Arkansas Tax Return Form

Arkansas Tax Return Form - Individual tax return form 1040 instructions; Web arkansas income tax forms. Sign into your efile.com account and check acceptance by the tax agency. Edit, sign and print tax forms on any device with signnow. And you are filing a form. Ar1000adj (r 9/27/07) attach as the second page of your return instructions line 1. And you are not enclosing a payment, then use this address. If you make $70,000 a year living in arkansas you will be taxed $11,683. Details on how to only. Web 26 rows arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the.

Complete, edit or print tax forms instantly. And you are enclosing a payment, then. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Fiduciary and estate income tax forms. Their state income tax refund to an arkansas tax deferred tuition. Web individuals with simple tax returns may instead file a simplified return, form ar1000s. Web popular forms & instructions; And you are not enclosing a payment, then use this address. See instructions on the reverse side of this form. This form is for income earned in tax year 2022, with tax returns.

And you are enclosing a payment, then. Web we last updated arkansas tax instruction booklet in january 2023 from the arkansas department of revenue. Complete, edit or print tax forms instantly. We last updated the full year resident individual income tax return in january 2023, so. Fiduciary and estate income tax forms. And you are filing a form. It is good for five (5) years from the date the original tax credit is filed. Web form ar1100ct corporation income tax return: Web popular forms & instructions; Web attached to your individual income tax return the first time this credit is taken.

