Certification Of Beneficial Ownership Form

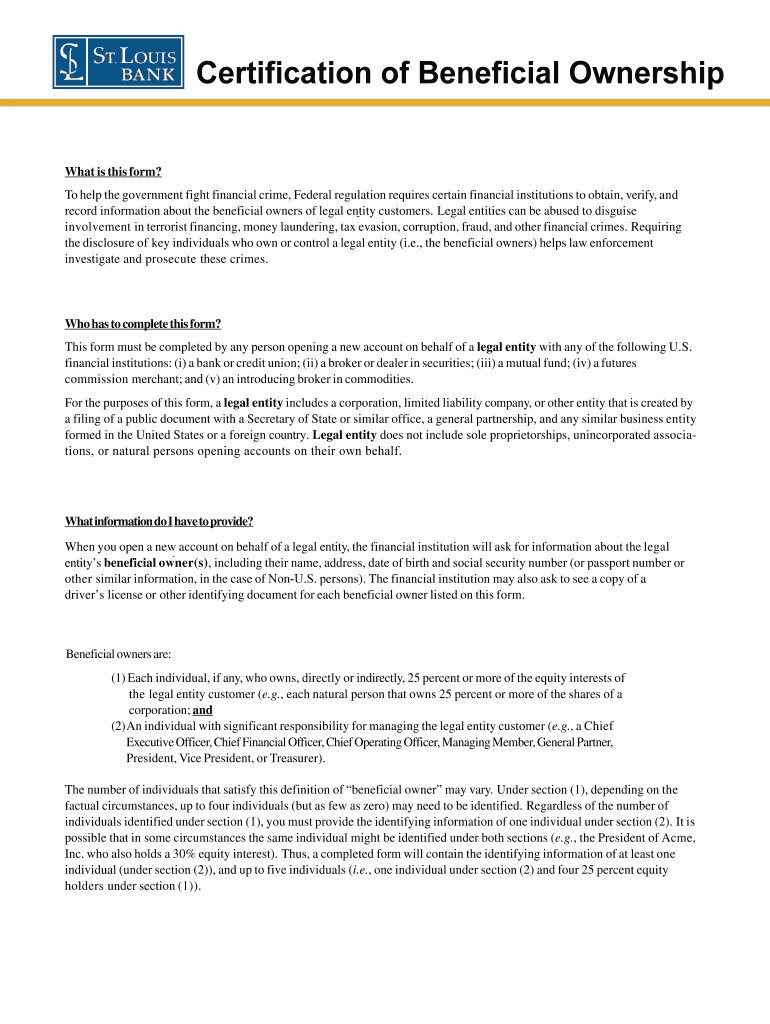

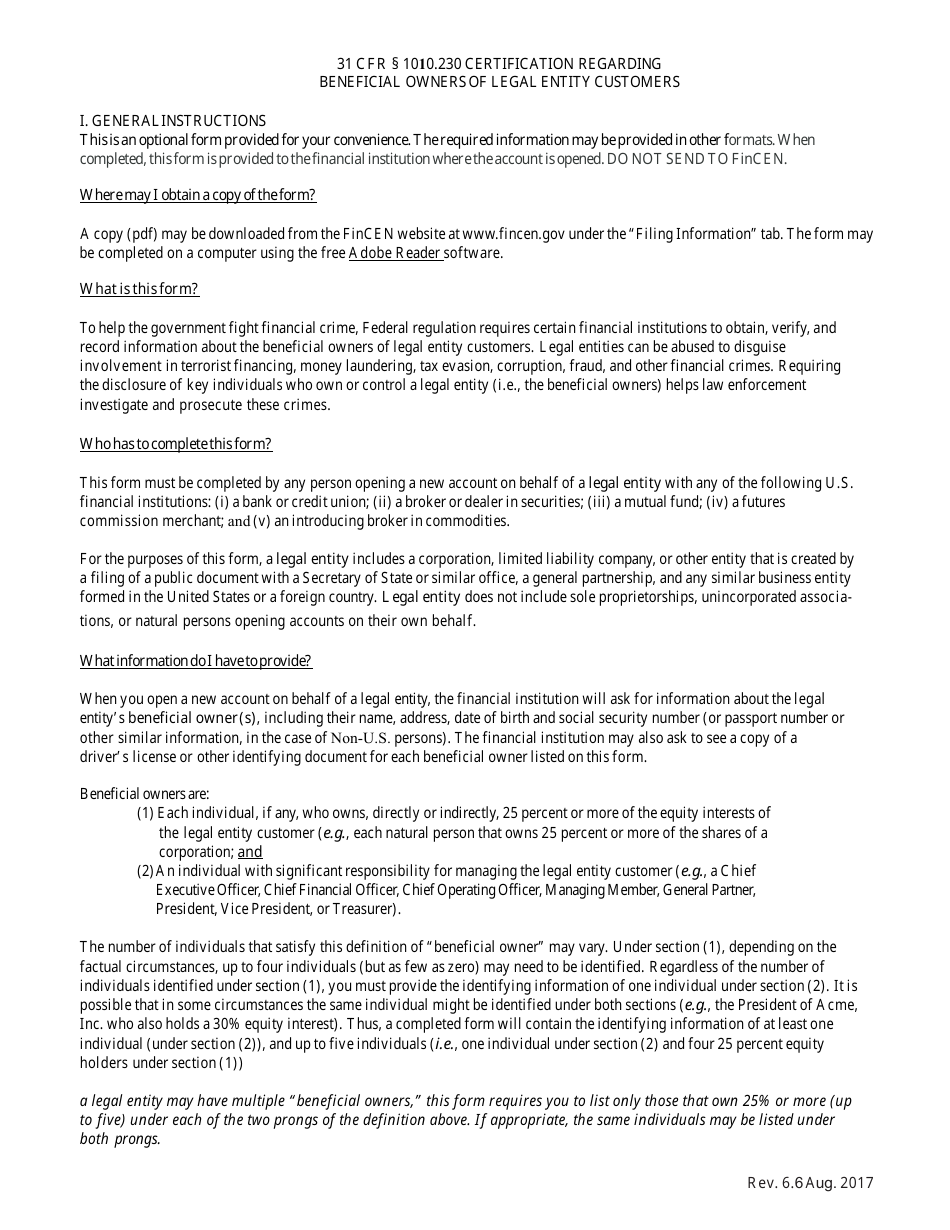

Certification Of Beneficial Ownership Form - These regulations go into effect on january 1, 2024. Name and address of legal entity for which the account is being opened: Web beneficial ownership information reporting. Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of legal entity customers and to include such procedures. All persons opening an account on behalf of a legal entity must provide the following information: Name and title of natural person opening account: All persons opening an account on behalf of a legal entity must provide the following information: This form cannot be digitally signed. Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not use this form for:

Web beneficial ownership information reporting. This form cannot be digitally signed. All persons opening an account on behalf of a legal entity must provide the following information: Completed forms require the signature of the individual providing the information. All persons opening an account on behalf of a legal entity must provide the following information: Name and address of legal entity for which the account is being opened: A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of legal entity customers and to include such procedures.

Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not use this form for: All persons opening an account on behalf of a legal entity must provide the following information: Name and title of natural person opening account: Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Name and address of legal entity for which the account is being opened: These regulations go into effect on january 1, 2024. Web beneficial ownership information reporting. This form cannot be digitally signed. Web certification of beneficial owner(s) persons opening an account on behalf of a legal entity must provide the following information: Completed forms require the signature of the individual providing the information.

About Privacy Policy Copyright TOS Contact Sitemap

All persons opening an account on behalf of a legal entity must provide the following information: Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). These regulations go into effect on january 1, 2024. Web under the beneficial.

