Can I Print Out A 1099 Form

Can I Print Out A 1099 Form - Web a financial advisor who specializes in tax planning can help lower your 1099 income taxes by harvesting your losses. This policy includes forms printed from irs.gov and. You'll need to provide copies to your contractors by january 31. The official printed version of copy a of this irs form is. Web 13 hours agoa federal grand jury has indicted former president donald trump in special counsel jack smith’s investigation into efforts to overturn the 2020 election leading up to. Please make sure you have pre. Try it for free now! Employment authorization document issued by the department of homeland. You can't print them on plain white paper. Do not miss the deadline

Submit copy a to the irs with form 1096,. Web 13 hours agoa federal grand jury has indicted former president donald trump in special counsel jack smith’s investigation into efforts to overturn the 2020 election leading up to. They may be able to help you get the information you need to e. Do not miss the deadline Fill, edit, sign, download & print. Web deal with a missing form. Specify the date range for the forms then choose ok. The official printed version of copy a of this irs form is. For more info about irs and state. “hire” means the beginning of.

Web we accept forms that are consistent with the official printed versions and do not have an adverse impact on our processing. After you print the a. This means that you will be able to use your. Web copy a of this form is provided for informational purposes only. Ad use readymade templates to report your payments without installing any software. Ad get the latest 1099 misc online. Web if you are sending a 1099 form, you can print one for yourself and your recipient, but you must order a free official, scannable version to send to the irs or they may assess a fee. Please make sure you have pre. You'll need to provide copies to your contractors by january 31. Upload, modify or create forms.

1099 MISC Form 2022 1099 Forms TaxUni

“hire” means the beginning of. Ad get the latest 1099 misc online. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Fill, edit, sign, download & print. Submit copy a to the irs with form 1096,.

2019 1099MISC/1096 IRS Copy A Form Print Template for Word Etsy

Web a financial advisor who specializes in tax planning can help lower your 1099 income taxes by harvesting your losses. Please make sure you have pre. You'll need to provide copies to your contractors by january 31. Web deal with a missing form. Web we accept forms that are consistent with the official printed versions and do not have an.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

Upload, modify or create forms. Copy a appears in red, similar to the official irs form. You can't print them on plain white paper. Do not miss the deadline For more info about irs and state.

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

Do not miss the deadline Upload, modify or create forms. Web get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Ad use readymade templates to report your payments without installing any software. “hire” means the beginning of.

Form 1099 Misc Fillable Universal Network

For more info about irs and state. Web best answers raywhite28 level 7 december 10, 2018 09:32 pm you need to purchase the 1099 forms. Try it for free now! Upload, modify or create forms. Ad get the latest 1099 misc online.

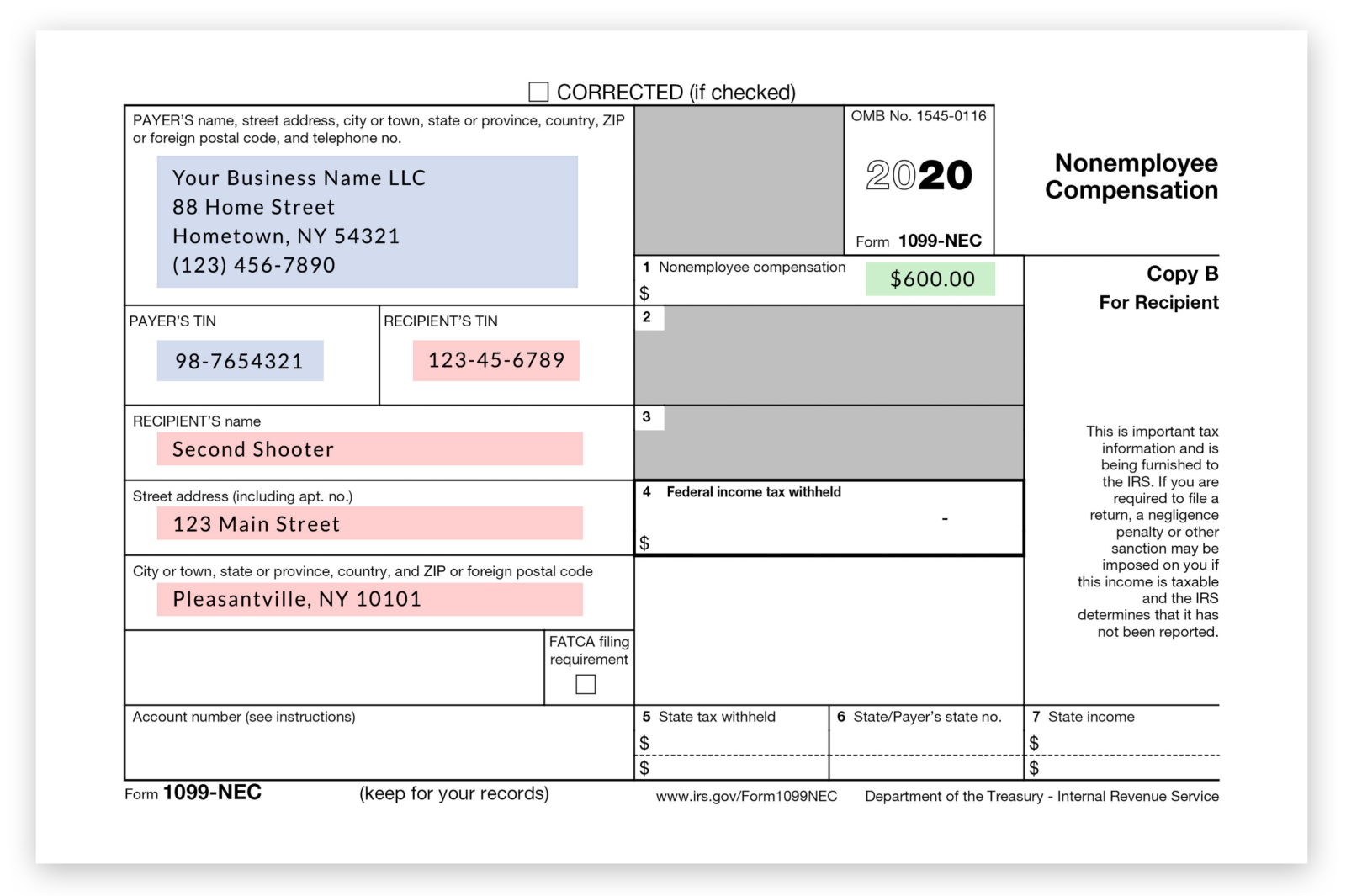

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

They may be able to help you get the information you need to e. Web best answers raywhite28 level 7 december 10, 2018 09:32 pm you need to purchase the 1099 forms. This policy includes forms printed from irs.gov and. After you print the a. Please make sure you have pre.

Form 1099 S Fill and Sign Printable Template Online US Legal Forms

Submit copy a to the irs with form 1096,. Specify the date range for the forms then choose ok. You can't print them on plain white paper. Web get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web deal with a missing form.

Free Printable 1099 Misc Forms Free Printable

“hire” means the beginning of. Web copy a of this form is provided for informational purposes only. You'll need to provide copies to your contractors by january 31. After you print the a. Web best answers raywhite28 level 7 december 10, 2018 09:32 pm you need to purchase the 1099 forms.

Florida 1099 Form Online Universal Network

For more info about irs and state. Web we accept forms that are consistent with the official printed versions and do not have an adverse impact on our processing. After you print the a. Please make sure you have pre. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to.

Web Get Paper Copies Of Federal And State Tax Forms, Their Instructions, And The Address For Mailing Them.

Upload, modify or create forms. Web a financial advisor who specializes in tax planning can help lower your 1099 income taxes by harvesting your losses. Ad get the latest 1099 misc online. This means that you will be able to use your.

Web We Accept Forms That Are Consistent With The Official Printed Versions And Do Not Have An Adverse Impact On Our Processing.

Do not miss the deadline They may be able to help you get the information you need to e. Web copy a of this form is provided for informational purposes only. Ad use readymade templates to report your payments without installing any software.

Employment Authorization Document Issued By The Department Of Homeland.

Web best answers raywhite28 level 7 december 10, 2018 09:32 pm you need to purchase the 1099 forms. You can't print them on plain white paper. Web you can print copies to mail to the federal and state governments, plus print and send a copy to each of your contractors. Web 13 hours agoa federal grand jury has indicted former president donald trump in special counsel jack smith’s investigation into efforts to overturn the 2020 election leading up to.

Please Make Sure You Have Pre.

After you print the a. This policy includes forms printed from irs.gov and. Web deal with a missing form. Web if you are sending a 1099 form, you can print one for yourself and your recipient, but you must order a free official, scannable version to send to the irs or they may assess a fee.