Az Tax Extension Form

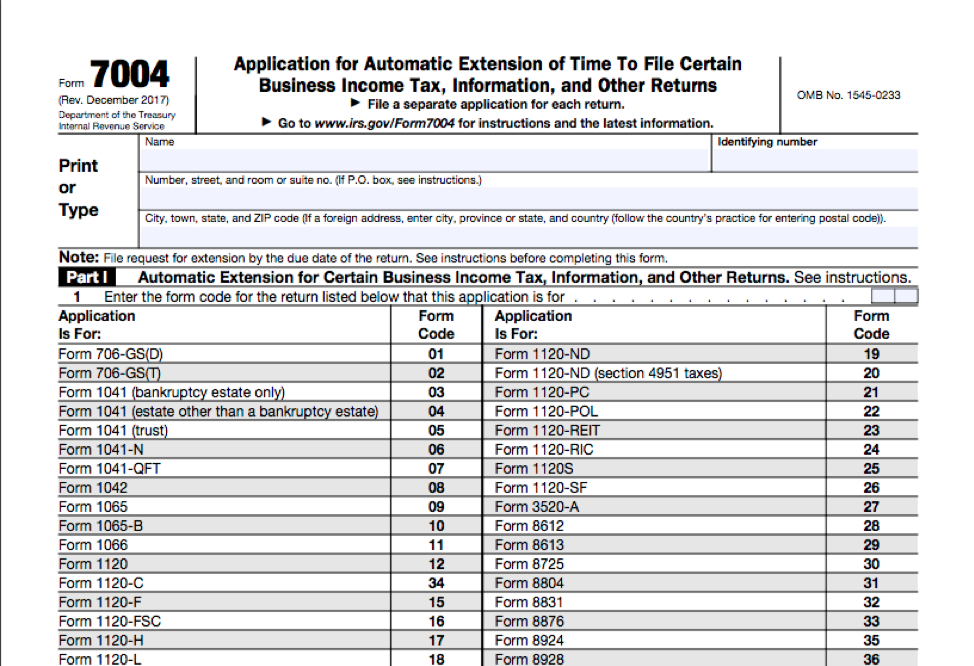

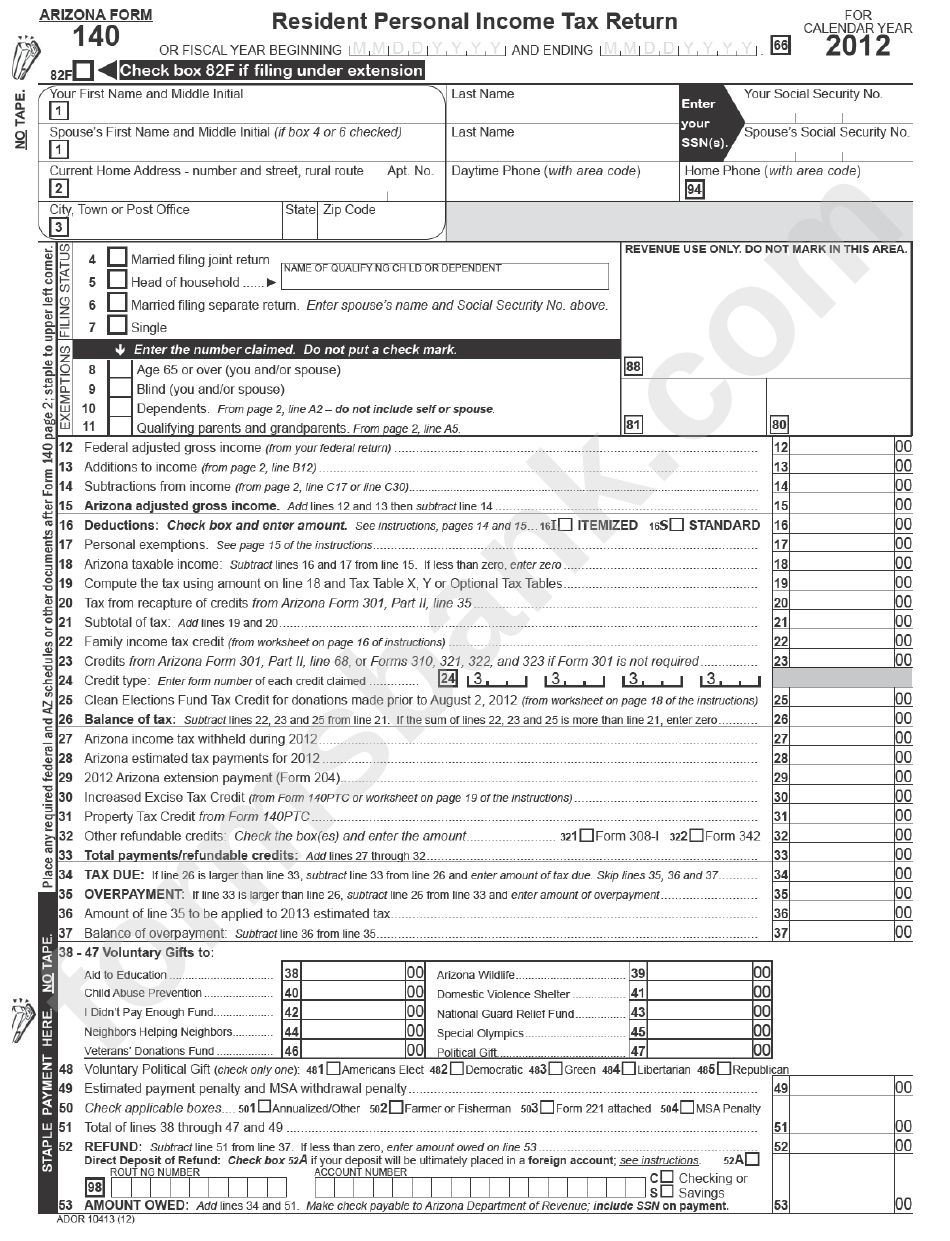

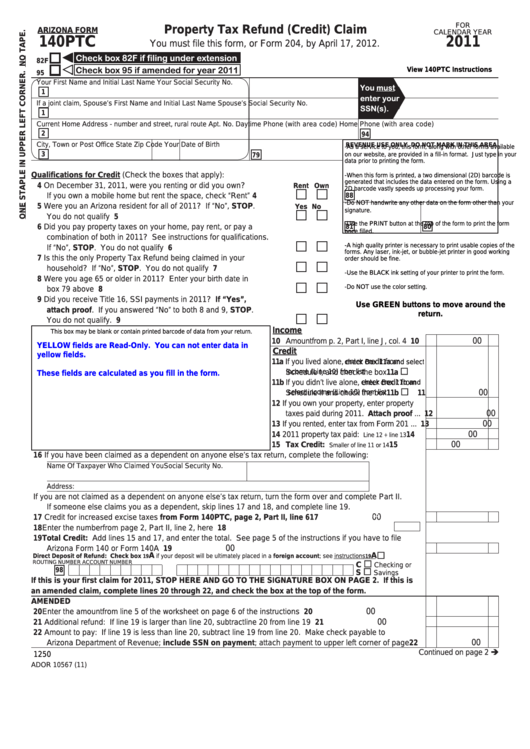

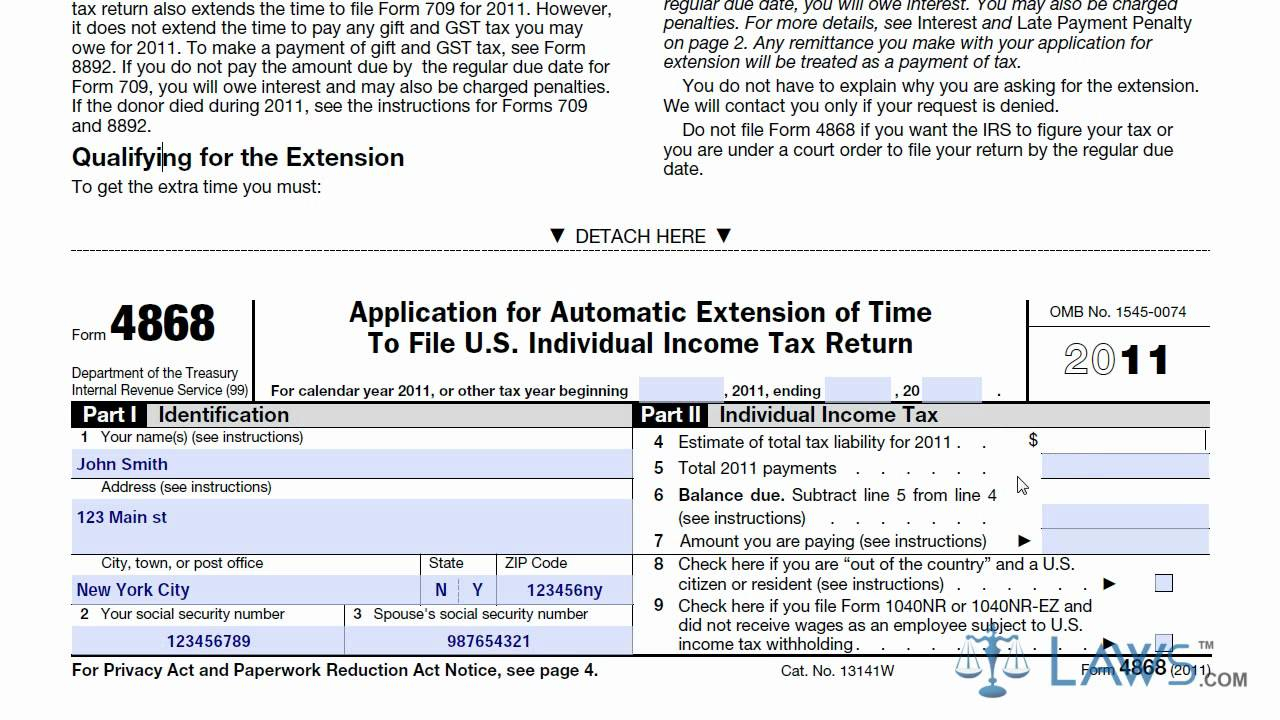

Az Tax Extension Form - If you are filing under a federal extension but are making an arizona. The arizona department of revenue will follow. Web if you pay your taxes online, you do not have to submit form 120ext unless you are. Web how to file business tax extension with arizona using expressextension? If you do not owe arizona income taxes by the tax deadline of april 18, 2023,. Web use this form to apply for an automatic 6 month extension of time to file arizona forms. Web application for filing extension for fiduciary returns only. Sign into your efile.com account and check acceptance by the irs. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use. Web what is the due date for fiduciary tax returns for taxpayers who received an extension?.

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use. Web file this form to request an extension to file forms 120, 120a, 120s, 99,. Web 26 rows arizona corporation income tax return: Web make an individual or small business income payment. Web how to file business tax extension with arizona using expressextension? Web application for filing extension for fiduciary returns only. Web extended deadline with arizona tax extension: Web more about the arizona form 204 extension. If you do not owe arizona income taxes by the tax deadline of april 18, 2023,. Web the completed extension form must be filed by april 18, 2023.

We last updated arizona form 204 in. Web file this form to request an extension to file forms 120, 120a, 120s, 99,. For individuals who filed a. Web extended deadline with arizona tax extension: Web 26 rows individual income tax forms. Individuals to file federal form 4868 to request an extension with the. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use. Web application for filing extension for fiduciary returns only. Web use this form to apply for an automatic 6 month extension of time to file arizona forms. Web how to file business tax extension with arizona using expressextension?

How Long Is An Extension For Business Taxes Business Walls

Web 26 rows arizona corporation income tax return: Web general tax return information. The arizona department of revenue will follow. Web use this form to apply for an automatic 6 month extension of time to file arizona forms. For individuals who filed a.

AZ ADEQ Out of State Exemption Form 20172022 Fill and Sign Printable

Web form 2350, application for extension of time to file u.s. If you do not owe arizona income taxes by the tax deadline of april 18, 2023,. Sign into your efile.com account and check acceptance by the irs. We last updated arizona form 204 in. Web more about the arizona form 204 extension.

LastMinute Tax Advice for 2021 Wow Gallery eBaum's World

For individuals who filed a. Web general tax return information. Web file this form to request an extension to file forms 120, 120a, 120s, 99,. Individuals to file federal form 4868 to request an extension with the. The arizona department of revenue will follow.

Printable Az 140 Tax Form Printable Form 2022

Web if you pay your taxes online, you do not have to submit form 120ext unless you are. We last updated arizona form 204 in. Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr,. Web make an individual or small business income payment. Web general tax return information.

Fillable Arizona Form 140ptc Property Tax Refund (Credit) Claim

Web 26 rows individual income tax forms. If you are filing under a federal extension but are making an arizona. If you do not owe arizona income taxes by the tax deadline of april 18, 2023,. Web general tax return information. Web how to file business tax extension with arizona using expressextension?

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

Web how to file business tax extension with arizona using expressextension? Individuals to file federal form 4868 to request an extension with the. We last updated arizona form 204 in. Web if you pay your taxes online, you do not have to submit form 120ext unless you are. Web what is the due date for fiduciary tax returns for taxpayers.

FREE 20+ Service Form Formats in PDF MS Word

Web extended deadline with arizona tax extension: Web the completed extension form must be filed by april 18, 2023. Web form 2350, application for extension of time to file u.s. Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr,. Individuals to file federal form 4868 to request an extension with the.

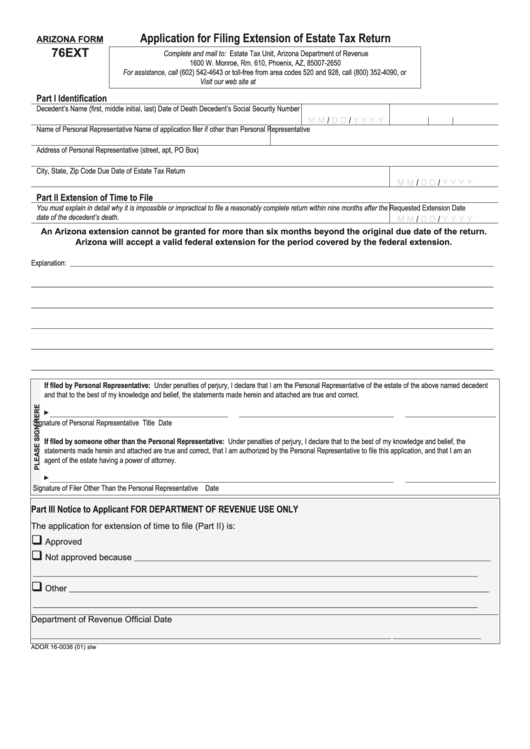

Form 76ext Application For Filing Extension Of Estate Tax Return

Web general tax return information. Web file this form to request an extension to file forms 120, 120a, 120s, 99,. If you do not owe arizona income taxes by the tax deadline of april 18, 2023,. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use. Web form 2350, application for extension of time to file u.s.

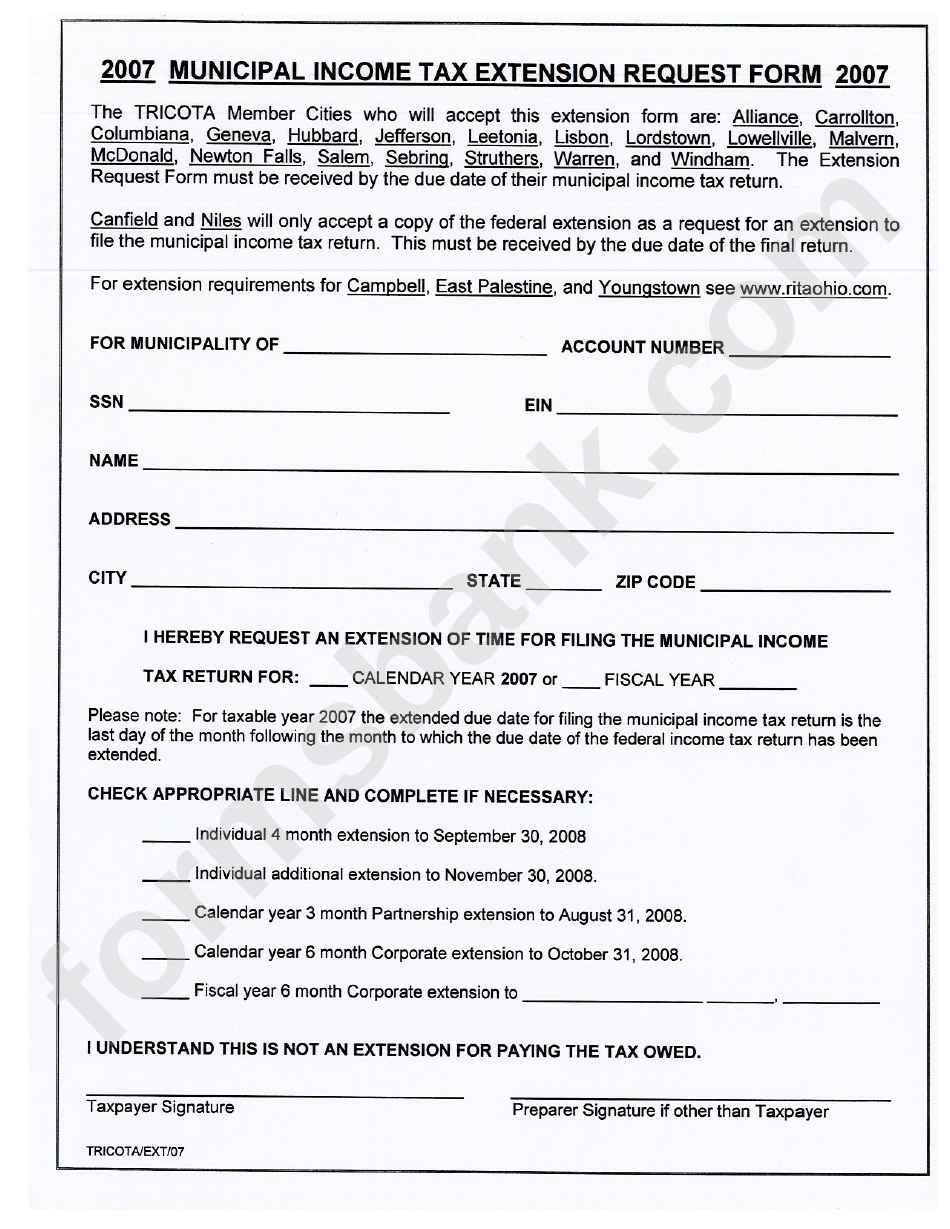

Municipal Tax Extension Request Form 2007 printable pdf download

If you do not owe arizona income taxes by the tax deadline of april 18, 2023,. Web form 2350, application for extension of time to file u.s. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use. Web what is the due date for fiduciary tax returns for taxpayers who received an extension?. Web make an individual.

AZ Form 5000A 2017 Fill out Tax Template Online US Legal Forms

Web 26 rows arizona corporation income tax return: Web 26 rows individual income tax forms. Web more about the arizona form 204 extension. Web what is the due date for fiduciary tax returns for taxpayers who received an extension?. For individuals who filed a.

For Individuals Who Filed A.

Web general tax return information. Web form 2350, application for extension of time to file u.s. Individuals to file federal form 4868 to request an extension with the. Web if you pay your taxes online, you do not have to submit form 120ext unless you are.

Web Aztaxes.gov Allows Electronic Filing And Payment Of Transaction Privilege Tax (Tpt), Use.

Web the completed extension form must be filed by april 18, 2023. The arizona department of revenue will follow. Web extended deadline with arizona tax extension: Web use this form to apply for an automatic 6 month extension of time to file arizona forms.

Web 26 Rows Individual Income Tax Forms.

If you are filing under a federal extension but are making an arizona. We last updated arizona form 204 in. If you do not owe arizona income taxes by the tax deadline of april 18, 2023,. Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr,.

Web What Is The Due Date For Fiduciary Tax Returns For Taxpayers Who Received An Extension?.

Web application for filing extension for fiduciary returns only. Web make an individual or small business income payment. Web 26 rows arizona corporation income tax return: Web more about the arizona form 204 extension.