Sterling Beneficial Ownership Certification MKP Team

Web beneficial ownership information reporting. Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not.

Beneficial Ownership Certification Form Inspirational regarding

All persons opening an account on behalf of a legal entity must provide the following information: Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of legal entity customers and to include such procedures. This form cannot be digitally signed. Web certification of beneficial owner(s).

Certification of Beneficial Owner Business Law Corporations

Web beneficial ownership information reporting. Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Name and address of legal entity for which the account is being opened: All persons opening an account on behalf of a legal entity.

Federal Register Customer Due Diligence Requirements for Financial

Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not use this form for: Completed forms require the signature of the individual providing the information. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022..

Form W8BENE Certificate of Entities Status of Beneficial Owner for

Completed forms require the signature of the individual providing the information. Name and title of natural person opening account: These regulations go into effect on january 1, 2024. Web certification of beneficial owner(s) persons opening an account on behalf of a legal entity must provide the following information: Web beneficial ownership information reporting.

Beneficial Ownership Form Blank Fill Online, Printable, Fillable

A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Completed forms require the signature of the individual providing the information. Name and title of natural person opening account: All persons opening an account on behalf of a legal entity must provide the following information: Web under the beneficial.

Beneficial Ownership Form Fill Out and Sign Printable PDF Template

These regulations go into effect on january 1, 2024. Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of legal entity customers and to include such procedures. Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of.

