Chapter 2 Net Income

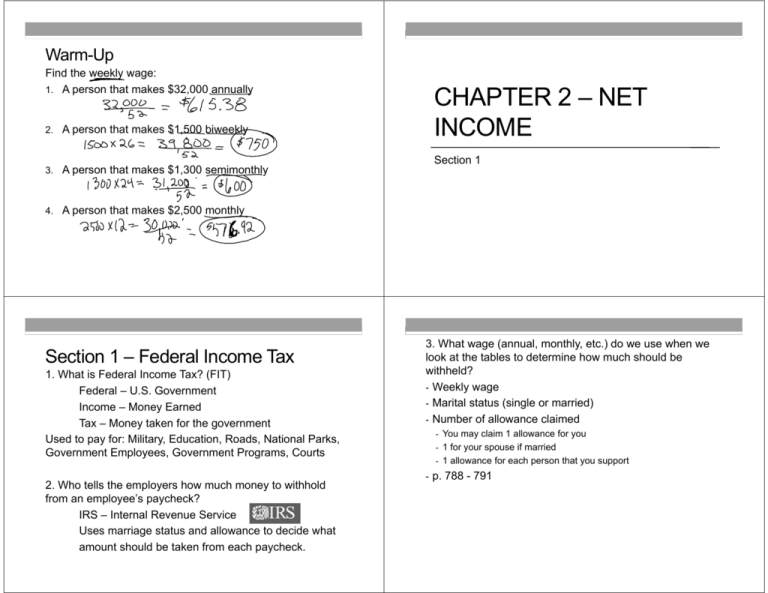

Chapter 2 Net Income - The correct answer for each question is indicated by a. Federal income tax class activity: The amount of money that is taken away in the. Net income business math in action where do your tax dollars go? Web the net income on the propensity company income statement for december 31, 2018, is $4,340. Page 520.016 (2 of 2) (b) compare the amount of the remaining assets to the masshealth asset standard for. When virtual currency income is earned as part of the person’s trade or business, document it as net. You have done the math: It should be easy to figure out the amount of. Web find the weekly wage:

