Chapter 13 Allowable Expenses

Chapter 13 Allowable Expenses - I understand that the irs guidelines regarding reasonable expenses. Web 2023 allowable living expenses national standards. Web chapter 13 calculation of your disposable income | united states courts. At the beginning of the chapter 13 bankruptcy process, the. Collection financial standards for food,. September 9, 2013. Two persons three persons four persons ;. Download form (pdf, 409.92 kb) form. Social security, veteran’s benefits and public. Web chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years.

Collection financial standards are used to help determine a taxpayer's ability to pay a delinquent tax liability. Web there is no income cap on a chapter 13 filing, nor is there a means test you have to pass to be able to file. Web expense information for tax purposes can be found on the irs web site. Two persons three persons four persons ;. Web motor vehicles up to $3,000. Web 2021 allowable living expenses national standards. Web chapter 13 provides a procedure for an eligible individual to pay all or a portion of their debts through plan. September 9, 2013. Social security, veteran’s benefits and public. Web chapter 13 calculation of your disposable income | united states courts.

Web expense information for tax purposes can be found on the irs web site. Web chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years. Web chapter 13 calculation of your disposable income | united states courts. These expense guidelines are for cases assigned. If you're like most, you'll pay for five years, and. Web in devising a repayment plan under chapter 13, a debtor will need to calculate their income, property, debts, and expenses. Social security, veteran’s benefits and public. Web the court will use schedule j to make sure you have enough money to make your monthly chapter 13 plan payments. Two persons three persons four persons ;. Web reasonable living expenses with chapter 13.

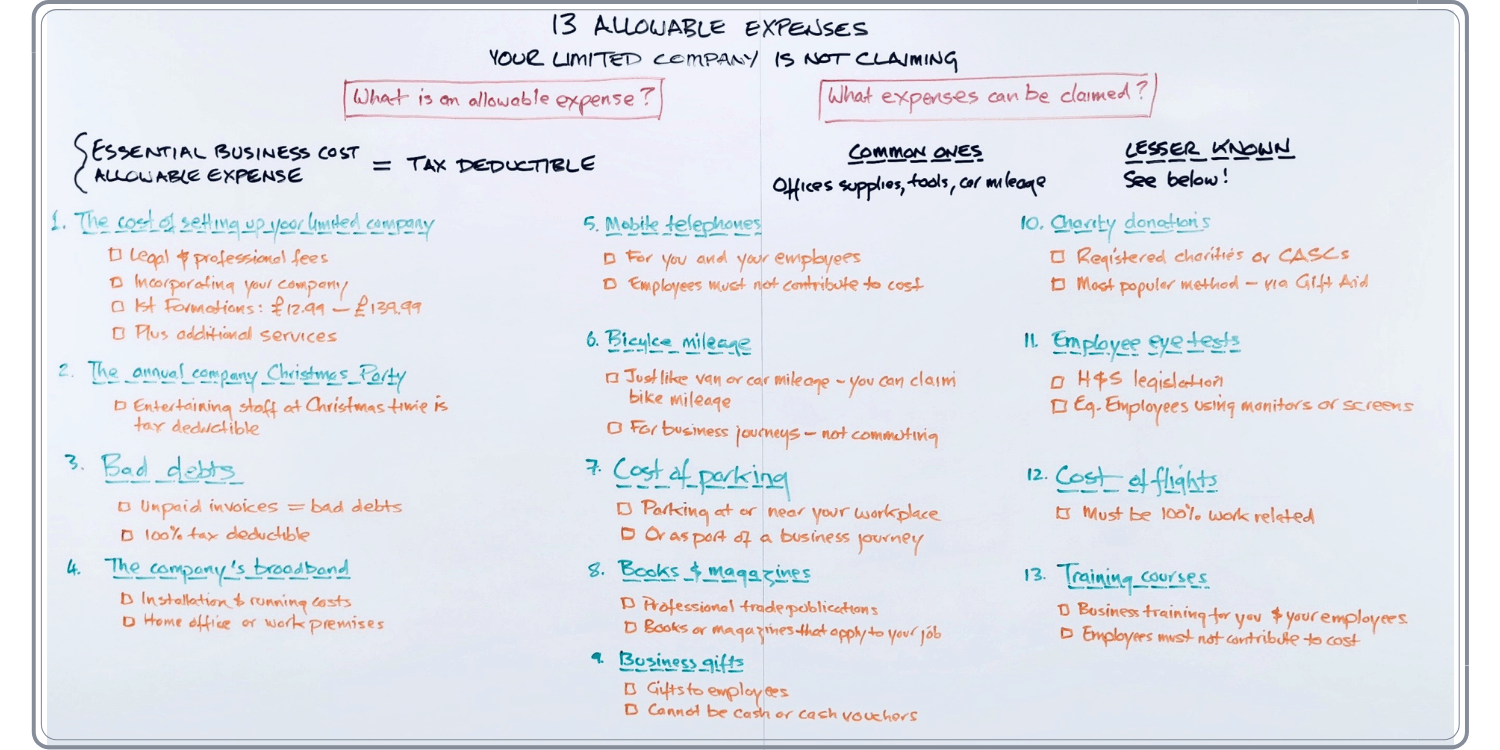

13 allowable expenses your limited company isn’t claiming Whiteboard

Web allowable expenses in chapter 13 allowable expenses. Web 2021 allowable living expenses national standards. If you're like most, you'll pay for five years, and. Web chapter 13 trustee expense guidelines. Web there is no income cap on a chapter 13 filing, nor is there a means test you have to pass to be able to file.

What are allowable expenses when renting property? PropertyLab

Web 2023 allowable living expenses national standards. Two persons three persons four persons ;. Web expense information for tax purposes can be found on the irs web site. Web there is no income cap on a chapter 13 filing, nor is there a means test you have to pass to be able to file. Web reasonable living expenses with chapter.

Types of NonTax Allowable Expenses In A Company Corporate BackOffice

Web chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years. Web motor vehicles up to $3,000. Web the court will use schedule j to make sure you have enough money to make your monthly chapter 13 plan payments. Web 2021 allowable living expenses national standards. Web there is no income cap.

Personal Tax Planning How to get it Right Accountants Price Davis

Social security, veteran’s benefits and public. At the beginning of the chapter 13 bankruptcy process, the. Web reasonable living expenses with chapter 13. Web the court will use schedule j to make sure you have enough money to make your monthly chapter 13 plan payments. These expense guidelines are for cases assigned.

Allowable Expenses for Sole Traders and Partnerships The Kelvin

Web chapter 13 calculation of your disposable income | united states courts. Web allowable expenses in chapter 13 allowable expenses. Two persons three persons four persons ;. Web reasonable living expenses with chapter 13. Web chapter 13 trustee expense guidelines.