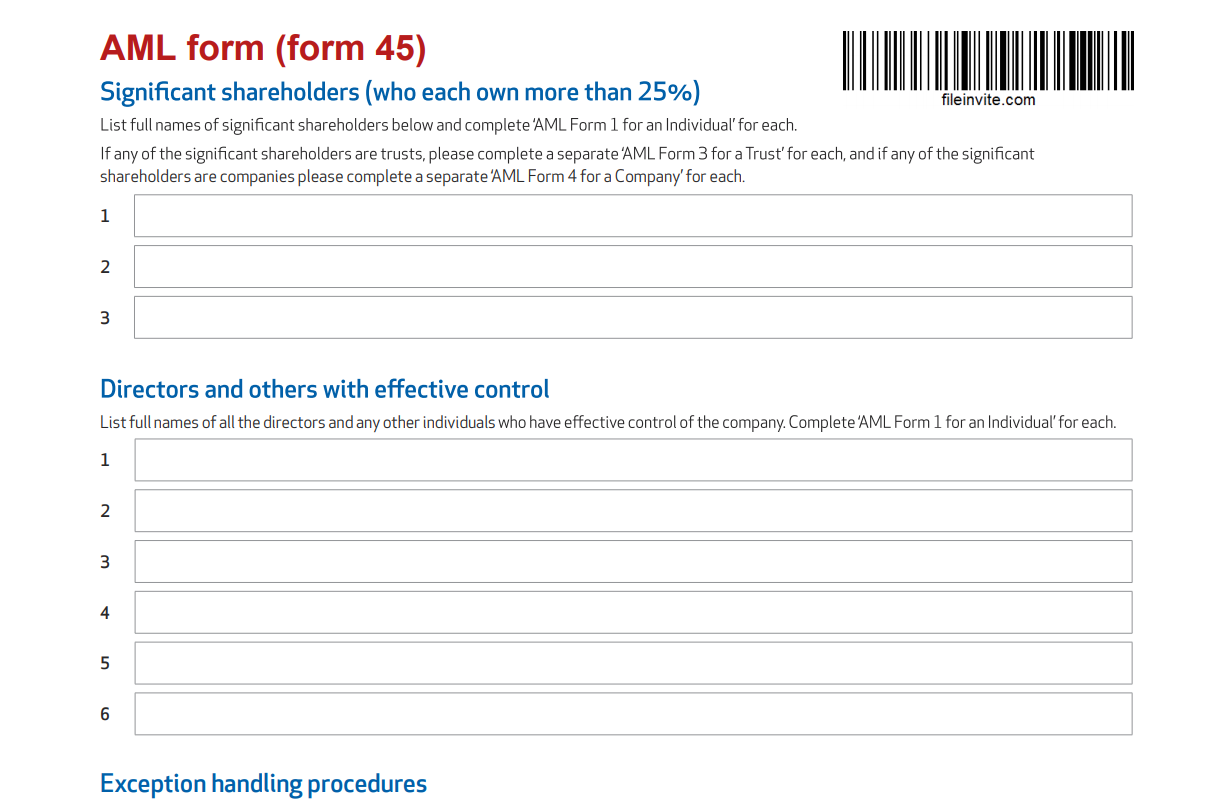

Create an online Beneficial Ownership Declaration Form with FileInvite

Completed forms require the signature of the individual providing the information. Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not use this form for: Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of.

Certification of Beneficial Owner(S) Download Fillable PDF Templateroller

Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of legal entity customers and to include such procedures. All persons opening an account on behalf of a legal entity must provide the following information: Web certification of beneficial owner(s) persons opening an account on behalf.

A Final Rule Implementing The Beneficial Ownership Information Reporting Requirements Of The Corporate Transparency Act (Cta) Was Issued In September 2022.

Web beneficial ownership information reporting. Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Web under the beneficial ownership rule,1 a bank must establish and maintain written procedures that are reasonably designed to identify and verify beneficial owner(s) of legal entity customers and to include such procedures. These regulations go into effect on january 1, 2024.

Name And Address Of Legal Entity For Which The Account Is Being Opened:

All persons opening an account on behalf of a legal entity must provide the following information: All persons opening an account on behalf of a legal entity must provide the following information: Web certification of beneficial owner(s) the information contained in this certification is sought pursuant to section 1020.230 of title 31 of the united states code of federal regulations (31 cfr 1020.230). Web certification of beneficial owner(s) persons opening an account on behalf of a legal entity must provide the following information:

This Form Cannot Be Digitally Signed.

Web certificate of status of beneficial owner for united states tax withholding and reporting (entities) department of the treasury internal revenue service do not use this form for: Completed forms require the signature of the individual providing the information. Name and title of natural person opening account: