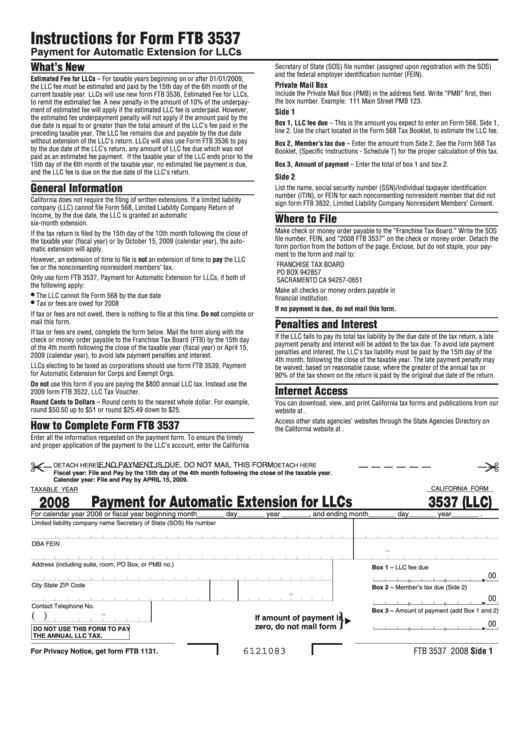

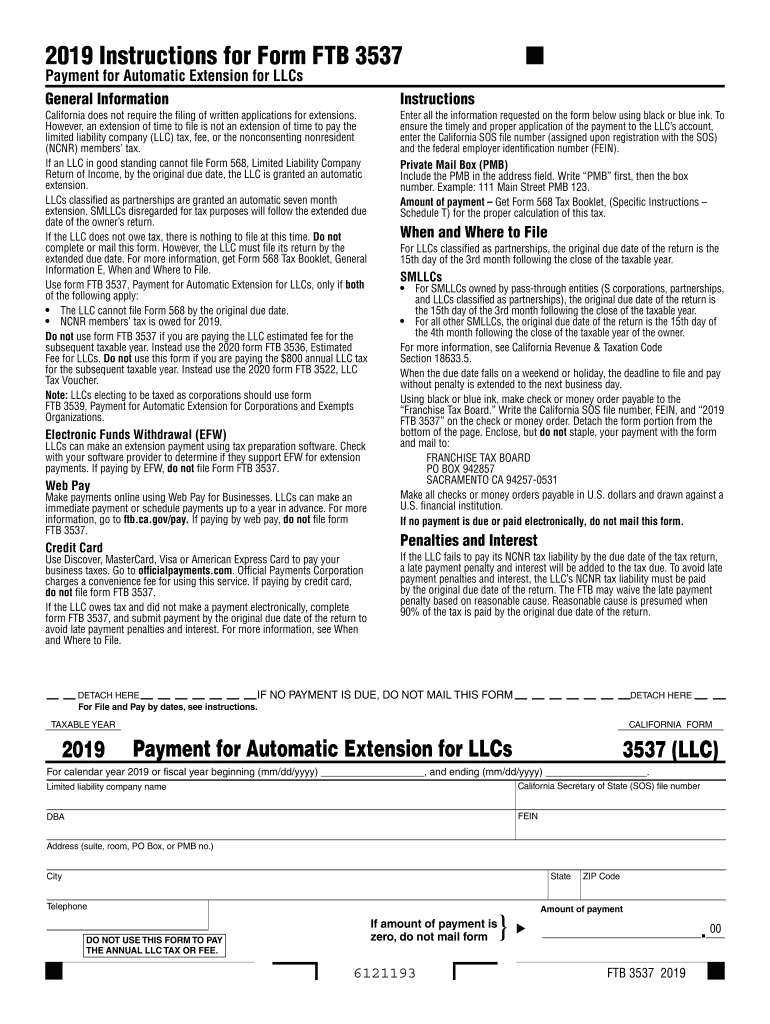

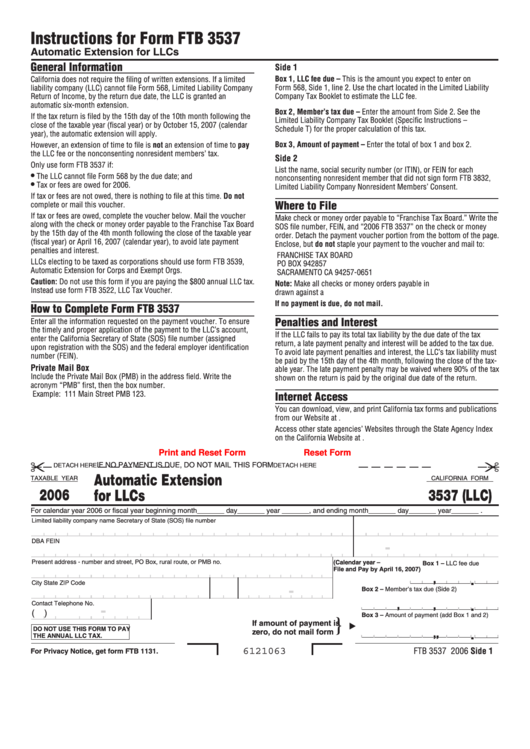

California Form 3537

California Form 3537 - Make payments online using web pay for businesses. Web file form ftb 3538. If the llc owes tax and did not make a payment electronically, complete. Web the llc cannot file form 568 by the original due date. If you're single and under age 65, then you must file if your gross income was at least $10,400. Web here is a basic breakdown for filing: Start completing the fillable fields. Download or email ca ftb 3537 & more fillable forms, register and subscribe now! This form is for income earned in tax year 2022, with tax returns. If the llc owes tax and did not make a payment electronically, complete form ftb 3537, and submit payment by the original due date of.

Web here is a basic breakdown for filing: Web file form ftb 3537. Form ftb 3537, and submit payment by the original due date of the return to. Use form ftb 3537 if you are paying the llc estimated fee for the. Edit your form 3537 online type text, add images, blackout confidential details, add comments, highlights and more. This form is for income earned in tax year 2022, with tax returns. Make payments online using web pay for businesses. If the llc owes tax and did not make a payment electronically, complete form ftb 3537, and submit payment by the original due date of. Web what is california form 3537? Web the llc cannot file form 568 by the original due date.

Cocodoc is the best place for you to go, offering you a free and modifiable version of form 3537 as you ask for. Edit your form 3537 online type text, add images, blackout confidential details, add comments, highlights and more. Edit your filable form ca 3537 online. Download or email ca ftb 3537 & more fillable forms, register and subscribe now! Form ftb 3537, and submit payment by the original due date of the return to. Sign it in a few clicks draw your signature, type it,. Web 1 best answer maryk4 expert alumni the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web we last updated california form 3537 (llc) in january 2023 from the california franchise tax board. Web here is a basic breakdown for filing: If the llc owes tax and did not make a payment electronically, complete form ftb 3537, and submit payment by the original due date of.

3 Day Eviction Notice Form California Template Form Resume Examples

Use form ftb 3537 if you are paying the llc estimated fee for the. If the llc owes tax and did not make a payment electronically, complete form ftb 3537, and submit payment by the original due date of. Web quick steps to complete and design 2020 california 3537 online: Edit your filable form ca 3537 online. Cocodoc is the.

Fillable California Form 3537 (Llc) Payment For Automatic Extension

Sign it in a few clicks draw your signature, type it,. If the llc owes tax and did not make a payment electronically, complete. Make payments online using web pay for businesses. Download or email ca ftb 3537 & more fillable forms, register and subscribe now! Web 2022 instructions for form ftb 3536 estimated fee for llcs general information the.

