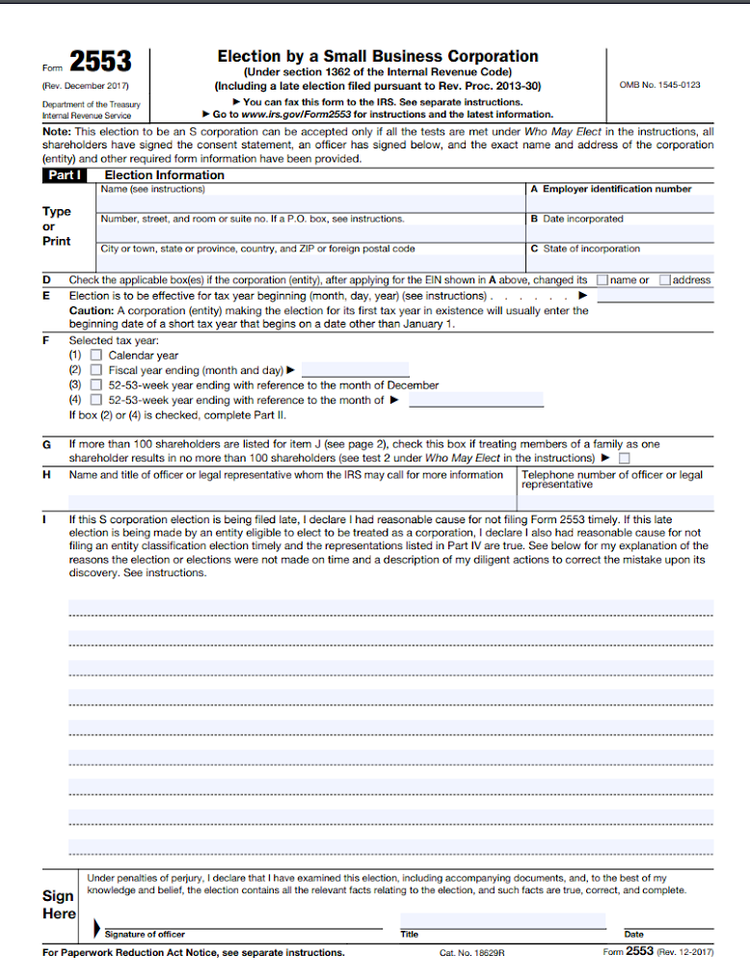

Download Form 2553

Download Form 2553 - December 2017) department of the treasury internal revenue service. Election by a small business corporation (under section 1362 of the internal revenue. Web we last updated the election by a small business corporation in february 2023, so this is the latest version of form 2553, fully updated for tax year 2022. Web instructions for form 2553 (12/2020) (for use with the december 2017 revision of form 2553, election by a small business corporation) section references are. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. Web download irs form 2553 and save to your computer. Web typically, an organization would incorporate in the state where it will conduct most of its business. Web you can download form from the an official website of the united states government and fill out the following information in the form.name of the companyaddress of the. Ad get ready for tax season deadlines by completing any required tax forms today. To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file it separately.

Ad get ready for tax season deadlines by completing any required tax forms today. December 2017) department of the treasury internal revenue service. Web download irs form 2553 and save to your computer. Web small businesses must file form 2553 with the irs within a specific time period to be considered for s corporation status, as mandated by law. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file it separately. Election by a small business corporation (under section 1362 of the internal revenue. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. For example, if you want. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c.

To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file it separately. A corporation or other entity eligible to be. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. Web we last updated the election by a small business corporation in february 2023, so this is the latest version of form 2553, fully updated for tax year 2022. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Download or email irs 2553 & more fillable forms, register and subscribe now! If you’d also like to download a completed sample form, please download this file as well: Ad get ready for tax season deadlines by completing any required tax forms today. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web in our simple guide, we'll walk you through form 2553 instructions so you can legally and officially start your new s corporation in the u.s.

Form 2553 Election by a Small Business Corporation (2014) Free Download

Download or email irs 2553 & more fillable forms, register and subscribe now! Web download irs form 2553 and save to your computer. Ad get ready for tax season deadlines by completing any required tax forms today. Web typically, an organization would incorporate in the state where it will conduct most of its business. For a corporation to be treated.

