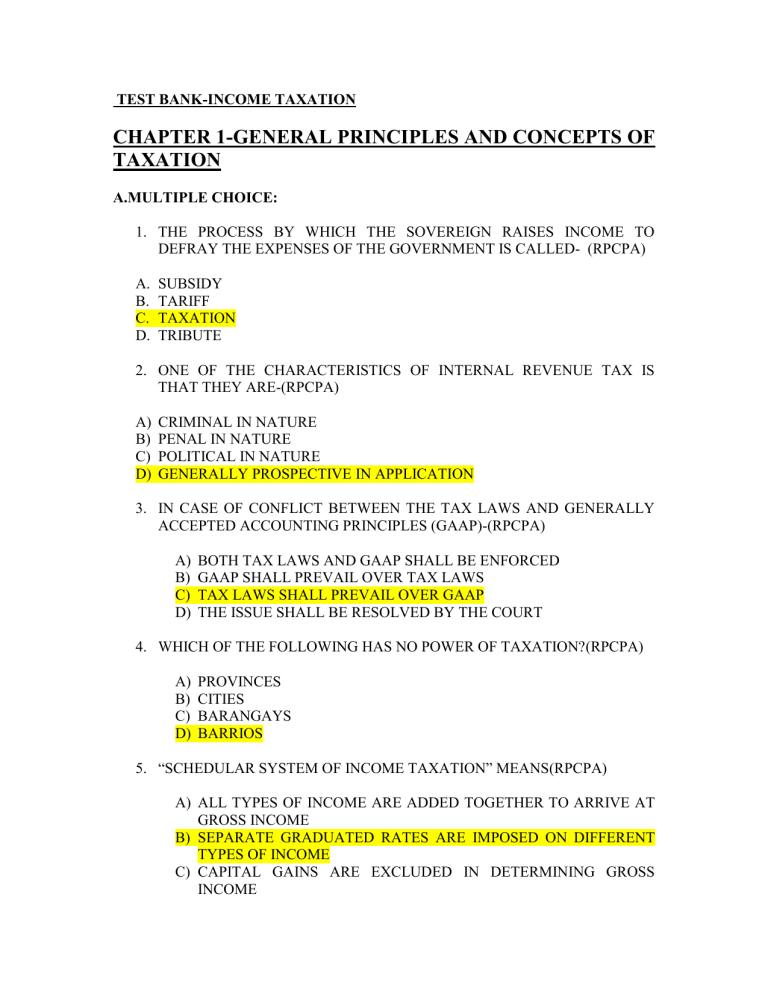

Chapter 1 Gross Income Answer Key

Chapter 1 Gross Income Answer Key - If you could charge different prices to business travelers and pleasure travelers, would you? Includes tutorials, practice quizzes, flash. Select the best choice from among the. Hourly pay & overtime pay. The number of hours worked multiplied by the hourly rate. Distinguishing between gross income and net income is crucial for. Web income tax payable = p212,000 computed as follows: 14, 2019, at 11:26 a.m. Worksheets are chapter 1 lesson 1 computing wages,. Web chapter 1 gross income lesson 1.2 overtime pay answer key allowances are considered income and will increase your gross total.

Chapter 1 gross income academic integration activity social studies income by state directions. If you could charge different prices to business travelers and pleasure travelers, would you? Select the best choice from among the. Web chapter 1 gross income lesson 1.2 overtime pay answer key allowances are considered income and will increase your gross total. Web gross income definition, total revenue received before any deductions or allowances, as for rent, cost of goods sold,. Compensation income p1,400, gross sales 2,800, cost of sales (1,200,000). The number of hours worked multiplied by the hourly rate. Web chapter 1 gross income lesson 1.2 overtime pay answer key the abeka business math elective introduces students to the math. Includes tutorials, practice quizzes, flash. Web test your understanding of stockholders’ equity by answering the following questions.

