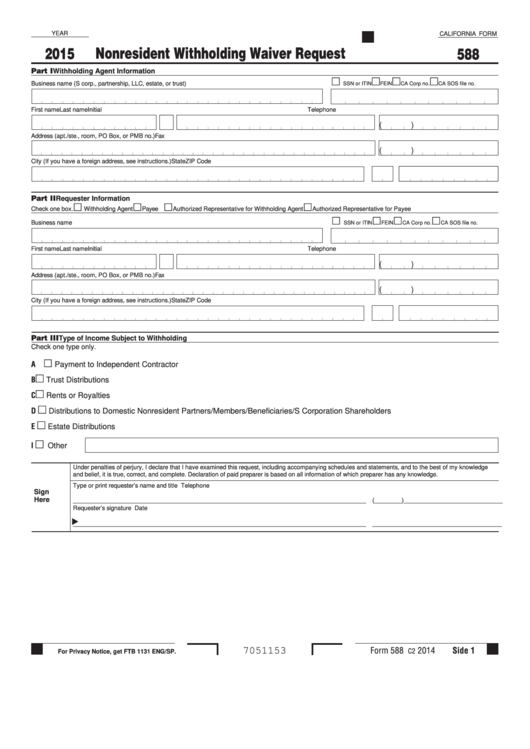

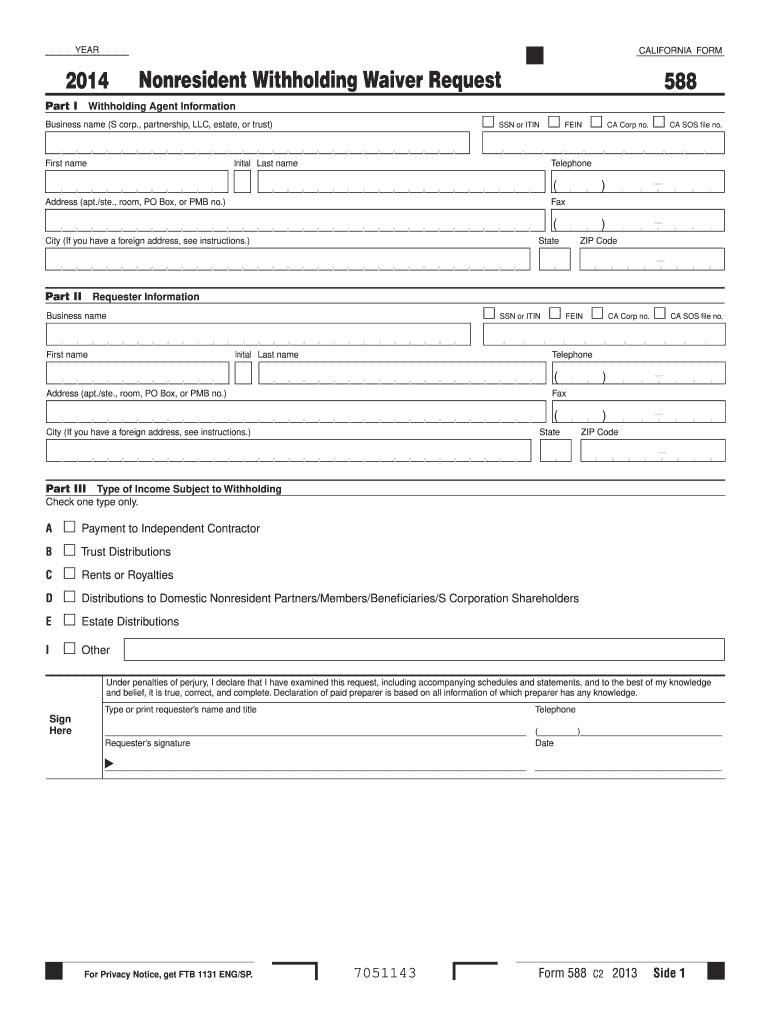

California Form 588

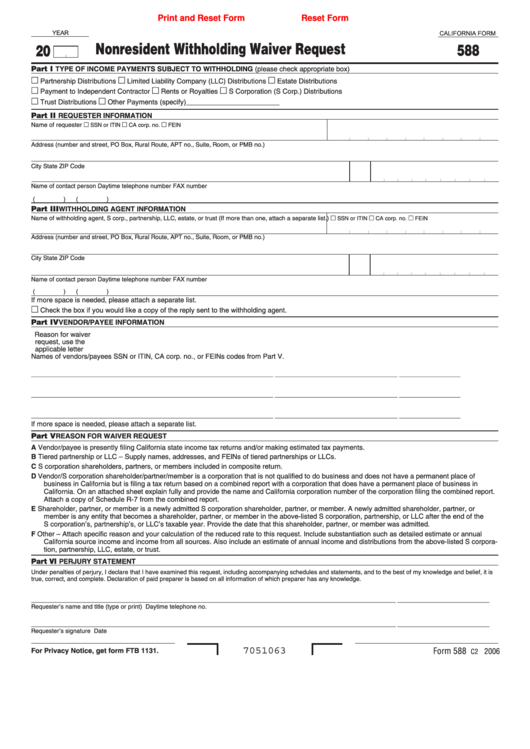

California Form 588 - Web do not use form 588 to request a waiver if you are a: File the form by mail or fax: We last updated the nonresident withholding waiver request in january 2022, so this is the latest version of form 588, fully updated for tax year 2022. Web a nonresident payee may request a waiver from withholding by submitting form 588, nonresident withholding waiver request. Web nonresident withholding allocation worksheet (form 587) use form 587 to allocate california source payments and determine if withholding is required. There are no provisions in the california revenue and taxation code (r&tc) to waive withholding for foreign partners or members. If we approve the waiver, no withholding is required. Web waivers from domestic owners consenting to the california pet. Please provide your email address and it will be emailed to you. This is only available by request.

Nonresident withholding waiver request (form 588) submit form 588 to apply for a waiver. Web a nonresident payee may request a waiver from withholding by submitting form 588, nonresident withholding waiver request. If we approve the waiver, no withholding is required. Web waivers from domestic owners consenting to the california pet. No withholding required with a waiver certificate. Web 2023, 588, instructions for form 588 nonresident withholding waiver request. This is only available by request. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. We last updated the nonresident withholding waiver request in january 2022, so this is the latest version of form 588, fully updated for tax year 2022. If you need to request a waiver prior to this date, please complete nonresident withholding waiver request ( form 588 ).