3 Reasons to File a Form 2553 for Your Business

Web typically, an organization would incorporate in the state where it will conduct most of its business. For a corporation to be treated as an s corporation, they must file form 2553, election by a small business corporation. Web instructions for form 2553 (12/2020) (for use with the december 2017 revision of form 2553, election by a small business corporation).

Form 2553 Instructions How and Where to File mojafarma

Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web you can download form from the an official website of the united states government and fill out the following information in the form.name of the companyaddress of the. Election by a small business corporation.

What Is IRS Form 2553? Question & Answer Session

Web typically, an organization would incorporate in the state where it will conduct most of its business. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. December 2017) department of the treasury internal revenue service. For a corporation to be treated as an s corporation, they must file.

Ssurvivor Form 2553 Sample

December 2017) department of the treasury internal revenue service. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. For example, if you want. Election by a small business corporation (under section 1362 of the internal revenue. Web you must file form 2553 within two.

Form 2553 An Overview of Who, When, and Why

Download or email irs 2553 & more fillable forms, register and subscribe now! Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web instructions for form 2553 (12/2020) (for use with the december 2017 revision of form 2553, election by a small business corporation).

Form 2553 (Rev December 2007) Edit, Fill, Sign Online Handypdf

A corporation or other entity eligible to be. For example, if you want. If you’d also like to download a completed sample form, please download this file as well: Ad get ready for tax season deadlines by completing any required tax forms today. Ad download or email irs 2553 & more fillable forms, register and subscribe now!

Irs Form 2553 Stock Photo Download Image Now Internal Revenue

Election by a small business corporation (under section 1362 of the internal revenue. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. If you’d also like to download a completed sample form, please download this file as well: Web typically, an organization would incorporate in the state where.

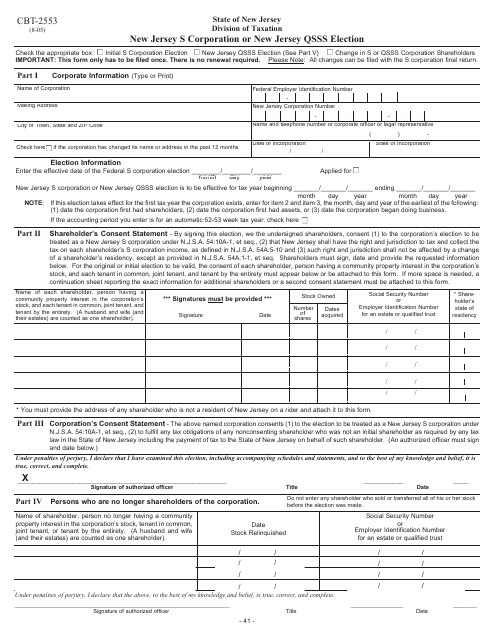

Form CBT2553 Download Fillable PDF or Fill Online New Jersey S

Web typically, an organization would incorporate in the state where it will conduct most of its business. December 2017) department of the treasury internal revenue service. Download or email irs 2553 & more fillable forms, register and subscribe now! Web small businesses must file form 2553 with the irs within a specific time period to be considered for s corporation.

