Chapter 7 And Social Security Income

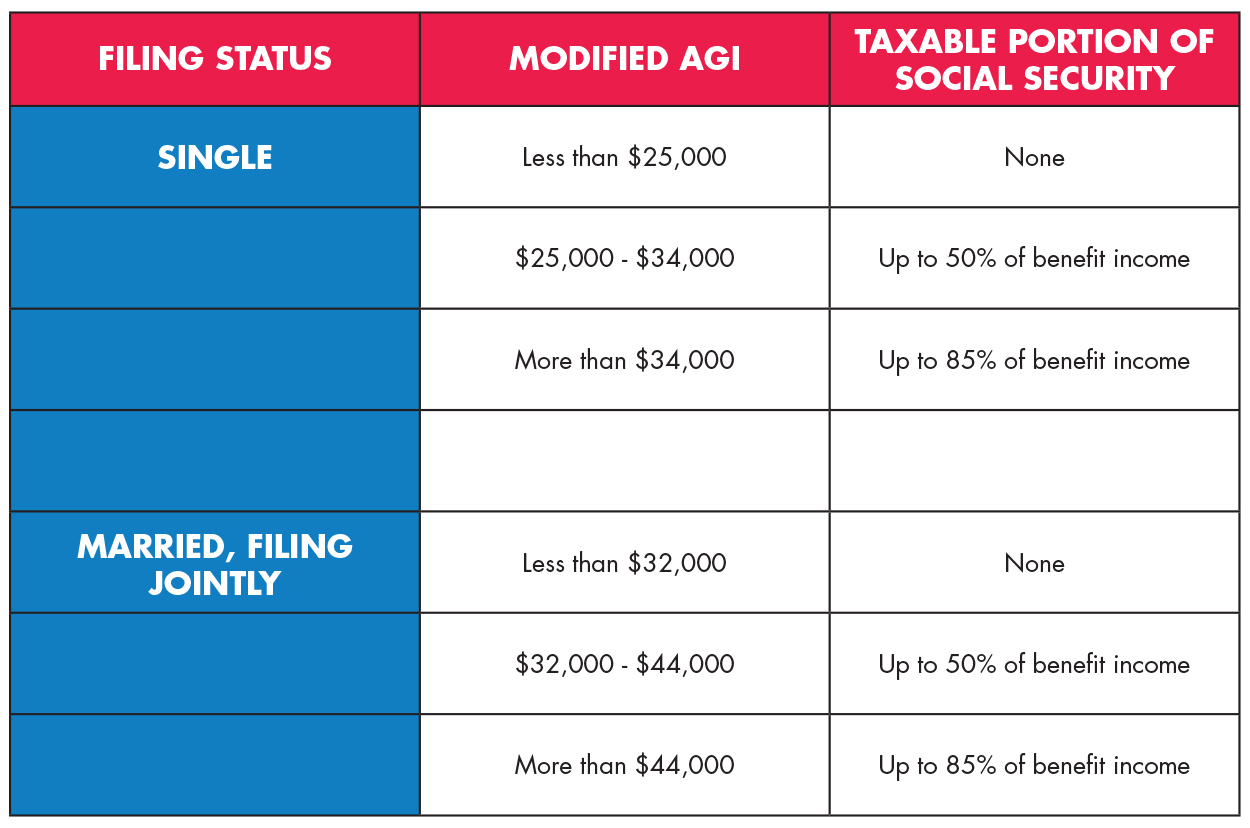

Chapter 7 And Social Security Income - To determine your chapter 7 bankruptcy income limit, add the last six months of your gross income. Persons who receive supplemental security income (ssi) benefits from the social security. Web if your combined income exceeds $34,000, 85% of your social security income could be taxable. Entitlement to retirement or disability insurance benefits and another benefit: [1] this title xvi of the social security act is administered by the social security administration. Social security and equivalent railroad retirement benefits. You'll pass the test as long as your income. Web but in a chapter 7 filing, the court may determine that prior social security payments deposited into your bank account are part of the bankruptcy estate — that is, the property you own at the time of. As a result, you can. Most consumers file one of two types of bankruptcy—either chapter 7.

