Az Form 165 Instructions 2021

Az Form 165 Instructions 2021 - Corporate payment type options include: Web az 165 information file form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) doing. Web use arizona form 165 and check the box labeled “amended” to file an amended return for all other changes to the partnership’s arizona income tax return for taxable year 2021. • all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Web form year form instructions publish date; To determine if you qualify to claim this. Who must use arizona form 165 from its operation as an nmmd. You can download or print. If the partnership has more than 8 partners,.

Web 24 rows form year form instructions publish date; You can download or print. Web 25 rows completed by a corporation for its arizona resident partners to provide each partner with his or her distributive share of partnership income. Web az 165 information file form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) doing. Web partnerships that made the election to opt out of the bba for taxable year 2021 must use an amended arizona form 165 to report changes to their federal return. To determine if you qualify to claim this. Web az form 165 (2021) page 3 of 4 schedule e partner information complete schedule e for all partners in the partnership. Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Web az form 165 (2021) page 3 of 4 schedule e partner information complete schedule e for all partners in the partnership. Who must use arizona form 165 from its operation as an nmmd.

File arizona form 165 for every domestic partnership including syndicates,. Web az form 165 (2021) page 3 of 4 schedule e partner information complete schedule e for all partners in the partnership. Web partnerships that made the election to opt out of the bba for taxable year 2021 must use an amended arizona form 165 to report changes to their federal return. Web form year form instructions publish date; Web az 165 information file form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) doing. Web 25 rows completed by a corporation for its arizona resident partners to provide each partner with his or her distributive share of partnership income. If the partnership has more than 8 partners,. • all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. If the partnership has more than 8 partners, include. Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal.

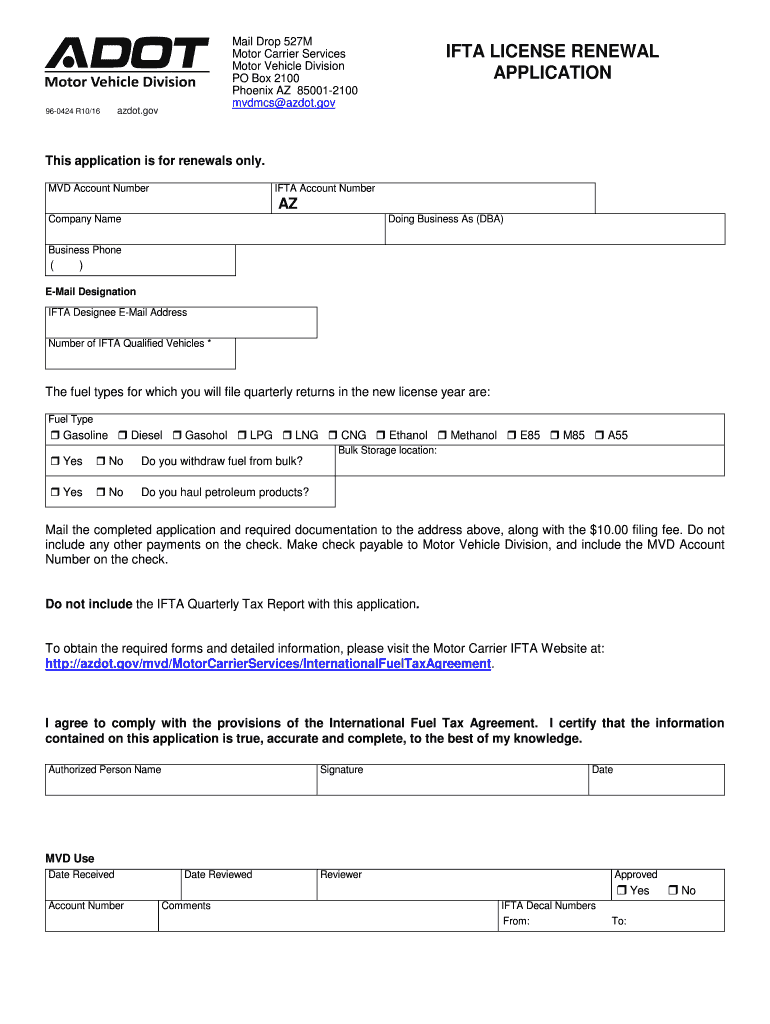

20162021 Form AZ 960424 Fill Online, Printable, Fillable, Blank

Web 25 rows completed by a corporation for its arizona resident partners to provide each partner with his or her distributive share of partnership income. • all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web az 165 information file form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign.

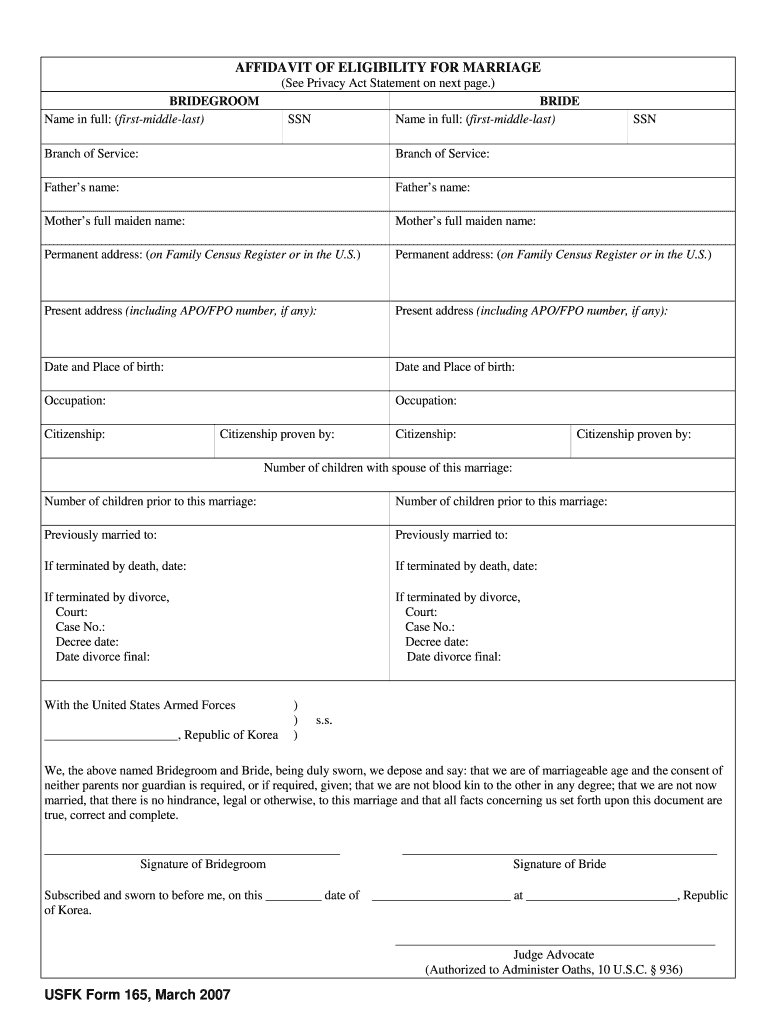

USFK 165 20072022 Fill and Sign Printable Template Online US Legal

Web we last updated the arizona partnership income tax return in february 2023, so this is the latest version of form 165, fully updated for tax year 2022. Web az 165 information file form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) doing. File arizona form 165 for every domestic.

DD Form 165 Fill Out, Sign Online and Download Fillable PDF

Web 25 rows completed by a corporation for its arizona resident partners to provide each partner with his or her distributive share of partnership income. • all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative.

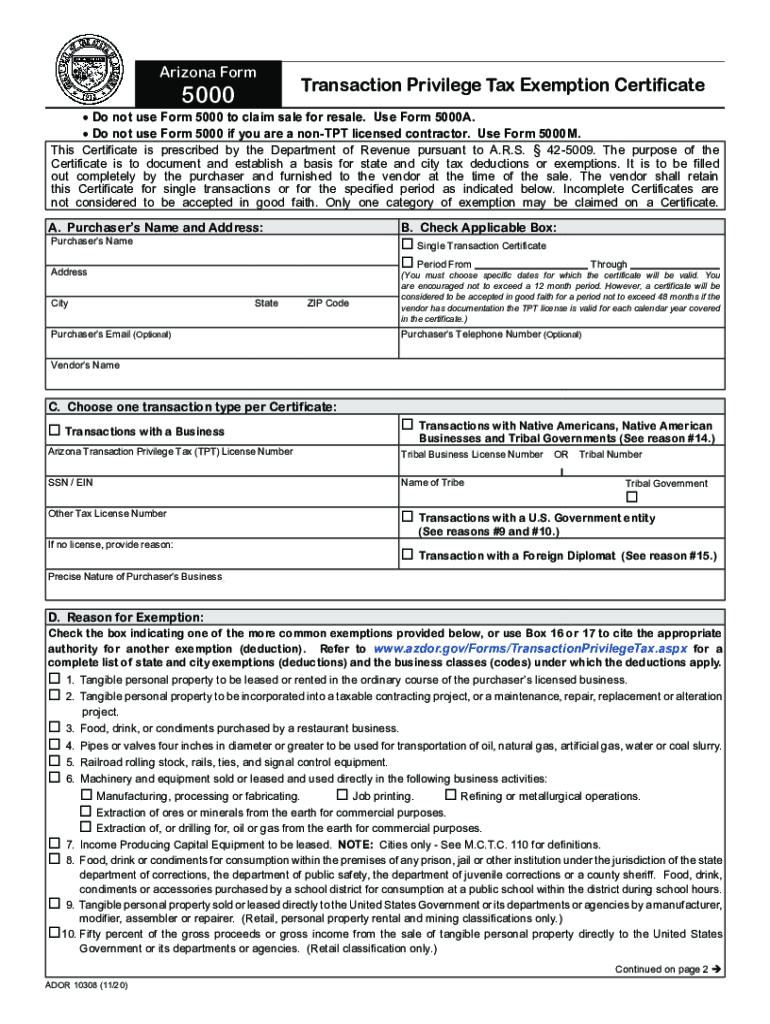

2020 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

Web use arizona form 165 and check the box labeled “amended” to file an amended return for all other changes to the partnership’s arizona income tax return for taxable year 2021. Web form year form instructions publish date; To determine if you qualify to claim this. Web partnerships that made the election to opt out of the bba for taxable.

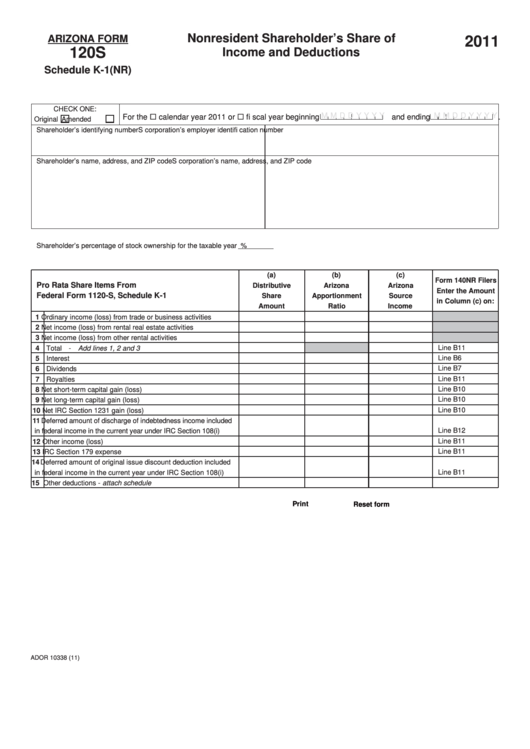

Fillable Arizona Form 120s Schedule K1(Nr) Nonresident Shareholder

Web use arizona form 165 and check the box labeled “amended” to file an amended return for all other changes to the partnership’s arizona income tax return for taxable year 2021. File arizona form 165 for every domestic partnership including syndicates,. • all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web for taxable years.

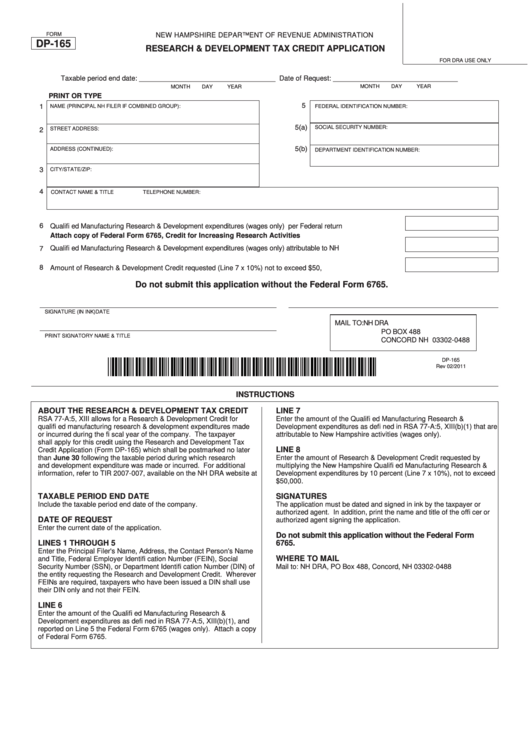

Fillable Form Dp165 Research And Development Tax Credit Application

Who must use arizona form 165 from its operation as an nmmd. To determine if you qualify to claim this. Web we last updated the arizona partnership income tax return in february 2023, so this is the latest version of form 165, fully updated for tax year 2022. If the partnership has more than 8 partners, include. Web partnerships that.

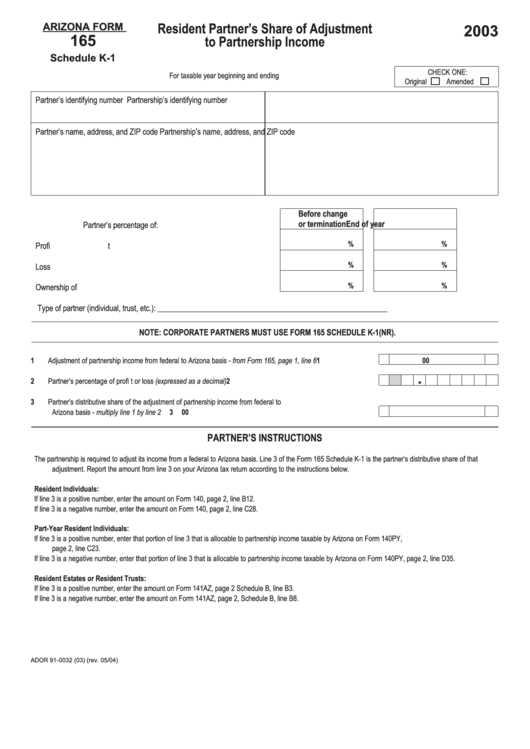

Fillable Arizona Form 165 Resident Partner'S Share Of Adjustment 2003

• all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Who must use arizona form 165 from its operation as an nmmd. To determine if you qualify to.

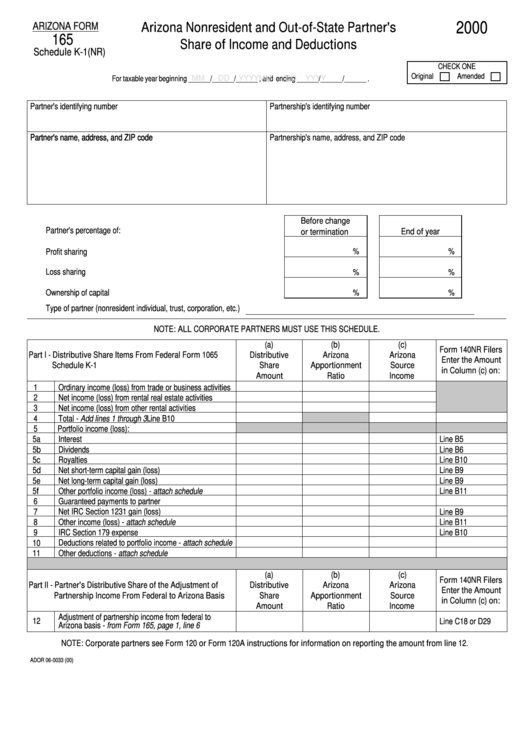

Arizona Form 165 Schedule K1(Nr) Arizona Nonresident And OutOf

Web partnerships that made the election to opt out of the bba for taxable year 2021 must use an amended arizona form 165 to report changes to their federal return. If the partnership has more than 8 partners,. Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request.

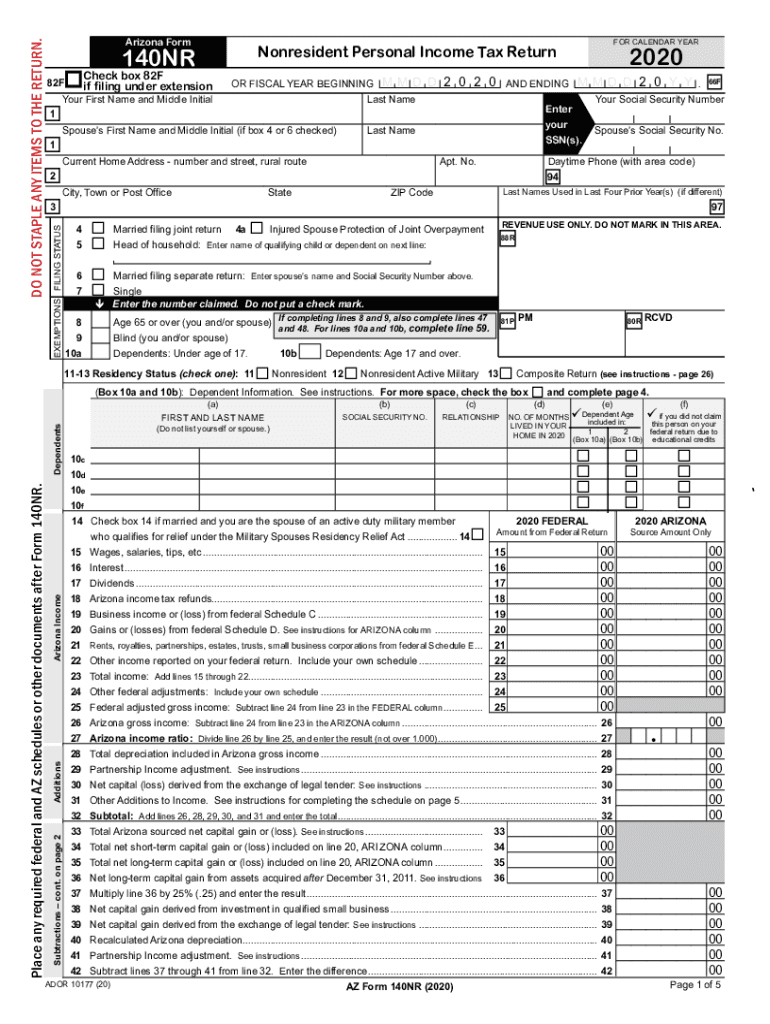

2020 Form AZ DoR 140NR Fill Online, Printable, Fillable, Blank pdfFiller

Web partnerships that made the election to opt out of the bba for taxable year 2021 must use an amended arizona form 165 to report changes to their federal return. Web az 165 information file form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) doing. Web we last updated the.

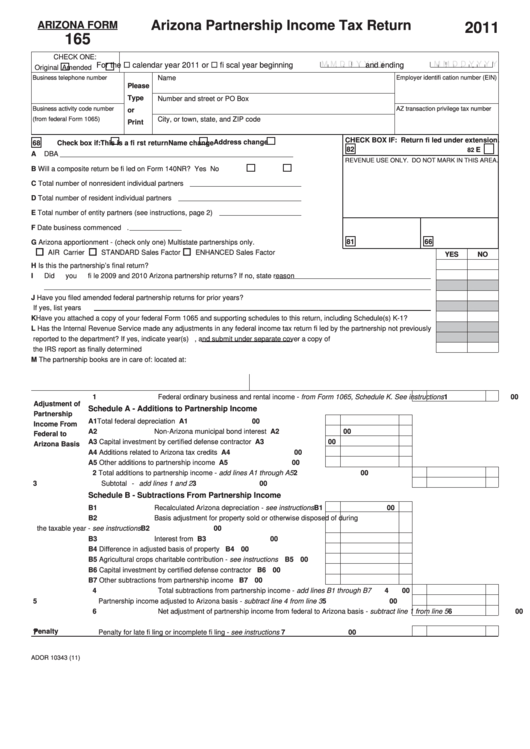

Fillable Form 165 Arizona Partnership Tax Return 2011

• all nonresident partners, • all nonresident estate partners, • all nonresident trust partners, •. Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Web partnerships that made the election to opt out of the bba for taxable year 2021 must use.

Web Use Arizona Form 165 And Check The Box Labeled “Amended” To File An Amended Return For All Other Changes To The Partnership’s Arizona Income Tax Return For Taxable Year 2021.

You can download or print. Web 24 rows form year form instructions publish date; Web 25 rows completed by a corporation for its arizona resident partners to provide each partner with his or her distributive share of partnership income. File arizona form 165 for every domestic partnership including syndicates,.

Web Az Form 165 (2021) Page 3 Of 4 Schedule E Partner Information Complete Schedule E For All Partners In The Partnership.

Corporate payment type options include: Web for taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative adjustment request that resulted in a federal. Web az form 165 (2021) page 3 of 4 schedule e partner information complete schedule e for all partners in the partnership. If the partnership has more than 8 partners,.

Web Az Form 165 (2016) Page 3 Of 3 Mail To:

If the partnership has more than 8 partners, include. Who must use arizona form 165 from its operation as an nmmd. Web partnerships that made the election to opt out of the bba for taxable year 2021 must use an amended arizona form 165 to report changes to their federal return. Web form year form instructions publish date;

• All Nonresident Partners, • All Nonresident Estate Partners, • All Nonresident Trust Partners, •.

To determine if you qualify to claim this. Web az 165 information file form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) doing. Web we last updated the arizona partnership income tax return in february 2023, so this is the latest version of form 165, fully updated for tax year 2022.