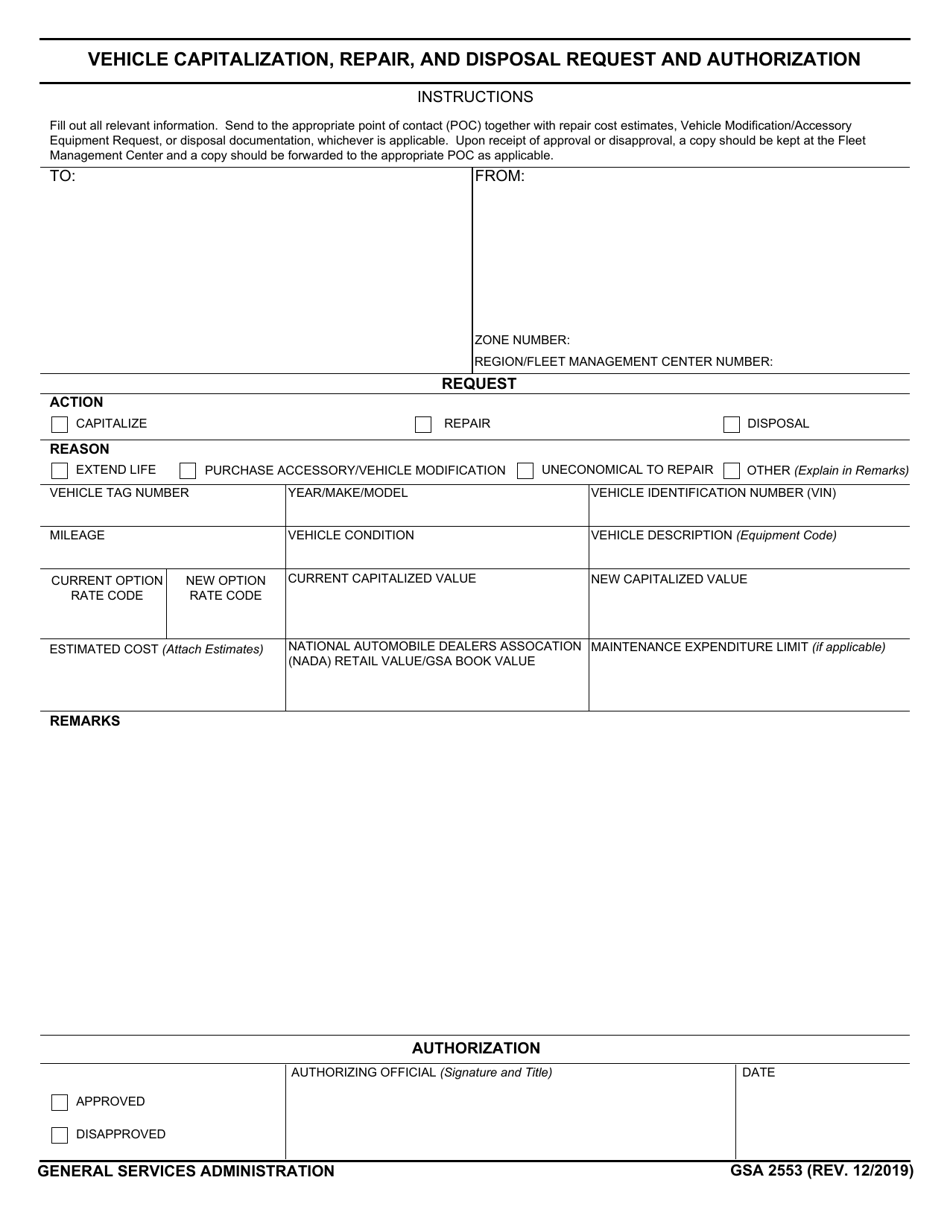

GSA Form 2553 Download Fillable PDF or Fill Online Vehicle

Web download irs form 2553 and save to your computer. Election by a small business corporation (under section 1362 of the internal revenue. Web small businesses must file form 2553 with the irs within a specific time period to be considered for s corporation status, as mandated by law. Web you can download form from the an official website of.

For Example, If You Want.

If you’d also like to download a completed sample form, please download this file as well: Web download irs form 2553 and save to your computer. For a corporation to be treated as an s corporation, they must file form 2553, election by a small business corporation. Web small businesses must file form 2553 with the irs within a specific time period to be considered for s corporation status, as mandated by law.

Web Typically, An Organization Would Incorporate In The State Where It Will Conduct Most Of Its Business.

Election by a small business corporation (under section 1362 of the internal revenue. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Ad download or email irs 2553 & more fillable forms, register and subscribe now! Web we last updated the election by a small business corporation in february 2023, so this is the latest version of form 2553, fully updated for tax year 2022.

Download Or Email Irs 2553 & More Fillable Forms, Register And Subscribe Now!

Web you can download form from the an official website of the united states government and fill out the following information in the form.name of the companyaddress of the. To make the election, you must complete form 8716, election to have a tax year other than a required tax year, and either attach it to form 2553 or file it separately. Ad get ready for tax season deadlines by completing any required tax forms today. December 2017) department of the treasury internal revenue service.

A Corporation Or Other Entity Eligible To Be.

Web instructions for form 2553 (12/2020) (for use with the december 2017 revision of form 2553, election by a small business corporation) section references are. Web in our simple guide, we'll walk you through form 2553 instructions so you can legally and officially start your new s corporation in the u.s. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start.