Web here are all 39 states (and d.c.) that don't tax social security benefits at all, listed in alphabetical order: Web but in a chapter 7 filing, the court may determine that prior social security payments deposited into your bank account are part of the bankruptcy estate — that is, the property you own at the time of. Web (f) for purposes of this paragraph, the phrase 'supplemental security income benefits under title xvi of the social security act' includes supplementary payments pursuant to an agreement for federal administration under section 1616(a) of the social security. 407 (a), which states that monies paid pursuant to the social security act “shall be subject to execution, levy, attachment, garnishment, or other legal process, or to the operation of any bankruptcy or insolvency law,” i take the position that any social security. Tax withholding and estimated tax. Web entitlement to more than one social security benefit at the same time : You'll pass the test as long as your income. Introduction to general financial requirements. When virtual currency income is assessed as unearned income, document it on the appropriate income. Income and adjustments to income.

Web entitlement to more than one social security benefit at the same time : Web however, it's a good idea to maintain your benefits in a separate account because once commingled with other funds, it can be difficult to prove that the money came from social security benefits rather than another source. Regulations with respect to this title xvi are contained in chapter. What happens if a child is entitled to benefits on more than. Web unless you're exempt, you must first pass the chapter 7 means test—and most people who file for chapter 7 bankruptcy must take it. You'll pass the means test if you don't have enough disposable income to repay a. Entitlement to retirement or disability insurance benefits and another benefit: 407 (a), which states that monies paid pursuant to the social security act “shall be subject to execution, levy, attachment, garnishment, or other legal process, or to the operation of any bankruptcy or insolvency law,” i take the position that any social security. Most consumers file one of two types of bankruptcy—either chapter 7. As a result, you can.

Chapter 7 and Social Security Eric Wilson Law

The state agency may disregard not more than $7.50 per month of any income and (ii) of the first $80 per month of additional income. Entitlement to retirement or disability insurance benefits and another benefit: Web gn 02215.196 objection to a discharge in a chapter 7 bankruptcy. How chapter 7 and chapter 13 bankruptcy work. Wages, salaries, and other earnings.

Social Security not enough to cover rent check in 8 states

In chapter 7, you can discharge most or all of your debts. Social security and equivalent railroad retirement benefits. Web entitlement to more than one social security benefit at the same time : Income and adjustments to income. When virtual currency income is assessed as unearned income, document it on the appropriate income.

56 of Social Security Households Pay Tax on Their Benefits — Will You

Web people who derive their income solely from social security also don’t have to take the means test. Web however, a sizable share of earned income is not counted. If your only income comes from social security, you are not prevented from filing for chapter 7 or chapter 13 bankruptcy. Most consumers file one of two types of bankruptcy—either chapter.

Social Security Limit What Counts as Social Security

In chapter 7, you can discharge most or all of your debts. Regulations with respect to this title xvi are contained in chapter. Tax withholding and estimated tax. Web the current payroll tax on social security is 6.2% of your salary, so your employer will withhold $4,650 to go toward social security. Web entitlement to more than one social security.

Maximizing your Social Security

The state agency may disregard not more than $7.50 per month of any income and (ii) of the first $80 per month of additional income. Tax withholding and estimated tax. Web here are all 39 states (and d.c.) that don't tax social security benefits at all, listed in alphabetical order: Regulations with respect to this title xvi are contained in.

Blank Social Security Card Template Download

Web unless you're exempt, you must first pass the chapter 7 means test—and most people who file for chapter 7 bankruptcy must take it. You'll pass the test as long as your income. Introduction to general financial requirements. Web based on 42 u. The state agency may disregard not more than $7.50 per month of any income and (ii) of.

Social security How much will you get in benefits?

