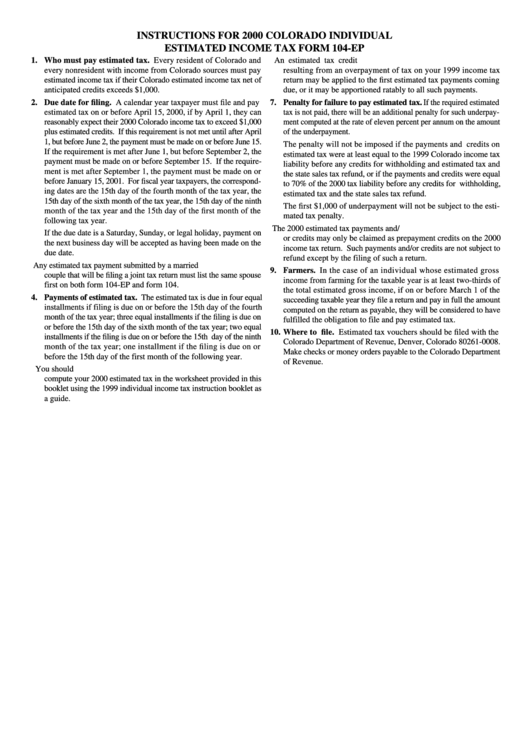

Colorado Form 204

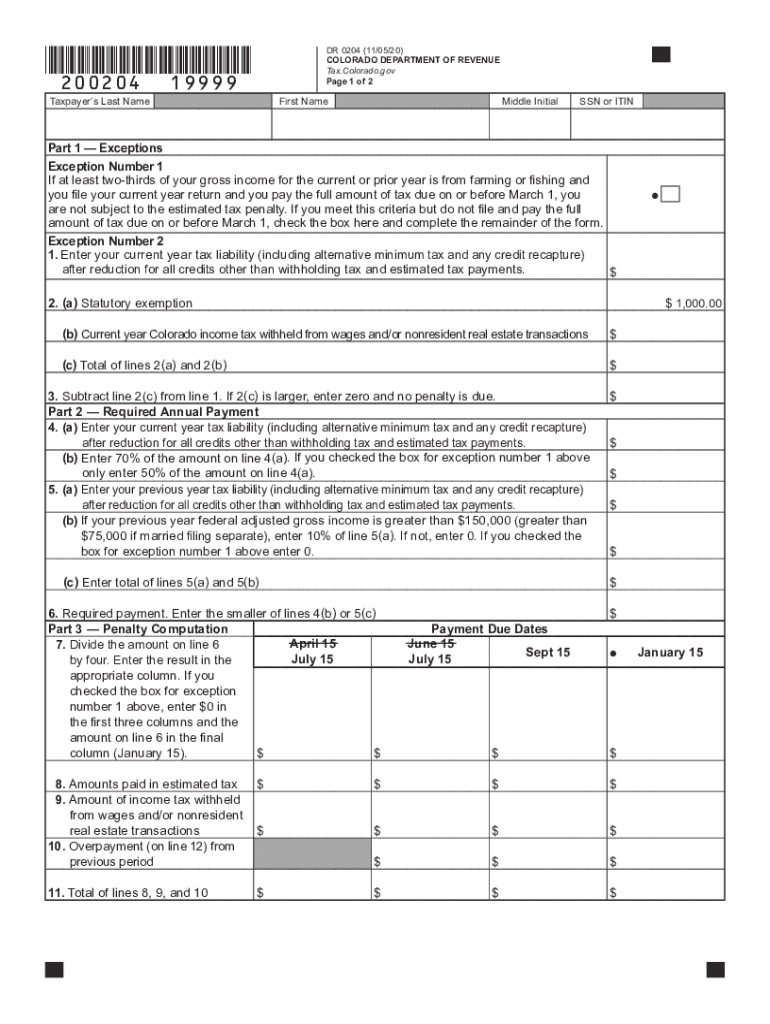

Colorado Form 204 - Form dr 0004 is the new colorado employee withholding certificate that is available for 2022. This form is for income earned in tax year 2022, with. The document has moved here. Web tax forms, colorado form 104. If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form 204 to calculate and pay. Start filing your tax return now : Web dr 2468 (06/24/21) colorado department of revenue division of motor vehicles vehicles services unit dmv.colorado.gov late fee review and refund request c.r.s. Vehicle forms and documents by name. Web printable colorado income tax form 204. Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration.

Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. Form dr 0716 statement of nonprofit church, synagogue, or organization; Web what is form dr 0004? Start filing your tax return now : Web dr 2468 (06/24/21) colorado department of revenue division of motor vehicles vehicles services unit dmv.colorado.gov late fee review and refund request c.r.s. (opens in new window) dr 2542. We last updated colorado form 104 in february 2023 from the colorado department of revenue. The document has moved here. Web on line 34 of form dr 0104 $ part 4 — annualized installment method schedule 20. All forms and documents in number order.

Web what is form dr 0004? If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form 204 to calculate and pay. Web file now with turbotax. Web colorado secretary of state Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. Form dr 0716 statement of nonprofit church, synagogue, or organization; We last updated colorado form 104 in february 2023 from the colorado department of revenue. Web form 104 ptc—colorado property tax/rent/heat rebate form 104 x —amended colorado individual income tax return form 204 —computation of penalty due form. Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. Form dr 0077 certification of.

Top 5 Colorado Form 104 Templates free to download in PDF format

Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. Start filing your tax return now : Form dr 0004 is the new colorado employee withholding certificate that is available for 2022. Web printable colorado income tax form 204. Ending date of annualization period march 31 may 31 august 31 dec.

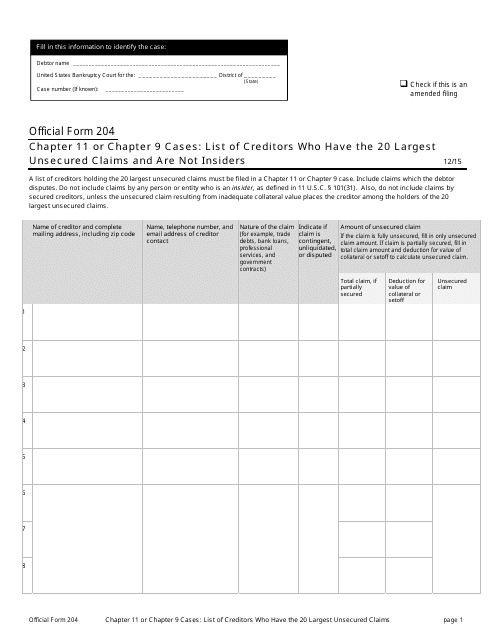

Official Form 204 Download Printable PDF or Fill Online Chapter 11 or

Web colorado secretary of state Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. Tax day is april 17th. Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. Web dr 2468 (06/24/21) colorado department of revenue division of motor vehicles vehicles services.

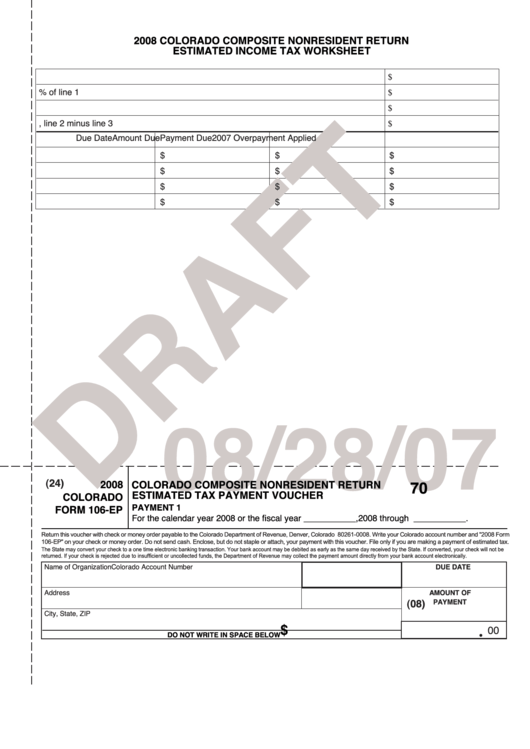

Colorado Form 106Ep Draft Colorado Composite Nonresident Return

Web tax forms, colorado form 104. Web file now with turbotax. Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. Web form 104 ptc—colorado property tax/rent/heat rebate form 104 x —amended colorado individual income tax return form 204 —computation of penalty due form. Web what is form dr 0004?

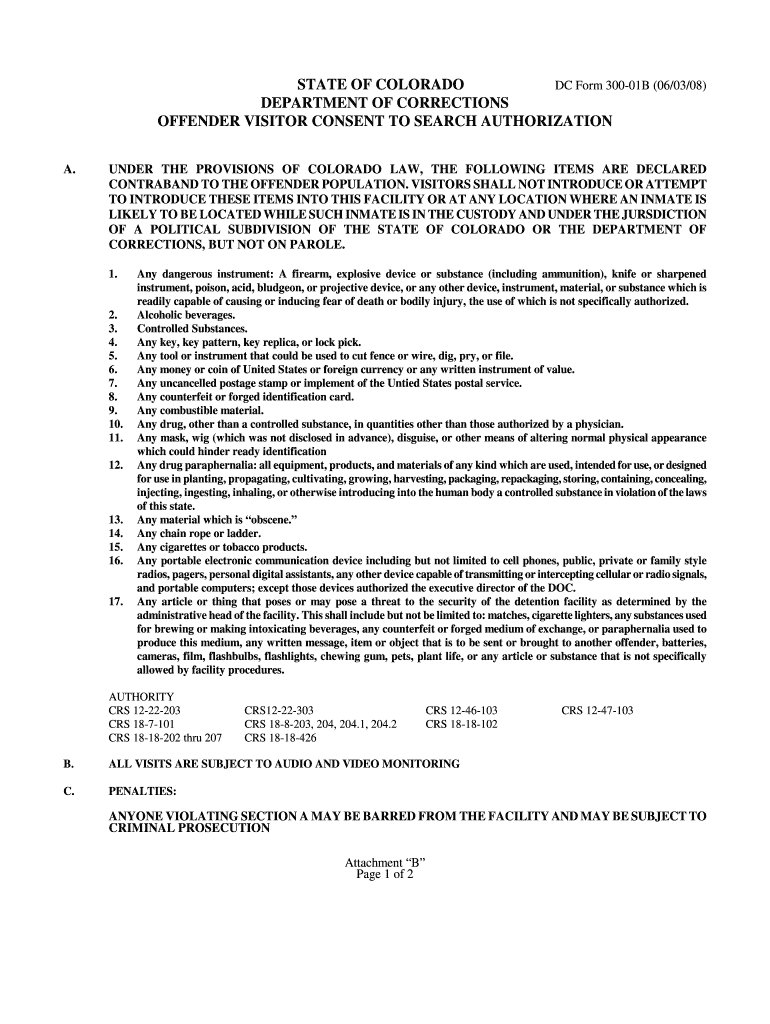

Colorado Form Ar Fform 300 01b Fill Online, Printable, Fillable

Web file now with turbotax. Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. Tax day is april 17th. All forms and documents in number order. License forms and documents by name.

204 Colorado Blvd, Glendive, MT 59330 The Plainview Apartments

Tax day is april 17th. License forms and documents by name. Web tax forms, colorado form 104. Form dr 0077 certification of. Web printable colorado income tax form 204.