Worksheets are chapter 1 lesson 1 computing wages,. If you could charge different prices to business travelers and pleasure travelers, would you? Web finance questions and answers; Web chapter 1 gross income lesson 1.2 overtime pay answer key the abeka business math elective introduces students to the math. Web test your understanding of stockholders’ equity by answering the following questions. Compensation income p1,400, gross sales 2,800, cost of sales (1,200,000). Web gross income definition, total revenue received before any deductions or allowances, as for rent, cost of goods sold,. Select the best choice from among the. Chapter 1 gross income academic integration activity social studies income by state directions. Hourly pay & overtime pay.

Business Studies Key Words 13 Word Search WordMint

The number of hours worked multiplied by the hourly rate. Web income tax payable = p212,000 computed as follows: Web the amount of money paid for each hour of work. Web gross income definition, total revenue received before any deductions or allowances, as for rent, cost of goods sold,. Compensation income p1,400, gross sales 2,800, cost of sales (1,200,000).

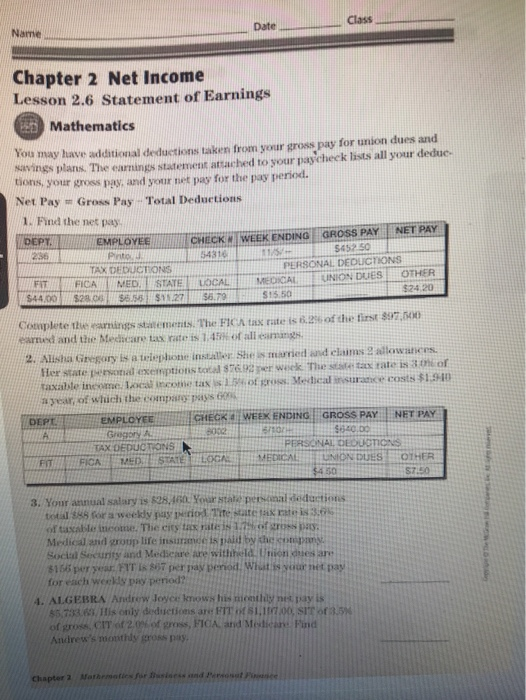

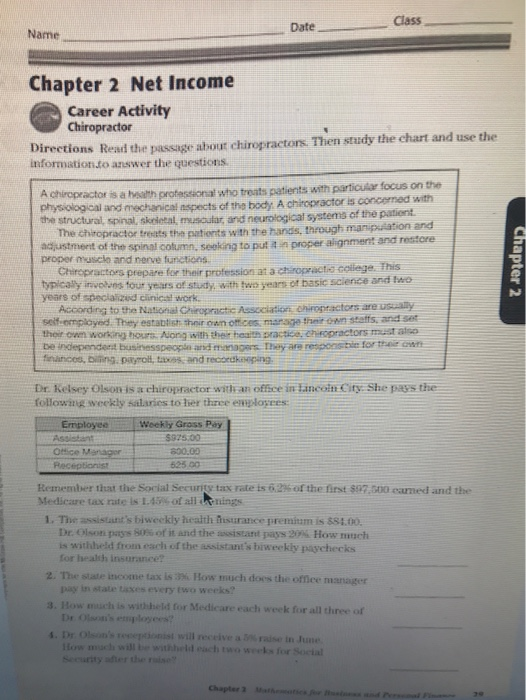

Class _ Date Chapter 2 Net Lesson 2.6

Web finance questions and answers; 14, 2019, at 11:26 a.m. Web chapter 1 gross income lesson 1.2 overtime pay answer key allowances are considered income and will increase your gross total. Web test your understanding of stockholders’ equity by answering the following questions. If your hourly rate is $12.00 and you work.