Web here are all 39 states (and d.c.) that don't tax social security benefits at all, listed in alphabetical order: In chapter 7, you can discharge most or all of your debts. Web based on 42 u. Income and adjustments to income. Web (f) for purposes of this paragraph, the phrase 'supplemental security income benefits under title xvi of the.

Is Social Security Considered Pure Financial Advisors

Alaska (no income tax at all) arizona. Web however, a sizable share of earned income is not counted. Web people who derive their income solely from social security also don’t have to take the means test. Web (f) for purposes of this paragraph, the phrase 'supplemental security income benefits under title xvi of the social security act' includes supplementary payments.

Social Security’s Total Costs Next Year to Exceed for First Time

Web entitlement to more than one social security benefit at the same time : Social security and equivalent railroad retirement benefits. Married couples face tax on 50% of their social security benefit if their combined income is. Web based on 42 u. Web here are all 39 states (and d.c.) that don't tax social security benefits at all, listed in.

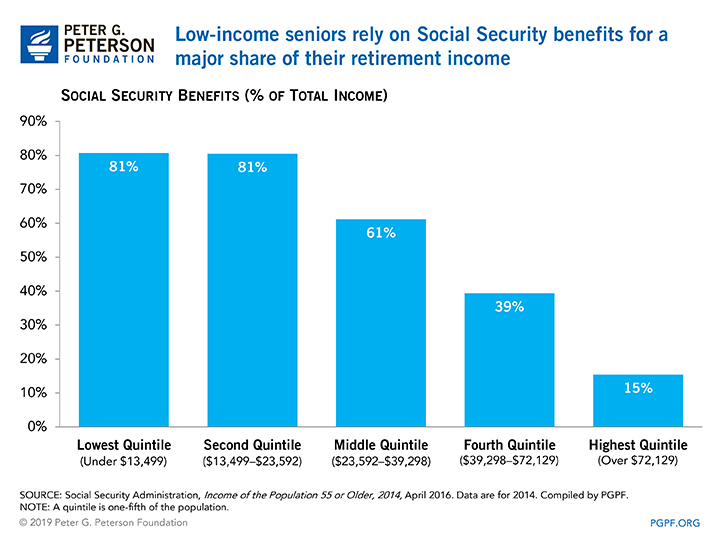

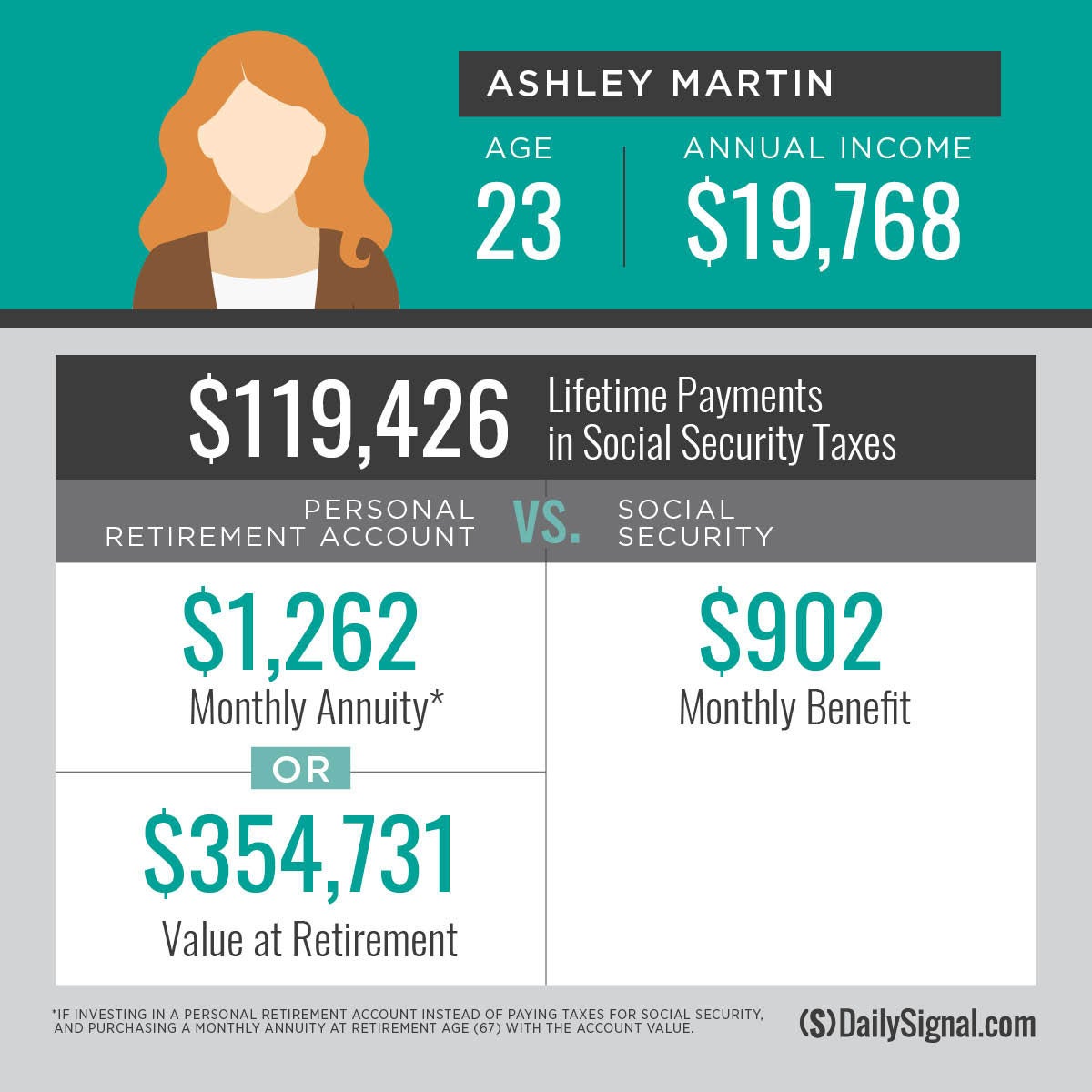

3 Examples of How Social Security Robs Americans of Greater

If you receive social security benefits, you've likely had many. Web but in a chapter 7 filing, the court may determine that prior social security payments deposited into your bank account are part of the bankruptcy estate — that is, the property you own at the time of. What happens if a child is entitled to benefits on more than..

Alaska (No Income Tax At All) Arizona.

Web people who derive their income solely from social security also don’t have to take the means test. Most consumers file one of two types of bankruptcy—either chapter 7. If your only income comes from social security, you are not prevented from filing for chapter 7 or chapter 13 bankruptcy. Social security and equivalent railroad retirement benefits.

Income And Adjustments To Income.

What happens if a child is entitled to benefits on more than. The state agency may disregard not more than $7.50 per month of any income and (ii) of the first $80 per month of additional income. In chapter 7, you can discharge most or all of your debts. Learn everything you need to know about social security.

Web But In A Chapter 7 Filing, The Court May Determine That Prior Social Security Payments Deposited Into Your Bank Account Are Part Of The Bankruptcy Estate — That Is, The Property You Own At The Time Of.

407 (a), which states that monies paid pursuant to the social security act “shall be subject to execution, levy, attachment, garnishment, or other legal process, or to the operation of any bankruptcy or insolvency law,” i take the position that any social security. Your employer will also pay $4,650 to cover the employer. Web based on 42 u. Web entitlement to more than one social security benefit at the same time :

Entitlement To Retirement Or Disability Insurance Benefits And Another Benefit:

To determine your chapter 7 bankruptcy income limit, add the last six months of your gross income. Web however, a sizable share of earned income is not counted. If you receive social security benefits, you've likely had many. You'll start by listing all gross income received during the six full months before your bankruptcy filing date.