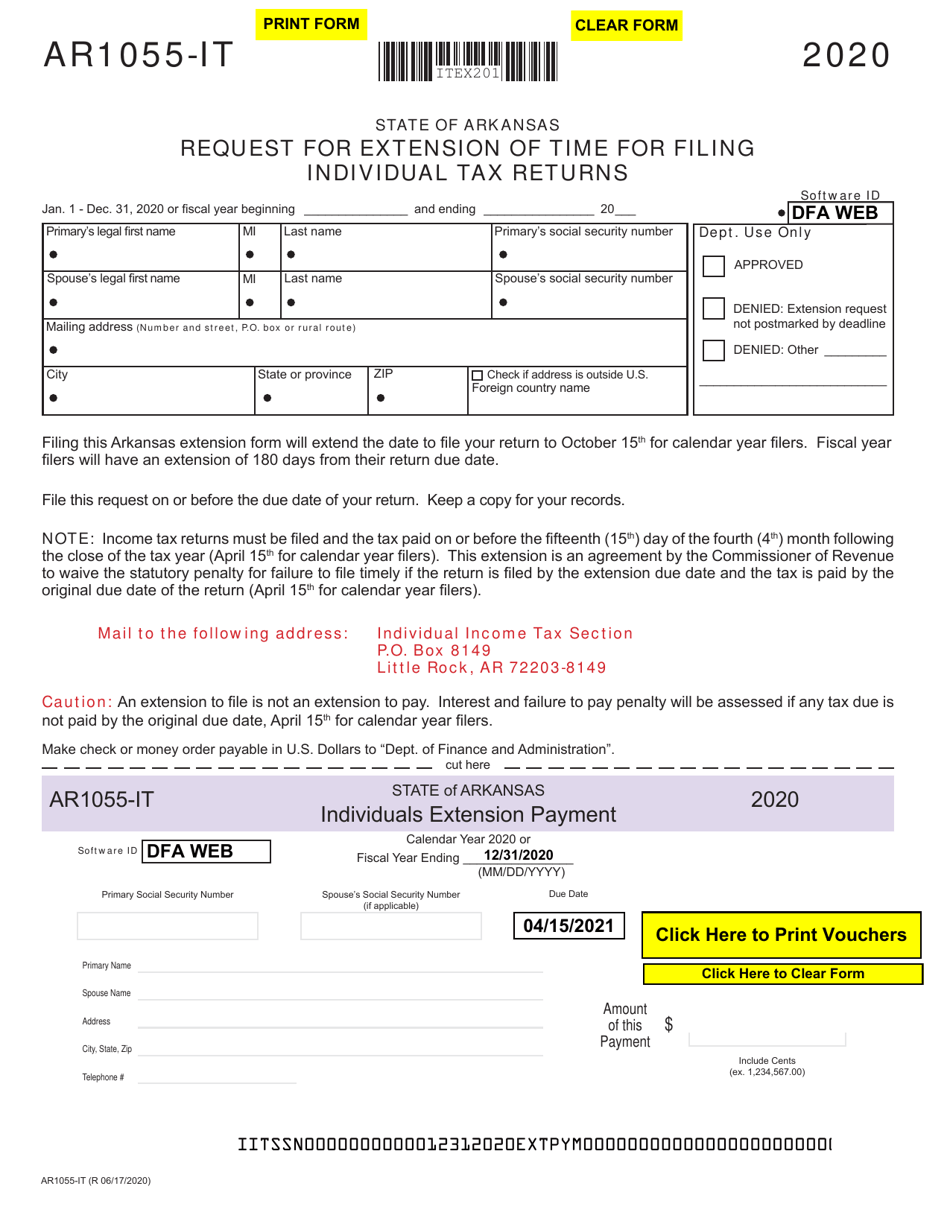

Form AR1055IT Download Fillable PDF or Fill Online Request for

Web we last updated arkansas tax instruction booklet in january 2023 from the arkansas department of revenue. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Fiduciary and estate income tax forms. Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Web 26.

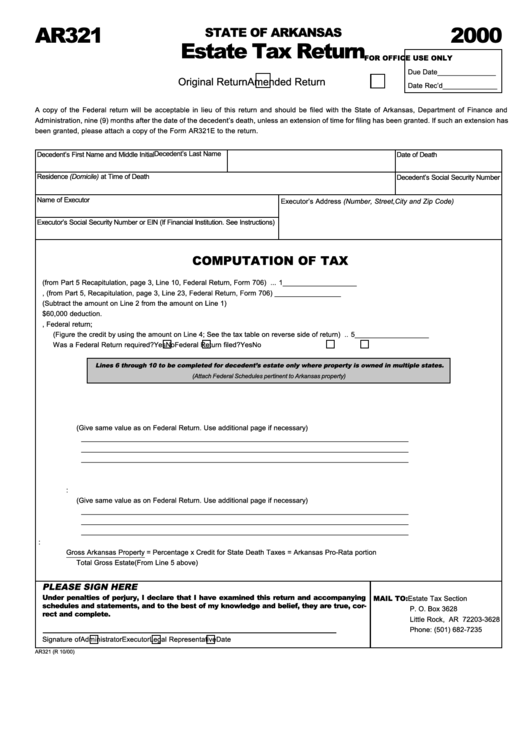

Form Ar321 Estate Tax Return 2000 printable pdf download

And you are not enclosing a payment, then use this address. Web arkansas income tax forms. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web individuals with simple tax returns may instead file a simplified return, form ar1000s. Fiduciary and estate income tax forms.

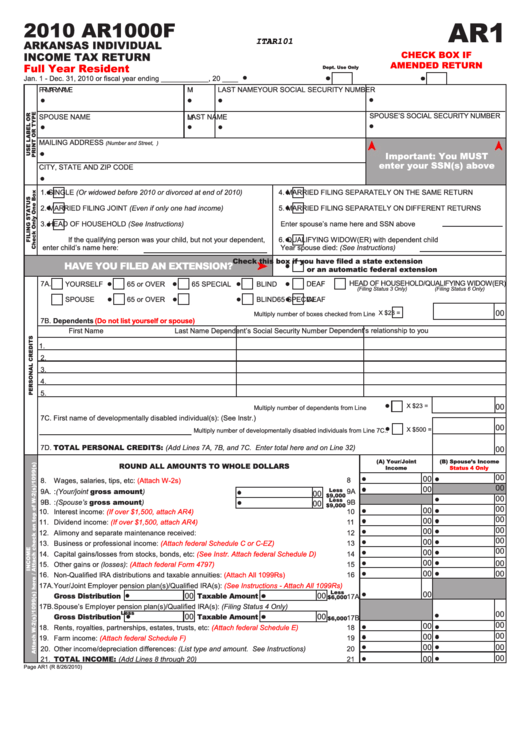

Form Ar1000f Arkansas Individual Tax Return 2010 printable

Web attached to your individual income tax return the first time this credit is taken. This form is for income earned in tax year 2022, with tax returns. Complete, edit or print tax forms instantly. Filing and pay due date. We will update this page with a new version of the form for 2024 as soon as it is made.

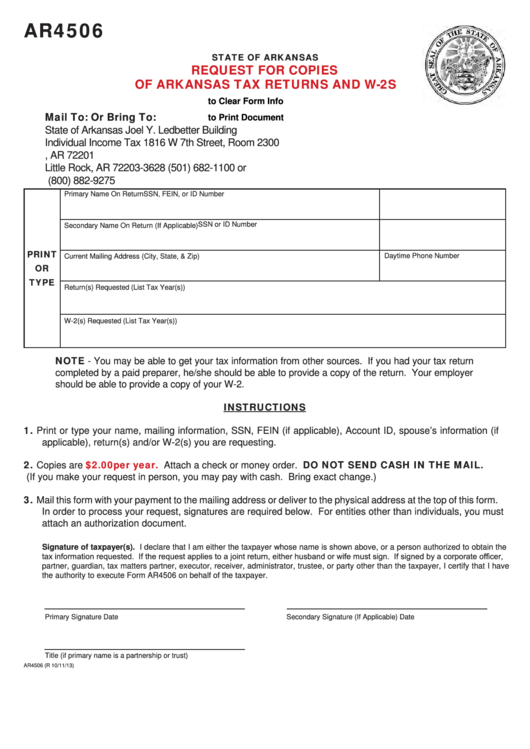

Fillable Form Ar4506 Request For Copies Of Arkansas Tax Returns And W

Where is your irs refund? Web there are two main ways to file arkansas state tax returns: Filing and pay due date. Web arkansas income tax forms. Web arkansas state income tax forms p.o.

Arkansas State Tax Return Phone Number TAXP

Download or email ar1000f & more fillable forms, register and subscribe now! Web if you live in arkansas. Fiduciary and estate income tax forms. Web popular forms & instructions; If you make $70,000 a year living in arkansas you will be taxed $11,683.

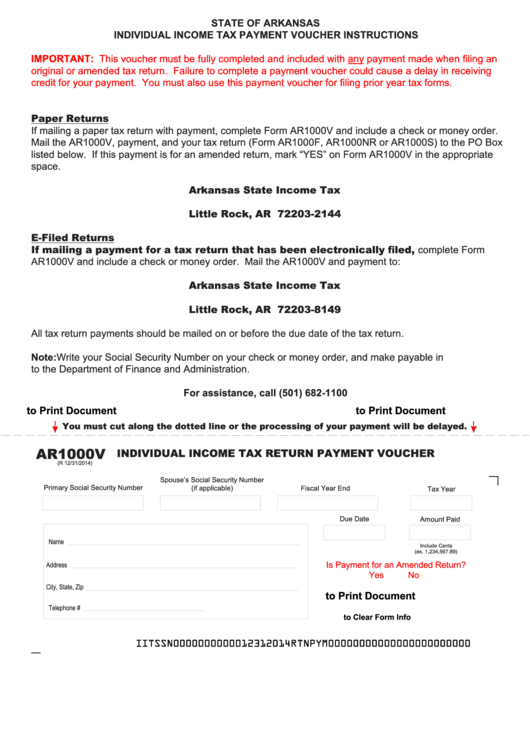

Fillable Form Ar1000v Arkansas Individual Tax Return Payment

And you are enclosing a payment, then. Complete, edit or print tax forms instantly. Web if you live in arkansas. Download or email ar1000f & more fillable forms, register and subscribe now! Sign into your efile.com account and check acceptance by the tax agency.