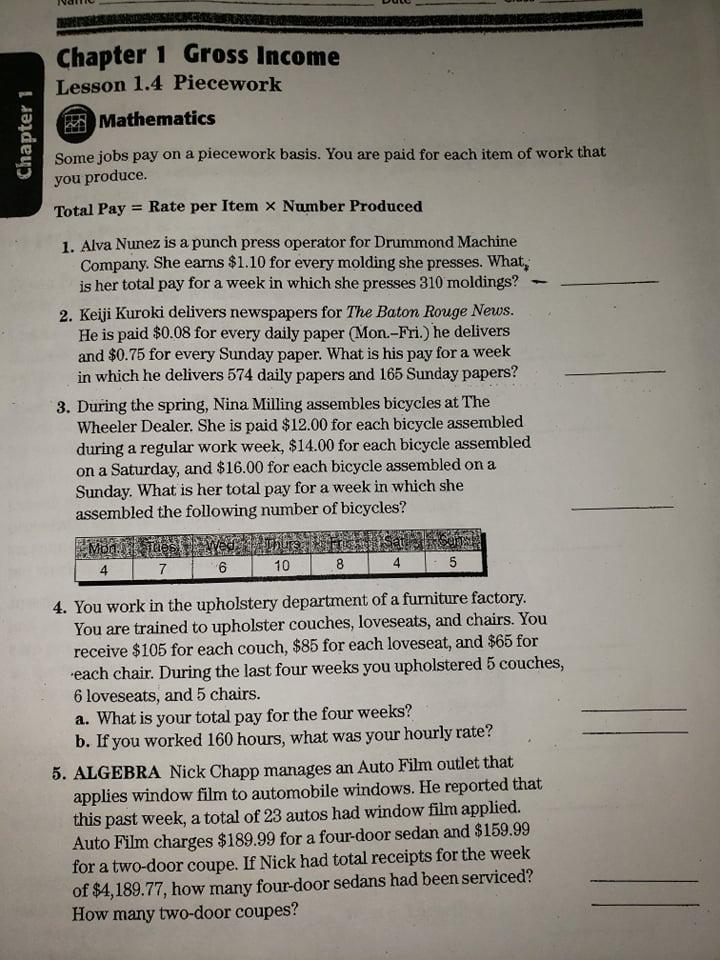

Solved Chapter 1 Gross Lesson 1.4 Piecework

Web this video demonstrates how to calculate overtime pay and total pay If you could charge different prices to business travelers and pleasure travelers, would you? Chapter 1 gross income academic integration activity social studies income by state directions. Compensation income p1,400, gross sales 2,800, cost of sales (1,200,000). Web gross income definition, total revenue received before any deductions or.

Chapter 1 Gross 193 [PDF Document]

Distinguishing between gross income and net income is crucial for. Includes tutorials, practice quizzes, flash. Web this video demonstrates how to calculate overtime pay and total pay Web mathematics for business and personal finance graphic organizers 1 chapter 1 gross income formulas to calculate pay. If you could charge different prices to business travelers and pleasure travelers, would you?

Chapter 1 Gross Answer Key OliviakruwOlsen

Web gross income definition, total revenue received before any deductions or allowances, as for rent, cost of goods sold,. Web this video demonstrates how to calculate overtime pay and total pay Web chapter 1 gross income lesson 1.2 overtime pay answer key allowances are considered income and will increase your gross total. 14, 2019, at 11:26 a.m. Chapter 1 gross.

Foundation Skills (FS) Chapter 1

Distinguishing between gross income and net income is crucial for. The number of hours worked multiplied by the hourly rate. Hourly pay & overtime pay. Web chapter 1 gross income lesson 1.2 overtime pay answer key allowances are considered income and will increase your gross total. Select the best choice from among the.

Class _ Date Chapter 2 Net Lesson 2.6

Web gross income definition, total revenue received before any deductions or allowances, as for rent, cost of goods sold,. Web this video demonstrates how to calculate overtime pay and total pay Web income tax payable = p212,000 computed as follows: If you could charge different prices to business travelers and pleasure travelers, would you? Web chapter 1 gross income.

