Can You Reaffirm A Debt In Chapter 13

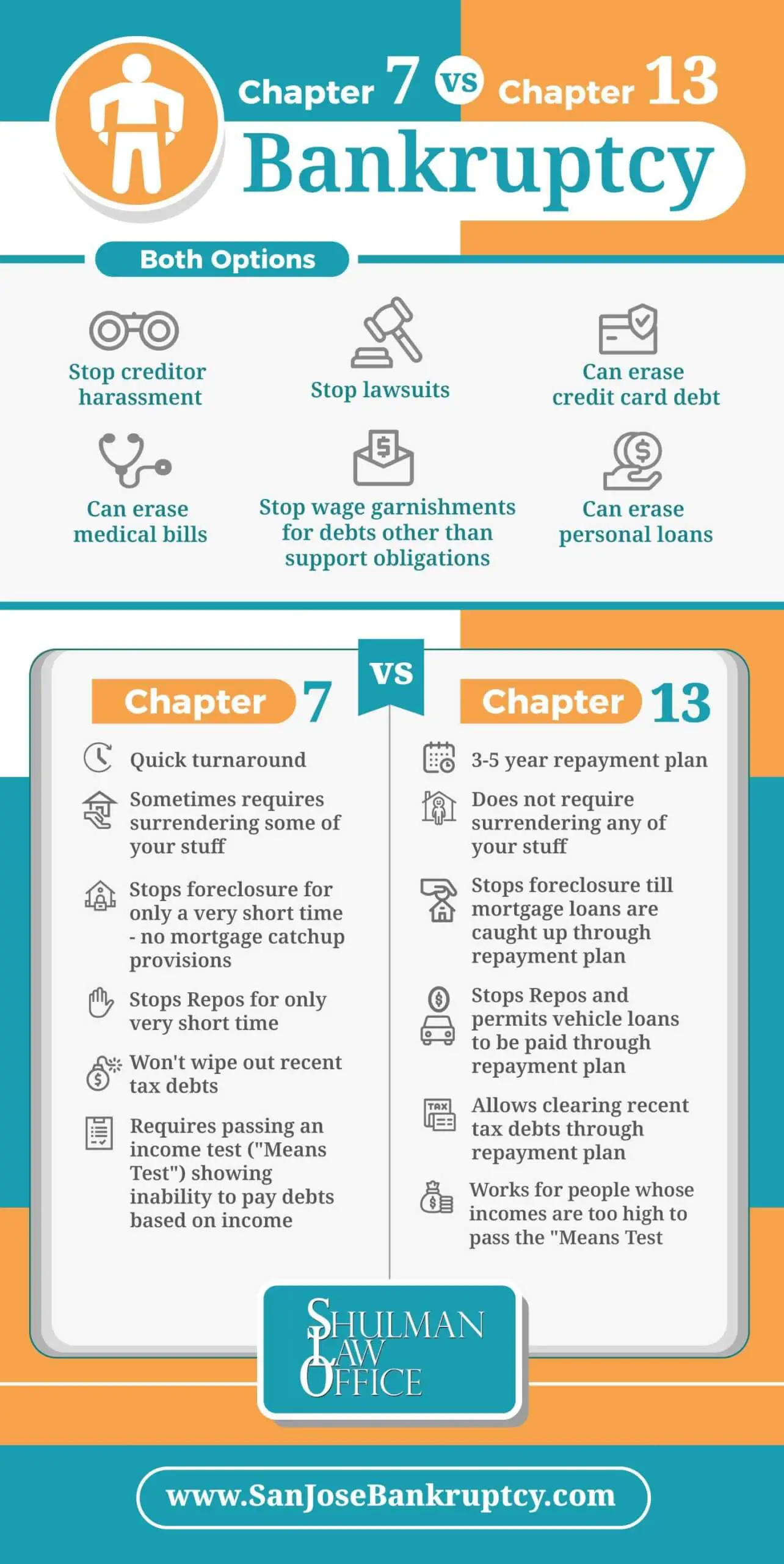

Can You Reaffirm A Debt In Chapter 13 - Web reaffirming your mortgage creates new debt: Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is less harmful to your credit scores than chapter. In both cases, you can surrender the collateral, which means the debt. To do so, you may need to reaffirm the debt. When you’re able to keep the collateral in chapter 7 if you are current on your debt payments, you would very likely be able to keep your collateral/vehicle under chapter 7. The amount of equity you have in the property is also essential. This kind of comparison of options can. Web you are not required to sig a reaffirmation agreement. Web chapter 13 bankruptcy. You usually have to formally reaffirm the debt.

In both cases, you can surrender the collateral, which means the debt. Web but since secured debts are connected to collateral, you don't get to keep the collateral unless you pay the debt. Web here are examples of the reaffirmation of a secured debt (like a vehicle loan) in a chapter 7 case vs. Web you are not required to sig a reaffirmation agreement. The lender and the court must be persuaded to approve your reaffirmation. Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is less harmful to your credit scores than chapter. As long as the codebtor stay is in effect, your creditors can… When you sign a reaffirmation agreement, you assume liability for a debt that would otherwise be eradicated in your bankruptcy. The amount of equity you have in the property is also essential. If you want to refinance to get a lower interest rate it should be no problem.

With a chapter 7 bankruptcy, the trustee gathers and liquidates your nonexempt assets. It is however very unlikely that if you continue to repay the note that the bank would foreclose anyway. Web you can reaffirm the debt(s) during the chapter 7 case, which means you accept the debt(s) as valid and promise to pay it/them, even though it/they could be discharged (eliminated) in bankruptcy. As for the discharge, after you. To do so, you may need to reaffirm the debt. Web reaffirming your mortgage creates new debt: Addressing it in a chapter 13 case. Web chapter 13 bankruptcy. When you sign a reaffirmation agreement, you assume liability for a debt that would otherwise be eradicated in your bankruptcy. These are assets that you cannot.

Reaffirming Debts After Chapter 7 Bankruptcy By Petitioners

When you sign a reaffirmation agreement, you assume liability for a debt that would otherwise be eradicated in your bankruptcy. The federal bankruptcy code states that if you do not reaffirm that the secured creditor can repossess even if you remain current with the payments. The last blog post was about when to reaffirm a secured debt under chapter 7.

What Is The Difference In Chapter 7 And 13 Bankruptcy

Addressing it in a chapter 13 case. In both cases, you can surrender the collateral, which means the debt. Web but since secured debts are connected to collateral, you don't get to keep the collateral unless you pay the debt. You usually have to formally reaffirm the debt. You may lose the property if you can…

SHOULD I REAFFIRM MY MORTGAGE AGREEMENT AFTER MY CHAPTER 7 BANKRUPTCY?

Web you can reaffirm the debt(s) during the chapter 7 case, which means you accept the debt(s) as valid and promise to pay it/them, even though it/they could be discharged (eliminated) in bankruptcy. Web you should only reaffirm a debt if you are current with your payments and know you can keep up with future payments. Web certain debts can.

All About Reaffirmation Agreements in Bankruptcy

You usually have to formally reaffirm the debt. Web reaffirming your mortgage creates new debt: In both cases, you can surrender the collateral, which means the debt. To do so, you may need to reaffirm the debt. Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains.

6 Things You Can Reaffirm for Positive Change and Validation

Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is less harmful to your credit scores than chapter. These are assets that you cannot. Web chapter 13 bankruptcy. As for the discharge, after you. Web you.

Neil T Anderson Quote “The more you reaffirm who you are in Christ

These are assets that you cannot. You may lose the property if you can… The lender and the court must be persuaded to approve your reaffirmation. If you want to refinance to get a lower interest rate it should be no problem. Web you should have already paid off the mortgage arrears in your chapter 13 if it is complete.

Infographic Chapter 7 vs. Chapter 13 BankruptcyWeaver Bankruptcy Law Firm

Web you will need to reaffirm or renegotiate your mortgage. These are assets that you cannot. Keep the secured property and continue paying the monthly amount, plus arrearages, in your repayment plan, or. When you’re able to keep the collateral in chapter 7 if you are current on your debt payments, you would very likely be able to keep your.

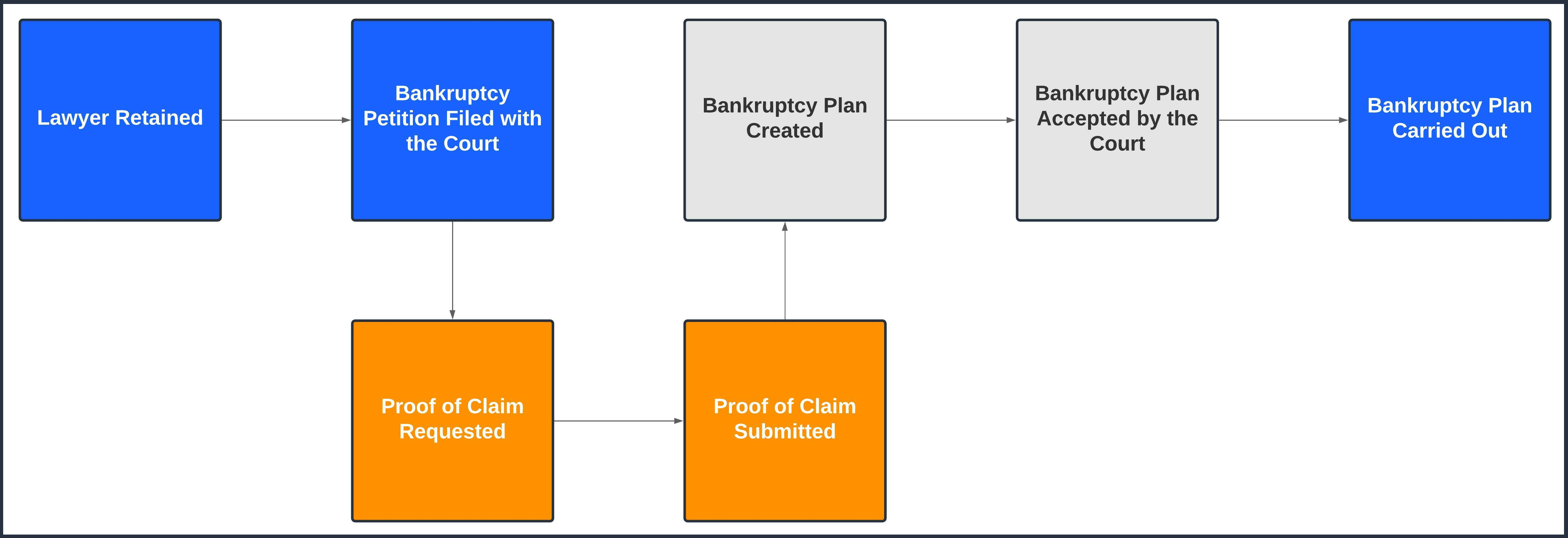

Bankruptcy 101 LoanPro Help

Web you should have already paid off the mortgage arrears in your chapter 13 if it is complete and there is no need to reaffirm. Web when you file for chapter 13, you'll have a choice for debt secured by collateral, such as your house, car, or other property: As long as the codebtor stay is in effect, your creditors.

Bankruptcy FAQs Sagre Law Firm

With a chapter 7 bankruptcy, the trustee gathers and liquidates your nonexempt assets. It is however very unlikely that if you continue to repay the note that the bank would foreclose anyway. The lender and the court must be persuaded to approve your reaffirmation. That means you exclude that debt from the discharge (legal write off) that chapter. At the.

What Happens After You File Bankruptcy

Web you can reaffirm the debt(s) during the chapter 7 case, which means you accept the debt(s) as valid and promise to pay it/them, even though it/they could be discharged (eliminated) in bankruptcy. Web chapter 13 bankruptcy. As long as the codebtor stay is in effect, your creditors can… Web a chapter 13 bankruptcy, which restructures your debts so you.

If You Want To Refinance To Get A Lower Interest Rate It Should Be No Problem.

This means that you will be responsible for paying the mortgage, even if the value of your home has decreased. As for the discharge, after you. Web a chapter 13 bankruptcy, which restructures your debts so you pay off a portion of them in three to five years, remains on your credit report for up to seven years and is less harmful to your credit scores than chapter. In both cases, you can surrender the collateral, which means the debt.

With A Chapter 7 Bankruptcy, The Trustee Gathers And Liquidates Your Nonexempt Assets.

You usually have to formally reaffirm the debt. Web you should have already paid off the mortgage arrears in your chapter 13 if it is complete and there is no need to reaffirm. To do so, you may need to reaffirm the debt. With this type of bankruptcy, you can keep your property as long as you.

In Chapter 13, You Repay Secured Debts Through The Repayment Plan.

When you sign a reaffirmation agreement, you assume liability for a debt that would otherwise be eradicated in your bankruptcy. Web but since secured debts are connected to collateral, you don't get to keep the collateral unless you pay the debt. You may lose the property if you can… Web you will need to reaffirm or renegotiate your mortgage.

Web Here Are Examples Of The Reaffirmation Of A Secured Debt (Like A Vehicle Loan) In A Chapter 7 Case Vs.

Web reaffirming your mortgage creates new debt: As long as the codebtor stay is in effect, your creditors can… You are not required to reaffirm any debt or sign any agreement regarding a debt that has been or will be discharged in your bankruptcy case. Web you can reaffirm the debt(s) during the chapter 7 case, which means you accept the debt(s) as valid and promise to pay it/them, even though it/they could be discharged (eliminated) in bankruptcy.