Cuyahoga County Homestead Exemption Form

Cuyahoga County Homestead Exemption Form - Web you can apply to the homestead program if you are 65 years of age or older or have a disability has defined by the program. Web posted may 18, 2022 12:00 pm by kristen nawrocki ohio’s homestead exemption shelters the primary $25,000 of your home’s value from corporate. Maintains records of property ownership, valuation, and taxation. Web in order to be eligible for the enhanced disabled veteran homestead exemption, the form of ownership must be identified. To get an application form, or if you need help or have questions, call your county. Web property exemption form exemption from residential rental registration owner name: Web senior citizens, permanently disabled, and surviving spouses of public service officers killed in the line of duty may be eligible to receive homestead exemption which is a reduction. Web __ y) from a county land reutilization corporation organized under r.c. Web the exemption, which takes the form of a credit on property tax bills, allows qualifying homeowners to exempt $25,000 of the market value of their home from all. 6.has the granter indicated that this property is entitled to receive the senior.

Web ohio revised code section 323.151: Web the grantor of the manufactured or mobile home referred to above states that the home received the senior citizen, disabled persons or surviving spouse homestead exemption. House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty. Preserves a complete historical record of all property transactions. Web senior citizens, permanently disabled, and surviving spouses of public service officers killed in the line of duty may be eligible to receive homestead exemption which is a reduction. Owned by a corporation, partnership,. Web find out what we can do for you. Maintains records of property ownership, valuation, and taxation. Web fill out application form dte105a.you can get the form at your county auditor’s office or at your county auditor’s website. Web in order to be eligible for the enhanced disabled veteran homestead exemption, the form of ownership must be identified.

House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty. This program offers you a property tax exemption to help you lower the amount of property tax you pay. Web you can apply to the homestead program if you are 65 years of age or older or have a disability has defined by the program. You must own and live at the address where you. To get an application form, or if you need help or have questions, call your county. Web ohio revised code section 323.151: View the services, forms, and resources available from the cuyahoga county fiscal officer. Preserves a complete historical record of all property transactions. Maintains records of property ownership, valuation, and taxation. Web senior citizens, permanently disabled, and surviving spouses of public service officers killed in the line of duty may be eligible to receive homestead exemption which is a reduction.

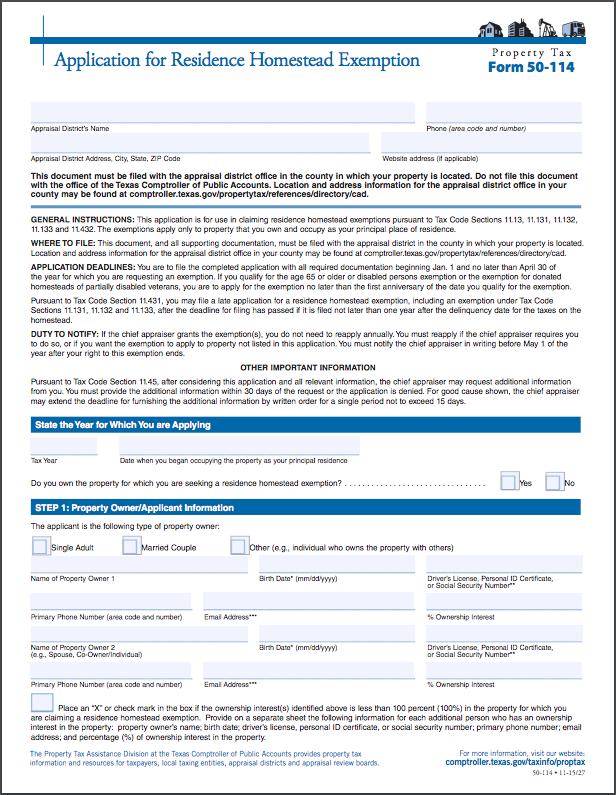

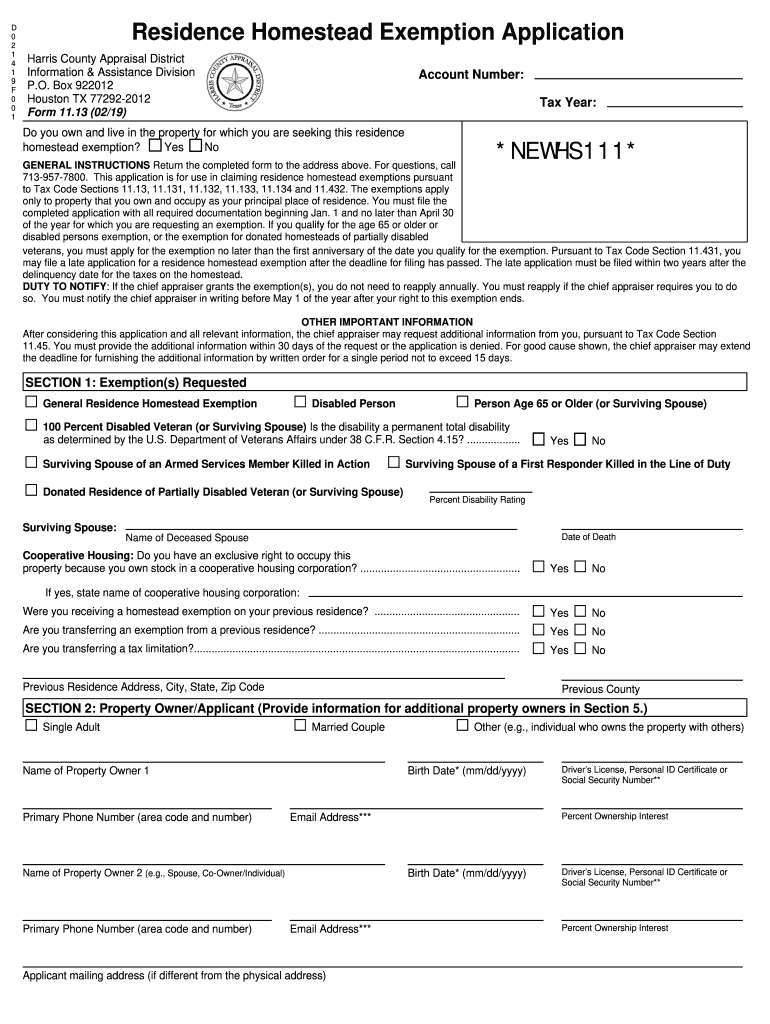

Harris County Homestead Exemption Form

You can get an exemption of your home's. You must own and live at the address where you. Web find out what we can do for you. Web property exemption form exemption from residential rental registration owner name: Web the grantor of the manufactured or mobile home referred to above states that the home received the senior citizen, disabled persons.

Riverside County Homestead Exemption Form

Web find out what we can do for you. Preserves a complete historical record of all property transactions. Owned by a corporation, partnership,. 10/19 senior citizens, disabled persons and surviving spouses in order to qualify an applicant for the homestead reduction, your county auditor is required to. To get an application form, or if you need help or have questions,.

