Deed Transfer Form California

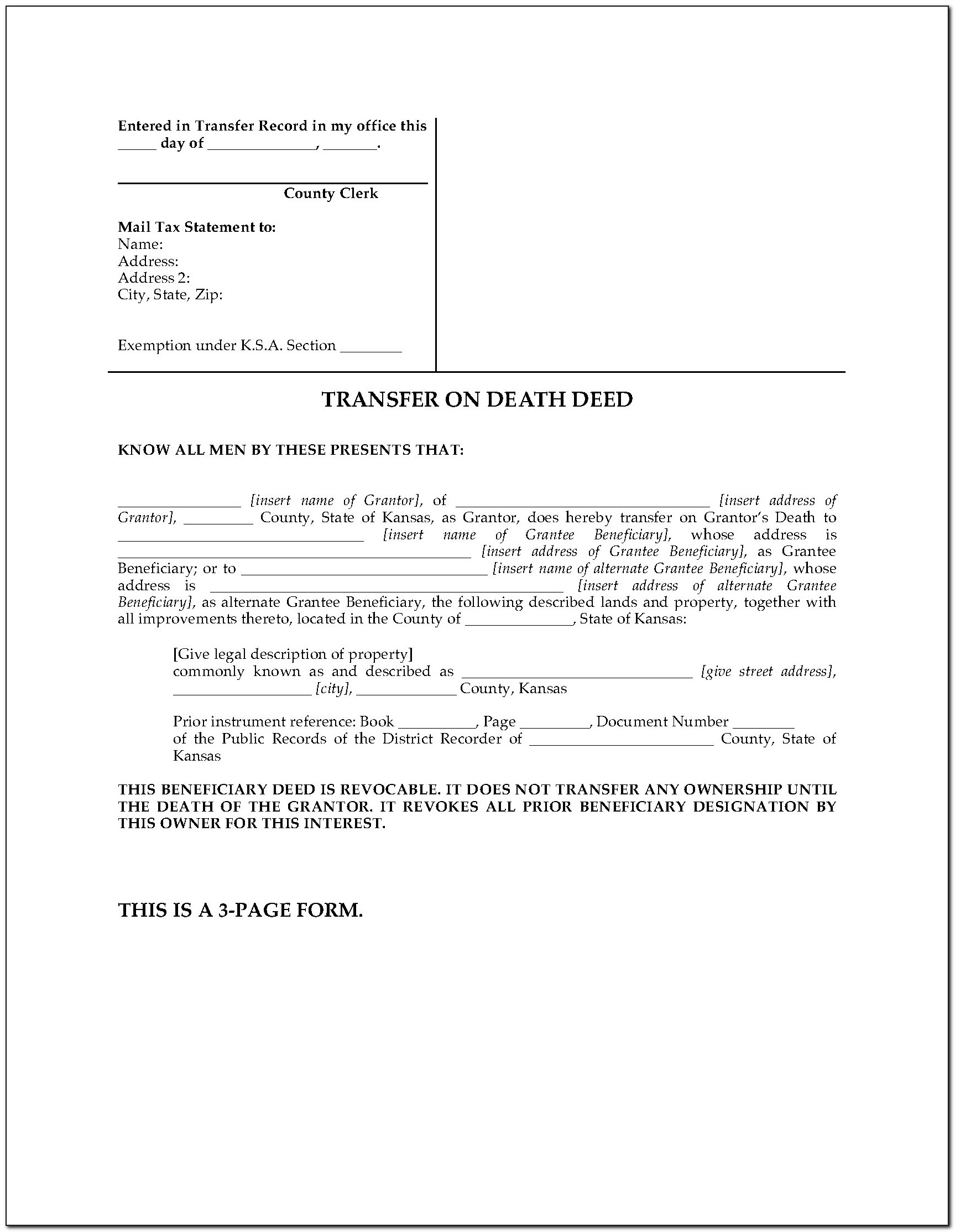

Deed Transfer Form California - Web california transfer on death affidavit information. This form is also available at the norwalk rr/cc main. Web use this deed to transfer the residential property described below directly to your named beneficiaries when you die. Ownership of property in joint tenancy or community property with right of survivorship. Upload, modify or create forms. What if i need help? How do i prepare the transfer on death deed? Using an affidavit of death to claim real estate from a california transfer on death deed. Web 20 day preliminary notice deeds when transferring property, a preliminary change of ownership form is required. Try it for free now!

Web some details in a real estate deed are presumed unless specifically restricted or removed. Web a deed form entails the legal transfer of property from the grantor or seller to the grantee or buyer. Start filling from the upper left corner of the paper. You should carefully read all of the. Web decedent in california how long do i have to wait to transfer the property? Web use this deed to transfer the residential property described below directly to your named beneficiaries when you die. Web what is california’s transfer on death (todd) deed? Web for a complete list, see california probate code section 13050. Web the simple revocable transfer on death deed, also called tod deed or beneficiary deed, is a simple way to leave your residence to your heirs without the need for probate. Create your contract for deed form california today.

Web the simple revocable transfer on death deed, also called tod deed or beneficiary deed, is a simple way to leave your residence to your heirs without the need for probate. The word “grant” is expressly designated by statute as a word of. Start filling from the upper left corner of the paper. 35 california law lets cities add a city transfer tax on deeds that transfer. Ownership of property in joint tenancy or community property with right of survivorship. You must wait at least 40 days after the person dies. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. What if i need help? The quitclaim deed authorizes the transfer of. Web a deed form entails the legal transfer of property from the grantor or seller to the grantee or buyer.

Individual Grant Deed Form California Universal Network

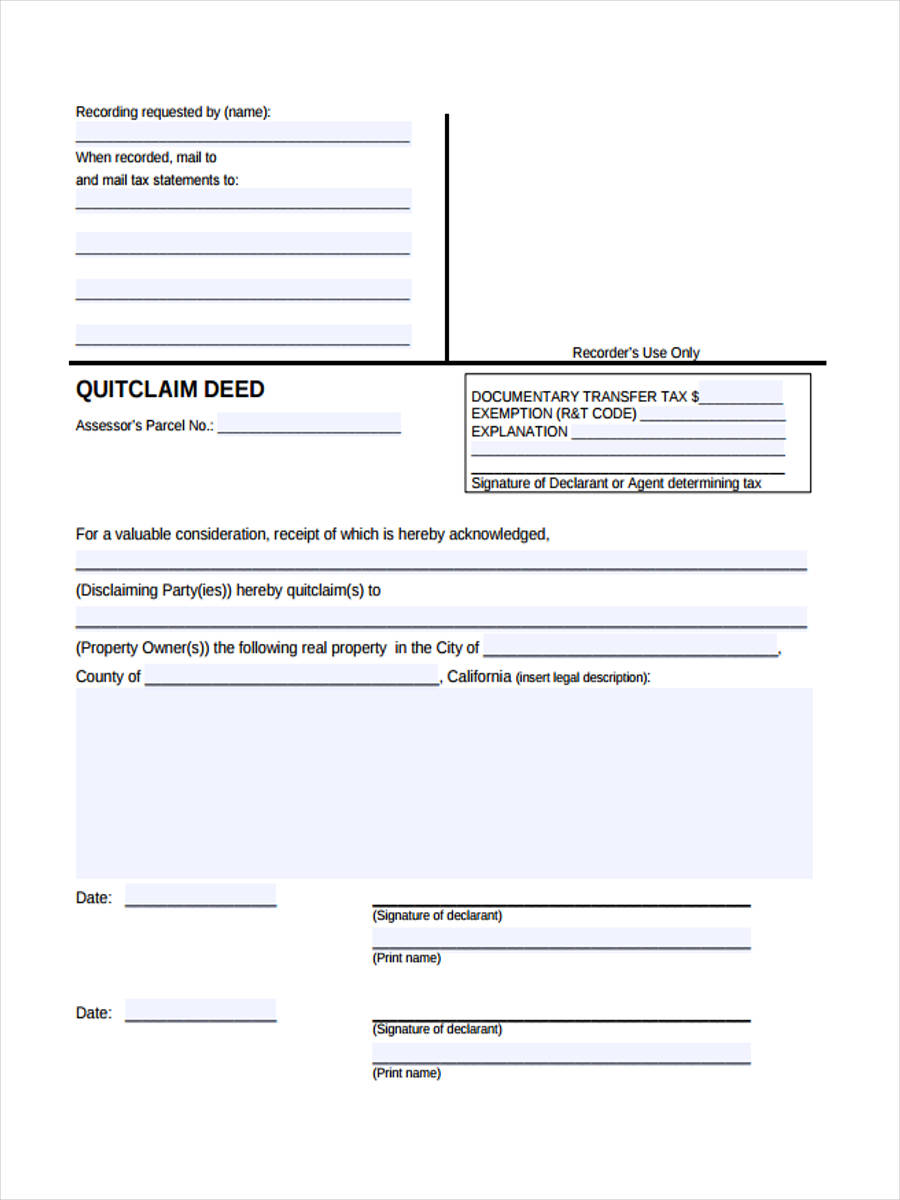

Ad answer simple questions to make a quit claim deed on any device in minutes. Web today, californians most often transfer title to real property by a simple written instrument, the grant deed. The california general warranty deed entails the same legal. This form is also available at the norwalk rr/cc main. Web what is california’s transfer on death (todd).

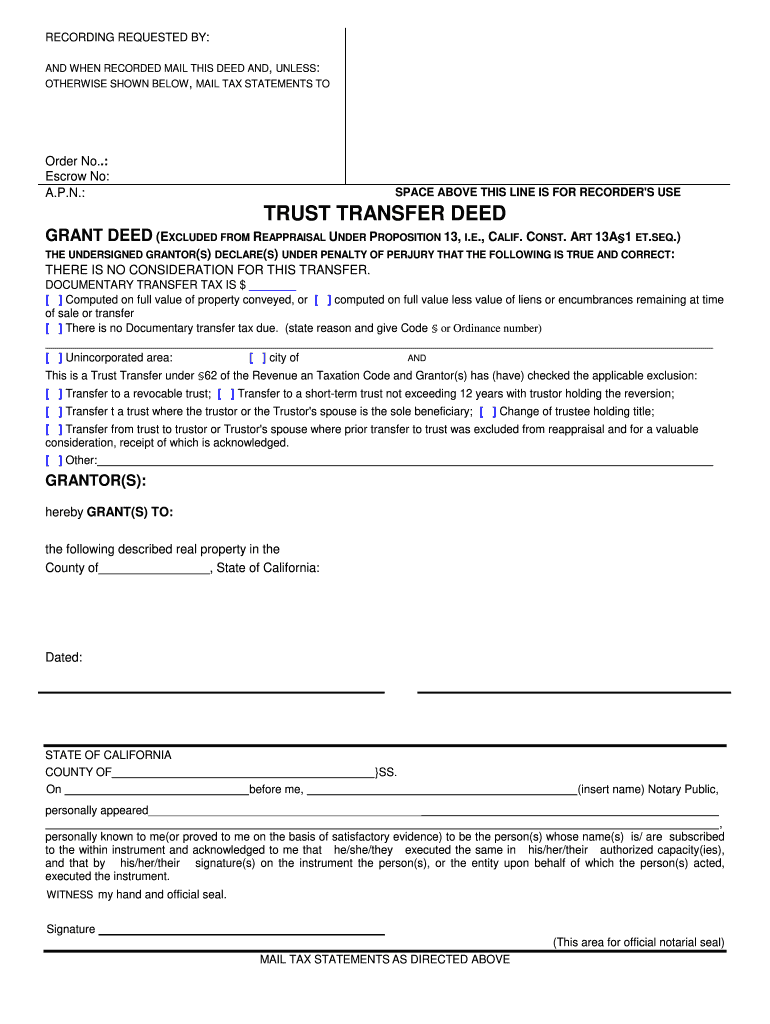

Trust Transfer Deed California Fill Online, Printable, Fillable

This form is also available at the norwalk rr/cc main. Web the simple revocable transfer on death deed, also called tod deed or beneficiary deed, is a simple way to leave your residence to your heirs without the need for probate. How do i prepare the transfer on death deed? Start filling from the upper left corner of the paper..