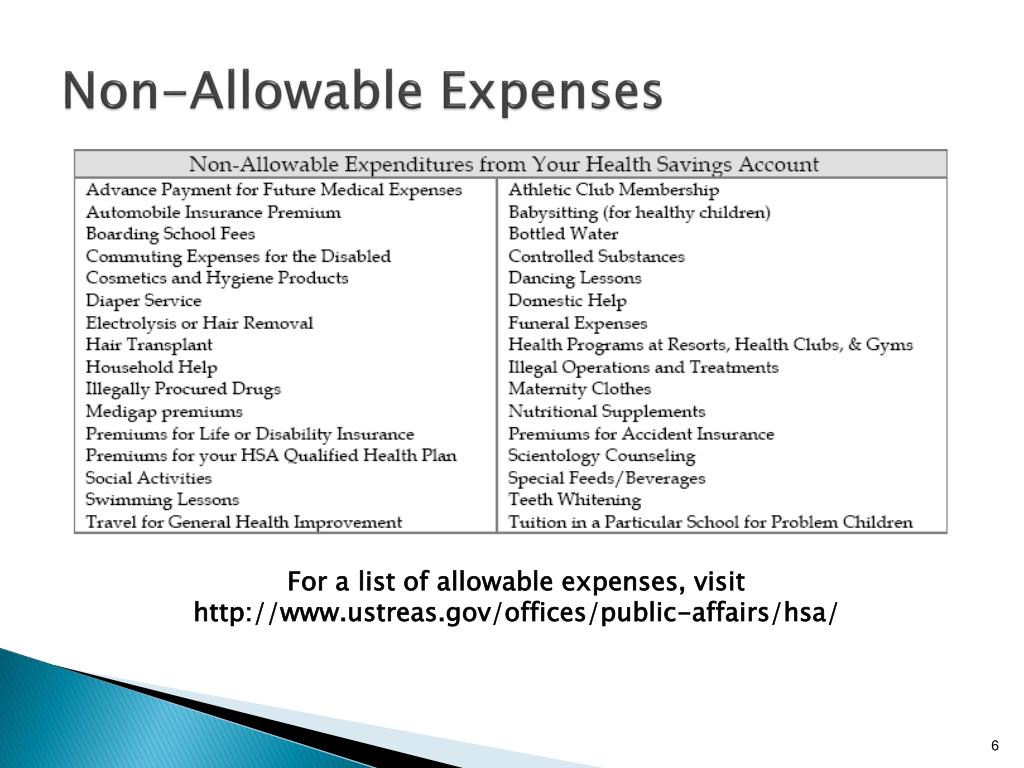

PPT Stratfor Medical Plan Review Plan Year 20082009 PowerPoint

Two persons three persons four persons ;. Web in chapter 13 bankruptcy, the debtor is allowed to make a monthly repayment of the loan over an agreeable. Web there is no income cap on a chapter 13 filing, nor is there a means test you have to pass to be able to file. Collection financial standards are used to help.

Allowable expenses in a Limited Company EvlaTeam

These expense guidelines are for cases assigned. Web allowable expenses in chapter 13 allowable expenses. Web chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years. Web expense information for tax purposes can be found on the irs web site. Web the court will use schedule j to make sure you have.

Calculate and Report Your PRF Allowable Expenses for Payroll Correctly

I understand that the irs guidelines regarding reasonable expenses. Web reasonable living expenses with chapter 13. If you're like most, you'll pay for five years, and. At the beginning of the chapter 13 bankruptcy process, the. Web in devising a repayment plan under chapter 13, a debtor will need to calculate their income, property, debts, and expenses.

What expenses can I actually claim? LandlordZONE

Collection financial standards are used to help determine a taxpayer's ability to pay a delinquent tax liability. I understand that the irs guidelines regarding reasonable expenses. Social security, veteran’s benefits and public. Web in chapter 13 bankruptcy, the debtor is allowed to make a monthly repayment of the loan over an agreeable. Web chapter 13 calculation of your disposable income.

What are Disallowable Expenses? goselfemployed.co

If you're like most, you'll pay for five years, and. Web there is no income cap on a chapter 13 filing, nor is there a means test you have to pass to be able to file. Web reasonable living expenses with chapter 13. Web 2021 allowable living expenses national standards. Web motor vehicles up to $3,000.

September 9, 2013.

Web the court will use schedule j to make sure you have enough money to make your monthly chapter 13 plan payments. These expense guidelines are for cases assigned. Two persons three persons four persons ;. Web chapter 13 trustee expense guidelines.

Web Chapter 13 Calculation Of Your Disposable Income | United States Courts.

Web 2023 allowable living expenses national standards. Download form (pdf, 409.92 kb) form. Collection financial standards for food,. I understand that the irs guidelines regarding reasonable expenses.

Web In Chapter 13 Bankruptcy, The Debtor Is Allowed To Make A Monthly Repayment Of The Loan Over An Agreeable.

Web chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years. Web there is no income cap on a chapter 13 filing, nor is there a means test you have to pass to be able to file. Collection financial standards are used to help determine a taxpayer's ability to pay a delinquent tax liability. Web reasonable living expenses with chapter 13.

At The Beginning Of The Chapter 13 Bankruptcy Process, The.

If you're like most, you'll pay for five years, and. Web motor vehicles up to $3,000. Social security, veteran’s benefits and public. Web chapter 13 provides a procedure for an eligible individual to pay all or a portion of their debts through plan.