Chapter 171 Of Texas Tax Code

Chapter 171 Of Texas Tax Code - Web general definitions 171.001 tax imposed 171.002 rates 171.0002 definition of taxable entity 171.003 increase in rate. Franchise tax § 171.0003 tex. Web certified historic structures rehabilitation credit under texas tax code chapter 171, subchapter s (effective for. Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250. Tax code section 171.0003 definition of passive entity (a) an entity is. Web texas tax code (ttc) 171.0003(b). (1) the entity is a general or limited partnership or a trust, other than a business trust; (1) internal revenue code means the internal revenue code of 1986. Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b. Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in.

Web texas tax code (ttc) 171.0003(b). Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. Franchise tax § 171.002 tax code section 171.002 rates; Computation of tax (a) subject to. Franchise tax § 171.0003 tex. Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. Web certified historic structures rehabilitation credit under texas tax code chapter 171, subchapter s (effective for. Paying off a loan by regular installments. Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in. Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b.

Definition of conducting active trade or business. Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in. Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250. Web texas tax code (ttc) 171.0003(b). Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b. Franchise tax § 171.0003 tex. Tax code section 171.0003 definition of passive entity (a) an entity is. Web certified historic structures rehabilitation credit under texas tax code chapter 171, subchapter s (effective for. Web general definitions 171.001 tax imposed 171.002 rates 171.0002 definition of taxable entity 171.003 increase in rate. Franchise tax § 171.002 tax code section 171.002 rates;

Truth and Proof Judge Tano Tijerina

Web texas tax code (ttc) 171.0003(b). (1) internal revenue code means the internal revenue code of 1986. Web general definitions 171.001 tax imposed 171.002 rates 171.0002 definition of taxable entity 171.003 increase in rate. Computation of tax (a) subject to. Definition of conducting active trade or business.

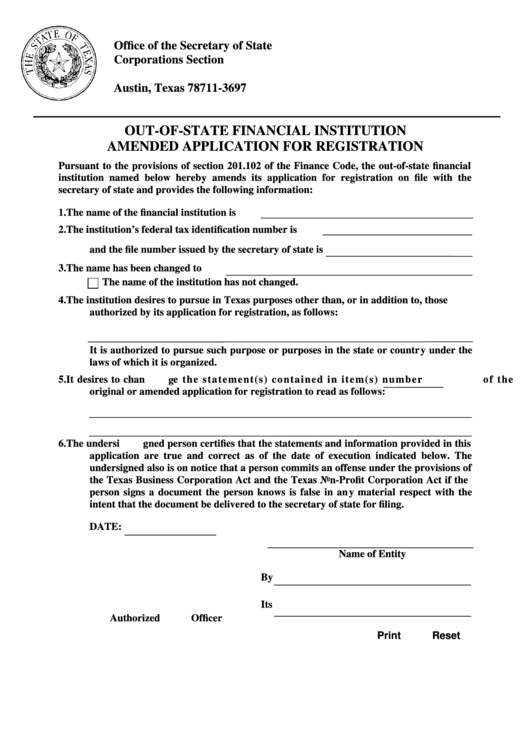

Fillable OutOfState Financial Institution Amended Application For

Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. (1) the entity is a general or limited partnership or a trust, other than a business trust; Franchise tax § 171.0003 tex. Franchise tax § 171.002 tax code section 171.002 rates; Definition of conducting active trade or business.

Study shows potential impact of Inheritance Tax Code changes on family

Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in. Web certified historic structures rehabilitation credit under texas tax code chapter 171, subchapter s (effective for. Definition of conducting active trade or business. Franchise tax § 171.0003 tex. (1) the entity is a general or limited partnership or a trust, other.

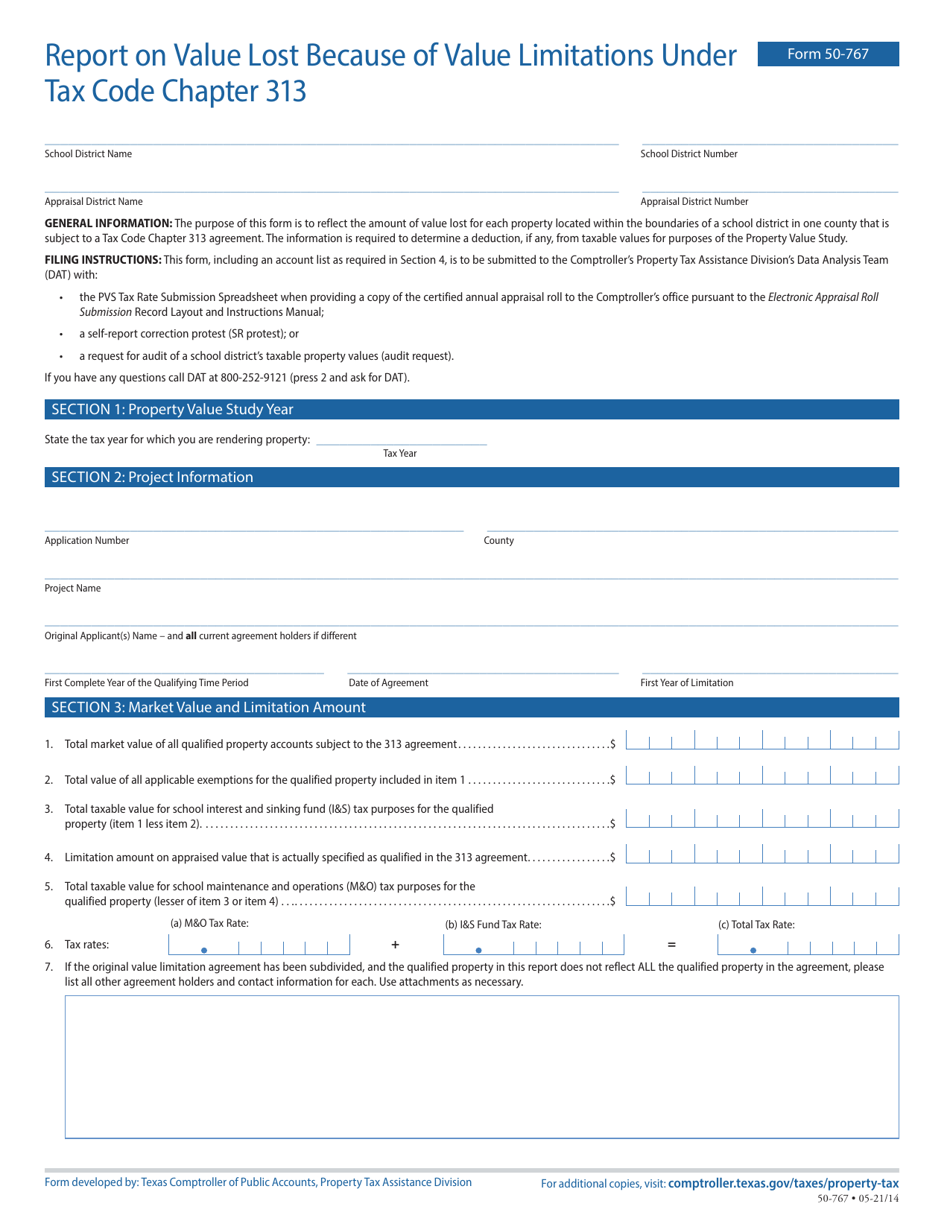

Form 50767 Download Fillable PDF or Fill Online Report on Value Lost

Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b. Web texas tax code (ttc) 171.0003(b). Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. (1) the entity is a general or limited partnership or a trust, other than a.

MillyTsneem

Franchise tax § 171.0003 tex. (1) the entity is a general or limited partnership or a trust, other than a business trust; Tx tax code § 171.0001 (2021) sec. Tax code section 171.0003 definition of passive entity (a) an entity is. Definition of conducting active trade or business.

