Business Property Statement Form 571 L

Business Property Statement Form 571 L - What is business personal property?. Please call our office at. Motor vehicles, trailers, mobile homes, watercraft, boat motors,. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. Web check in with the receptionist. Web filing form 571l business property statement businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business. What is the “lien date” for property tax purposes? Who must file a bps? Assessor, business/personal property last updated: Web what is a form 571l business property statement (bps)?

Please call our office at. Who must file a bps? 2023 busi ness proper ty statement. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. If you have a commercial financing account with pathward or are. Individual personal property and business personal property include: Web check in with the receptionist. What is the “lien date” for property tax purposes? Web filing form 571l business property statement businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business. Motor vehicles, trailers, mobile homes, watercraft, boat motors,.

Assessor, business/personal property last updated: Motor vehicles, trailers, mobile homes, watercraft, boat motors,. Web check in with the receptionist. Web what is a form 571l business property statement (bps)? Individual personal property and business personal property include: Web business personal property tax exemption 2023 application (pdf, 245kb) business personal property mailing and/or situs address change (pdf, 13kb) individual. Who must file a bps? Web filing form 571l business property statement businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business. If you have a commercial financing account with pathward or are. What is the “lien date” for property tax purposes?

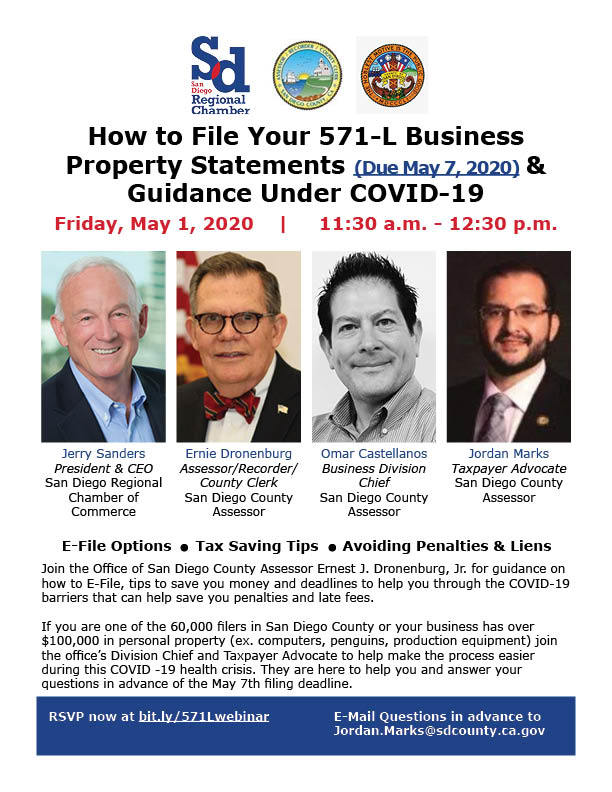

Mark Your Calendars You're Invited to Attend Business Property

Who must file a bps? Web filing form 571l business property statement businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business. 2023 busi ness proper ty statement. What is business personal property?. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer.

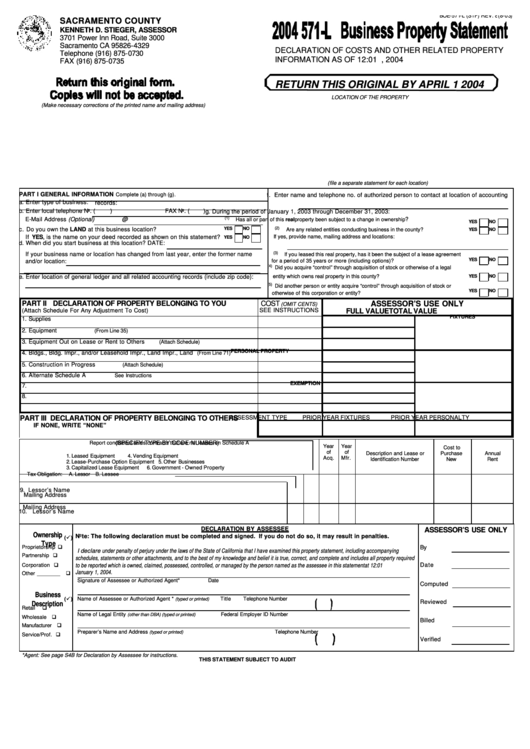

Form 571 L Alameda County Aulaiestpdm Blog

Web business personal property tax exemption 2023 application (pdf, 245kb) business personal property mailing and/or situs address change (pdf, 13kb) individual. Web what is a form 571l business property statement (bps)? What is the “lien date” for property tax purposes? Please call our office at. Motor vehicles, trailers, mobile homes, watercraft, boat motors,.

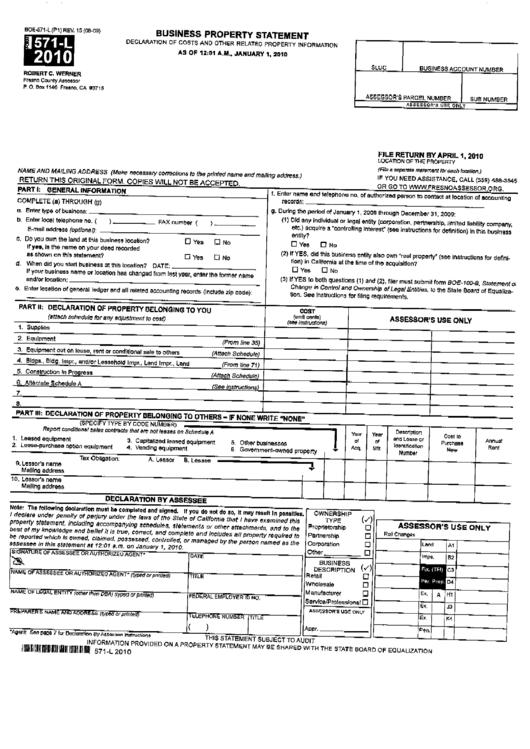

Form Boe571L Business Property Statement Montana 2010 printable

Web filing form 571l business property statement businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business. 2023 busi ness proper ty statement. Assessor, business/personal property last updated: Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette.

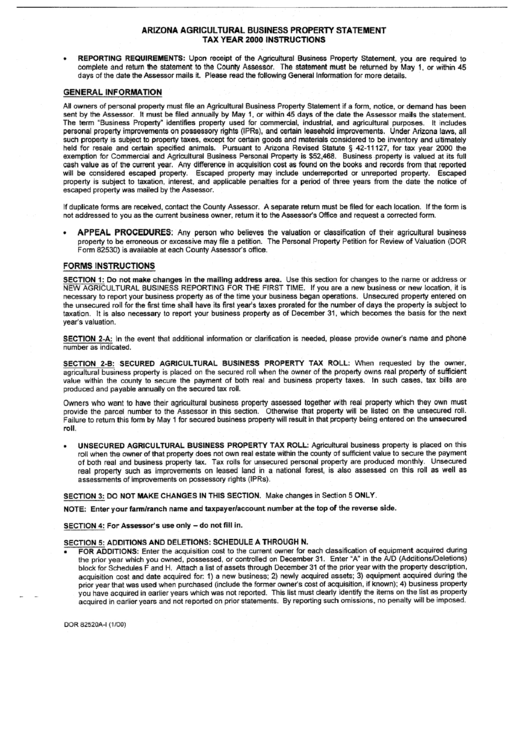

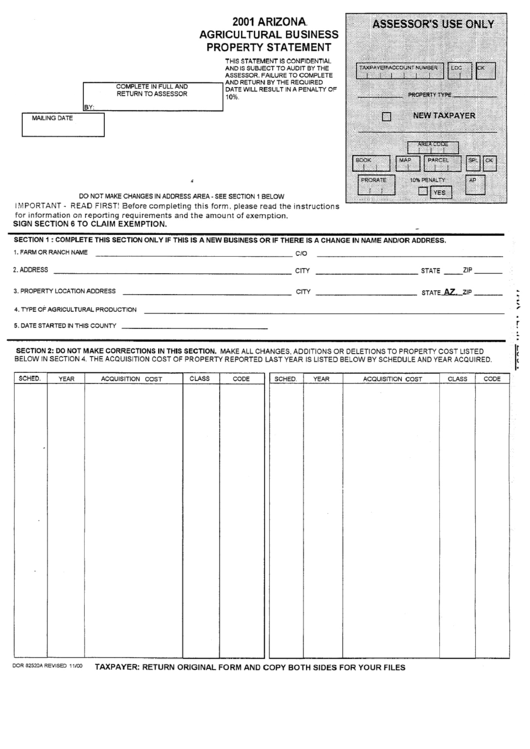

Instructions For Arizona Agricultural Business Property Statement Form

What is business personal property?. Individual personal property and business personal property include: Assessor, business/personal property last updated: Please call our office at. Motor vehicles, trailers, mobile homes, watercraft, boat motors,.

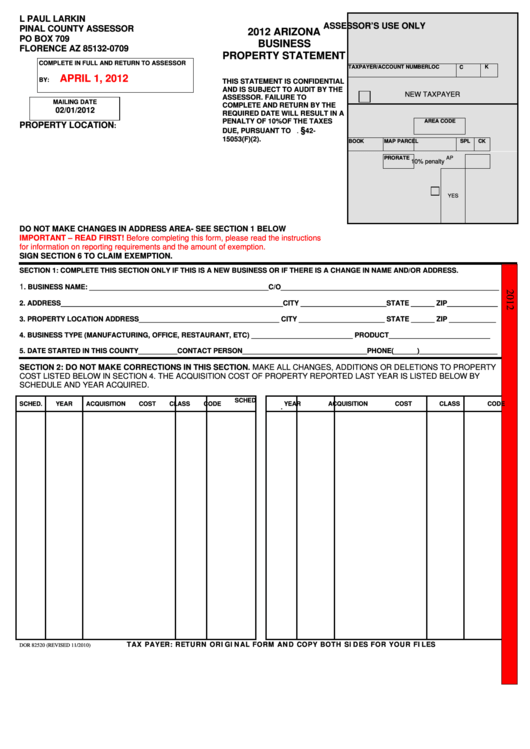

Form Dor 82520 Arizona Business Property Statement Pinal County

Who must file a bps? If you have a commercial financing account with pathward or are. 2023 busi ness proper ty statement. What is the “lien date” for property tax purposes? Assessor, business/personal property last updated:

Form Dor 82520a Arizona Agricultural Business Property Statement

Please call our office at. What is the “lien date” for property tax purposes? Web business personal property tax exemption 2023 application (pdf, 245kb) business personal property mailing and/or situs address change (pdf, 13kb) individual. Individual personal property and business personal property include: Web check in with the receptionist.

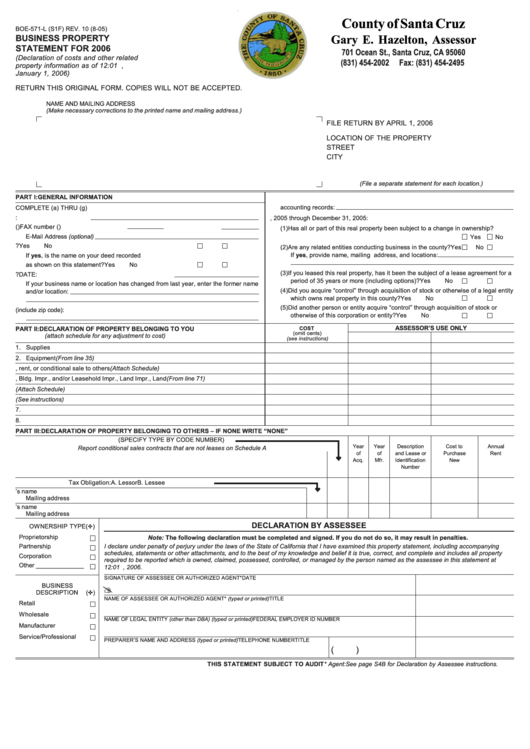

Business Property Statement CCSF Office of AssessorRecorder

Web check in with the receptionist. Web what is a form 571l business property statement (bps)? What is the “lien date” for property tax purposes? Motor vehicles, trailers, mobile homes, watercraft, boat motors,. Individual personal property and business personal property include:

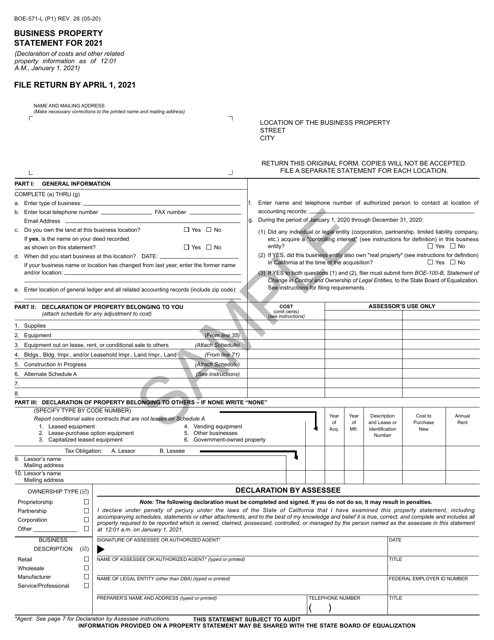

Fillable Form Boe571L Business Property Statement printable pdf

Assessor, business/personal property last updated: Please call our office at. What is the “lien date” for property tax purposes? Web filing form 571l business property statement businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business. If you have a commercial financing account with pathward or are.

Form BOE571L Download Printable PDF or Fill Online Business Property

Motor vehicles, trailers, mobile homes, watercraft, boat motors,. Web filing form 571l business property statement businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. 2023.

Fill Free fillable BUSINESS PROPERTY STATEMENT FOR 2021 FILE RETURN

Web filing form 571l business property statement businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business. What is the “lien date” for property tax purposes? Motor vehicles, trailers, mobile homes, watercraft, boat motors,. What is business personal property?. Individual personal property and business personal property include:

If You Have A Commercial Financing Account With Pathward Or Are.

Individual personal property and business personal property include: Who must file a bps? Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. Web what is a form 571l business property statement (bps)?

2023 Busi Ness Proper Ty Statement.

Please call our office at. Motor vehicles, trailers, mobile homes, watercraft, boat motors,. What is business personal property?. Assessor, business/personal property last updated:

What Is The “Lien Date” For Property Tax Purposes?

Web business personal property tax exemption 2023 application (pdf, 245kb) business personal property mailing and/or situs address change (pdf, 13kb) individual. Web check in with the receptionist. Web filing form 571l business property statement businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business.