Chapter 13 Median Income

Chapter 13 Median Income - Web however, several of the issues below are unique to the chapter 13 disposable income test. Disposable income in chapter 13 bankruptcy. The last time these limits were adjusted was on april 1, 2013, and are currently limited to: Download form (pdf, 409.92 kb) form number: Web while there is no maximum income to qualify for chapter 13, there are debt limits. $44,286 (as of july 2016). As of april 1, 2021, the median income levels have been updated. Missouri, median income change reflects decrease except for larger families. Web november 1, 2012 median income levels are down in kansas for chapter 7 and chapter 13 bankruptcy. Web in bankruptcy, the means test looks at your median income and family size to determine which chapter you may qualify:

Web one of the reasons your income is important in chapter 13 bankruptcy is because it determines the length of your repayment plan. As of april 1, 2021, the median income levels have been updated. Web you will need to calculate your average monthly income during the six months before you filed under chapter 13, and then you will need to compare this amount to the state median for a household of the same size. $44,286 (as of july 2016). We recommend working with a florida bankruptcy lawyer from hoskins, turco, lloyd & lloyd to tackle the bankruptcy process as smoothly as possible. Web you can find the median income in your state on the u.s. Web a typical chapter 13 plan lasts five years which is a long time. Web only $300 upfront fees for a st. Circumstances, jobs, and incomes can change in five years. Web the debtor must not exceed the chapter 13 debt limits.

Web it is offered to the public as is as an adjunct to the nolo books, how to file chapter 7 bankruptcy, and chapter 13 bankruptcy: Web whether your income is less than your state's median income. Web in bankruptcy, the means test looks at your median income and family size to determine which chapter you may qualify: Chapter 7 or chapter 13. Web a typical chapter 13 plan lasts five years which is a long time. Web one of the reasons your income is important in chapter 13 bankruptcy is because it determines the length of your repayment plan. Filers use the amounts to complete the means test to determine a filer's chapter 7 discharge qualifications and calculate a chapter 13. Web only $300 upfront fees for a st. Trustee's website at www.justice.gov/ust (choose means testing information, choose the correct date range, and then choose median family income based on state/territory and family size.) figuring out your minimum monthly chapter 13. Web you can find the median income in your state on the u.s.

Interactive U.S. Counties By Median Household ValueWalk Premium

Chapter 7 or chapter 13. Five years is the maximum length of any chapter 13. Web however, several of the issues below are unique to the chapter 13 disposable income test. For instance, according to the state of missouri and the federal government, the average (or median) income for a household of one is: Web while there is no maximum.

Median Household By State

Web you will need to calculate your average monthly income during the six months before you filed under chapter 13, and then you will need to compare this amount to the state median for a household of the same size. The last time these limits were adjusted was on april 1, 2013, and are currently limited to: Web you can.

Detroit Median Drawing Detroit

Web only $300 upfront fees for a st. Web however, several of the issues below are unique to the chapter 13 disposable income test. Whether you have disposable income available to pay back some or all of your debt in a chapter 13 case, and. Web the debtor must not exceed the chapter 13 debt limits. Chapter 7 or chapter.

EconomicGreenfield Median Household Chart

For instance, according to the state of missouri and the federal government, the average (or median) income for a household of one is: Section 101 (30) of the bankruptcy code defines “regular income” as “income. Web the debtor must not exceed the chapter 13 debt limits. Web chapter 13 calculation of your disposable income. Missouri, median income change reflects decrease.

Median For Bankruptcy Chapter 7

Unsecured debts less than $383,175, and secured debts less than $1,149,525. Keep your property and repay your debts over time (10th edition, 2010):. The length of time of the chapter 13 repayment plan (three years if under the median. Web however, several of the issues below are unique to the chapter 13 disposable income test. The debtor must have a.

Contra Corner David Stockman's Contra Corner

Section 101 (30) of the bankruptcy code defines “regular income” as “income. Unsecured debts less than $383,175, and secured debts less than $1,149,525. Web while there is no maximum income to qualify for chapter 13, there are debt limits. The last time these limits were adjusted was on april 1, 2013, and are currently limited to: Web one of the.