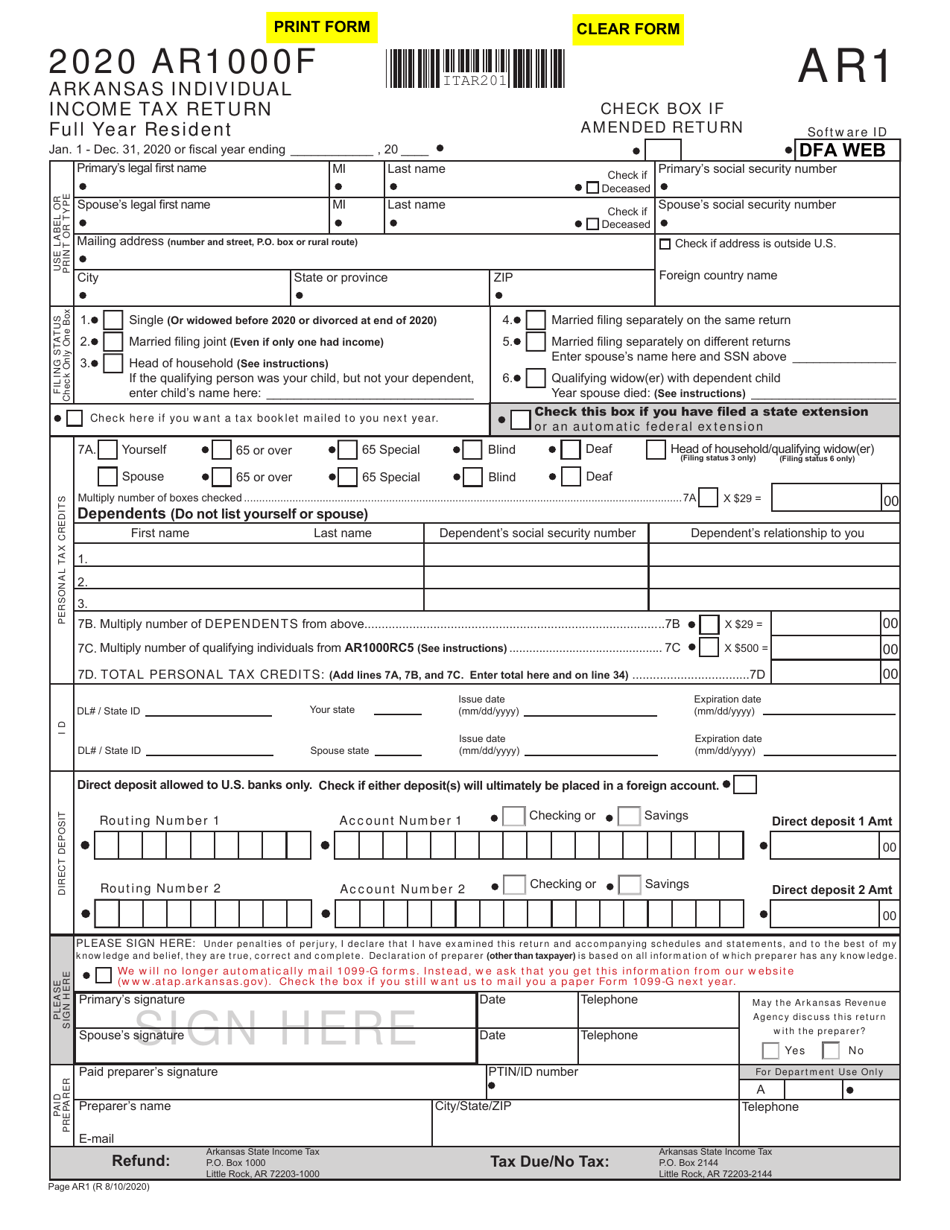

Form AR1000F Download Fillable PDF or Fill Online Arkansas Full Year

Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Web if you need to adjust your arkansas income tax return, you must complete either the ar1000a or the ar1000anr amended form. We last updated the full year resident individual income tax return in january 2023, so. Download or email ar1000f & more.

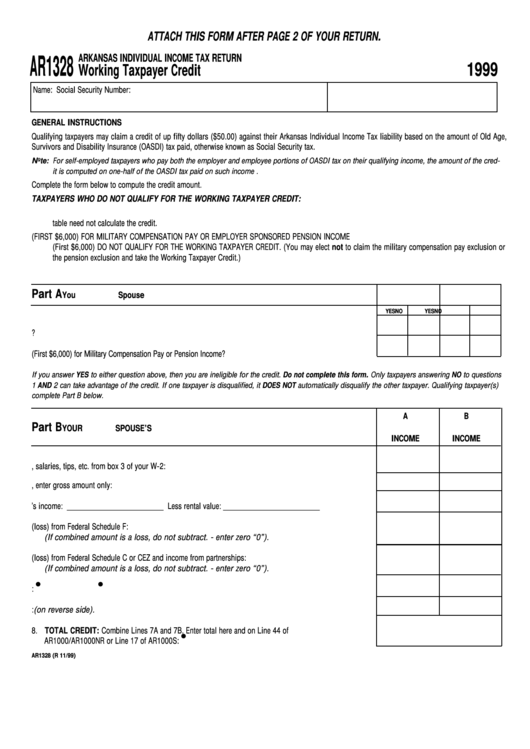

Form Ar1328 Arkansas Individual Tax Return printable pdf download

We last updated the full year resident individual income tax return in january 2023, so. Fiduciary and estate income tax forms. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns. Filing and pay due date.

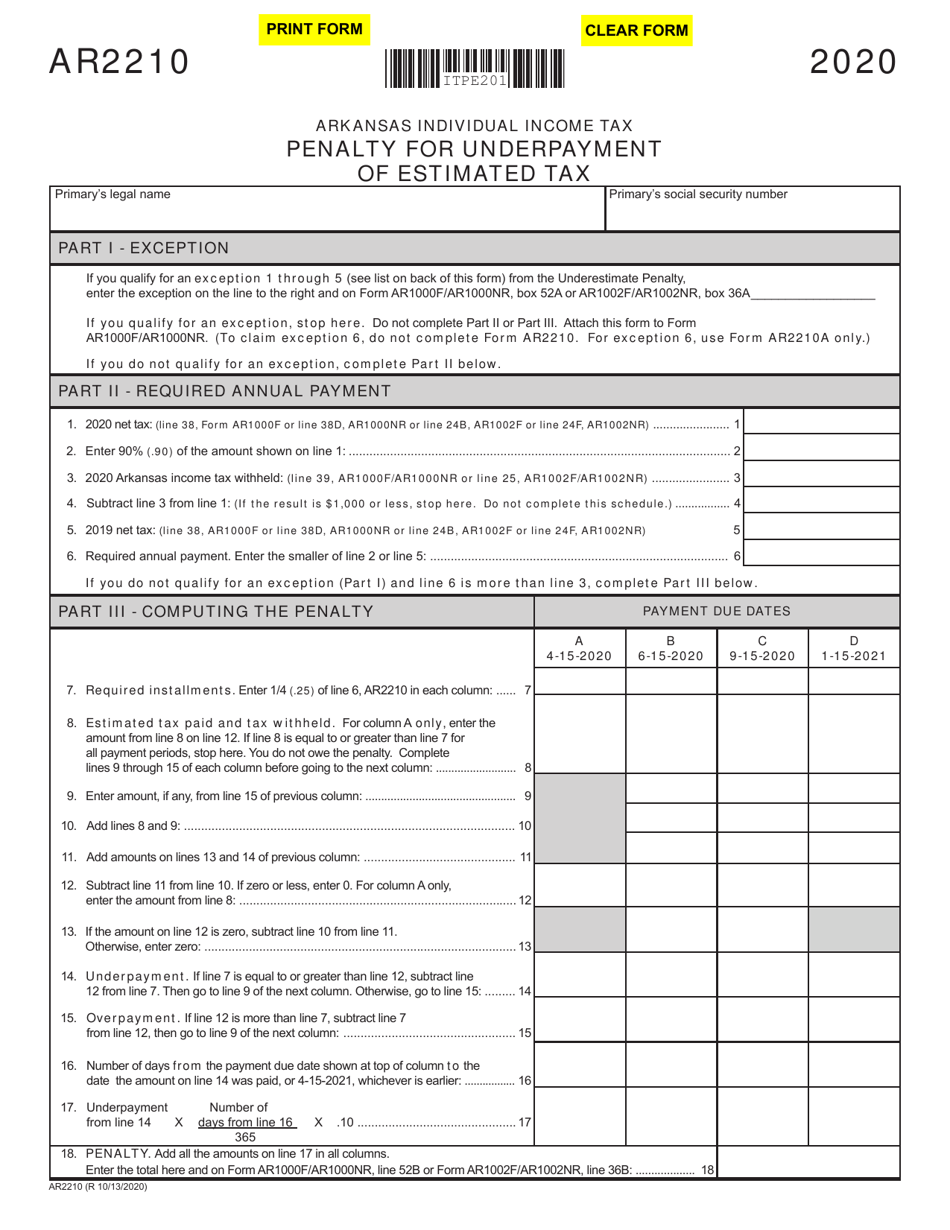

Form AR2210 Download Fillable PDF or Fill Online Penalty for

Web individuals with simple tax returns may instead file a simplified return, form ar1000s. Web 26 rows arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the. Web we last updated arkansas tax instruction booklet in january 2023 from the arkansas department of revenue. Web this form is for income earned in tax.

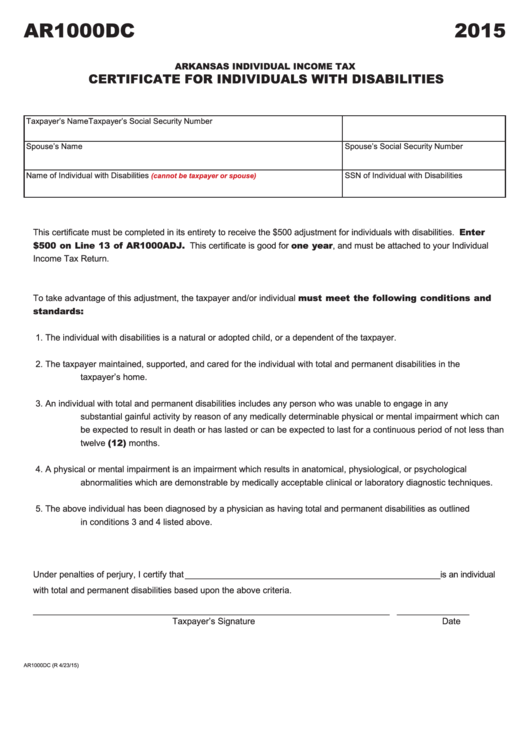

Form Ar1000dc Arkansas Individual Tax Certificate For

Form ar1100ctx corporation income tax amended return: Their state income tax refund to an arkansas tax deferred tuition. Sign into your efile.com account and check acceptance by the tax agency. Web if you live in arkansas. Web arkansas state income tax forms p.o.

Web 26 Rows Arkansas Has A State Income Tax That Ranges Between 2% And 6.6%, Which Is Administered By The.

Fiduciary and estate income tax forms. It is good for five (5) years from the date the original tax credit is filed. And you are not enclosing a payment, then use this address. Download or email ar1000f & more fillable forms, register and subscribe now!

Web If You Need To Adjust Your Arkansas Income Tax Return, You Must Complete Either The Ar1000A Or The Ar1000Anr Amended Form.

Web arkansas state income tax forms p.o. Complete, edit or print tax forms instantly. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Sign into your efile.com account and check acceptance by the tax agency.

Ar1000Adj (R 9/27/07) Attach As The Second Page Of Your Return Instructions Line 1.

Form ar1100ctx corporation income tax amended return: Details on how to only. Web there are two main ways to file arkansas state tax returns: At the end of five (5).

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available.

Do not file a second ar1000, ar1000nr,. Web if you live in arkansas. Check the status of your refund get. Complete, edit or print tax forms instantly.