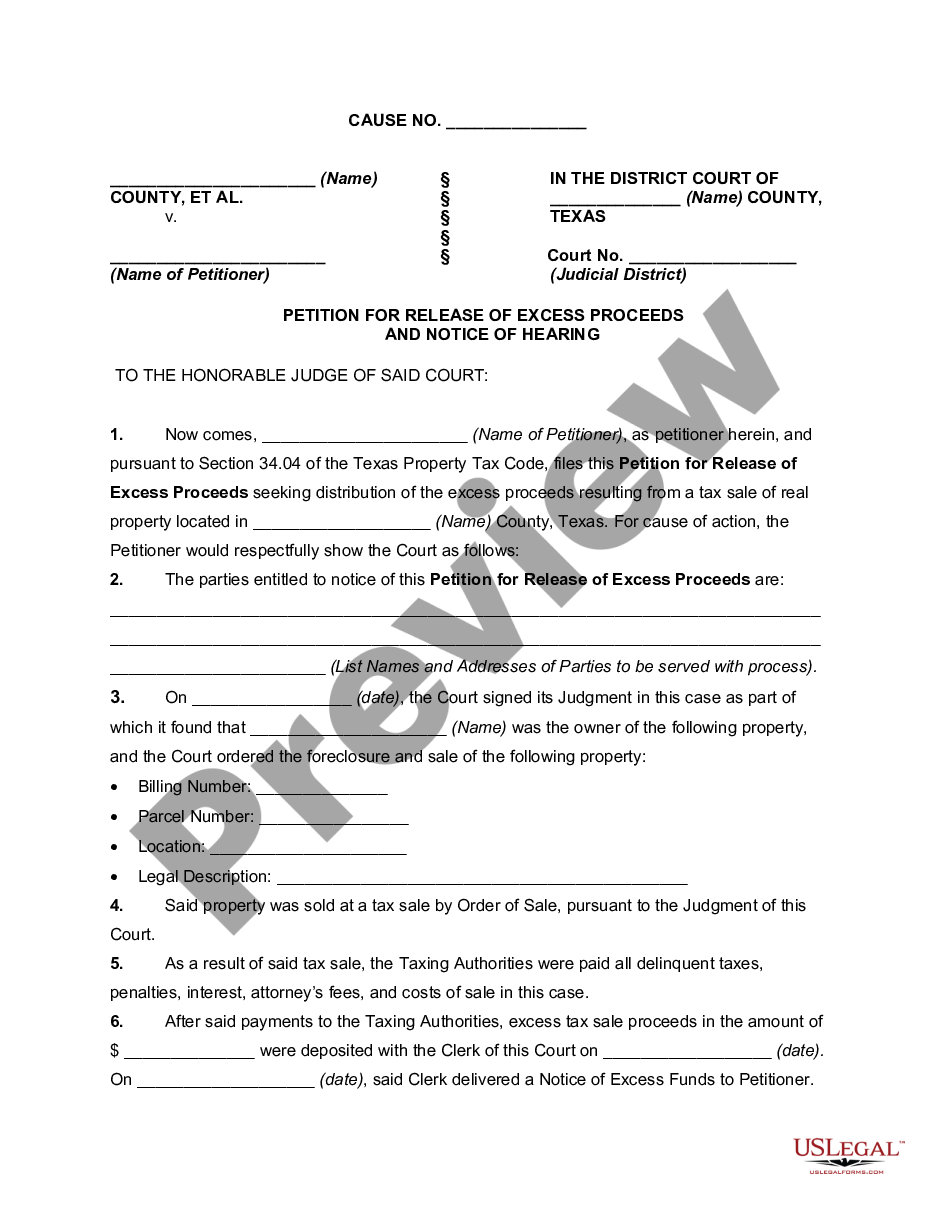

Texas Petition for Release of Excess Proceeds and Notice of Hearing

Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b. Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. (1) internal revenue code means the internal revenue code of 1986. Franchise tax § 171.002 tax code section 171.002 rates; Computation of tax (a) subject.