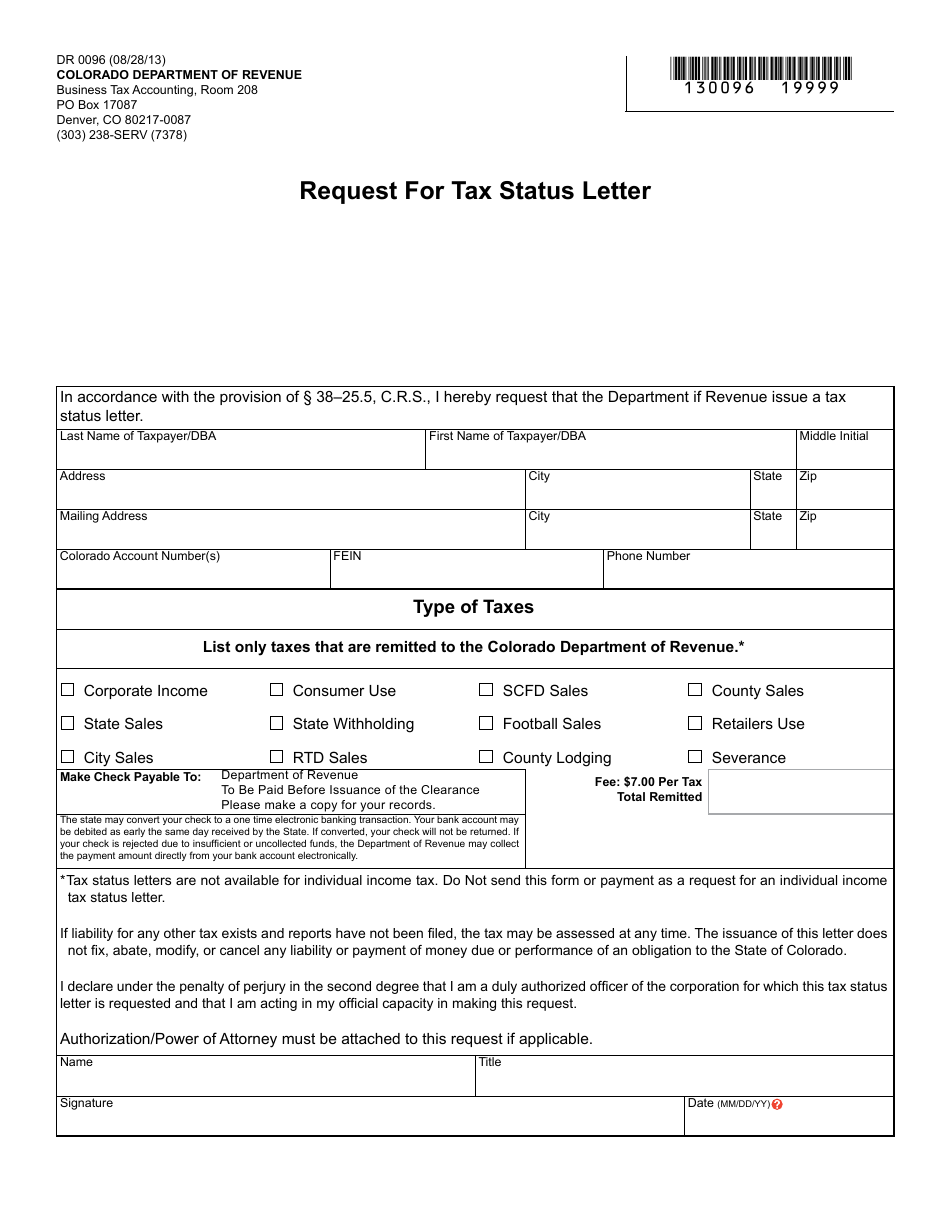

Form DR0096 Download Fillable PDF or Fill Online Request for Tax Status

(opens in new window) dr 2542. Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. Web form 104 ptc—colorado property tax/rent/heat rebate form 104 x —amended colorado individual income tax return form 204 —computation of penalty due form. Tax day is april 17th. Web what is form dr 0004?

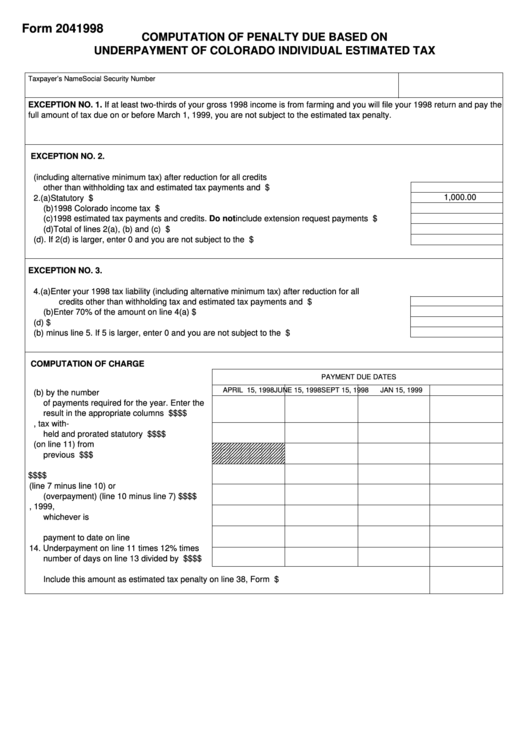

Fillable Form 204 Computation Of Penalty Due Based On Underpayment Of

Form dr 0004 is the new colorado employee withholding certificate that is available for 2022. Web form 104 ptc—colorado property tax/rent/heat rebate form 104 x —amended colorado individual income tax return form 204 —computation of penalty due form. Web what is form dr 0004? The document has moved here. License forms and documents by name.

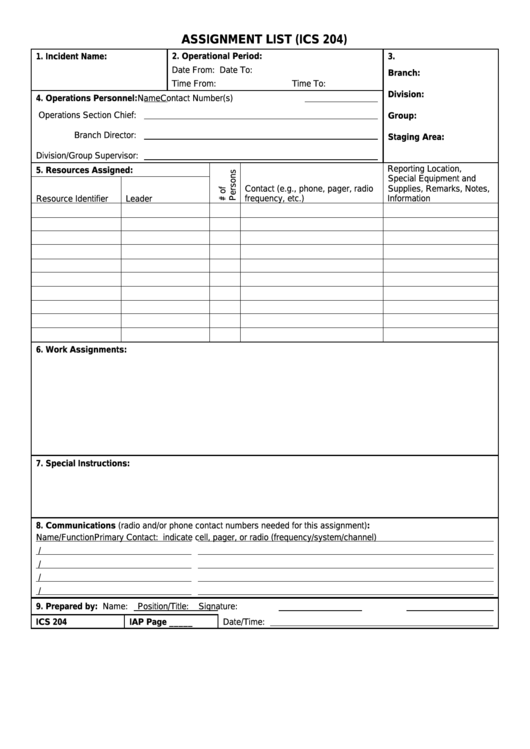

Fillable Ics Form 204 Assignment List printable pdf download

Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. A fee of $0.50 per record or history is paid when submitting a request for certification of records or histories. If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form.

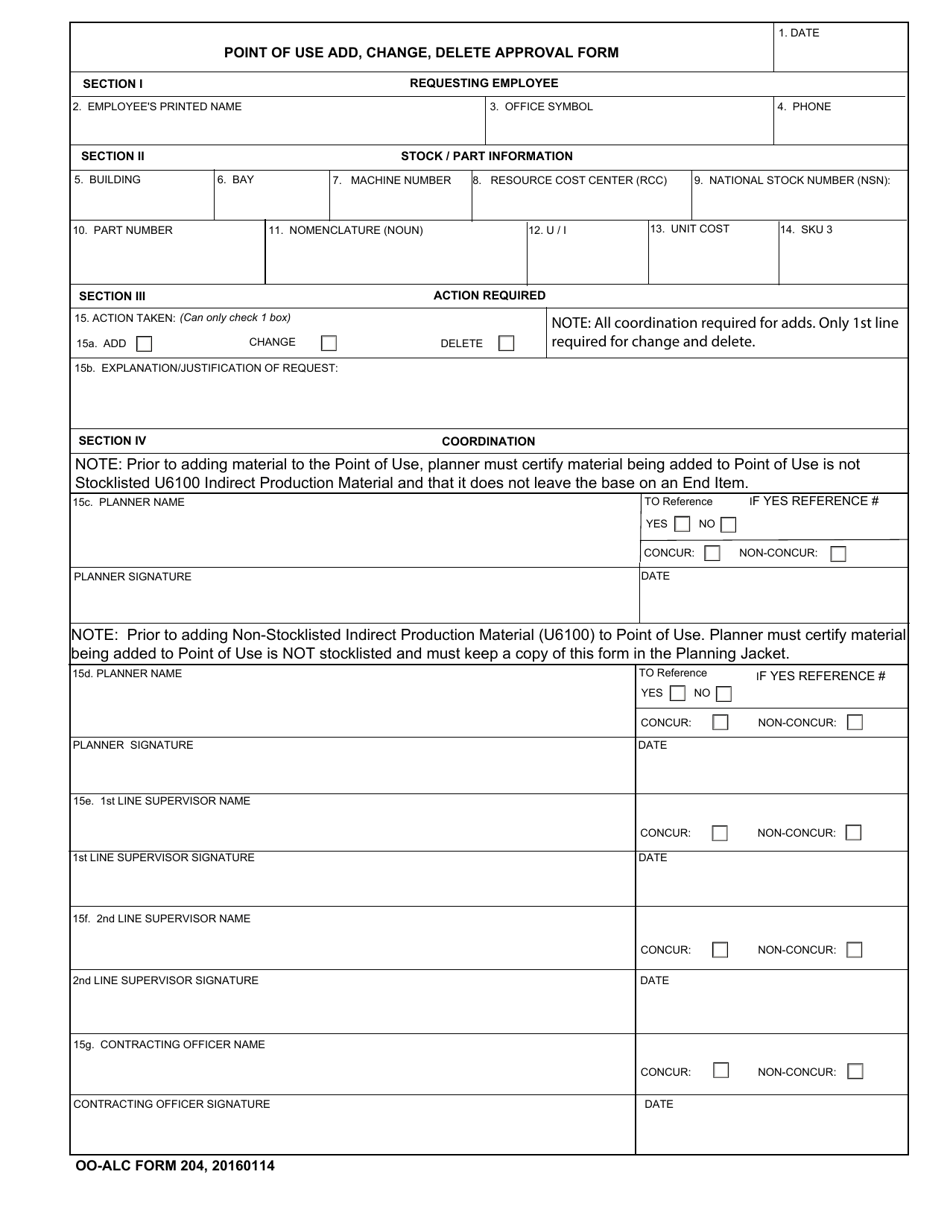

OOALC Form 204 Download Fillable PDF or Fill Online Point of Use Add

Web file now with turbotax. Web tax forms, colorado form 104. License forms and documents by name. Web colorado secretary of state All forms and documents in number order.

Dr 0204 Form Fill Out and Sign Printable PDF Template signNow

Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. Web what is form dr 0004? Form dr 0004 is the new colorado employee withholding certificate that is available for 2022. All forms and documents in number order. Web on line 34 of form dr 0104 $ part 4 — annualized.

Web Colorado Department Of Revenue Division Of Motor Vehicles Registration Section Www.colorado.gov/Revenue Fleet Owners Request For Common Registration Expiration.

Web on line 34 of form dr 0104 $ part 4 — annualized installment method schedule 20. License forms and documents by name. Tax day is april 17th. Web dr 2468 (06/24/21) colorado department of revenue division of motor vehicles vehicles services unit dmv.colorado.gov late fee review and refund request c.r.s.

Web Dmv Forms And Documents.

Vehicle forms and documents by name. Form dr 0077 certification of. Form dr 0004 is the new colorado employee withholding certificate that is available for 2022. Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue.

The Document Has Moved Here.

Web file now with turbotax. If no colorado record found,. Ending date of annualization period march 31 may 31 august 31 dec 31 21. Start filing your tax return now :

We Last Updated Colorado Form 104 In February 2023 From The Colorado Department Of Revenue.

(opens in new window) dr 2542. If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form 204 to calculate and pay. Web printable colorado income tax form 204. A fee of $0.50 per record or history is paid when submitting a request for certification of records or histories.