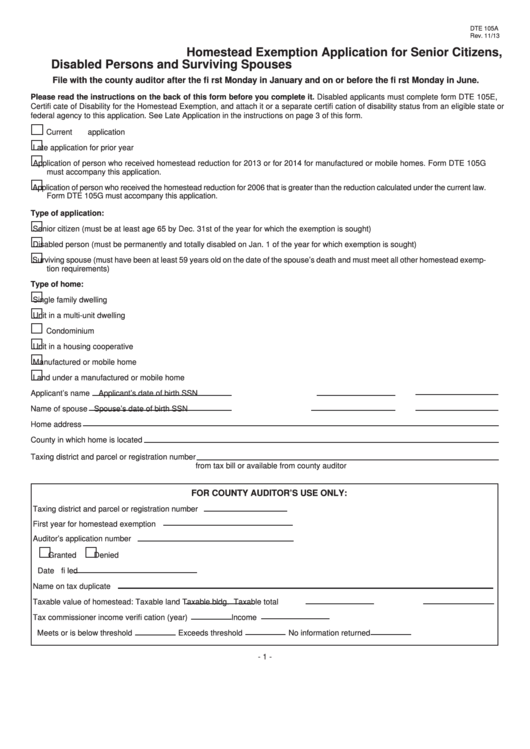

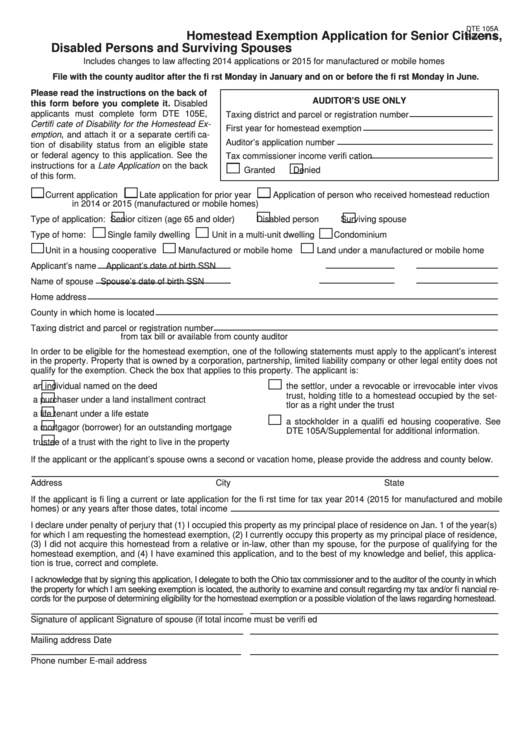

Fillable Form Dte 105a Homestead Exemption Application For Senior

Web ohio revised code section 323.151: Web in order to be eligible for the enhanced disabled veteran homestead exemption, the form of ownership must be identified. Web the grantor of the manufactured or mobile home referred to above states that the home received the senior citizen, disabled persons or surviving spouse homestead exemption. Web find out what we can do.

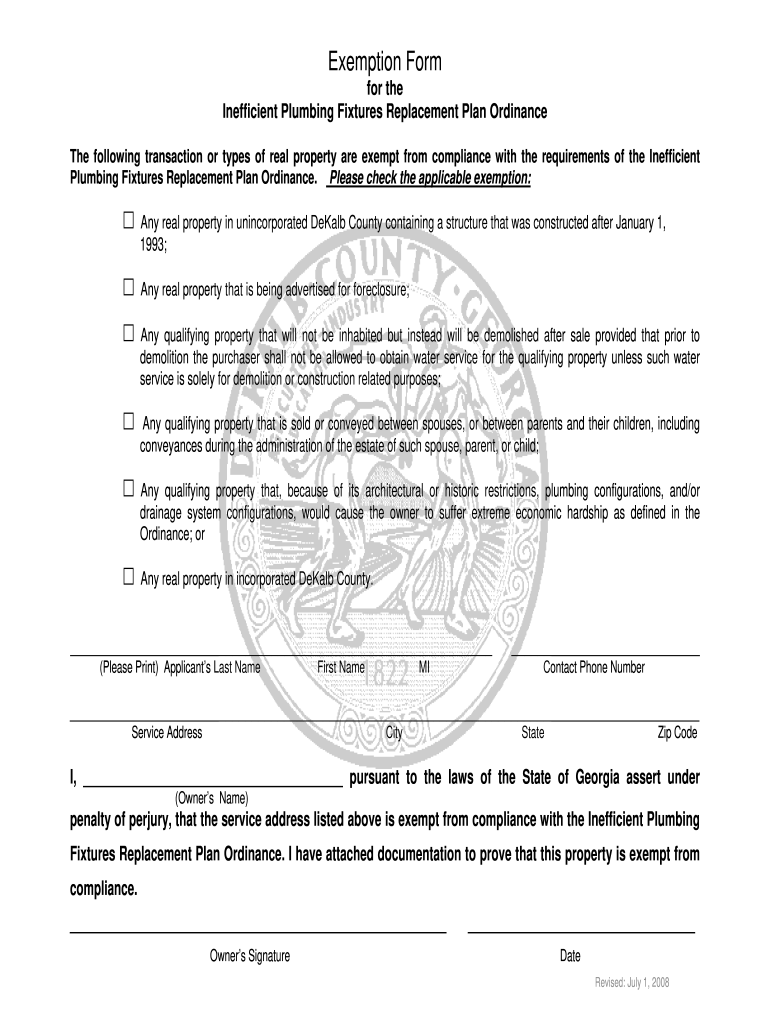

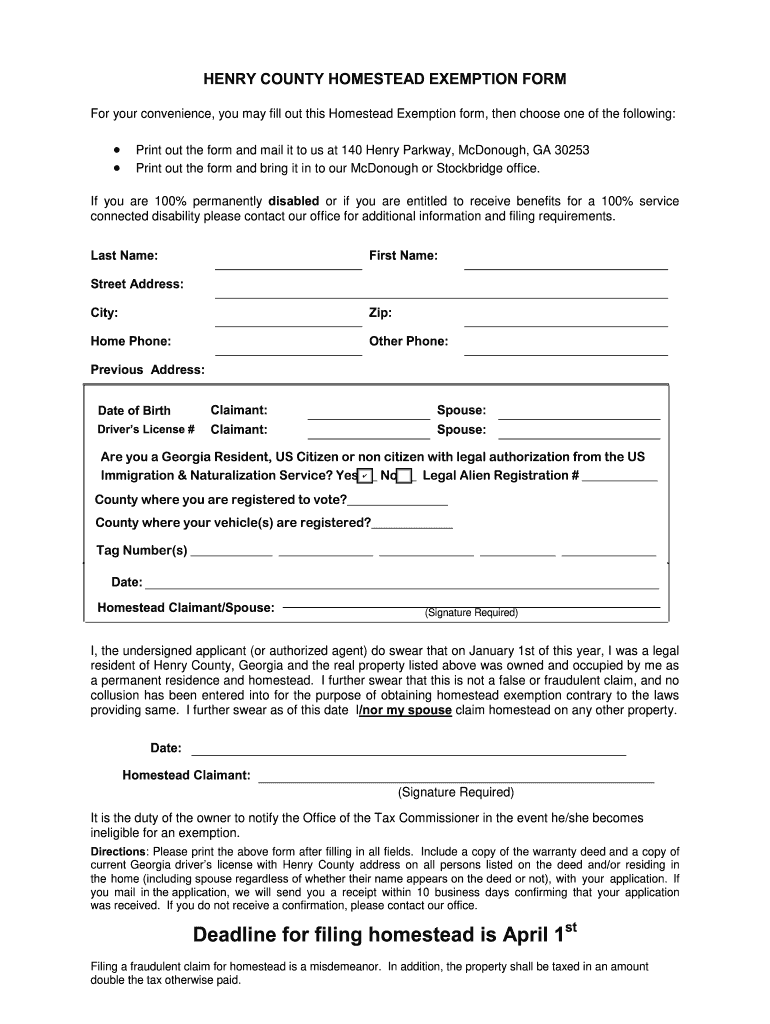

How To Apply For Homestead Exemption In Dekalb County Ga PRORFETY

Web ohio revised code section 323.151: Web you can apply to the homestead program if you are 65 years of age or older or have a disability has defined by the program. File form dte105a with your county. 10/19 senior citizens, disabled persons and surviving spouses in order to qualify an applicant for the homestead reduction, your county auditor is.

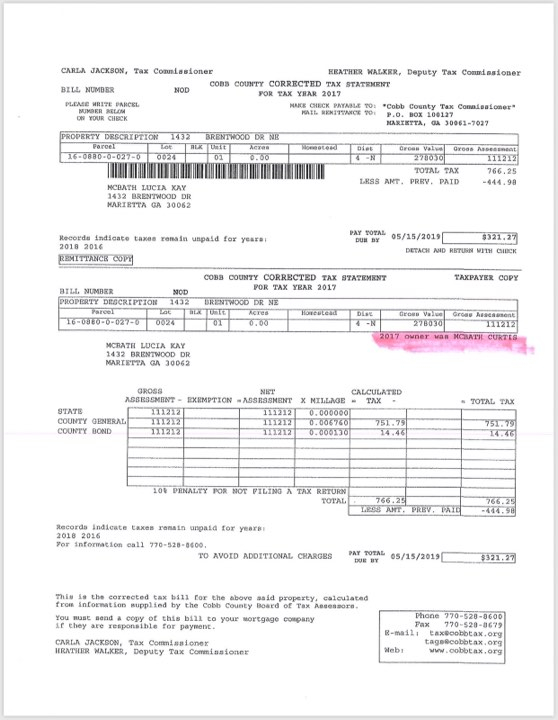

2022 Update Houston Homestead Home Exemptions StepByStep Guide

Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with. This program offers you a property tax exemption to help you lower the amount of property tax you pay. You can get an exemption of your home's. Web we last updated the homestead exemption application.

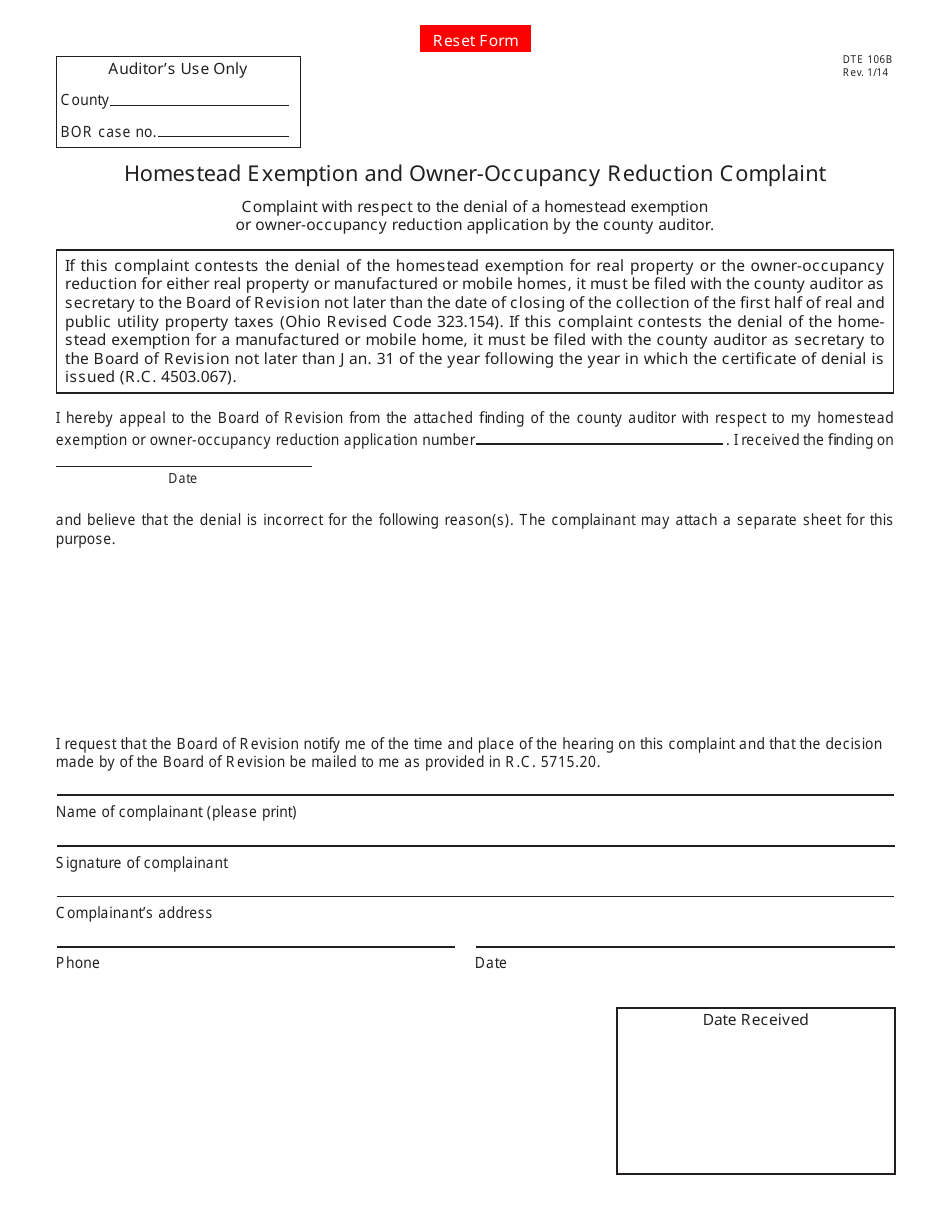

How To Apply For Homestead Tax Credit In Ohio PRORFETY

Web the exemption, which takes the form of a credit on property tax bills, allows qualifying homeowners to exempt $25,000 of the market value of their home from all. Web the real property department: 10/19 senior citizens, disabled persons and surviving spouses in order to qualify an applicant for the homestead reduction, your county auditor is required to. Web posted.

Form Residence Homestead Exemption Application Fill Out and Sign

This program offers you a property tax exemption to help you lower the amount of property tax you pay. Owned by a corporation, partnership,. To get an application form, or if you need help or have questions, call your county. Web the real property department: Web to apply, complete the application form (dte 105a, homestead exemption application form for senior.

Free Washington State Homestead Exemption Form

Web __ y) from a county land reutilization corporation organized under r.c. You can get an exemption of your home's. You must own and live at the address where you. 10/19 senior citizens, disabled persons and surviving spouses in order to qualify an applicant for the homestead reduction, your county auditor is required to. Web senior citizens, permanently disabled, and.

Bibb County Homestead Exemption Form

File form dte105a with your county. Maintains records of property ownership, valuation, and taxation. Preserves a complete historical record of all property transactions. Section 1724 to a third party. Owned by a corporation, partnership,.

Cuyahoga County Homestead Exemption Form

Web the grantor of the manufactured or mobile home referred to above states that the home received the senior citizen, disabled persons or surviving spouse homestead exemption. 10/19 senior citizens, disabled persons and surviving spouses in order to qualify an applicant for the homestead reduction, your county auditor is required to. Section 1724 to a third party. 6.has the granter.

Preserves A Complete Historical Record Of All Property Transactions.

To get an application form, or if you need help or have questions, call your county. Web in order to be eligible for the enhanced disabled veteran homestead exemption, the form of ownership must be identified. 6.has the granter indicated that this property is entitled to receive the senior. Web find out what we can do for you.

Web The Grantor Of The Manufactured Or Mobile Home Referred To Above States That The Home Received The Senior Citizen, Disabled Persons Or Surviving Spouse Homestead Exemption.

Owned by a corporation, partnership,. Web fill out application form dte105a.you can get the form at your county auditor’s office or at your county auditor’s website. Web ohio revised code section 323.151: Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with.

Web We Last Updated The Homestead Exemption Application For Senior Citizens, Disabled Persons And Surviving Spouses In February 2023, So This Is The Latest Version Of Form.

Web the real property department: View the services, forms, and resources available from the cuyahoga county fiscal officer. Maintains records of property ownership, valuation, and taxation. Web property exemption form exemption from residential rental registration owner name:

Web The Exemption, Which Takes The Form Of A Credit On Property Tax Bills, Allows Qualifying Homeowners To Exempt $25,000 Of The Market Value Of Their Home From All.

House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty. Web you can apply to the homestead program if you are 65 years of age or older or have a disability has defined by the program. Web __ y) from a county land reutilization corporation organized under r.c. This program offers you a property tax exemption to help you lower the amount of property tax you pay.