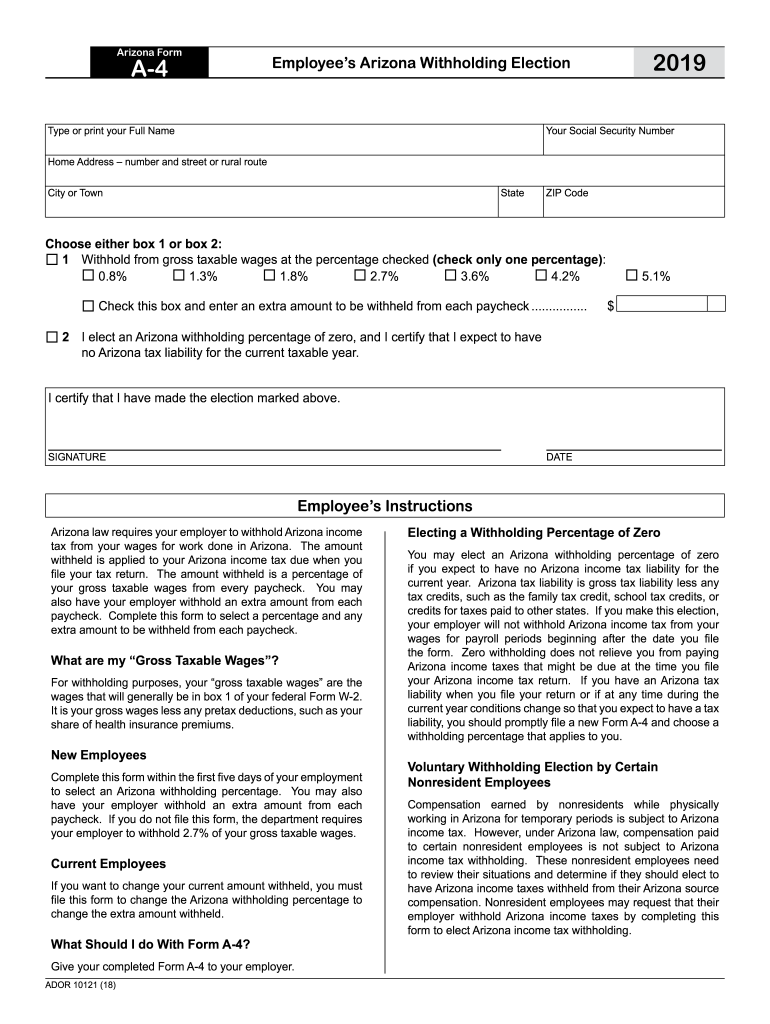

Az W4 Form

Az W4 Form - 100 n 15th ave, #301. Thursday, december 9th, 2021 if your small. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. If too little is withheld, you will generally owe tax when you file your tax return. You can use your results from the. Web complete this form within the first five days of your employment to select an arizona withholding percentage. In addition to the federal income tax withholding form, w4, each employee needs to. If too little is withheld, you will generally owe tax when. Web fortunately, there is a very simple form to help each employer determine that. Ad access irs tax forms.

You can use your results from the. Web form/ template number; Web complete this form within the first five days of your employment to select an arizona withholding percentage. You may also have your employer withhold an extra amount. The word allowance has been removed from the title since employees may. Web adoa human resources. Thursday, december 9th, 2021 if your small. Get ready for tax season deadlines by completing any required tax forms today. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Web arizona withholding percentage:

If too little is withheld, you will generally owe tax when you file your tax return. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web adoa human resources. Web complete this form within the first five days of your employment to select an arizona withholding percentage. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. You can use your results from the. In addition to the federal income tax withholding form, w4, each employee needs to. Web fortunately, there is a very simple form to help each employer determine that.

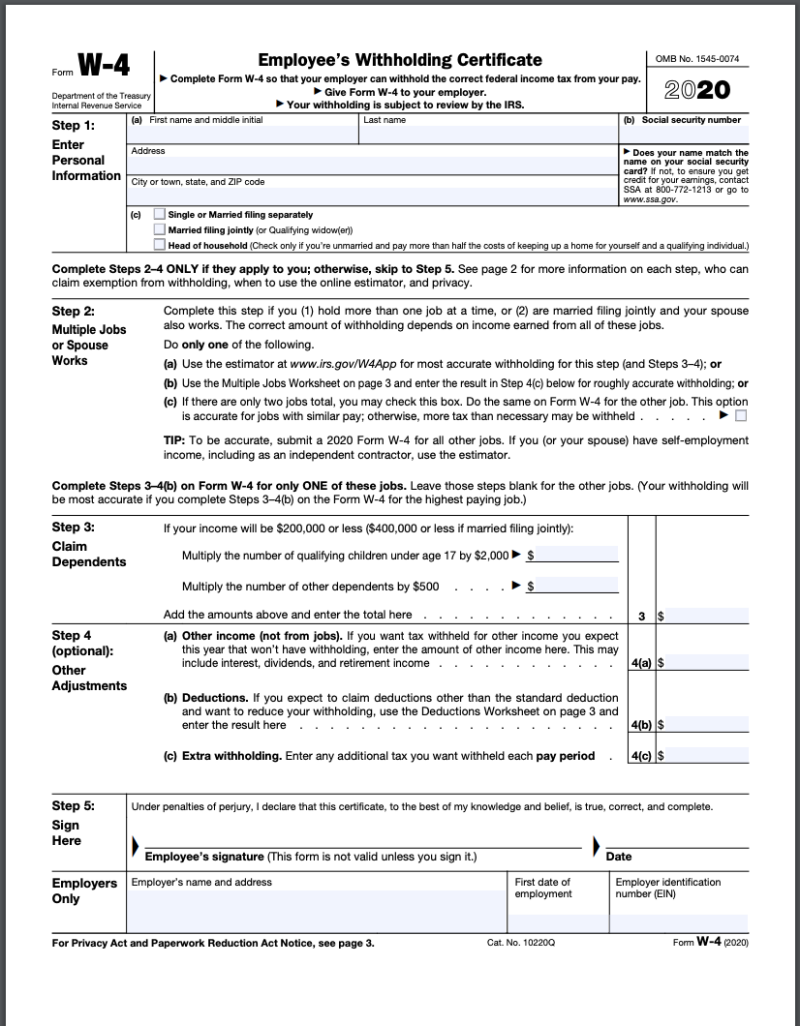

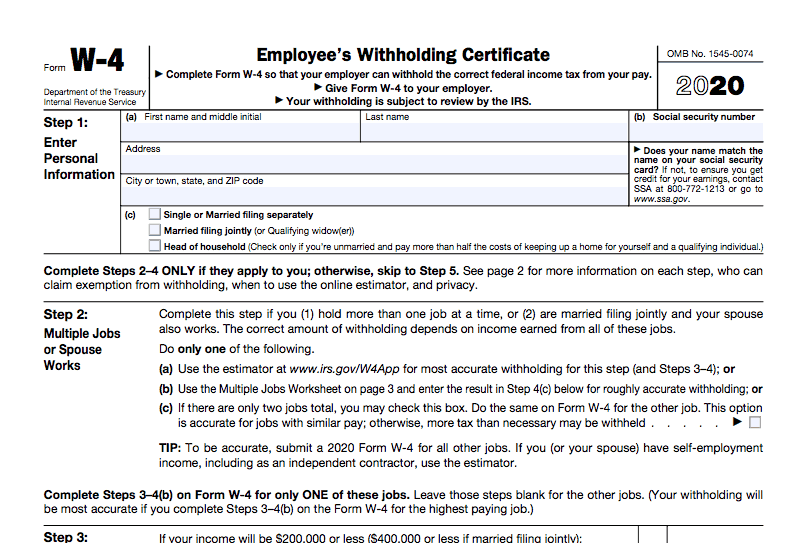

Il W 4 2020 2022 W4 Form

100 n 15th ave, #301. Web adoa human resources. Web fortunately, there is a very simple form to help each employer determine that. Get ready for tax season deadlines by completing any required tax forms today. Web file this form to change the arizona withholding percentage or to change the extra amount withheld.

A4 Form Fill Out and Sign Printable PDF Template signNow

Web form/ template number; Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. 100 n 15th ave, #301. You may also have your employer withhold an extra amount. Web arizona withholding percentage:

W4 Form Example For Single 2022 W4 Forms Zrivo

You may also have your employer withhold an extra amount. The word allowance has been removed from the title since employees may. In addition to the federal income tax withholding form, w4, each employee needs to. Web adoa human resources. Get ready for tax season deadlines by completing any required tax forms today.

Major Revamp of W4 (withholding form) Merlak Tax Advisory Group, Inc.

In addition to the federal income tax withholding form, w4, each employee needs to. Web adoa human resources. Complete, edit or print tax forms instantly. Web arizona withholding percentage: If too little is withheld, you will generally owe tax when you file your tax return.

The IRS has developed a new Form W4, Employee's Withholding

Web complete this form within the first five days of your employment to select an arizona withholding percentage. Ad access irs tax forms. Web arizona withholding percentage: Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability,.

AZ DoR A4 2020 Fill out Tax Template Online US Legal Forms

Get ready for tax season deadlines by completing any required tax forms today. If too little is withheld, you will generally owe tax when. Complete, edit or print tax forms instantly. Web adoa human resources. Thursday, december 9th, 2021 if your small.

W4 Form 2023 Withholding Adjustment W4 Forms TaxUni

The word allowance has been removed from the title since employees may. Ad access irs tax forms. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Get ready for tax season deadlines by completing any required tax forms today. If too little is withheld, you will generally owe tax when.

What Is The Annual Withholding Allowance For 2022 Gettrip24

Web complete this form within the first five days of your employment to select an arizona withholding percentage. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web adoa human resources. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new.

W4 2020 Form Printable IRS 2022 W4 Form

Thursday, december 9th, 2021 if your small. In addition to the federal income tax withholding form, w4, each employee needs to. Ad access irs tax forms. This form is for income earned in tax year 2022,. Web form/ template number;

2022 Form W4 IRS Tax Forms W4 Form 2022 Printable

Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. If too little is withheld, you will generally owe tax when you file your tax return. Thursday, december 9th, 2021 if your small. The word allowance has been removed from the title.

You Can Use Your Results From The.

This form is for income earned in tax year 2022,. The word allowance has been removed from the title since employees may. Web file this form to change the arizona withholding percentage or to change the extra amount withheld. Web complete this form within the first five days of your employment to select an arizona withholding percentage.

Web Arizona Withholding Percentage:

Web fortunately, there is a very simple form to help each employer determine that. If too little is withheld, you will generally owe tax when you file your tax return. In addition to the federal income tax withholding form, w4, each employee needs to. Web form/ template number;

Complete, Edit Or Print Tax Forms Instantly.

Get ready for tax season deadlines by completing any required tax forms today. Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should. 100 n 15th ave, #301. Thursday, december 9th, 2021 if your small.

You May Also Have Your Employer Withhold An Extra Amount.

Web adoa human resources. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. If too little is withheld, you will generally owe tax when you file your tax return. Ad access irs tax forms.