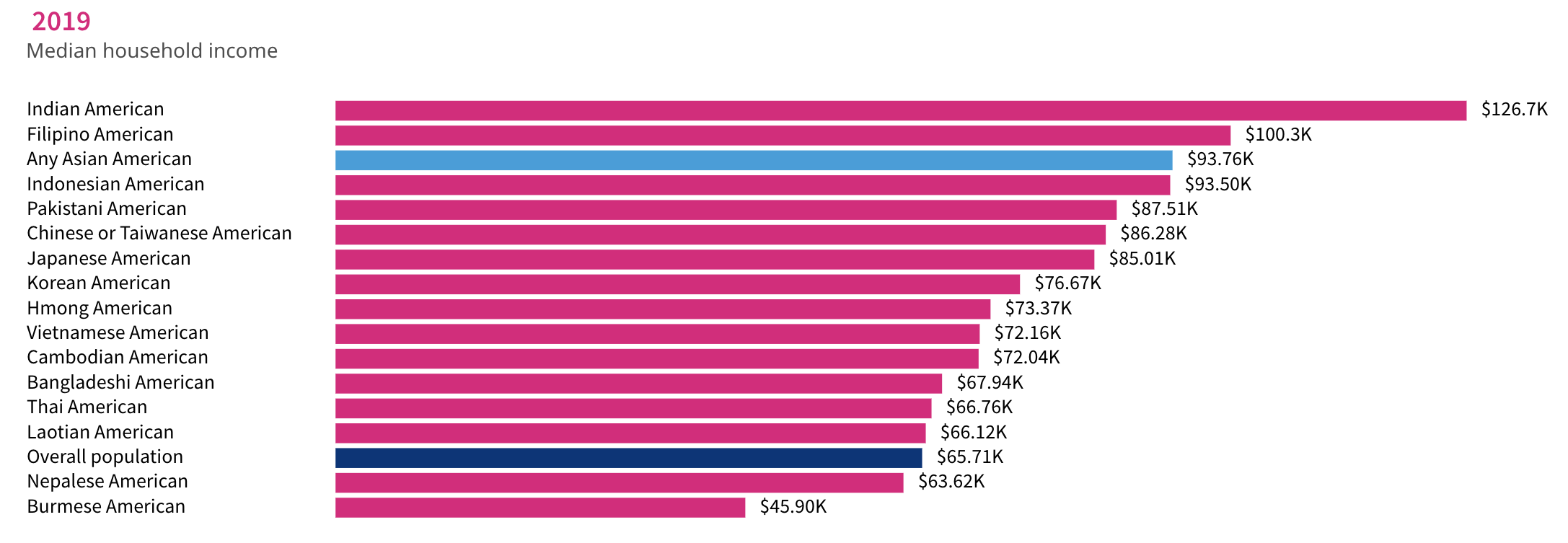

US Census PakistaniAmericans Are Young, Welleducated and Prosperous

Web however, several of the issues below are unique to the chapter 13 disposable income test. Web in chapter 13, disposable income is income (other than child support payments received by the debtor) less amounts reasonably necessary for the maintenance or support of the debtor or dependents and less charitable contributions up to 15% of the debtor's gross income. Web.

Median Info Carnivore

Web it is offered to the public as is as an adjunct to the nolo books, how to file chapter 7 bankruptcy, and chapter 13 bankruptcy: Web a chapter 13 bankruptcy represents a voluntary reorganization of debts for individuals. Five years is the maximum length of any chapter 13. Web the new bankruptcy median family income figures change on november.

