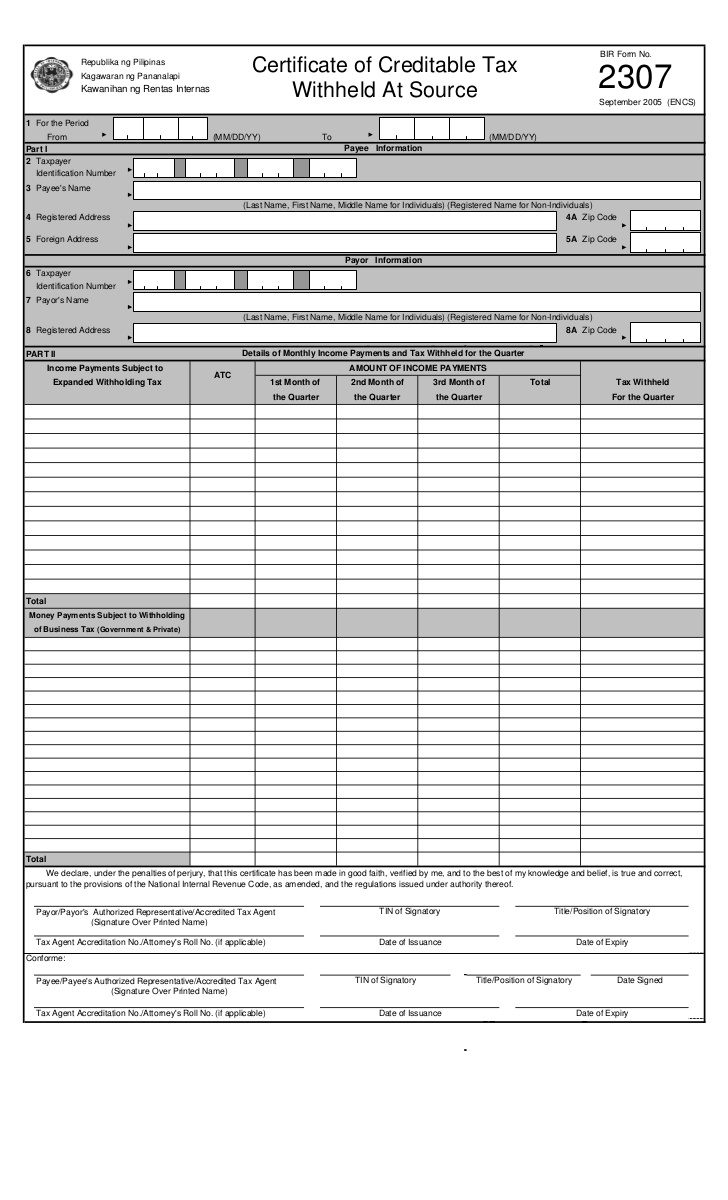

Bir Form 2307

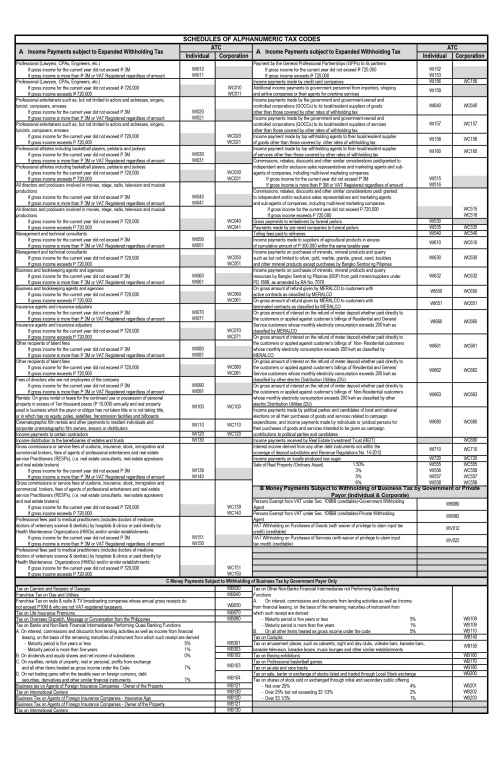

Bir Form 2307 - The commissioner of internal revenue. 2307 and 2316 under revenue regulations (rr) no. Web bir form 2307, also known as the certificate of credible tax withheld at source, is used to present the income of an individual or business entity that is subject to expanded. 📌 bir form 2307, simply referred to as certificate of creditable tax withheld at source are certificates that show income subjected to the expanded withholding tax. Web clarification on the submission of bir forms 2307 and 2306. Dear business partners, please be reminded that creditable withholding tax certificate (bir form 2307) should. This certificate shows the income subjected to expanded. This certificate exhibits the income that is subjugated to expanded. Web clarification on the manner of submission of bir form nos. Web edit bir form 2307.

This is used to present the income of an individual or business entity that is. Web the obligation to issue duly accomplished cwt certificates or bir form 2307, as proof of withholding, rests with the payer, also known as the withholding tax agent. Dear business partners, please be reminded that creditable withholding tax certificate (bir form 2307) should. Web edit bir form 2307. This certificate exhibits the income that is subjugated to expanded. A bir certificate to be accomplished and issued to recipients of income subject to expanded withholding tax. Web bir form 2307 original title: Web what is bir form 2307? 📌 bir form 2307, simply referred to as certificate of creditable tax withheld at source are certificates that show income subjected to the expanded withholding tax. The commissioner of internal revenue.

Quickly add and underline text, insert images, checkmarks, and symbols, drop new fillable fields, and rearrange or remove pages from your paperwork. 2307 and 2316 under revenue regulations (rr) no. Web clarification on the submission of bir forms 2307 and 2306. Web submission of 1 st quarter 2021 bir form 2307. The bir form 2037 is also called the certificate of creditable tax withheld at source. The commissioner of internal revenue. 📌 bir form 2307, simply referred to as certificate of creditable tax withheld at source are certificates that show income subjected to the expanded withholding tax. Web what is bir form 2307? This certificate exhibits the income that is subjugated to expanded. This certificate shows the income subjected to expanded.

BIR Form 2306 Withholding Tax Value Added Tax

The bir form 2037 is also called the certificate of creditable tax withheld at source. This certificate exhibits the income that is subjugated. Web clarification on the manner of submission of bir form nos. Web what is bir form 2307? This certificate exhibits the income that is subjugated to expanded.

2307 Withholding Tax Corporate Tax

The philippines bureau of internal revenue announced revenue memorandum circular no. Republika ng pilipinas kagawaran ng pananalapi kawanihan ng rentas internas certificate of creditable tax withheld at source 2307 september 2005 (encs) 📌 bir form 2307, simply referred to as certificate of creditable tax withheld at source are certificates that show income subjected to the expanded withholding tax. The commissioner.

BIR Ready QNE Accounting Software in the Philippines

The bir form 2037 is also called the certificate of creditable tax withheld at source. This certificate shows the income subjected to expanded. The commissioner of internal revenue. For the submission of bir form no. 2307 certificate of creditable tax withheld at source.

BIR FORM 2307 Value Added Tax Withholding Tax

The bir form 2037 is also called the certificate of creditable tax withheld at source. Web the bir form 2307 is more commonly referred to as the certificate of creditable tax withheld at source. Web bir form 2307, also known as the certificate of credible tax withheld at source, is used to present the income of an individual or business.

FORM 2307 Withholding Tax Taxpayer

Web edit bir form 2307. Web what is bir form 2307? For the submission of bir form no. The commissioner of internal revenue. Web bir form 2307 original title:

Generate BIR Form 2307 in QNE Accounting System

Web the bir form 2307 is more commonly referred to as the certificate of creditable tax withheld at source. A bir certificate to be accomplished and issued to recipients of income subject to expanded withholding tax. Web what is bir form 2307? Bir form 2307 uploaded by salve dela cruz copyright: Web the bir form 2307 is more commonly referred.

BIR Form 2307 Withholding Tax Services (Economics)

2307 certificate of creditable tax withheld at source. Duly issued certificate of creditable tax withheld at source ( bir form 2307. Bir form 2307 uploaded by salve dela cruz copyright: This certificate exhibits the income that is subjugated. Web the bir form 2307 is more commonly referred to as the certificate of creditable tax withheld at source.

BIR Form 2307 Everything You Need to Know FullSuite

Web bir form 2307 original title: Web the bir form 2307 is more commonly referred to as the certificate of creditable tax withheld at source. This certificate shows the income subjected to expanded. For the submission of bir form no. This is used to present the income of an individual or business entity that is.

BIR Form 2307 The What, When, and How

The bir form 2037 is also called the certificate of creditable tax withheld at source. Web the bir form 2307 is more commonly referred to as the certificate of creditable tax withheld at source. Download | certificate of creditable tax withheld at source. Web clarification on the manner of submission of bir form nos. The commissioner of internal revenue.

Generate BIR Form 2307 in QNE Accounting System

Dear business partners, please be reminded that creditable withholding tax certificate (bir form 2307) should. Web bir form 2307 original title: This certificate exhibits the income that is subjugated. Web what is bir form 2307? Download | certificate of creditable tax withheld at source.

Quickly Add And Underline Text, Insert Images, Checkmarks, And Symbols, Drop New Fillable Fields, And Rearrange Or Remove Pages From Your Paperwork.

Web submission of 1 st quarter 2021 bir form 2307. Download | certificate of creditable tax withheld at source. Web the secretary of finance has issued rr no. This is used to present the income of an individual or business entity that is.

Bir Form 2307 Uploaded By Salve Dela Cruz Copyright:

2307 and 2316 under revenue regulations (rr) no. A bir certificate to be accomplished and issued to recipients of income subject to expanded withholding tax. The bir form 2037 is also called the certificate of creditable tax withheld at source. Web the obligation to issue duly accomplished cwt certificates or bir form 2307, as proof of withholding, rests with the payer, also known as the withholding tax agent.

Web Clarification On The Manner Of Submission Of Bir Form Nos.

Web the bir form 2307 is also known as the certificate of credible tax withheld at source. This certificate shows the income subjected to expanded. 📌 bir form 2307, simply referred to as certificate of creditable tax withheld at source are certificates that show income subjected to the expanded withholding tax. Web bir form 2307 original title:

2307 Certificate Of Creditable Tax Withheld At Source.

Web bir form 2307, also known as the certificate of credible tax withheld at source, is used to present the income of an individual or business entity that is subject to expanded. Web edit bir form 2307. The philippines bureau of internal revenue announced revenue memorandum circular no. The commissioner of internal revenue.