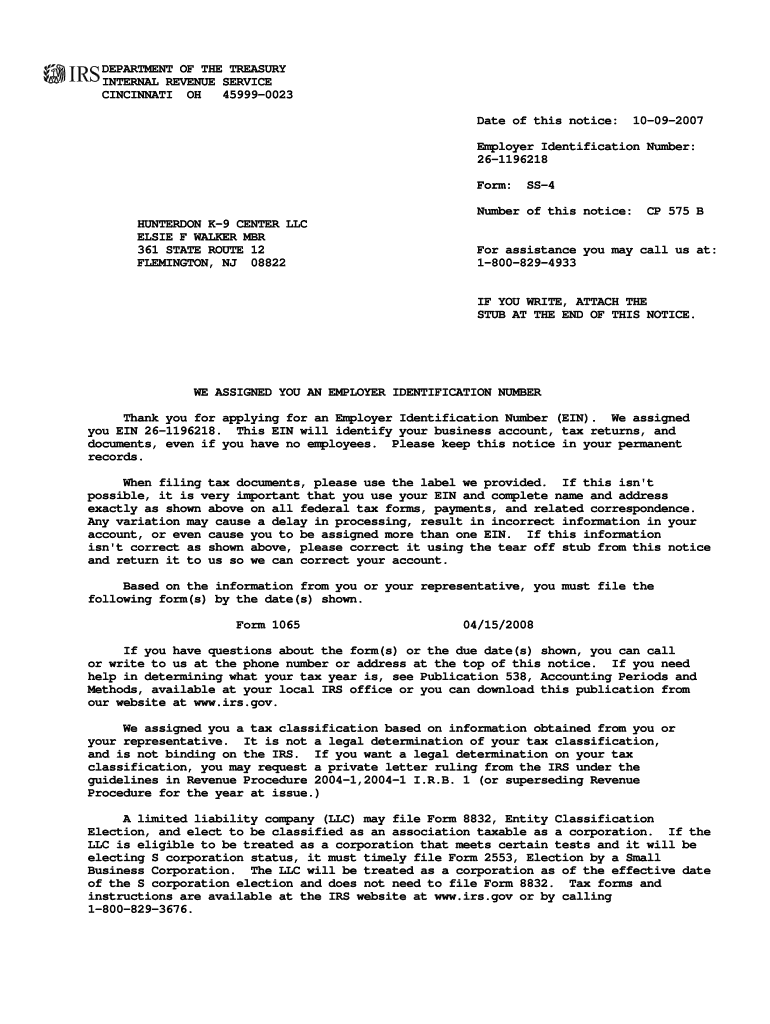

Cp575 Irs Form

Cp575 Irs Form - Your previously filed return should. Select the button get form to open it and start modifying. If you don't receive this letter, you will receive its copy. Fill in all necessary lines in the file utilizing our. Web the irs form cp 575 is an internal revenue service (irs) generated letter you receive from the irs granting your employer identification number (ein). Web what this notice is about we gave you an individual taxpayer identification number (itin). Web what’s new qualified disaster tax relief. Ad irs cp 575 g notice & more fillable forms, register and subscribe now! They explain the information you must send to us. A copy of your cp 575.

Web what this notice is about we gave you an individual taxpayer identification number (itin). Web the irs form cp 575 is an internal revenue service (irs) computer generated letter you receive from the irs granting your employer identification number. Web what’s new qualified disaster tax relief. In the us, the internal revenue service (irs) issues a cp 575 ein confirmation letter to confirm the unique employer identification number (ein). Ad access irs tax forms. This ein confirmation letter is called cp 575, and the irs only. Web form cp 575 is issued by the irs as a way of identifying and tracking various entities. A copy of your cp 575. Web what is a cp 575 form? Ad irs cp 575 g notice & more fillable forms, register and subscribe now!

Complete irs tax forms online or print government tax documents. Ad access irs tax forms. Web what’s new qualified disaster tax relief. Web the irs form cp 575 is an internal revenue service (irs) computer generated letter you receive from the irs granting your employer identification number. Web 575, such as legislation enacted after it was published, go to irs.gov/pub575. Web form cp 575 is issued by the irs as a way of identifying and tracking various entities. Complete, edit or print tax forms instantly. Web irs form cp 575 is proof of your ein’s authenticity, and you will receive it after applying for this number online or manually. Organized entities that are entitled to receive an ein include sole. Web what this notice is about we gave you an individual taxpayer identification number (itin).