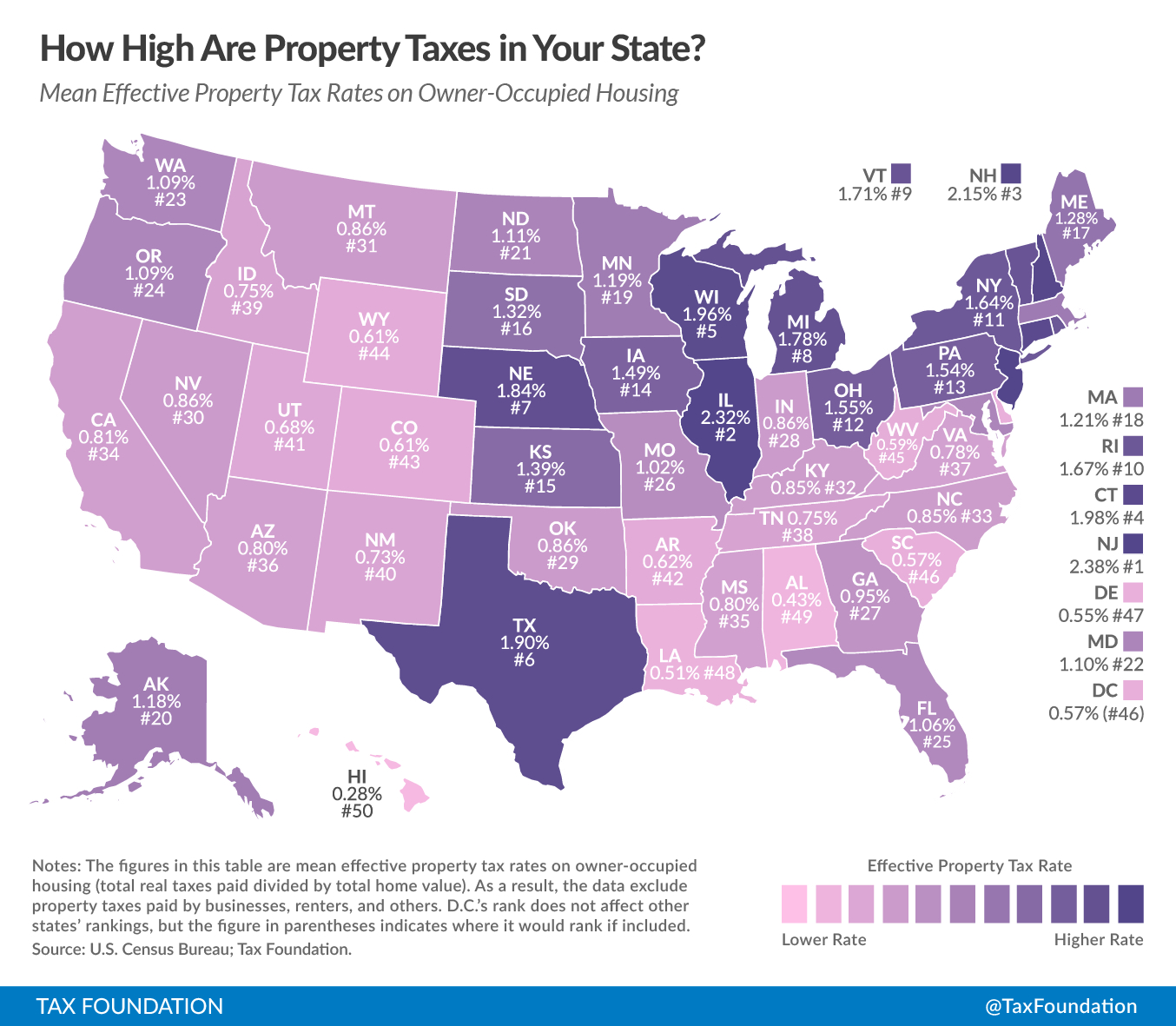

How High Are Property Taxes In Your State? Tax Foundation Texas

Web texas tax code (ttc) 171.0003(b). Franchise tax § 171.0003 tex. Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in. Franchise tax § 171.002 tax code section 171.002 rates; Paying off a loan by regular installments.