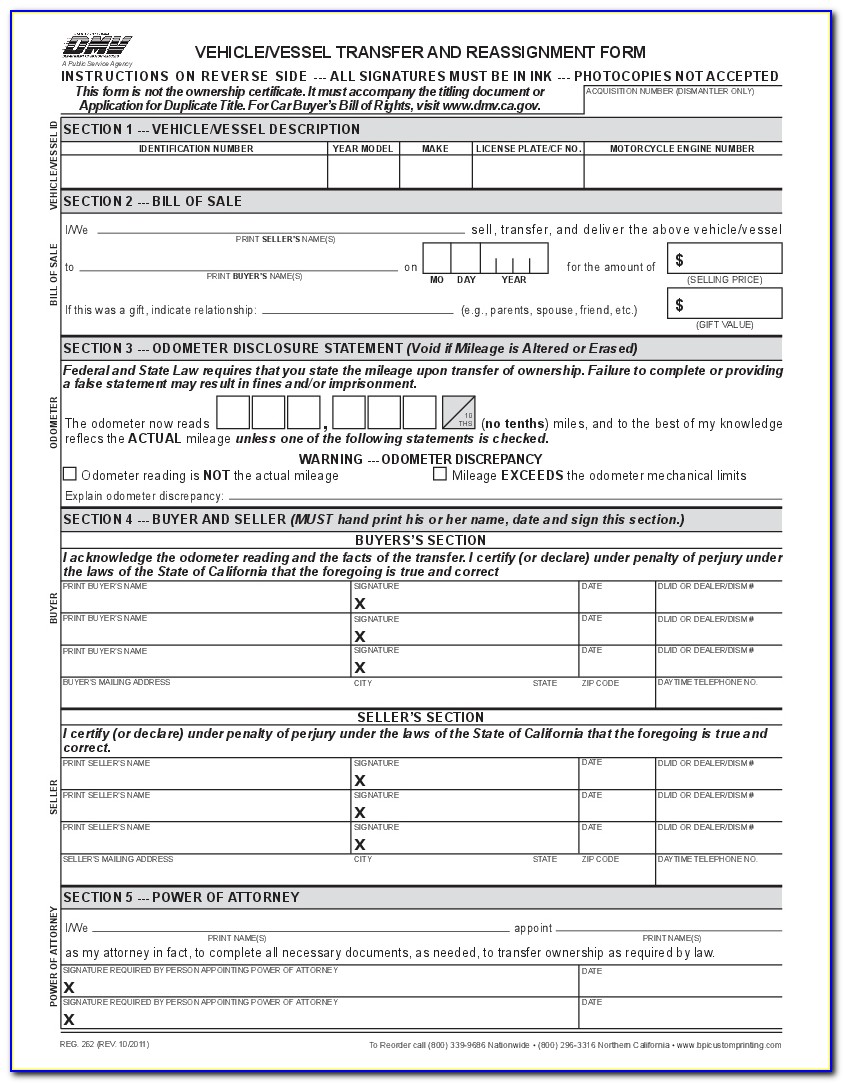

California Dmv Registration Form 343 Form Resume Examples gzOe1BeOWq

Web california form 3537 (llc) for calendar year 2015 or fscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). Use get form or simply click on the template preview to open it in the editor. Web ca form 3537 is now used only to pay the nonconsenting nonresident members' tax. Lps, llps, and remics can make an immediate payment or schedule.

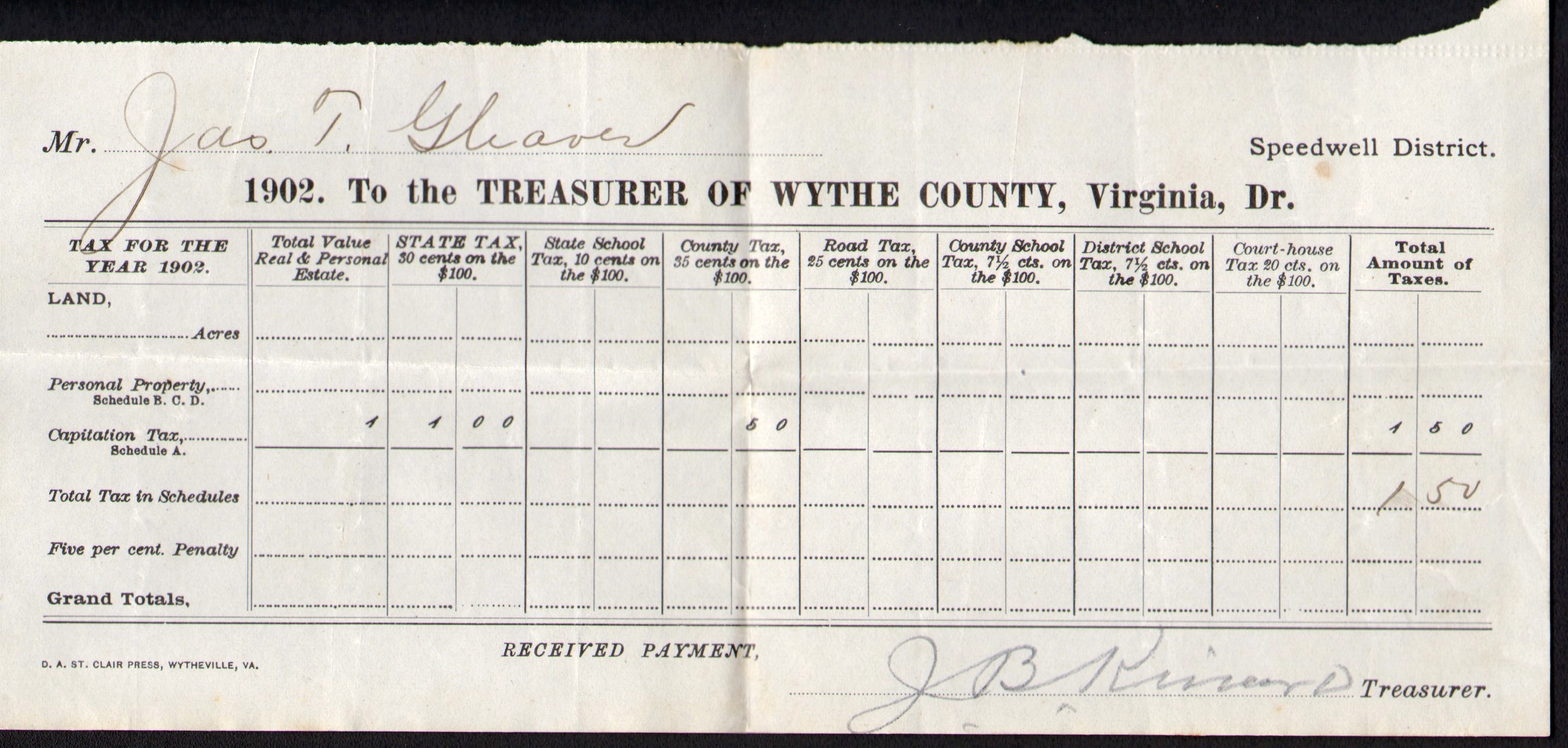

Letters Tax for 1902 Gleaves Family

2022 instructions 2021 instructions how did we. Start completing the fillable fields. Web we last updated california form 3537 (llc) in january 2023 from the california franchise tax board. • ncnr members’ tax is owed for 2019. This form is for income earned in tax year 2022, with tax returns.

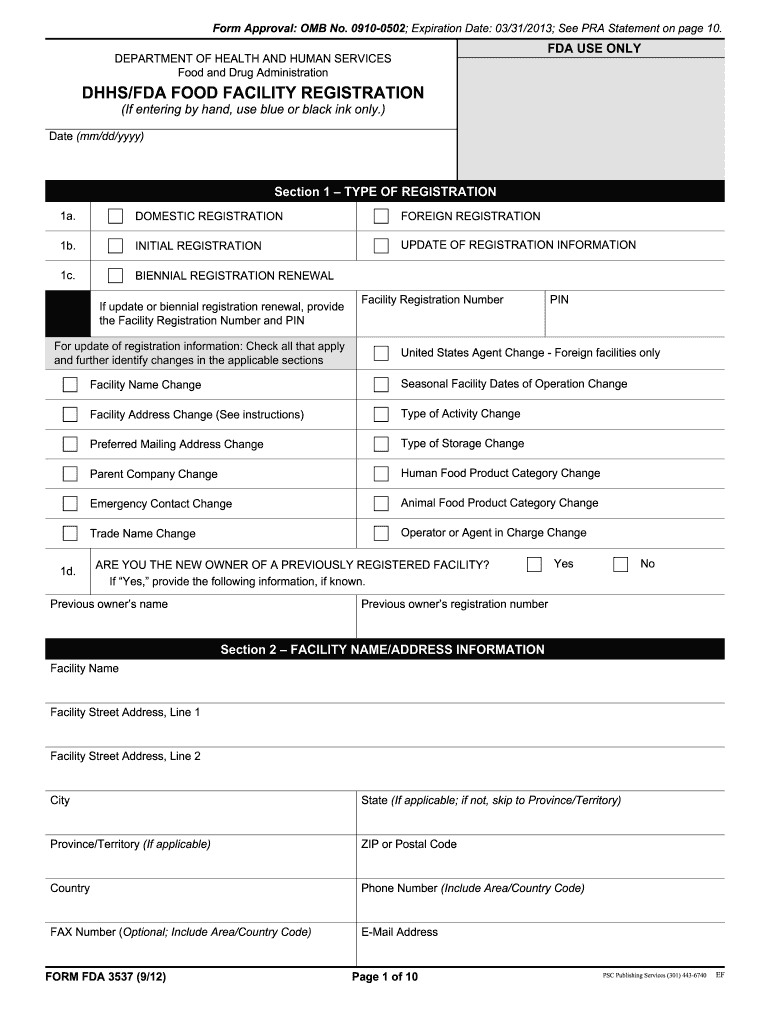

Form FDA 3537 Fill Out and Sign Printable PDF Template signNow

Web what is california form 3537? Go to the extensions >. Web ca form 3537 is now used only to pay the nonconsenting nonresident members' tax. If the llc owes tax and did not make a payment electronically, complete. Edit your form 3537 online type text, add images, blackout confidential details, add comments, highlights and more.

California Form 3537 LLC Payment For Automatic Extension For LLCs

Edit your form 3537 online type text, add images, blackout confidential details, add comments, highlights and more. Use form ftb 3537 if you are paying the llc estimated fee for the. If you're over age 65, this increases to. Web 1 best answer maryk4 expert alumni the 3522 is for the 2020 annual payment, the 3536 is used during the.

Download California Medical Release Form for Free FormTemplate

Use form ftb 3537 if you are paying the llc estimated fee for the. Type text, add images, blackout confidential details, add comments, highlights and more. Web file form ftb 3538. Web quick steps to complete and design 2020 california 3537 online: Web searching for form 3537 to fill?

9+ California Rent and Lease Template Free Download

Form 3536 should be used to pay the llc fee. Lps, llps, and remics can make an immediate payment or schedule payments up to a year. Its bewildering collection of forms. Start completing the fillable fields. If you're over age 65, this increases to.

Fillable California Form 3537 (Llc) Automatic Extension For Llcs

Web file form ftb 3537. Web 2022 instructions for form ftb 3536 estimated fee for llcs general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and. Its bewildering collection of forms. 2022 instructions 2021 instructions how did we. Web file form ftb 3538.

6 X 5/8 PHIL OVAL SEMS CNTRSNK WSHR TAP SCREW

Web searching for form 3537 to fill? Edit your filable form ca 3537 online. Lps, llps, and remics can make an immediate payment or schedule payments up to a year. Web we last updated california form 3537 (llc) in january 2023 from the california franchise tax board. If the llc owes tax and did not make a payment electronically, complete.

Web 1 Best Answer Maryk4 Expert Alumni The 3522 Is For The 2020 Annual Payment, The 3536 Is Used During The Tax Year To Pay Next Year's Llc Tax.

Use get form or simply click on the template preview to open it in the editor. Web quick steps to complete and design 2020 california 3537 online: Sign it in a few clicks. If the llc owes tax and did not make a payment electronically, complete.

Web Here Is A Basic Breakdown For Filing:

Make payments online using web pay for businesses. 2022 instructions 2021 instructions how did we. If the llc owes tax and did not make a payment electronically, complete form ftb 3537, and submit payment by the original due date of. Web the llc cannot file form 568 by the original due date.

Sign It In A Few Clicks Draw Your Signature, Type It,.

• ncnr members’ tax is owed for 2019. This form is for income earned in tax year 2022, with tax returns. Web file form ftb 3538. Web file form ftb 3537.

Web Ca Form 3537 Is Now Used Only To Pay The Nonconsenting Nonresident Members' Tax.

Web we last updated california form 3537 (llc) in january 2023 from the california franchise tax board. Web california form 3537 (llc) for calendar year 2015 or fscal year beginning (mm/dd/yyyy) , and ending (mm/dd/yyyy). If you're over age 65, this increases to. If you're single and under age 65, then you must file if your gross income was at least $10,400.