Form 588 must be submitted at least 21 business days before payment is made. No withholding required with a waiver certificate. A nonresident payee may request a reduction in the amount to be withheld by submitting form 589,. File the form by mail or fax: Web we expect to have it available by october 1, 2019. Form 588, nonresident withholding waiver request, can be filed to request a waiver from withholding on payments of california source income to nonresident domestic owners. Web 2023, 588, instructions for form 588 nonresident withholding waiver request. This is only available by request. If we approve the waiver, no withholding is required. Withholding agent keeps a copy of the waiver certificate in records.

Notice of Temporary Displacement — RPI Form 588

Form 588, nonresident withholding waiver request, can be filed to request a waiver from withholding on payments of california source income to nonresident domestic owners. Web this california form is for nonresidents of the state who want to file a withholding waiver for any type of income listed. Web use form 588, nonresident withholding waiver request, to request a waiver.

ftb.ca.gov forms 09_588

First name first name check one box only. Nonresident withholding waiver request (form 588) submit form 588 to apply for a waiver. • seller of california real estate. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Web 2023, 588, instructions for form 588 nonresident withholding.

Fillable California Form 588 Nonresident Withholding Waiver Request

Web 2023, 588, instructions for form 588 nonresident withholding waiver request. File the form by mail or fax: We last updated the nonresident withholding waiver request in january 2022, so this is the latest version of form 588, fully updated for tax year 2022. Web waivers from domestic owners consenting to the california pet. Web do not use form 588.