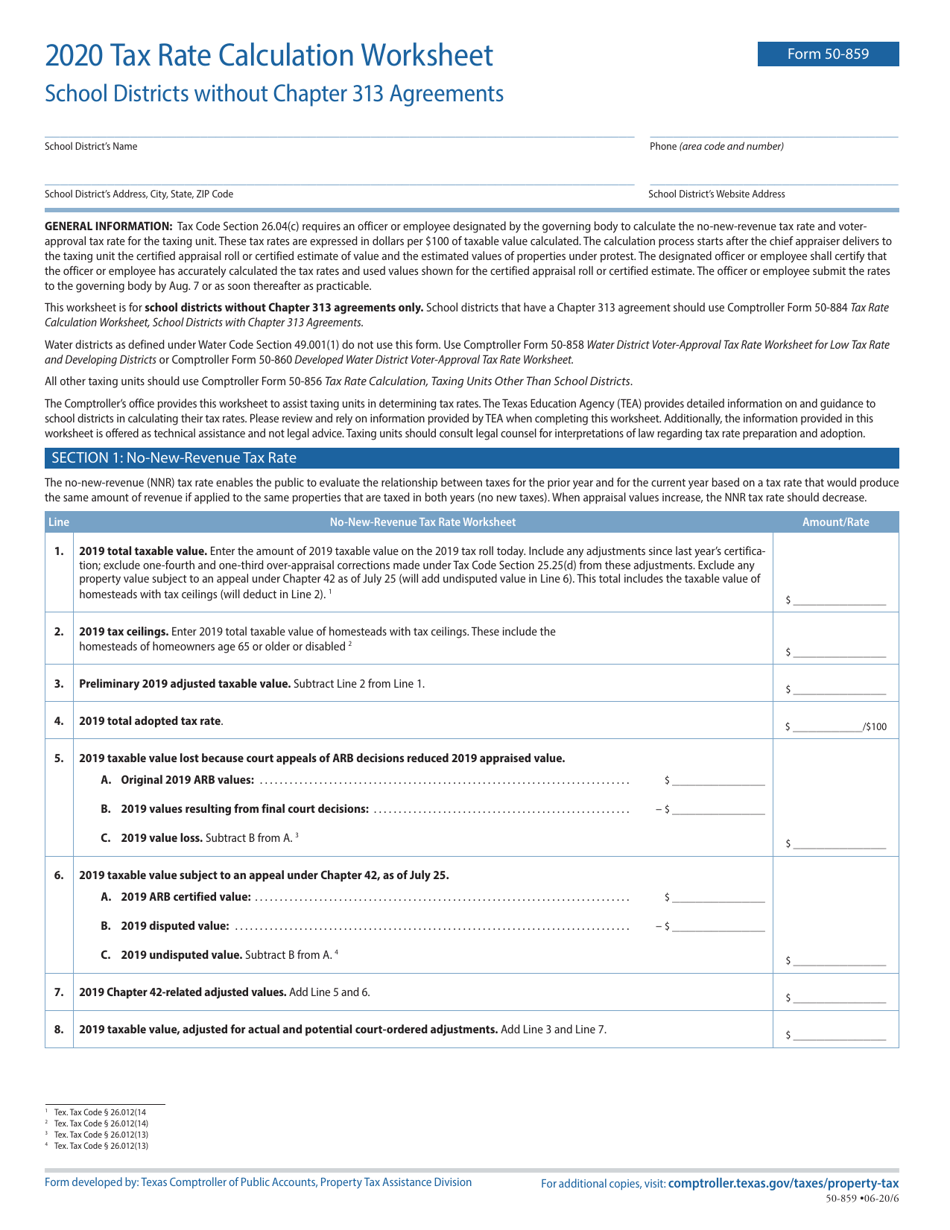

Form 50859 Download Fillable PDF or Fill Online Tax Rate Calculation

Definition of conducting active trade or business. Tx tax code § 171.0001 (2021) sec. Paying off a loan by regular installments. Franchise tax § 171.002 tax code section 171.002 rates; Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250.

hongkongerdesign Pay Arkansas Franchise Tax Online

Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250. (1) internal revenue code means the internal.

Tax Increment Reinvestment Zones Garland, TX

Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. Franchise tax § 171.002 tax code section 171.002 rates; Tax code section 171.0003 definition of passive entity (a) an entity is. Web general definitions 171.001 tax imposed 171.002 rates 171.0002 definition of taxable entity 171.003 increase in rate. Definition of conducting active.

Web Texas Tax Code (Ttc) 171.0003(B).

Paying off a loan by regular installments. Computation of tax (a) subject to. Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in. Definition of conducting active trade or business.

Web General Definitions 171.001 Tax Imposed 171.002 Rates 171.0002 Definition Of Taxable Entity 171.003 Increase In Rate.

Tax code section 171.0003 definition of passive entity (a) an entity is. (1) internal revenue code means the internal revenue code of 1986. (1) the entity is a general or limited partnership or a trust, other than a business trust; Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250.

Web Certain Exemptions From The Franchise Tax Are Outlined In Texas Tax Code Chapter 171, Subchapter B.

Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. Web certified historic structures rehabilitation credit under texas tax code chapter 171, subchapter s (effective for. Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. Franchise tax § 171.002 tax code section 171.002 rates;

Tx Tax Code § 171.0001 (2021) Sec.

Franchise tax § 171.0003 tex.