Chapter 13 Secured Debt

Chapter 13 Secured Debt - • $1,257,850 in secured debts; Check if you qualify for debt relief. Web secured debt limit: Debt can i defer chapter 13 bankruptcy payments? If it seems like your debts are too high, you might still qualify for chapter 13… When you complete your plan, you will receive a chapter 13 discharge that eliminates most of your remaining debts. Web chapter 13 bankruptcy allows you to catch up on missed mortgage or car loan payments and restructure your debts through a repayment plan. This is an increase of more than $25,000, about the same amount of increase announced in 2019 for unsecured debt. You keep your property and repay some or all of your debts through a repayment plan which lasts for three or five years. Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875.

Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. You'll find both lists below. Web secured debt limit: This is an increase of more than $25,000, about the same amount of increase announced in 2019 for unsecured debt. The debt limit is $1,257,850 (the. Debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. Web you are eligible to file for chapter 13 relief if your total secured and unsecured debts total less than $2,750,000 at the time you file. The quick rule is that a. And, • $419,275 in unsecured debts. Chapter 13 cases are now permitted for individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875.

You'll find both lists below. Web as of april 1, 2022: Web the court deems the aggregate amount of $525.00 as reasonable compensation (and the secured creditor may file a single flat fee rule 3002.1 notice of such amount) for chapter 13 secured. Web below, we’ll discuss debt limits, how they work, and what you can do if you owe more than the chapter 13 debt limits allow. How does bankruptcy handle different classes of debt? You keep your property and repay some or all of your debts through a repayment plan which lasts for three or five years. Web secured and unsecured debt in chapter 13 when you're filling out your bankruptcy paperwork, you'll want to know how to divide your debts into unsecured and secured categories. Web secured debts include: Web here's how chapter 13 bankruptcy generally works: When you complete your plan, you will receive a chapter 13 discharge that eliminates most of your remaining debts.

Secured and Unsecured Debt Limitations Under Chapter 13

Chapter 13 plans are often used to cure arrearages on a mortgage, avoid underwater junior mortgages or other liens, pay back taxes over time, or partially repay general unsecured debt. The debtor must resume regular mortgage payments directly to the mortgage lender and remain current. Debt can i defer chapter 13 bankruptcy payments? Web secured and unsecured debt in chapter.

Chapter 13 Bankruptcy Better Debt Consolidation AV Bankruptcy

Web to qualify for chapter 13 bankruptcy, you must have less than $1,395,875 in secured debt for cases filed between april 1, 2022, and march 31, 2025. You'll find both lists below. Ad compare online the best debt consolidators. It's more likely that a chapter 13 debtor will have a problem with the secured debt limit than the limit on.

What Does Chapter 13 Bankruptcy Do With The Debt I Owe? iBankruptcy

It's more likely that a chapter 13 debtor will have a problem with the secured debt limit than the limit on unsecured debt, and here's why. Check if you qualify for debt relief. Web what debt is forgiven in chapter 13 bankruptcy? Web you are eligible to file for chapter 13 relief if your total secured and unsecured debts total.

Chapter 13 Bankruptcy Allows you to consolidate all of your personal

Debtors typically are able to keep property classified as secured debt. Web secured and unsecured debt in chapter 13 when you're filling out your bankruptcy paperwork, you'll want to know how to divide your debts into unsecured and secured categories. Web if you file a case between april 1, 2022, and march 31, 2025, and your secured debts (mortgages and.

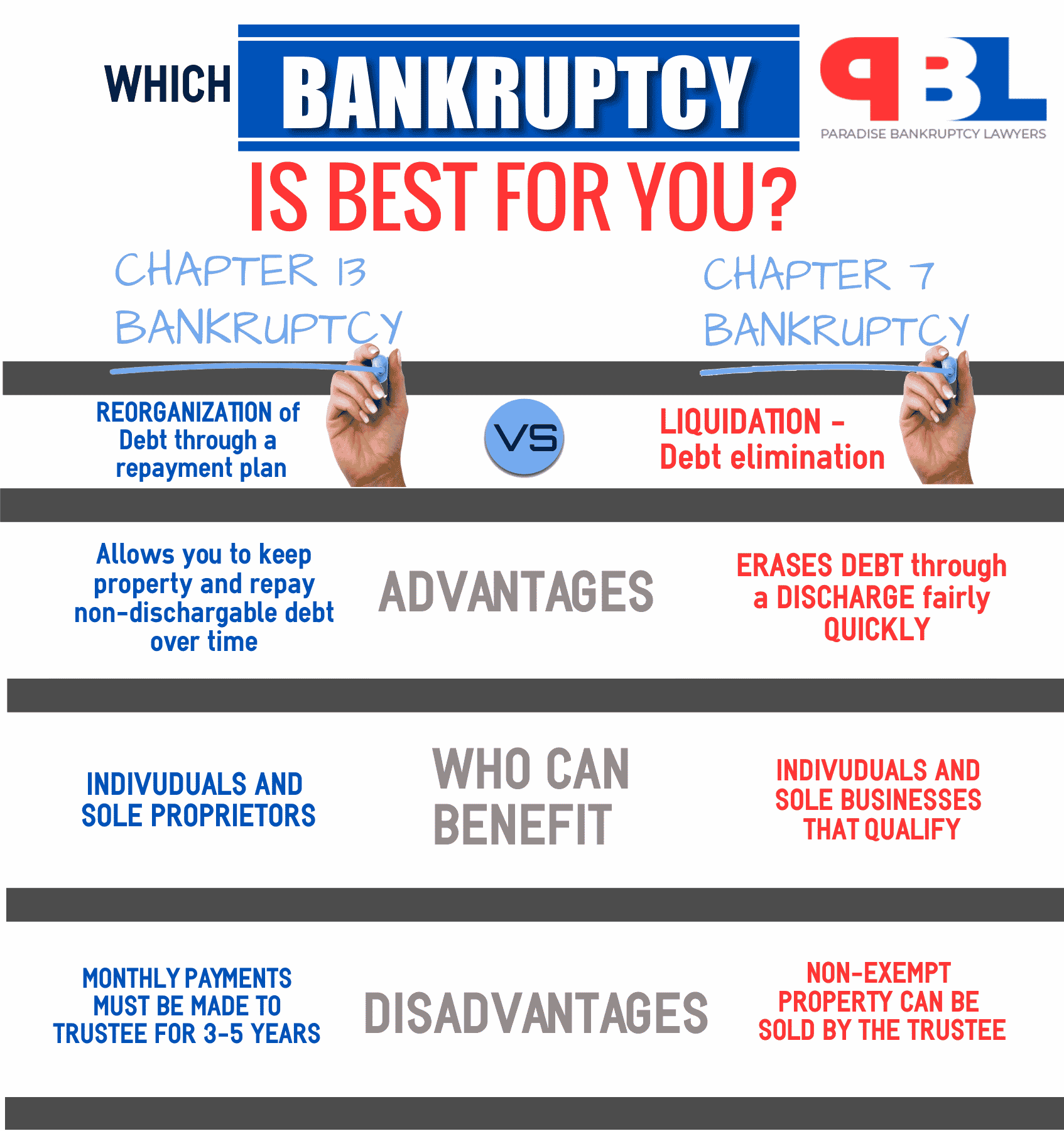

Paradise, NV Debt Relief Attorney Chapter 13 Bankruptcy, 7026053306

Debt can i defer chapter 13 bankruptcy payments? Debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. What you'll have to pay will depend on whether the claim is a: How much you pay on a given debt depends on a number of factors. Web by cara o'neill, attorney.

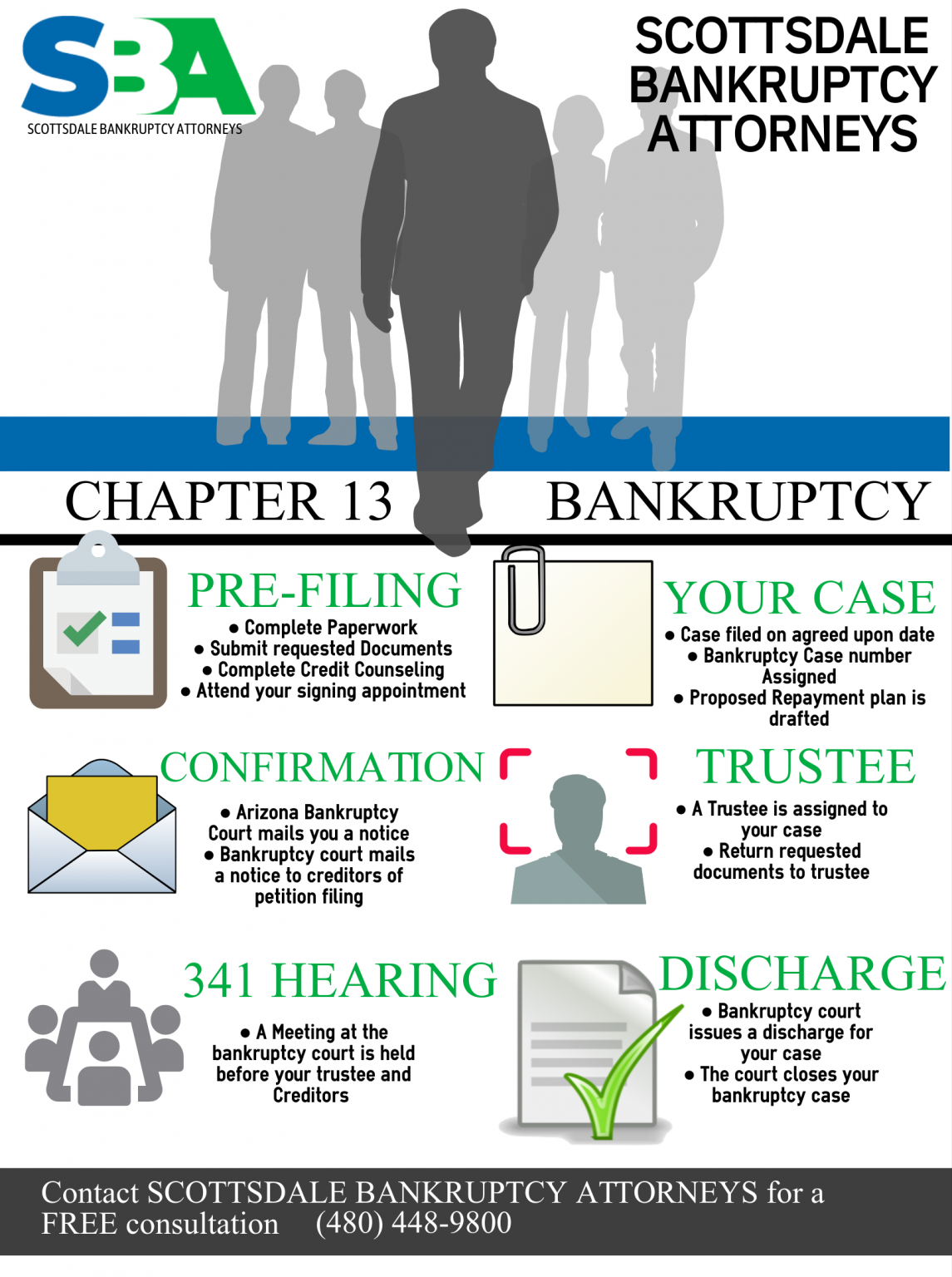

Chapter 13 Bankruptcy Attorney in Scottsdale Low Cost Bankruptcy

Web here's how chapter 13 bankruptcy generally works: Mortgages, automobile loans, and home equity loans or lines of credit. Apply today for financial freedom! Web you are eligible to file for chapter 13 relief if your total secured and unsecured debts total less than $2,750,000 at the time you file. When you complete your plan, you will receive a chapter.

The Pros and Cons of Secured Debt In Newsweekly

Read on to learn more about which debts can be discharged in chapter 13. What you'll have to pay will depend on whether the claim is a: Priority claims, secured claims, priority unsecured claims, and general unsecured claims. Mortgages, automobile loans, and home equity loans or lines of credit. Web you are eligible to file for chapter 13 relief if.

Services CT Bankruptcy Attorneys

Debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. Web below, we’ll discuss debt limits, how they work, and.

What Is Chapter 13 Bankruptcy? Experian

Check if you qualify for debt relief. You can wipe out nonpriority unsecured debts in bankruptcy chapters 7 and 13 You keep your property and repay some or all of your debts through a repayment plan which lasts for three or five years. Under sb 3823, debtors no longer are required to limit debts in specific categories as secured. Web.

Chapter 13 Bankruptcy A Different Way to Deal with Debt Pruvent PLLC

Debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. Web until today, 11 usc §109 (e) limited the eligibility for chapter 13 proceedings to individuals with unsecured debts of no more than $465,275 and secured debts of no more than $1,395,875. Web here's how chapter 13 bankruptcy generally works: $1,257,850 these.

Ad Compare Online The Best Debt Consolidators.

Web the court deems the aggregate amount of $525.00 as reasonable compensation (and the secured creditor may file a single flat fee rule 3002.1 notice of such amount) for chapter 13 secured. Web you are eligible to file for chapter 13 relief if your total secured and unsecured debts total less than $2,750,000 at the time you file. How much you must pay for each type of debt differs. The debtor must resume regular mortgage payments directly to the mortgage lender and remain current.

Priority Claims, Secured Claims, Priority Unsecured Claims, And General Unsecured Claims.

Web here's how chapter 13 bankruptcy generally works: If it seems like your debts are too high, you might still qualify for chapter 13… Web in order to be eligible to file for bankruptcy protection under chapter 13 of the bankruptcy code, the amount of secured debt that an individual debtor can have is limited. It's more likely that a chapter 13 debtor will have a problem with the secured debt limit than the limit on unsecured debt, and here's why.

What You'll Have To Pay Will Depend On Whether The Claim Is A:

How much you pay on a given debt depends on a number of factors. Web secured and unsecured debt in chapter 13 when you're filling out your bankruptcy paperwork, you'll want to know how to divide your debts into unsecured and secured categories. How does bankruptcy handle different classes of debt? Under sb 3823, debtors no longer are required to limit debts in specific categories as secured.

You Can Wipe Out Nonpriority Unsecured Debts In Bankruptcy Chapters 7 And 13

Debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. Web by cara o'neill, attorney. But they must have the disposable income needed to develop a repayment plan. Web below, we’ll discuss debt limits, how they work, and what you can do if you owe more than the chapter 13 debt limits allow.