FormoftheWeek Notice of Intent to Enter Dwelling and Notice of

File the form by mail or fax: Form 588 must be submitted at least 21 business days before payment is made. Withholding agent keeps a copy of the waiver certificate in records. Web waivers from domestic owners consenting to the california pet. Web do not use form 588 to request a waiver if you are a:

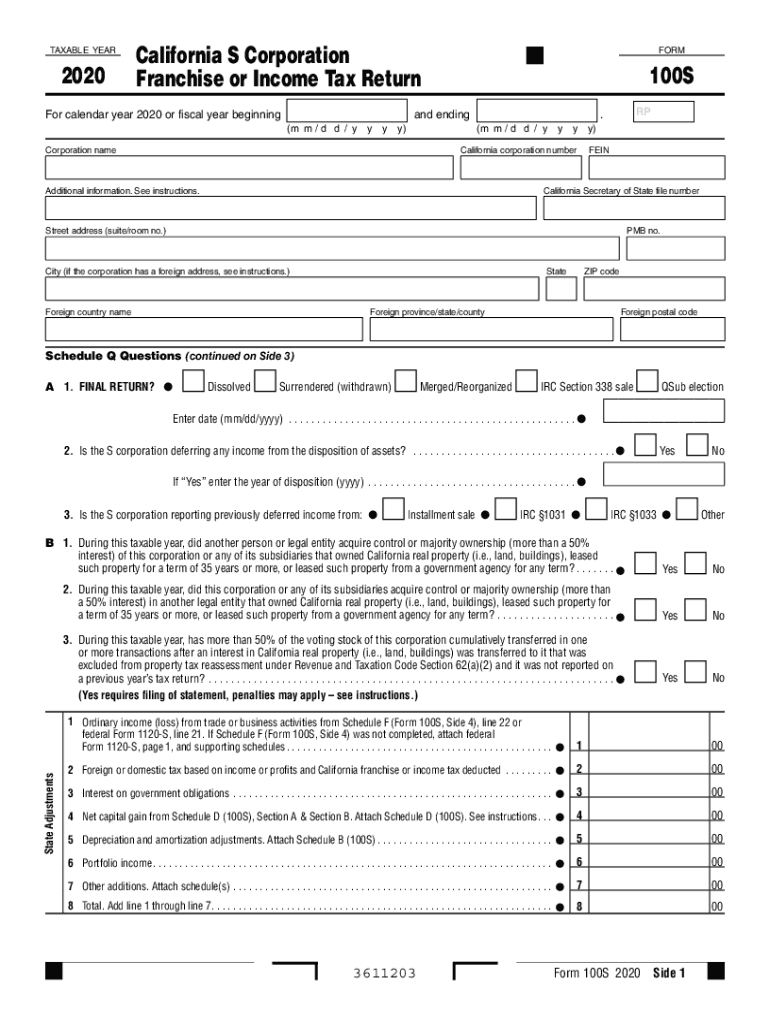

Ca Franchise Tax Board Form Fill Out and Sign Printable PDF Template

We last updated the nonresident withholding waiver request in january 2022, so this is the latest version of form 588, fully updated for tax year 2022. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Web waivers from domestic owners consenting to the california pet. Electing.

Fillable California Form 588 Nonresident Withholding Waiver Request

Please provide your email address and it will be emailed to you. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Web this california form is for nonresidents of the state who want to file a withholding waiver for any type of income listed. Web nonresident.

Instructions for Form 588 Nonresident Withholding Waiver Request

If we approve the waiver, no withholding is required. Form 588, nonresident withholding waiver request, can be filed to request a waiver from withholding on payments of california source income to nonresident domestic owners. Web california form 588 form 588 2022 side 1 part i withholding agent information part ii requester information part iii type of income subject to withholding.