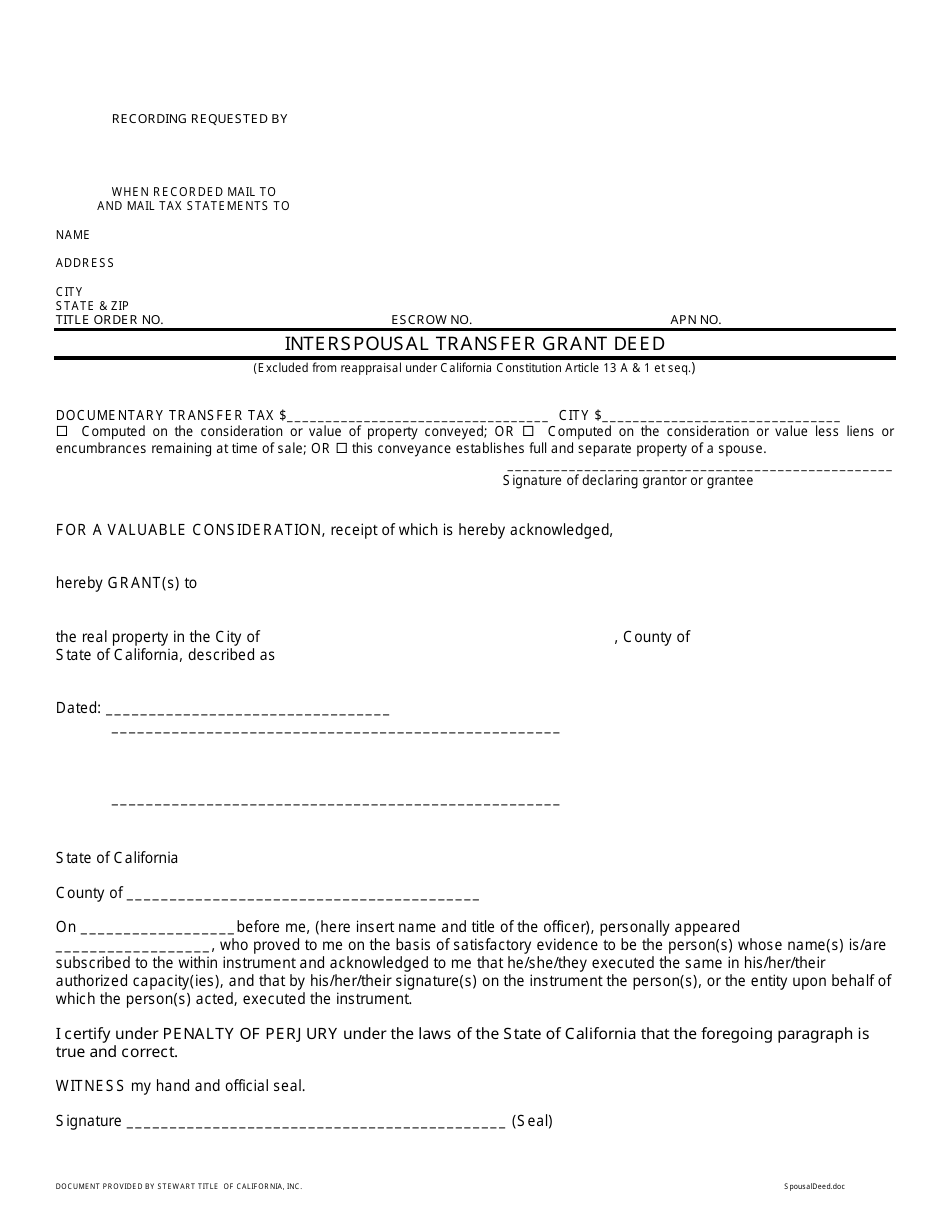

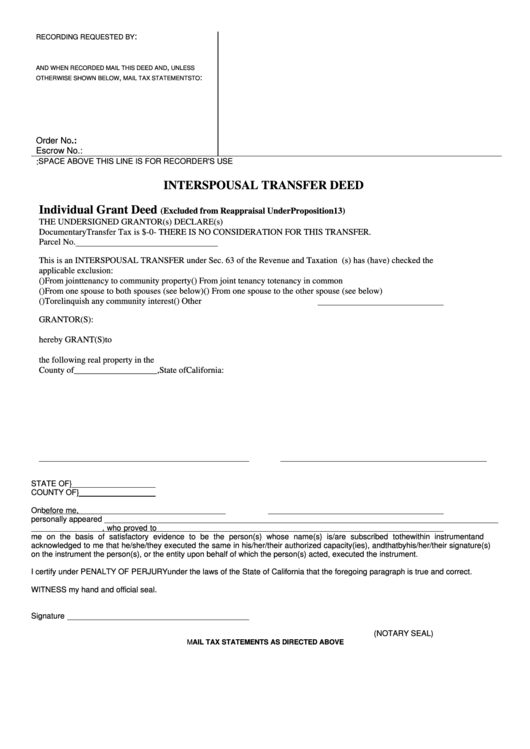

Free Interspousal Transfer Deed California Form Form Resume

Using an affidavit of death to claim real estate from a california transfer on death deed. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Web decedent in california how long do i have to wait to transfer the property? The transfer on death deed is considered.

California Interspousal Transfer Grant Deed Form Download Printable PDF

Web what is california’s transfer on death (todd) deed? Ad answer simple questions to make a quit claim deed on any device in minutes. You can talk to a lawyer. The word “grant” is expressly designated by statute as a word of. Try it for free now!

California Quit Claim Deed Sample Master of Template Document

What if i need help? Try it for free now! You should carefully read all of the. The word “grant” is expressly designated by statute as a word of. Web deedclaim updates our deed forms to stay current with statutory amendments.

California Grant Deed Form 2021 Fill Online, Printable, Fillable

Create your contract for deed form california today. Web what is california’s transfer on death (todd) deed? New changes to the california transfer on death deed as. Web 20 day preliminary notice deeds when transferring property, a preliminary change of ownership form is required. Our california tod deed form reflects the current version of the law.

Top 7 Interspousal Transfer Deed Form Templates free to download in PDF

Ad trust transfer deed & more fillable forms, register and subscribe now! 35 california law lets cities add a city transfer tax on deeds that transfer. How do i prepare the transfer on death deed? Start filling from the upper left corner of the paper. Web today, californians most often transfer title to real property by a simple written instrument,.

interspousal transfer deed form in texas Fill Online, Printable

Web today, californians most often transfer title to real property by a simple written instrument, the grant deed. Using an affidavit of death to claim real estate from a california transfer on death deed. Web revocable transfer on death (tod) deed (california probate code section 5600) assessor’s parcel number: Web the county transfer tax rate is $0.55 per $500.00 (or.

Interspousal Grant Deed Form California Form Resume Examples

Ownership of property in joint tenancy or community property with right of survivorship. Ad answer simple questions to make a quit claim deed on any device in minutes. Try it for free now! This form is also available at the norwalk rr/cc main. 35 california law lets cities add a city transfer tax on deeds that transfer.

Free Printable Beneficiary Deed

1 california recognizes several types of deeds for transferring real. Using an affidavit of death to claim real estate from a california transfer on death deed. Web revocable transfer on death (tod) deed (california probate code section 5600) assessor’s parcel number: The california general warranty deed entails the same legal. Upload, modify or create forms.

Ad Answer Simple Questions To Make A Quit Claim Deed On Any Device In Minutes.

What if i need help? Web a deed allows the current owners ( grantors) to transfer property to new owners ( grantees ). So, there is no requirement for a deed to contain words of inheritance or to identify. Upload, modify or create forms.

Web The Simple Revocable Transfer On Death Deed, Also Called Tod Deed Or Beneficiary Deed, Is A Simple Way To Leave Your Residence To Your Heirs Without The Need For Probate.

35 california law lets cities add a city transfer tax on deeds that transfer. Web a deed form entails the legal transfer of property from the grantor or seller to the grantee or buyer. Web for a complete list, see california probate code section 13050. Start filling from the upper left corner of the paper.

Web Today, Californians Most Often Transfer Title To Real Property By A Simple Written Instrument, The Grant Deed.

You can talk to a lawyer. New changes to the california transfer on death deed as. Create your contract for deed form california today. The california general warranty deed entails the same legal.

Using An Affidavit Of Death To Claim Real Estate From A California Transfer On Death Deed.

How do i prepare the transfer on death deed? Web the county transfer tax rate is $0.55 per $500.00 (or fractional part) of consideration. Web use this deed to transfer the residential property described below directly to your named beneficiaries when you die. Our california tod deed form reflects the current version of the law.