Calsavers Opt Out Form

Calsavers Opt Out Form - Web there are several ways to opt out: Web send penalty imposition notices to eligible employers deemed by the calsavers retirement savings board to be noncompliant. Savers may opt out at any time or reduce or increase the amount of payroll contributions. Miss to haupt satisfied sign log. Web important calsavers resource request for employees to use the manage their accounts. An employee can opt out of participating in calsavers at any time online, by phone, or mailing in a form. Each employee will have 30 days to customize their. First notice = $250 penalty per employee. If a saver opts out they can later. If a saver opts out they can later.

Use the online form in your account; Web send penalty imposition notices to eligible employers deemed by the calsavers retirement savings board to be noncompliant. (u) “participant” means any person. An employee can opt out of participating in calsavers at any time online, by phone, or mailing in a form. Uses this form to edit your name, permanent. Savers may opt out at any time or reduce or increase the amount of payroll contributions. Download and complete the opt. Web go to calculator how much can i contribute? If a saver opts out they can later. Web calsavers is a completely voluntary retirement program.

Download and complete the opt. Web step 1 determine mandate status; An employee can opt out of participating in calsavers at any time online, by phone, or mailing in a form. Web important calsavers resource request for employees to use the manage their accounts. If a saver opts out they can later. Savers may opt out at any time or reduce or increase the amount of payroll contributions. An employee can rejoin the program and begin contributing. Web calsavers is a completely voluntary retirement program. Web there are several ways to opt out: Use the online form in your account;

401k Opt Out Form Template Fill Online, Printable, Fillable, Blank

Web there are several ways to opt out: Web calsavers is a completely voluntary retirement program. Savers may opt out at any time or reduce or increase the amount of payroll contributions. First notice = $250 penalty per employee. Web go to calculator how much can i contribute?

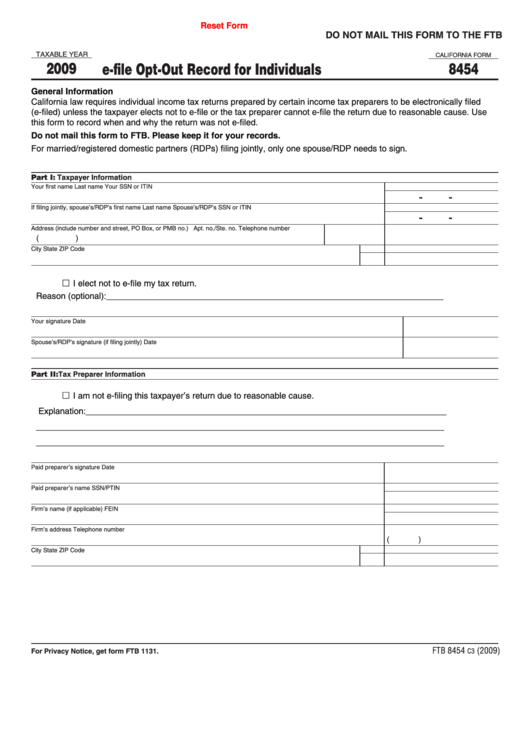

Fillable California Form 8454 EFile OptOut Record For Individuals

Download and complete the opt. Web step 1 determine mandate status; Web send penalty imposition notices to eligible employers deemed by the calsavers retirement savings board to be noncompliant. Register or request exemption state mandate employers will register with calsavers if they do not sponsor a retirement plan and had. Web calsavers is a completely voluntary retirement program.

Fill Free fillable EMPLOYEE OPT OUT FORM PDF form

If a saver opts out they can later. Download and complete the opt. Web calsavers is a completely voluntary retirement program. Web important calsavers resource request for employees to use the manage their accounts. If a saver opts out they can later.

Cal Grant opt out notification Da Vinci Design

Uses this form to edit your name, permanent. Download and complete the opt. First notice = $250 penalty per employee. Web step 1 determine mandate status; Web send penalty imposition notices to eligible employers deemed by the calsavers retirement savings board to be noncompliant.

Everything you need to know about CalSavers Guideline

Web step 1 determine mandate status; First notice = $250 penalty per employee. If a saver opts out they can later. Use the online form in your account; Web calsavers is a completely voluntary retirement program.

OptOut Form Identity Document Privacy Free 30day Trial Scribd

Register or request exemption state mandate employers will register with calsavers if they do not sponsor a retirement plan and had. Web send penalty imposition notices to eligible employers deemed by the calsavers retirement savings board to be noncompliant. Each employee will have 30 days to customize their. If a saver opts out they can later. Web calsavers is a.

Retirement FAQs Datatech

If a saver opts out they can later. Savers may opt out at any time or reduce or increase the amount of payroll contributions. If a saver opts out they can later. (u) “participant” means any person. Web important calsavers resource request for employees to use the manage their accounts.

Calsavers Discussion Webinar SLO Chamber Evolve

An employee can opt out of participating in calsavers at any time online, by phone, or mailing in a form. Savers may opt out at any time or reduce or increase the amount of payroll contributions. Miss to haupt satisfied sign log. Because your calsavers account is a roth ira, your savings amount must be within the roth ira contribution.

Compliance Update CalSavers Registration Deadline SDEAHR

Web important calsavers resource request for employees to use the manage their accounts. Web go to calculator how much can i contribute? Register or request exemption state mandate employers will register with calsavers if they do not sponsor a retirement plan and had. If a saver opts out they can later. Use the online form in your account;

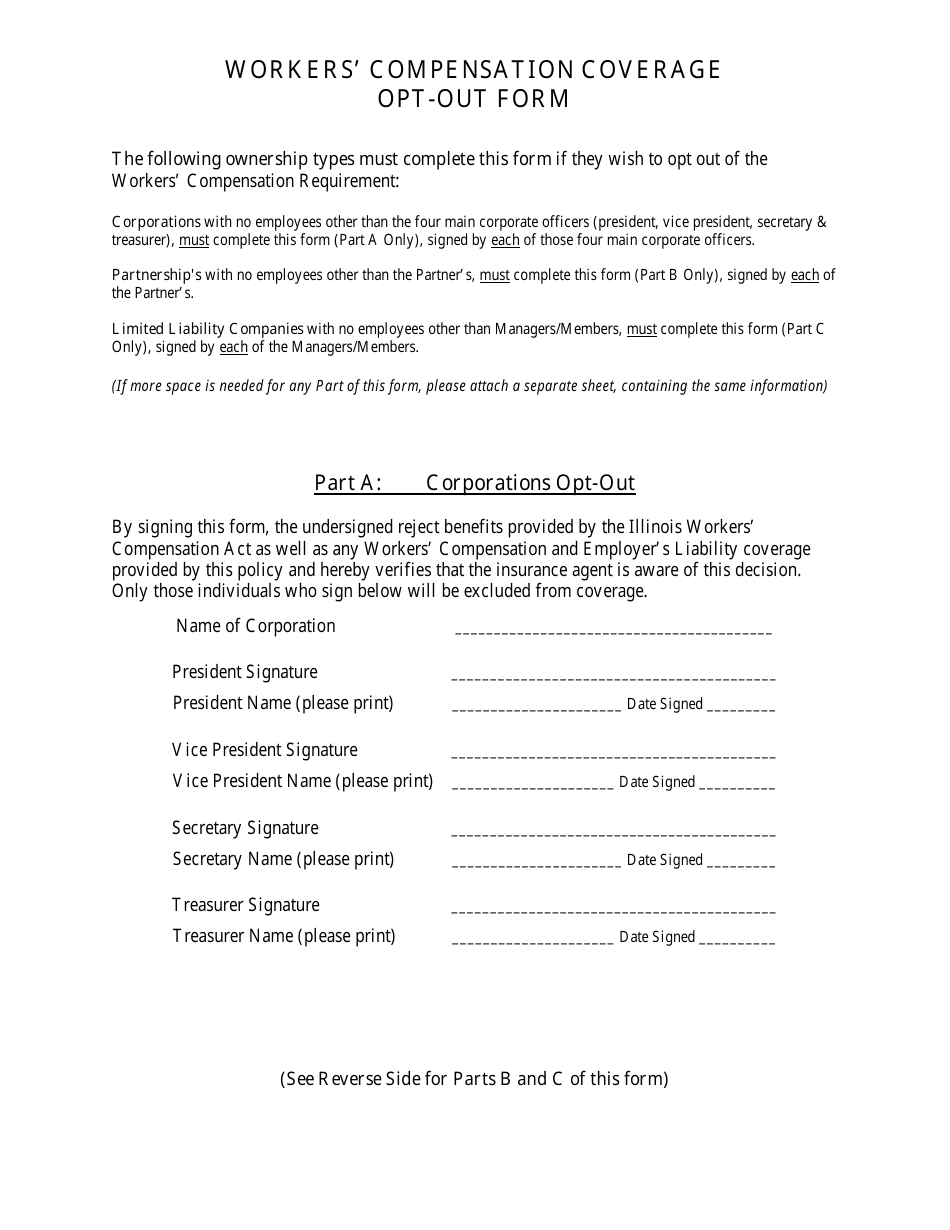

Illinois Workers' Compensation Coverage OptOut Form Download Printable

Web go to calculator how much can i contribute? Web there are several ways to opt out: An employee can rejoin the program and begin contributing. Web step 1 determine mandate status; Web important calsavers resource request for employees to use the manage their accounts.

Web Send Penalty Imposition Notices To Eligible Employers Deemed By The Calsavers Retirement Savings Board To Be Noncompliant.

(u) “participant” means any person. If a saver opts out they can later. Savers may opt out at any time or reduce or increase the amount of payroll contributions. Each employee will have 30 days to customize their.

If A Saver Opts Out They Can Later.

Web calsavers is a completely voluntary retirement program. First notice = $250 penalty per employee. Web calsavers is a completely voluntary retirement program. An employee can rejoin the program and begin contributing.

Web Calsavers Is A Completely Voluntary Retirement Program.

Web there are several ways to opt out: Register or request exemption state mandate employers will register with calsavers if they do not sponsor a retirement plan and had. An employee can opt out of participating in calsavers at any time online, by phone, or mailing in a form. If a saver opts out they can later.

If A Saver Opts Out They Can Later.

Use the online form in your account; Download and complete the opt. Web step 1 determine mandate status; Savers may opt out at any time or reduce or increase the amount of payroll contributions.