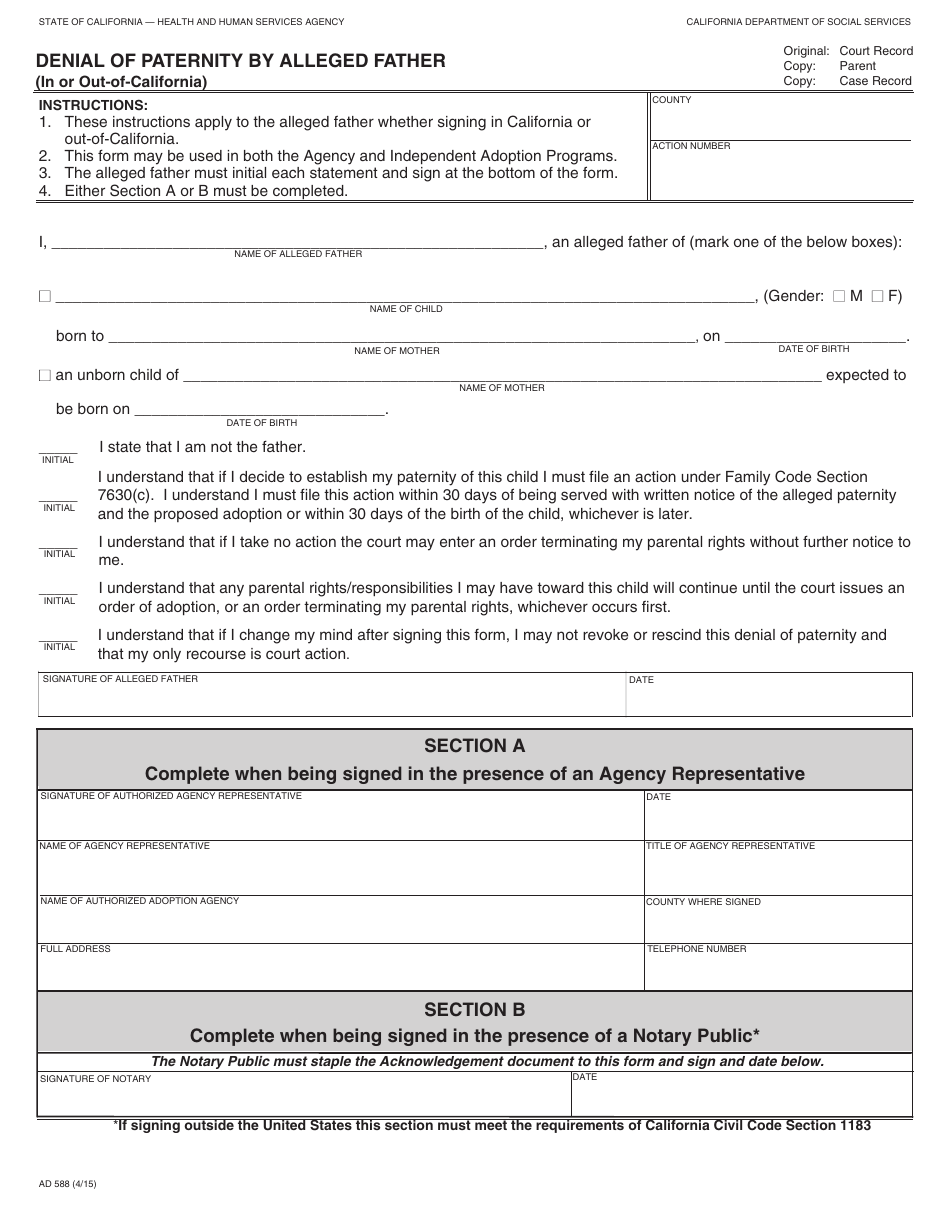

Form AD588 Download Fillable PDF or Fill Online Denial of Paternity by

Web a nonresident payee may request a waiver from withholding by submitting form 588, nonresident withholding waiver request. Please provide your email address and it will be emailed to you. Web waivers from domestic owners consenting to the california pet. Web nonresident withholding allocation worksheet (form 587) use form 587 to allocate california source payments and determine if withholding is.