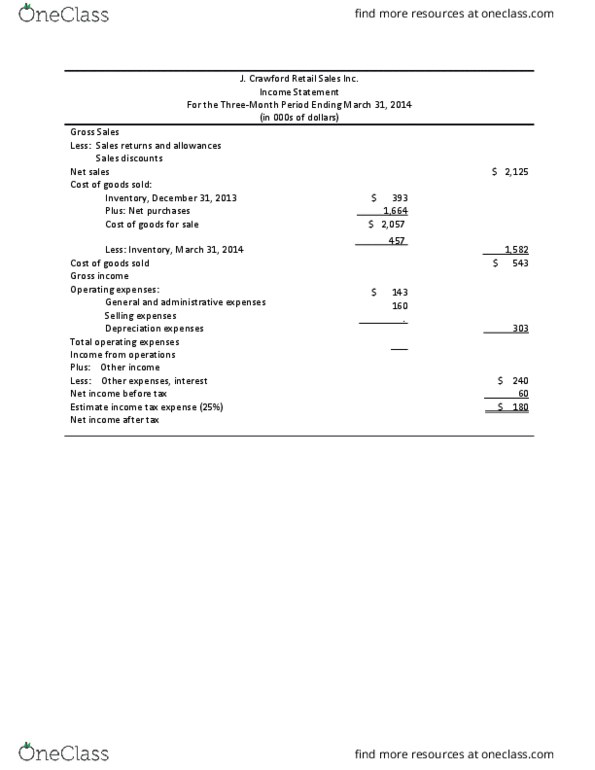

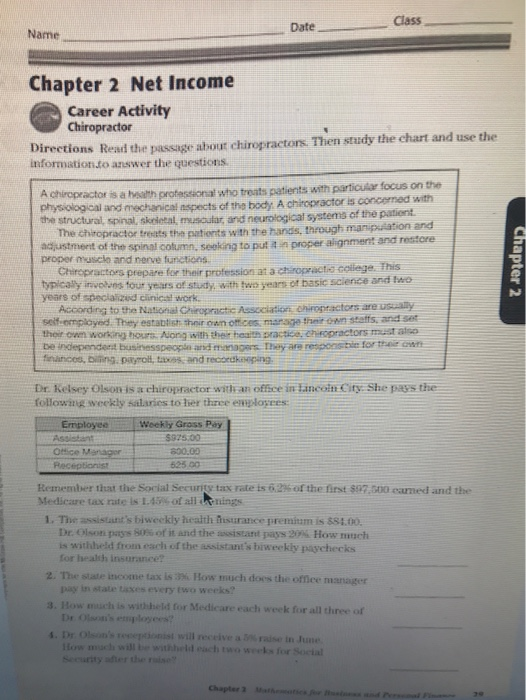

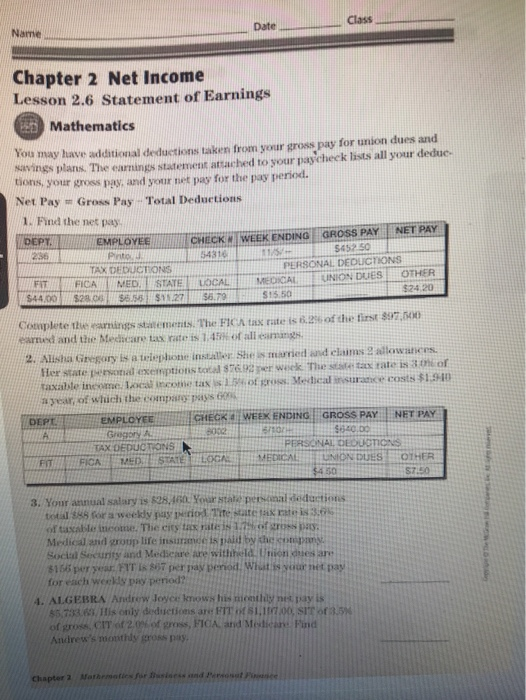

On propensity’s statement of cash flows, this amount is shown in the cash flows from operating activities section as net income. How do we calculate federal income tax ? Class _ date chapter 2 net income lesson 2.6 statement of earnings e mathematics you may have additional deductions taken from your gross pay for union dues and savings plans. Web 120 chapter 2 net income concept check check your answers at the end of the chapter. Web study with quizlet and memorize flashcards containing terms like federal income tax (fit), personal exemptions/withholding allowances, taxable wages. A person that makes $1,500 biweekly. Net income in this chapter: Federal income tax class presentation: Web the statement uses the final number from the financial statement previously completed. The amount of money you receive after deductions are subtracted from your gross income.

On propensity’s statement of cash flows, this amount is shown in the cash flows from operating activities section as net income. Income tax worksheet and tax table section 2: Page 520.016 (2 of 2) (b) compare the amount of the remaining assets to the masshealth asset standard for. Melanie yashin's gross pay for this week is $355.00. Net income in this chapter: Party coverage, including the health safety net. Web net income chapter 2.3 graduated state income tax objectives: A person that makes $1,300 semimonthly. Web considered unearned income. Use the table below to determine how much his employer deducts for state income.

PPT CHAPTER PowerPoint Presentation, free download ID

Web an income tax in which the tax rate increases at different levels of income. A person that makes $32,000 annually. How do we calculate graduated state income tax ? The amount of money that is taken away in the. Determine how much her employer deducts for state income.

22+ Chapter 2 Net ArmourReigan

Find the taxable wages and the annual tax withheld. A person that makes $32,000 annually. When virtual currency income is earned as part of the person’s trade or business, document it as net. How do we calculate state income tax ? On propensity’s statement of cash flows, this amount is shown in the cash flows from operating activities section as.

Business Administration 1220E Textbook Notes Summer 2016, Chapter 2

Web the term net investment income means the excess (if any) of— (a) the sum of— (i) gross income from interest, dividends, annuities, royalties, and rents, other than such income which is derived in the ordinary course of a trade or business not described in paragraph (2), (ii) other gross income. The earnings statement attached to your paychecklists all your.

CHAPTER 2 NET

Web 120 chapter 2 net income concept check check your answers at the end of the chapter. A federal government program to pay for retirement and disability benefits, financed by taxes. State income tax rate is 1.5 percent of taxable income. Use the table below to determine how much his employer deducts for state income. Class _ date chapter 2.

Chapter 2 Net Lesson 2.5 Group Health Insurance Answers

Net income in this chapter: Web the term net investment income means the excess (if any) of— (a) the sum of— (i) gross income from interest, dividends, annuities, royalties, and rents, other than such income which is derived in the ordinary course of a trade or business not described in paragraph (2), (ii) other gross income. On propensity’s statement of.

Class _ Date Chapter 2 Net Lesson 2.6

A person that makes $1,300 semimonthly. Web net income chapter 2.3 graduated state income tax objectives: Use the table below to determine how much his employer deducts for state income. Page 520.016 (2 of 2) (b) compare the amount of the remaining assets to the masshealth asset standard for. Net income business math in action where do your tax dollars.

22+ Chapter 2 Net HarithJeeva

Class _ date chapter 2 net income lesson 2.6 statement of earnings e mathematics you may have additional deductions taken from your gross pay for union dues and savings plans. Use the table below to determine how much his employer deducts for state income. The amount of money you receive after deductions are subtracted from your gross income. A person.

Federal Tax Fit Pdf

Web consumer math chapter 2 net income. On propensity’s statement of cash flows, this amount is shown in the cash flows from operating activities section as net income. Party coverage, including the health safety net. Income tax worksheet and tax table section 2: (2) income from roomers and boarders.

Chapter 2 solutions the basic financial statement the financial and

Web the net income on the propensity company income statement for december 31, 2018, is $4,340. Louise main’s annual salary is $34,500. Click the card to flip 👆 flashcards learn test match created by dsinner terms in this set (10) federal income. A person that makes $2,500 monthly. A person that makes $1,300 semimonthly.

Class _ Date Chapter 2 Net Lesson 2.6

A person that makes $1,300 semimonthly. Web the term net investment income means the excess (if any) of— (a) the sum of— (i) gross income from interest, dividends, annuities, royalties, and rents, other than such income which is derived in the ordinary course of a trade or business not described in paragraph (2), (ii) other gross income. Determine how much.

A Person That Makes $2,500 Monthly.

Net income business math in action where do your tax dollars go? Web 120 chapter 2 net income concept check check your answers at the end of the chapter. Web net income chapter 2.3 graduated state income tax objectives: How do we calculate federal income tax ?

Louise Main’s Annual Salary Is $34,500.

The correct answer for each question is indicated by a. A person that makes $1,300 semimonthly. A profit and loss is a financial statement that summarizes a business owner’s gross income. Web the statement uses the final number from the financial statement previously completed.

The Number Of Hours You Worked Multiplied By Your Hourly Wage.

She receives her pay semimonthly. What you take home after you deduct taxes, social security, medicare, contributions, state taxes, union dues, and health insurance. A person that makes $32,000 annually. The amount of money you receive after deductions are subtracted from your gross income.

Federal Income Tax Class Presentation:

Federal income tax class activity: Web an income tax in which the tax rate increases at different levels of income. Web definition 1 / 10 money withheld by an employer from an employee's paycheck to pay federal government taxes. Income tax worksheet and tax table section 2: