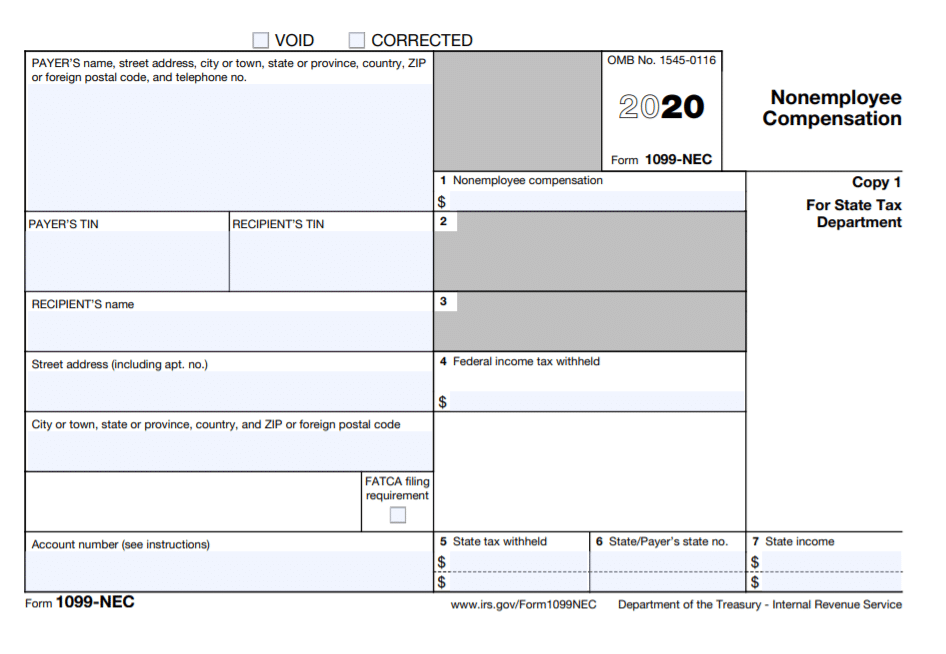

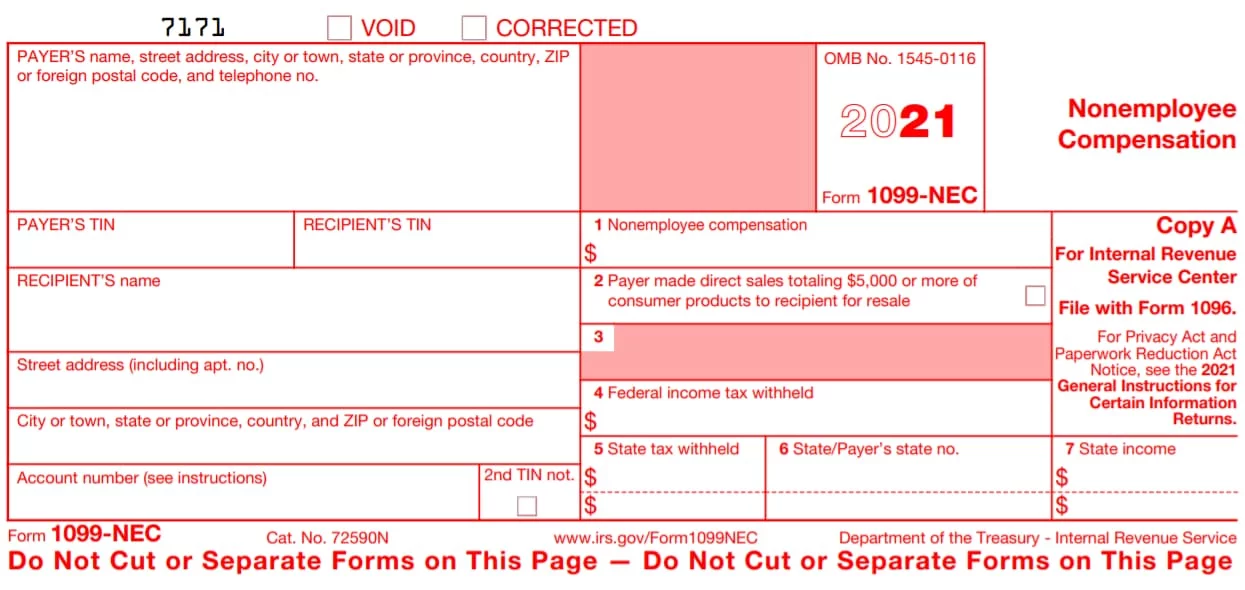

Blank 1099 Nec Form 2022

Blank 1099 Nec Form 2022 - This applies to both federal and state taxes. This is important tax information and is being furnished to the irs. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. Web select which type of form you’re printing: Who gets a 1099 nec; For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Both the forms and instructions will be updated as needed. Web fillable form 1099 nec for 2022: Current general instructions for certain information returns.

Both the forms and instructions will be updated as needed. Web fillable form 1099 nec for 2022: Current general instructions for certain information returns. Web select which type of form you’re printing: For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. You might face substantial fines for misclassifying employees as independent contractors. Who gets a 1099 nec; This is important tax information and is being furnished to the irs. Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. This applies to both federal and state taxes.

Who gets a 1099 nec; For internal revenue service center. This is important tax information and is being furnished to the irs. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs Web select which type of form you’re printing: Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. This applies to both federal and state taxes. You might face substantial fines for misclassifying employees as independent contractors. Both the forms and instructions will be updated as needed. Web fillable form 1099 nec for 2022:

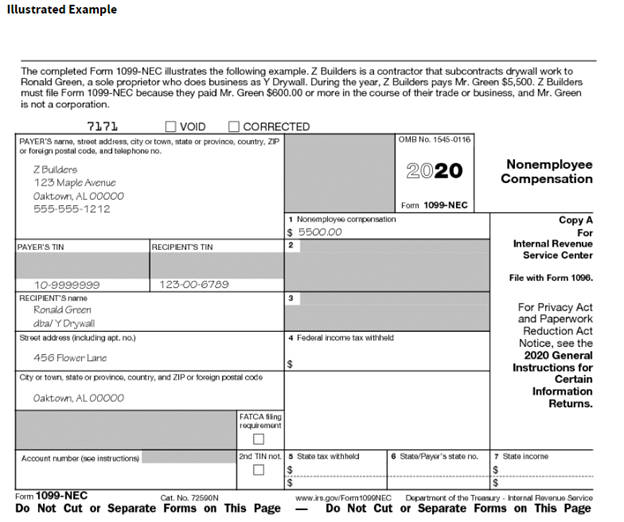

What the 1099NEC Coming Back Means for your Business Chortek

This applies to both federal and state taxes. Web fillable form 1099 nec for 2022: Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. For internal revenue service center. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Who gets a 1099 nec; Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. This applies to both federal and state taxes. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Both the forms and instructions will be updated as needed.

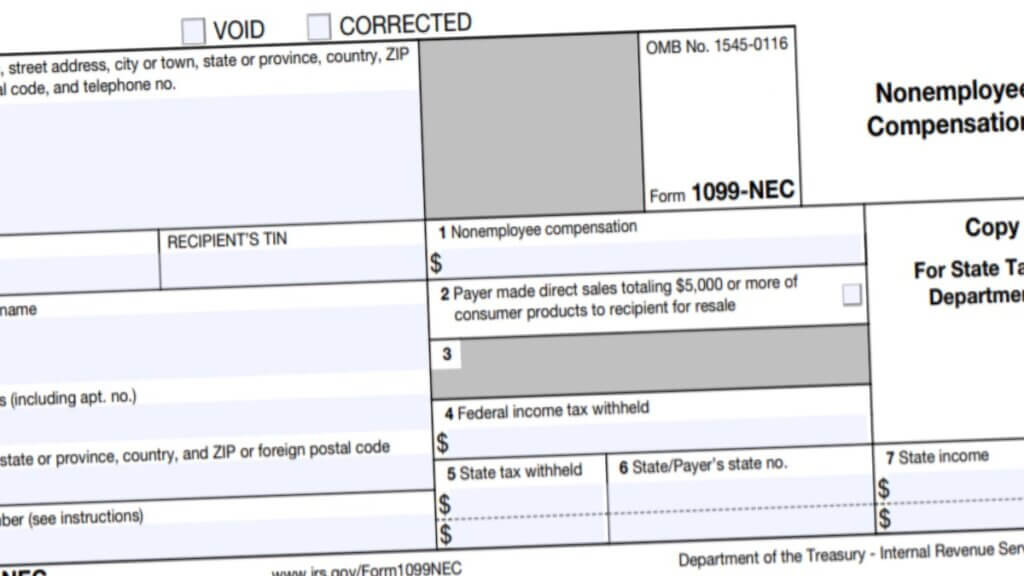

How to File Your Taxes if You Received a Form 1099NEC

For internal revenue service center. This applies to both federal and state taxes. Current general instructions for certain information returns. Who gets a 1099 nec; Both the forms and instructions will be updated as needed.

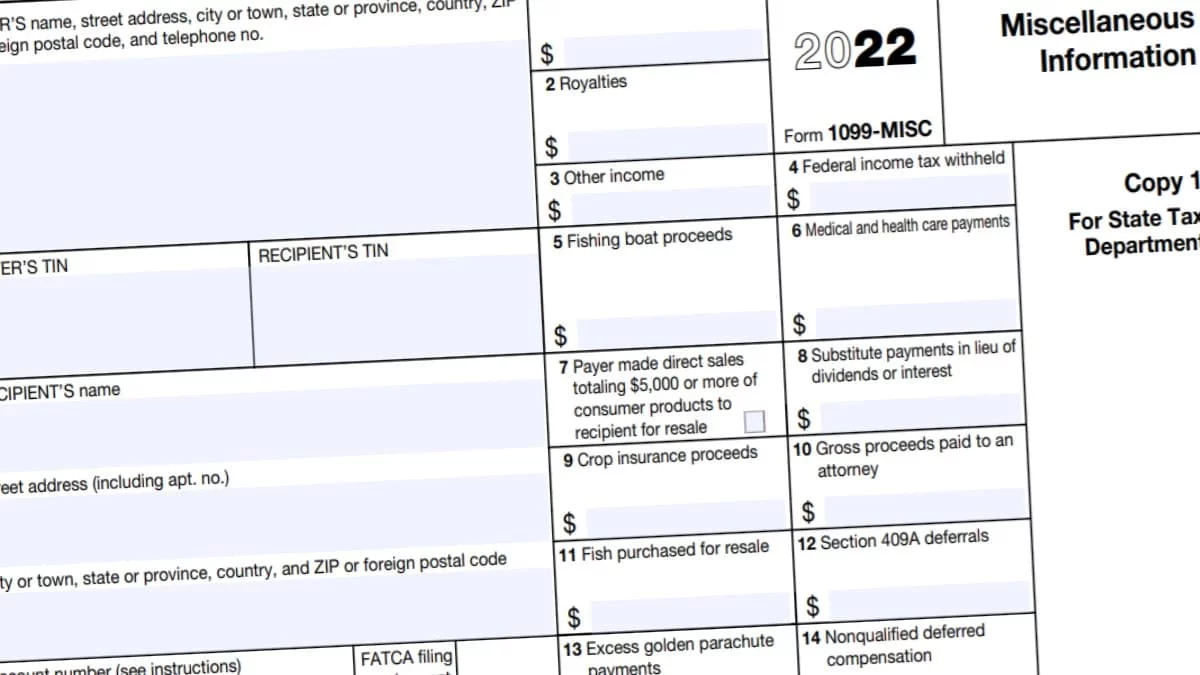

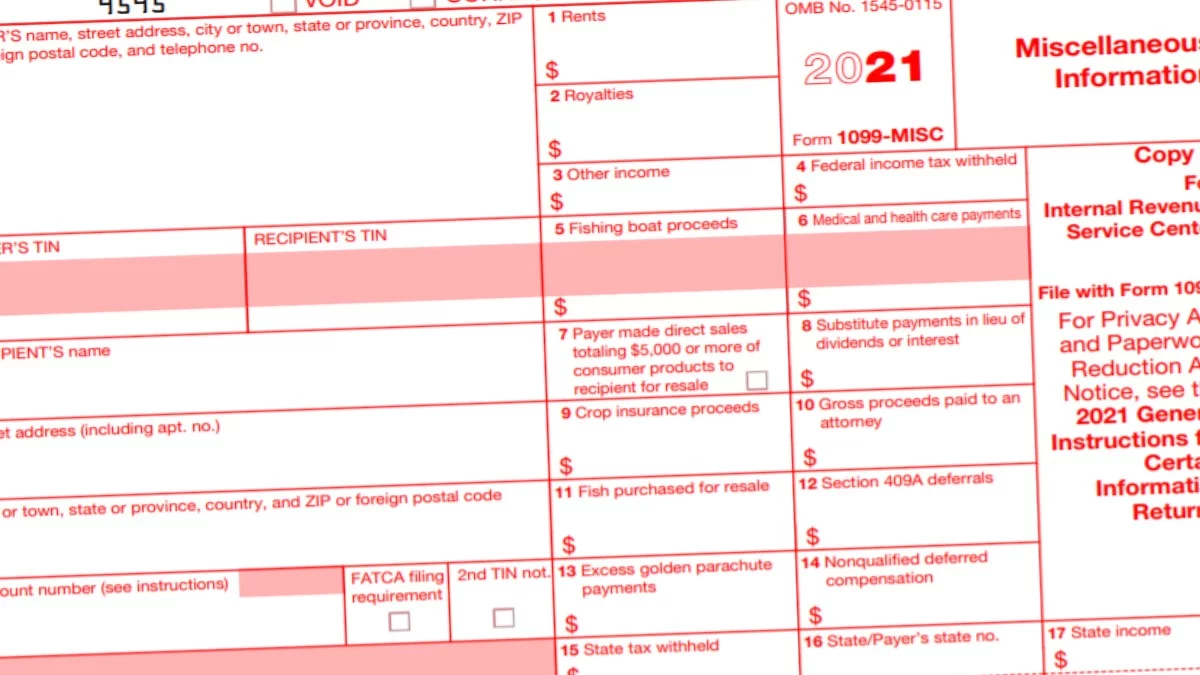

1099 NEC vs 1099 MISC 2021 2022 1099 Forms TaxUni

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs Both the forms and instructions will be updated as needed. Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. This.

1099 Nec Form 2021 Fill and Sign Printable Template Online US Legal

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. This is important tax information and is being furnished to the irs. Who gets a 1099 nec; Web fillable form 1099 nec for 2022: You might face substantial fines for misclassifying employees as independent contractors.

1099 NEC Form 2022

This is important tax information and is being furnished to the irs. For internal revenue service center. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. This applies to both federal and state taxes. You might face substantial fines for misclassifying employees as independent contractors.

1099 MISC Form 2022 1099 Forms TaxUni

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web fillable form 1099 nec for 2022: Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this.

1099 Form Independent Contractor Pdf Form 1099 Nec Form Pros / Some

Web fillable form 1099 nec for 2022: Web select which type of form you’re printing: You might face substantial fines for misclassifying employees as independent contractors. For internal revenue service center. This is important tax information and is being furnished to the irs.

IRS 1099NEC 20202022 Fill and Sign Printable Template Online US

Web select which type of form you’re printing: This applies to both federal and state taxes. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs Who gets a 1099 nec; Current general instructions for certain information returns.

1096 Form 2021 1099 Forms TaxUni

You might face substantial fines for misclassifying employees as independent contractors. This applies to both federal and state taxes. Who gets a 1099 nec; If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs Web in order to record pay, tips, and other.

This Applies To Both Federal And State Taxes.

Current general instructions for certain information returns. Who gets a 1099 nec; For internal revenue service center. Both the forms and instructions will be updated as needed.

If You Are Required To File A Return, A Negligence Penalty Or Other Sanction May Be Imposed On You If This Income Is Taxable And The Irs

Web fillable form 1099 nec for 2022: This is important tax information and is being furnished to the irs. Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

You Might Face Substantial Fines For Misclassifying Employees As Independent Contractors.

Web select which type of form you’re printing: