Distribution Code J On Form 1099-R

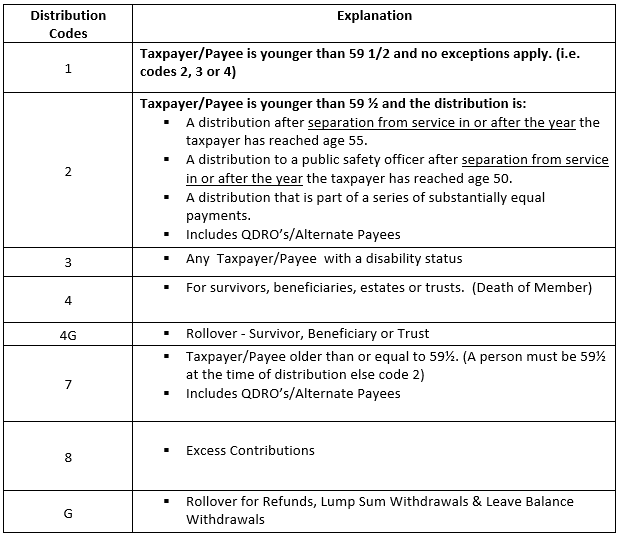

Distribution Code J On Form 1099-R - This is indexed on box 7. If there is any prior or. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Early distribution from a roth ira: Code j can be combined with the following codes: Web 1099r box 7 says code j but roth ira distribution shouldn't be taxed as it was contributions only, not earnings. Taxable amount is blank and it is marked that. Do not combine with any other codes. Do i need to file an amended return for tax year 2019 against the return i filed last year (2020 for tax year. Find the explanation for box 7 codes here.

Taxable amount is blank and it is marked that. Web if an ira conversion contribution or a rollover from a qualified plan is made to a roth ira that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross. Web but code j says the amount is *taxable in 2019*. Web if the distribution code entered is j, the gross distribution carries to form 8606 as a distribution from a roth ira, but see the following note. In the distribution code #1 field, select code g from the dropdown menu. This is indexed on box 7. Do not combine with any other codes. We use these codes and your answers to some interview. Early distribution from a roth ira: The amount may or may not be taxable depending on the amount distributed and the.

Do i need to file an amended return for tax year 2019 against the return i filed last year (2020 for tax year. Web if the distribution code entered is j, the gross distribution carries to form 8606 as a distribution from a roth ira, but see the following note. In the distribution code #1 field, select code g from the dropdown menu. If earnings are distributed, enter the amount. Web but code j says the amount is *taxable in 2019*. Find the explanation for box 7 codes here. This is indexed on box 7. Taxable amount is blank and it is marked that. Web code h can be combined with the following code: Should i change code to q (qualified) &.

Do I Get A Tax Statement For 401k Tax Walls

Web 1099r box 7 says code j but roth ira distribution shouldn't be taxed as it was contributions only, not earnings. In the distribution code #1 field, select code g from the dropdown menu. If there is any prior or. Do not combine with any other codes. Early distribution from a roth ira:

Example Of Non Ssa 1099 Form / Publication 915 (2020), Social Security

Box 7 codes 1 = early distribution. Web if an ira conversion contribution or a rollover from a qualified plan is made to a roth ira that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross. Web if the distribution code entered is j, the gross distribution carries to form 8606 as a.

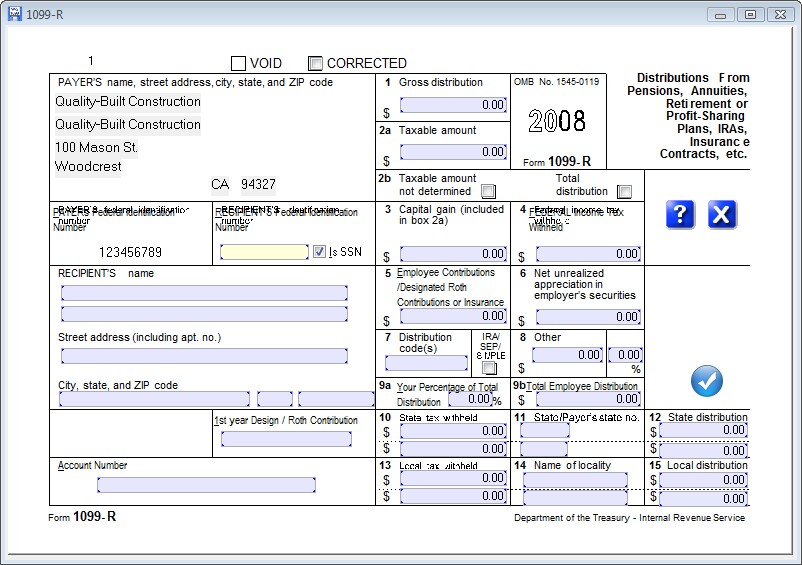

Entering & Editing Data > Form 1099R

Web code j indicates that there was an early distribution from a roth ira. Should i change code to q (qualified) &. Web but code j says the amount is *taxable in 2019*. Web code h can be combined with the following code: Do i need to file an amended return for tax year 2019 against the return i filed.

Sample 12r Form Filled Out You Should Experience Sample 12r Form

Web if an ira conversion contribution or a rollover from a qualified plan is made to a roth ira that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross. Should i change code to q (qualified) &. In the distribution code #1 field, select code g from the dropdown menu. Web code h.

Form 1099R Distribution Codes for Defined Contribution Plans DWC

This is indexed on box 7. Box 7 codes 1 = early distribution. If there is any prior or. If earnings are distributed, enter the amount. Web 1099r box 7 says code j but roth ira distribution shouldn't be taxed as it was contributions only, not earnings.

