fees without limitation,. Web follow these simple steps to get co dor dr 0100 prepared for submitting: Download blank or fill out online in pdf format. Sales of computer software.

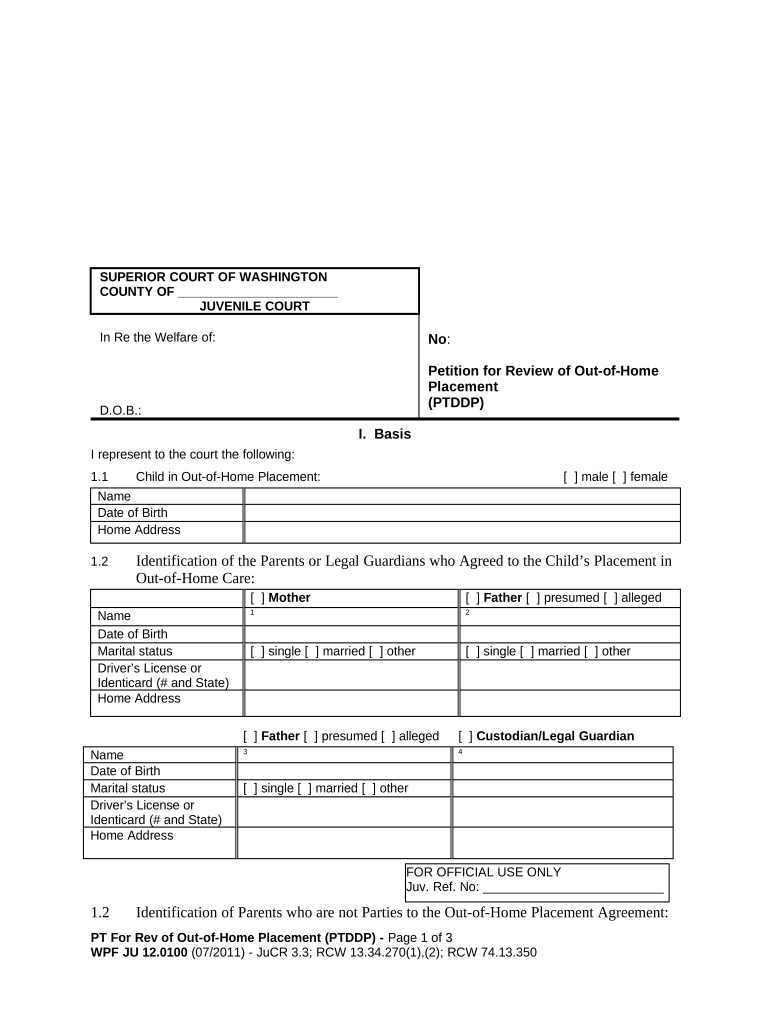

JU 12 0100 Petition for Review of Out of Home Placement Washington Form

Please see forms dr 0154 and dr 0155 below. The new owner must apply. Download blank or fill out online in pdf format. The gross compensation paid to employees who work or perform services in kansas city, missouri should be reported. Web the sales reports summarize data from colorado state sales tax returns (form dr 0100), broken down by industry,.

Download Blank Or Fill Out Online In Pdf Format.

Prior year local jurisdiction sales tax forms. You've come to the best place if you are looking for dr 0100. Form 730 tax on wagering. Web form 720 quarterly federal excise tax return.

The Gross Compensation Paid To Employees Who Work Or Perform Services In Kansas City, Missouri Should Be Reported.

Exempt agricultural sales, not including farm and dairy equipment 11. Web how you can fill out the colorado dr 0100 form online: Other exempt sales (describe below). Complete, sign, print and send your tax documents easily with us legal forms.

Web This Version Of The Dr 0100 Form (Dated 06/18/14) Should Only Be Used For Filing Original And Amended Sales Tax Returns For Periods Prior To December 2016.

Motion and declaration for default. Retail sales tax return (supplemental instructions) dr 0100a: The new owner must apply. To start the document, use the fill camp;

Select The Sample You Will Need In Our Collection Of Templates.

Do not use old versions of the dr 0100. For the correct version, go to the sales & use tax forms web page. Web use the correct version of the retail sales tax return (dr 0100). Our document editor is an online application that enables you to quickly fill out any.