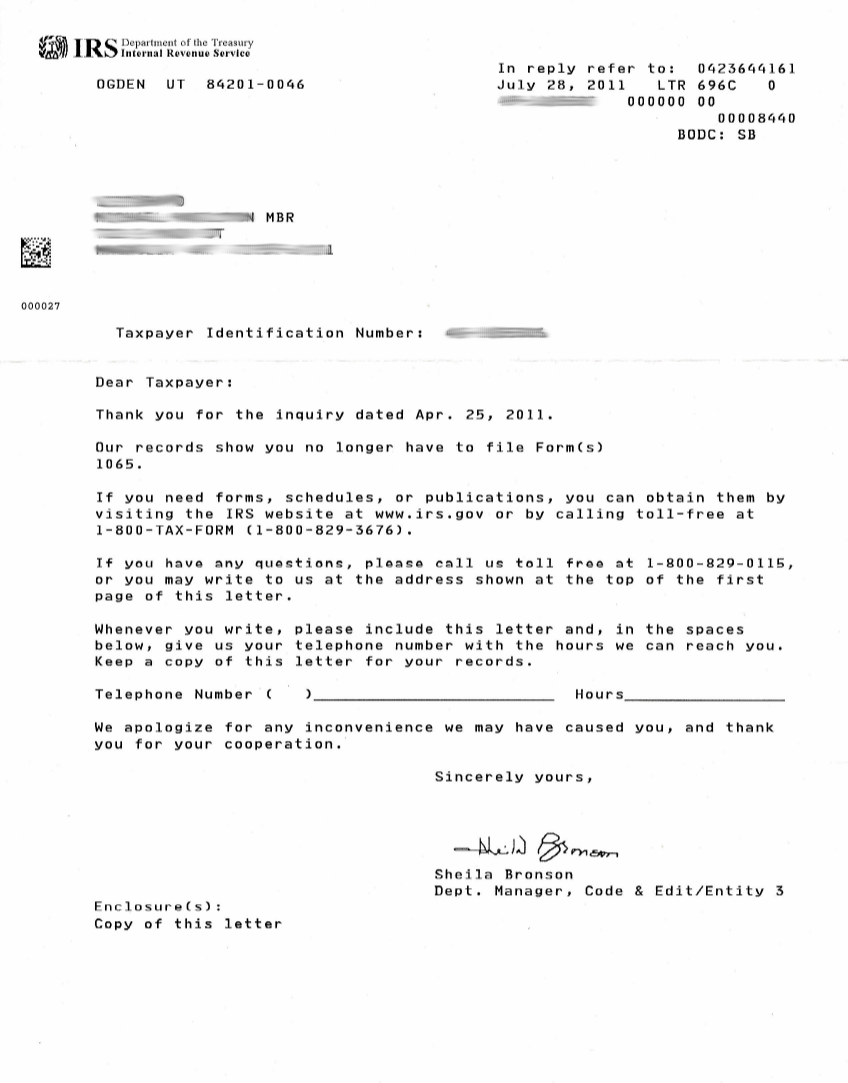

Understanding Your CP515 Business Notice

We're auditing your tax return and need documentation to verify the earned income credit (eic) you claimed. Web the irs form cp 575 contains: They explain the information you must send to us. In the us, the internal revenue service (irs) issues a cp 575 ein confirmation letter to confirm the unique employer identification number (ein). What’s new qualified disaster.

IRS CP565 Fill and Sign Printable Template Online US Legal Forms

Web the irs form cp 575 is an internal revenue service (irs) computer generated letter you receive from the irs granting your employer identification number (ein). Web the irs form cp 575 contains: Web what is a cp 575 form? We're auditing your tax return and need documentation to verify the earned income credit (eic) you claimed. Complete, edit or.

Irs Ein Confirmation Letter Copy

Web what this notice is about we gave you an individual taxpayer identification number (itin). Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. If you don't receive this letter, you will receive its copy. Web the irs form cp 575 is an.

What Is an IRS Form CP 575? Pocketsense

We're auditing your tax return and need documentation to verify the earned income credit (eic) you claimed. Web form cp 575 is issued by the irs as a way of identifying and tracking various entities. Web what’s new qualified disaster tax relief. Provide copies of the documentation we. Web the way to complete the irs cp 575 g notice on.

Understanding Your CP75 Notice

They explain the information you must send to us. Web the irs form cp 575 is an internal revenue service (irs) computer generated letter you receive from the irs granting your employer identification number. What’s new qualified disaster tax relief. We're auditing your tax return and need documentation to verify the earned income credit (eic) you claimed. Web what is.

Printable Cp 575 Form Fill Online, Printable, Fillable, Blank pdfFiller

Fill in all necessary lines in the file utilizing our. Complete, edit or print tax forms instantly. What you need to do read your notice carefully. Web what this notice is about we gave you an individual taxpayer identification number (itin). Web what’s new qualified disaster tax relief.

WEB SITE SAMPLE COPY Images Frompo

The letter’s information can help secure. Web irs form cp 575 is proof of your ein’s authenticity, and you will receive it after applying for this number online or manually. Complete irs tax forms online or print government tax documents. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you.

What Is Form CP575? Gusto

Fill in all necessary lines in the file utilizing our. Ad irs cp 575 g notice & more fillable forms, register and subscribe now! What you need to do read your notice carefully. Web what this notice is about we gave you an individual taxpayer identification number (itin). Web the irs form cp 575 contains:

New IRS Form 1040 Click here for a larger view John Benson Flickr

They explain the information you must send to us. Your previously filed return should. Web the irs form cp 575 is an internal revenue service (irs) computer generated letter you receive from the irs granting your employer identification number (ein). A copy of your cp 575. What’s new qualified disaster tax relief.

Web What’s New Qualified Disaster Tax Relief.

Web form cp 575 is issued by the irs as a way of identifying and tracking various entities. Complete, edit or print tax forms instantly. Provide copies of the documentation we. Web what this notice is about we gave you an individual taxpayer identification number (itin).

They Explain The Information You Must Send To Us.

What you need to do read your notice carefully. Web what you need to do read the notice and the enclosed forms carefully. Complete irs tax forms online or print government tax documents. Web the way to complete the irs cp 575 g notice on the internet:

Web The Irs Form Cp 575 Is An Internal Revenue Service (Irs) Computer Generated Letter You Receive From The Irs Granting Your Employer Identification Number (Ein).

Fill in all necessary lines in the file utilizing our. We're auditing your tax return and need documentation to verify the earned income credit (eic) you claimed. Web the irs form cp 575 is an internal revenue service (irs) computer generated letter you receive from the irs granting your employer identification number. Web irs form cp 575 is proof of your ein’s authenticity, and you will receive it after applying for this number online or manually.

This Ein Confirmation Letter Is Called Cp 575, And The Irs Only.

Ad access irs tax forms. Organized entities that are entitled to receive an ein include sole. Complete, edit or print tax forms instantly. Your previously filed return should.