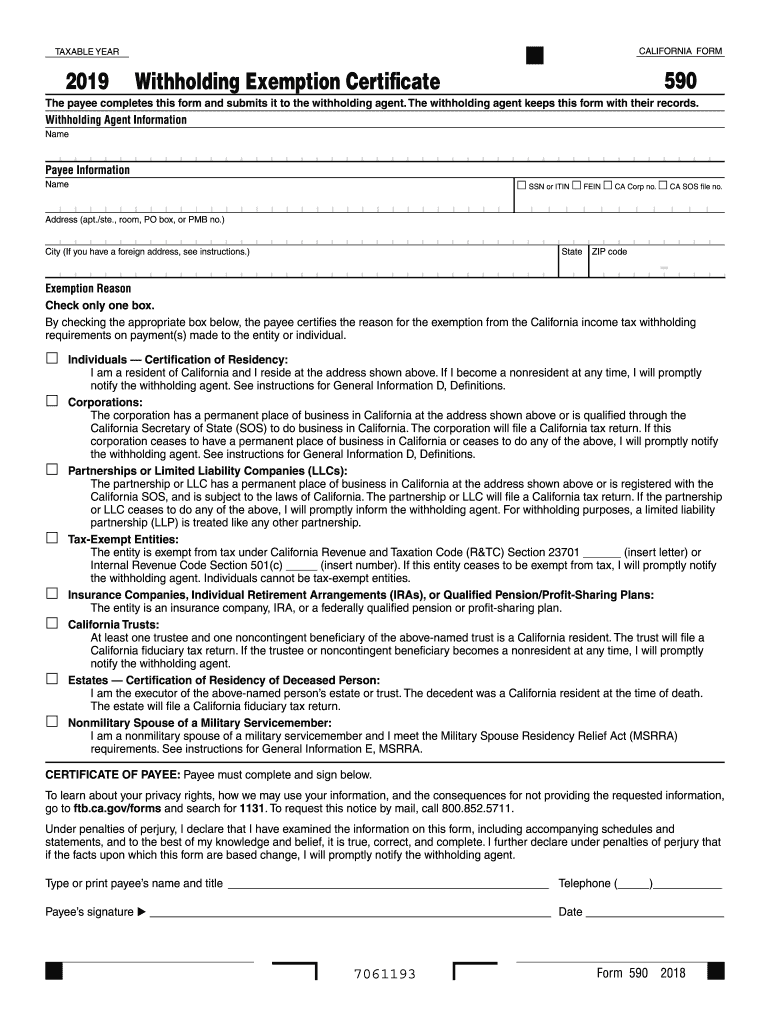

2019 Form CA FTB 590 Fill Online, Printable, Fillable, Blank PDFfiller

No withholding required with a waiver certificate. File the form by mail or fax: Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. If you need to request a waiver prior to this date, please complete nonresident withholding waiver request ( form 588 ). Withholding agent.

CA FTB 588 2013 Fill out Tax Template Online US Legal Forms

Electing entities can file form 588 on behalf of its partners/members/shareholders. No withholding required with a waiver certificate. Web waivers from domestic owners consenting to the california pet. Web nonresident payee who qualifies can use form 588 to get a waiver from withholding based generally on california tax filing history. This is only available by request.

Electing Entities Can File Form 588 On Behalf Of Its Partners/Members/Shareholders.

This is only available by request. A nonresident payee may request a reduction in the amount to be withheld by submitting form 589,. Web nonresident withholding allocation worksheet (form 587) use form 587 to allocate california source payments and determine if withholding is required. Web we expect to have it available by october 1, 2019.

Please Provide Your Email Address And It Will Be Emailed To You.

If we approve the waiver, no withholding is required. Web this california form is for nonresidents of the state who want to file a withholding waiver for any type of income listed. Web a nonresident payee may request a waiver from withholding by submitting form 588, nonresident withholding waiver request. Web california form 588 form 588 2022 side 1 part i withholding agent information part ii requester information part iii type of income subject to withholding business name business name ssn or itin ssn or itin fein fein ca corp no.

Withholding Agent Keeps A Copy Of The Waiver Certificate In Records.

First name first name check one box only. Form 588, nonresident withholding waiver request, can be filed to request a waiver from withholding on payments of california source income to nonresident domestic owners. • seller of california real estate. Nonresident withholding waiver request (form 588) submit form 588 to apply for a waiver.

Form 588 Must Be Submitted At Least 21 Business Days Before Payment Is Made.

Web waivers from domestic owners consenting to the california pet. There are no provisions in the california revenue and taxation code (r&tc) to waive withholding for foreign partners or members. No withholding required with a waiver certificate. Web 2023, 588, instructions for form 588 nonresident withholding waiver request.