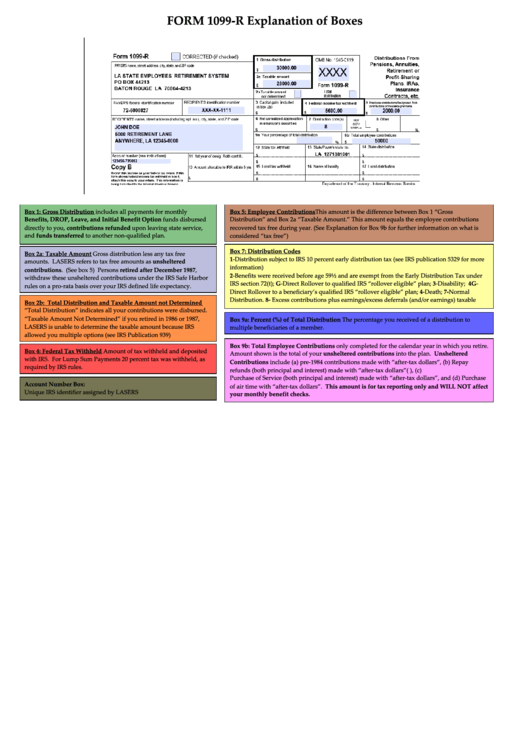

Form 1099R Explanation Of Boxes printable pdf download

Web if an ira conversion contribution or a rollover from a qualified plan is made to a roth ira that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross. This is indexed on box 7. Do i need to file an amended return for tax year 2019 against the return i filed last.

How To Fill Out Form 1099 R Universal Network

Web code j indicates that there was an early distribution from a roth ira. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Web if no earnings are distributed, enter 0 (zero) in box 2a and code 8 in box 7 for a traditional ira and code j for.

1099R Software EFile TIN Matching Print and Mail 1099R Forms

Web if no earnings are distributed, enter 0 (zero) in box 2a and code 8 in box 7 for a traditional ira and code j for a roth ira. Box 7 codes 1 = early distribution. This is indexed on box 7. Do not combine with any other codes. Web if the distribution code entered is j, the gross distribution.

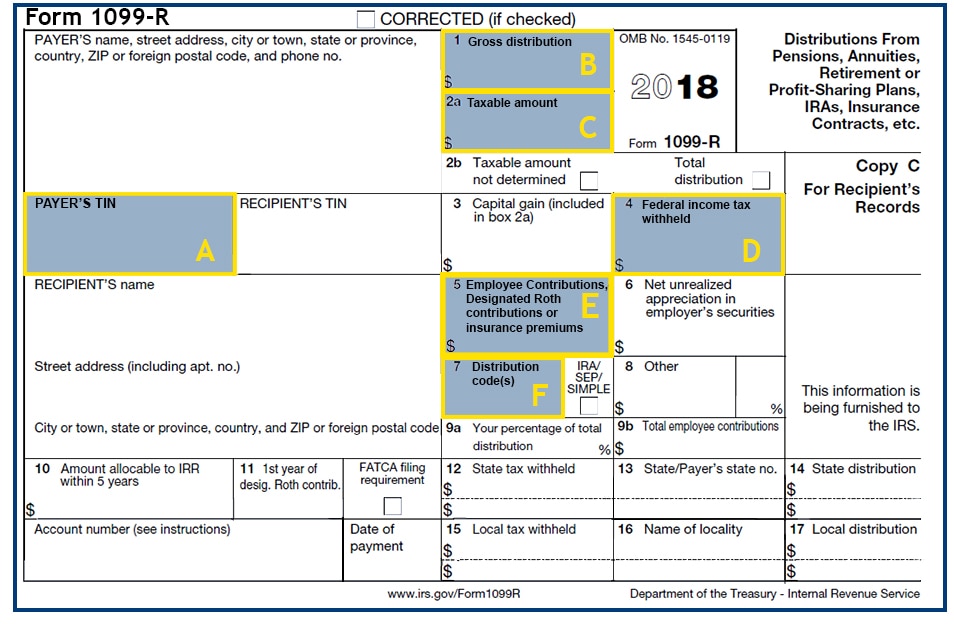

IRS Form 1099R Box 7 Distribution Codes — Ascensus

Web code h can be combined with the following code: Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Web but code j says the amount is *taxable in 2019*. Code j can be combined with the following codes: If there is any prior or.

1099R Forms LASERS

Do i need to file an amended return for tax year 2019 against the return i filed last year (2020 for tax year. Should i change code to q (qualified) &. Web code j indicates that there was an early distribution from a roth ira. Taxable amount is blank and it is marked that. We use these codes and your.

Web Code H Can Be Combined With The Following Code:

Taxable amount is blank and it is marked that. If earnings are distributed, enter the amount. Early distribution from a roth ira: This is indexed on box 7.

Should I Change Code To Q (Qualified) &.

The amount may or may not be taxable depending on the amount distributed and the. We use these codes and your answers to some interview. If there is any prior or. Do not combine with any other codes.

Code J Can Be Combined With The Following Codes:

Box 7 codes 1 = early distribution. Web if no earnings are distributed, enter 0 (zero) in box 2a and code 8 in box 7 for a traditional ira and code j for a roth ira. Web code j indicates that there was an early distribution from a roth ira. Find the explanation for box 7 codes here.

Client Has A Form 1099R With A Code J In Box 7 Which States Early Distribution From A Roth Ira.

Web 1099r box 7 says code j but roth ira distribution shouldn't be taxed as it was contributions only, not earnings. Web if the distribution code entered is j, the gross distribution carries to form 8606 as a distribution from a roth ira, but see the following note. Web if an ira conversion contribution or a rollover from a qualified plan is made to a roth ira that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross. In the distribution code #1 field, select code g from the dropdown menu.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)