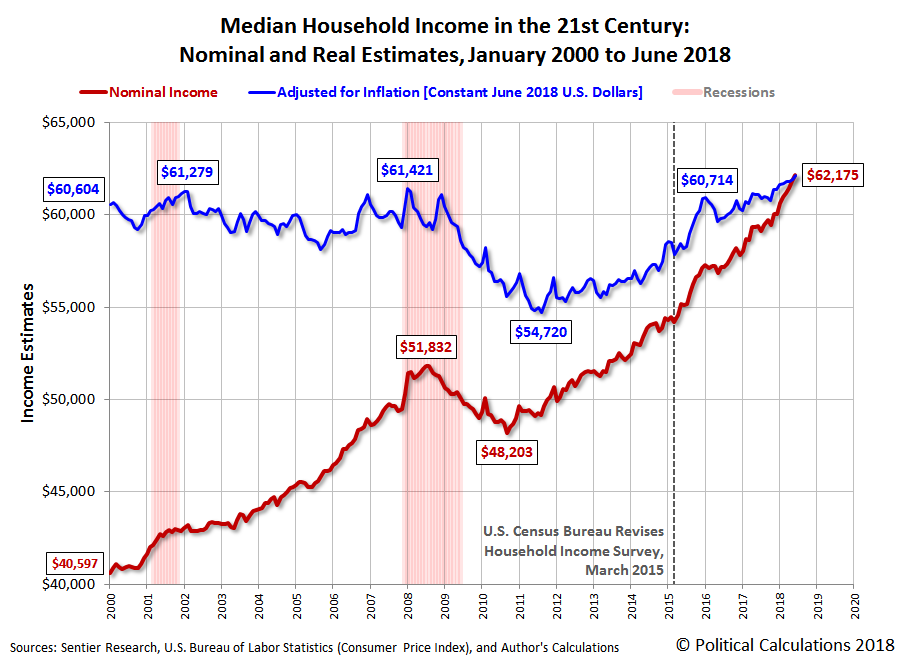

June 2018 Median Household Seeking Alpha

Web you can find the median income in your state on the u.s. Missouri, median income change reflects decrease except for larger families. Download form (pdf, 409.92 kb) form number: The length of time of the chapter 13 repayment plan (three years if under the median. For instance, according to the state of missouri and the federal government, the average.

What are the median figures for bankruptcy in Utah (April 2017

The length of time of the chapter 13 repayment plan (three years if under the median. For instance, according to the state of missouri and the federal government, the average (or median) income for a household of one is: Whether you have disposable income available to pay back some or all of your debt in a chapter 13 case, and..

The Debtors, Who Usually Retain All Of Their Assets, Commit A Portion Of Their Future Income To Repay.

The debtor must have a regular income. Web only $300 upfront fees for a st. Trustee's website at www.justice.gov/ust (choose means testing information, choose the correct date range, and then choose median family income based on state/territory and family size.) figuring out your minimum monthly chapter 13. $44,286 (as of july 2016).

Web The Debtor Must Not Exceed The Chapter 13 Debt Limits.

Web you will need to calculate your average monthly income during the six months before you filed under chapter 13, and then you will need to compare this amount to the state median for a household of the same size. The basis for chapter 13 payments to the bankruptcy trustee is derived from disposable income… Section 101 (30) of the bankruptcy code defines “regular income” as “income. Chapter 7 or chapter 13.

For Instance, According To The State Of Missouri And The Federal Government, The Average (Or Median) Income For A Household Of One Is:

Web while there is no maximum income to qualify for chapter 13, there are debt limits. If your income is less than your state's median income, your repayment plan will probably last three years. Web one of the reasons your income is important in chapter 13 bankruptcy is because it determines the length of your repayment plan. The plan increases to five years if you earn more than the state median income.

Filers Use The Amounts To Complete The Means Test To Determine A Filer's Chapter 7 Discharge Qualifications And Calculate A Chapter 13.

Unsecured debts less than $383,175, and secured debts less than $1,149,525. Disposable income in chapter 13 bankruptcy. We recommend working with a florida bankruptcy lawyer from hoskins, turco, lloyd & lloyd to tackle the bankruptcy process as smoothly as possible. Web however, several of the issues below are unique to the chapter 13 disposable income test.