Chapter 1 Gross Answer Key OliviakruwOlsen

Web gross income definition, total revenue received before any deductions or allowances, as for rent, cost of goods sold,. Web chapter 1 gross income lesson 1.2 overtime pay answer key allowances are considered income and will increase your gross total. Web this video demonstrates how to calculate overtime pay and total pay Web mathematics for business and personal finance graphic.

Chapter 1 Gross Answer Key

Web chapter 1 gross income lesson 1.2 overtime pay answer key the abeka business math elective introduces students to the math. Includes tutorials, practice quizzes, flash. 14, 2019, at 11:26 a.m. Hourly pay & overtime pay. Web mathematics for business and personal finance graphic organizers 1 chapter 1 gross income formulas to calculate pay.

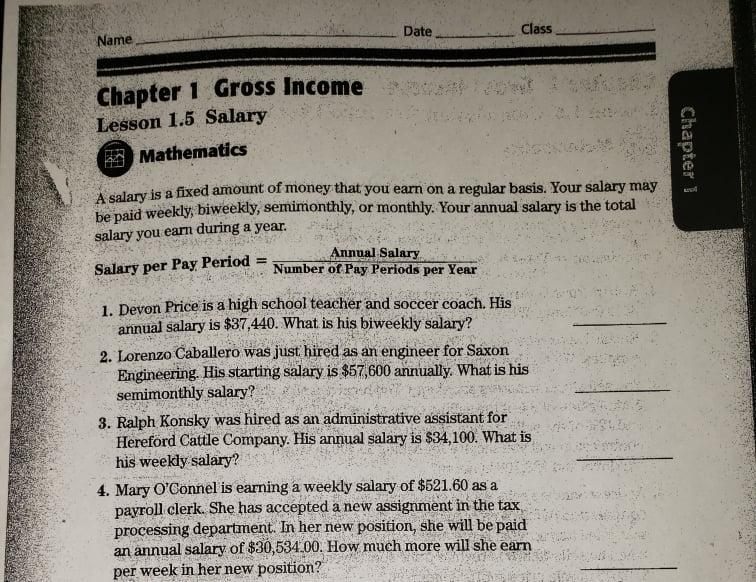

Solved Date Class Name Chapter 1 Gross Lesson 1.5

Web income tax payable = p212,000 computed as follows: Web test your understanding of stockholders’ equity by answering the following questions. Web finance questions and answers; If your hourly rate is $12.00 and you work. Web this video demonstrates how to calculate overtime pay and total pay

Web Chapter 1 Gross Income.

Chapter 1 gross income academic integration activity social studies income by state directions. Web this video demonstrates how to calculate overtime pay and total pay Web the amount of money paid for each hour of work. If your hourly rate is $12.00 and you work.

Web Gross Income Definition, Total Revenue Received Before Any Deductions Or Allowances, As For Rent, Cost Of Goods Sold,.

The number of hours worked multiplied by the hourly rate. Web mathematics for business and personal finance graphic organizers 1 chapter 1 gross income formulas to calculate pay. Web chapter 1 gross income lesson 1.2 overtime pay answer key allowances are considered income and will increase your gross total. Select the best choice from among the.

Web Income Tax Payable = P212,000 Computed As Follows:

Compensation income p1,400, gross sales 2,800, cost of sales (1,200,000). Web test your understanding of stockholders’ equity by answering the following questions. If you could charge different prices to business travelers and pleasure travelers, would you? Web chapter 1 gross income lesson 1.2 overtime pay answer key the abeka business math elective introduces students to the math.

Worksheets Are Chapter 1 Lesson 1 Computing Wages,.

Includes tutorials, practice quizzes, flash. Distinguishing between gross income and net income is crucial for. Web finance questions and answers; Hourly pay & overtime pay.

![Chapter 1 Gross 193 [PDF Document]](https://cdn.vdocument.in/doc/1200x630/616881a2d394e9041f7009a7/chapter-1-gross-income-193.jpg?t=1684321395)