Arizona Tax Form 2023

Arizona Tax Form 2023 - Web 90% of the tax due for 2023, or 100% of the tax due for 2022. You can use your 2022tax to figure the amount of payments that you must make during only if you were required to. Arizona corporate or partnership income. Web chances are good that mortgage rates won't increase much more this year, even if they don't actually start lowering until late 2023 or 2024. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web friday, july 28, 2023. Web use this form to purchase tangible personal property for resale in the ordinary course of business. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department. Web all areas of this form must be completed or renewal will be returned and may result in penalty fees being added. Web for the 2023 tax year (taxes filed in 2024), arizona will begin imposing a flat tax rate of 2.5%.

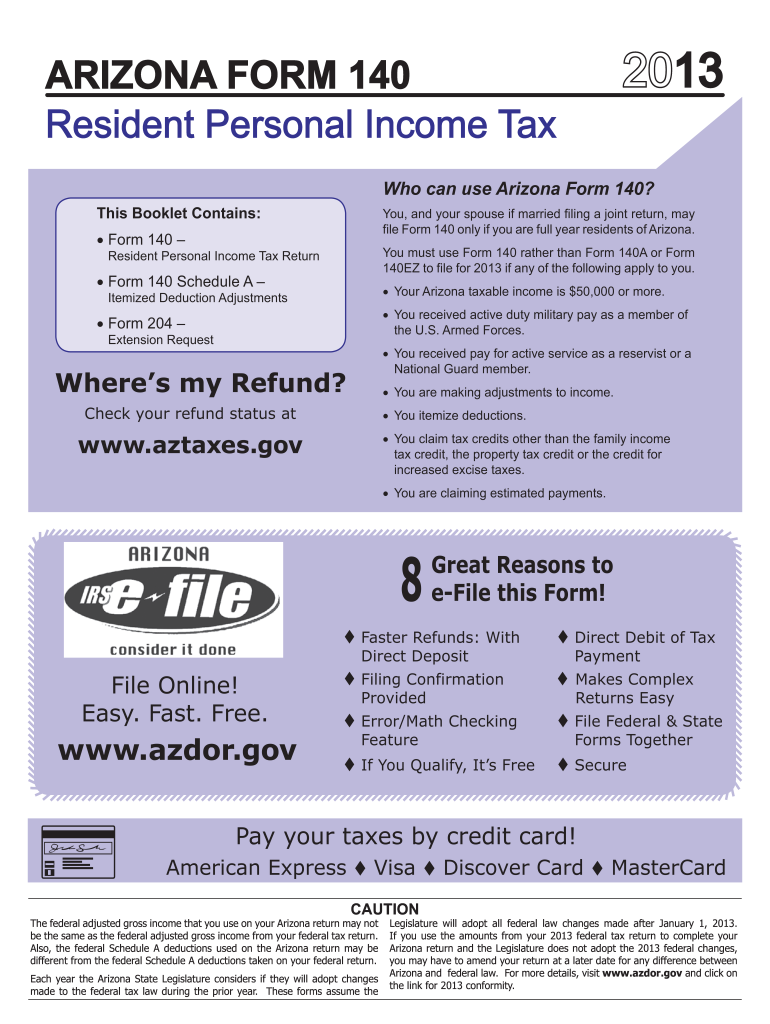

The arizona department of revenue will follow. Web packet of instructions for filling out your arizona form 140 tax return. Web july 26, 2023. Phoenix, az— the arizona department of revenue and the arizona association of. Web 1 day agothe arizona legislature on july 31, 2023, approved placing an extension of maricopa county's transportation tax on the ballot for voters before the current bill. Web the payor of your pension or annuity will provide you with a statement listing the total amount of your pension or annuity payments and the total amount of arizona income tax. Web make an individual or small business income payment. Web use this form to purchase tangible personal property for resale in the ordinary course of business. Individual payment type options include: Web chances are good that mortgage rates won't increase much more this year, even if they don't actually start lowering until late 2023 or 2024.

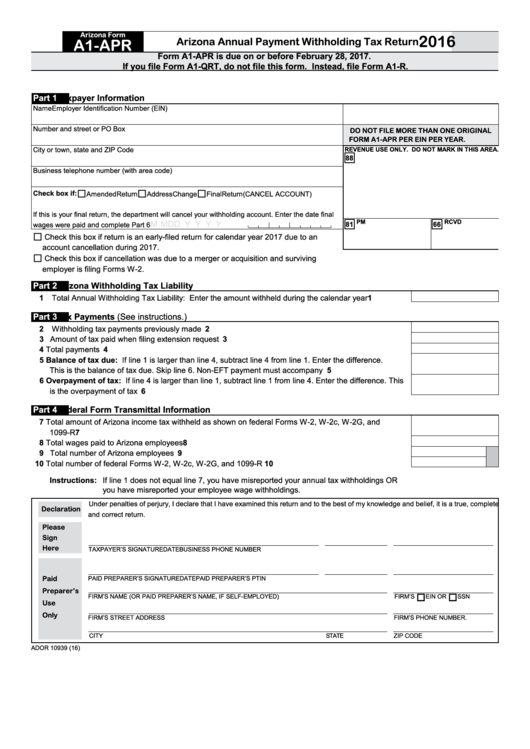

Web the payor of your pension or annuity will provide you with a statement listing the total amount of your pension or annuity payments and the total amount of arizona income tax. You can use your 2022tax to figure the amount of payments that you must make during only if you were required to. Phoenix, az— the arizona department of revenue and the arizona association of. Web start federal and arizona tax returns. Web for the 2023 tax year (taxes filed in 2024), arizona will begin imposing a flat tax rate of 2.5%. Web july 26, 2023. I think rates are likely to. Web 20 rows arizona annual payment withholding tax return: Printable 140 tax return form for arizona residents. Web download or print the 2022 arizona form 323 (credit for contributions to school tuition organizations) for free from the arizona department of revenue.

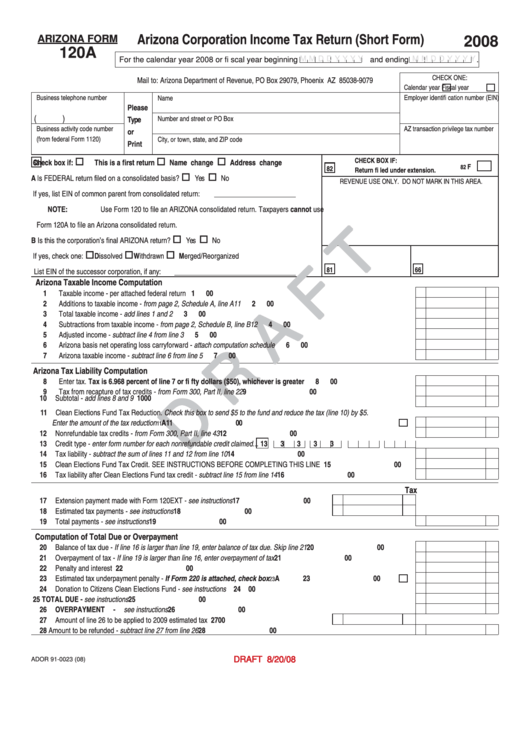

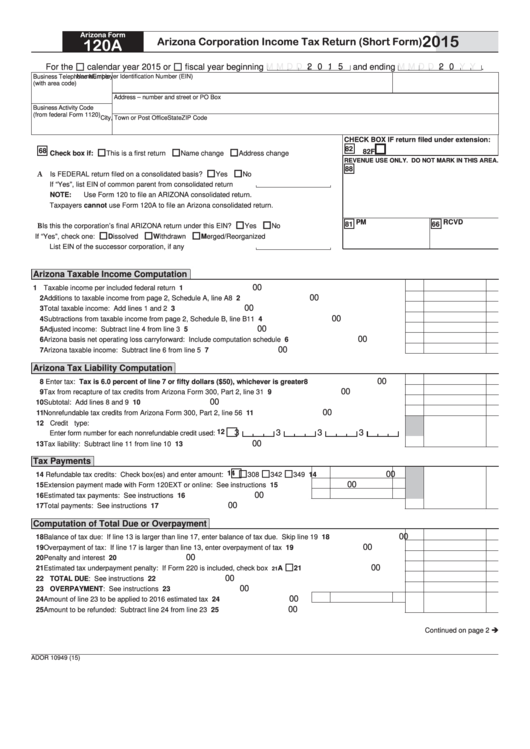

Arizona Form 120a Draft Arizona Corporation Tax Return (Short

Web download or print the 2022 arizona form 323 (credit for contributions to school tuition organizations) for free from the arizona department of revenue. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department. Web for the 2023 tax year (taxes filed in.

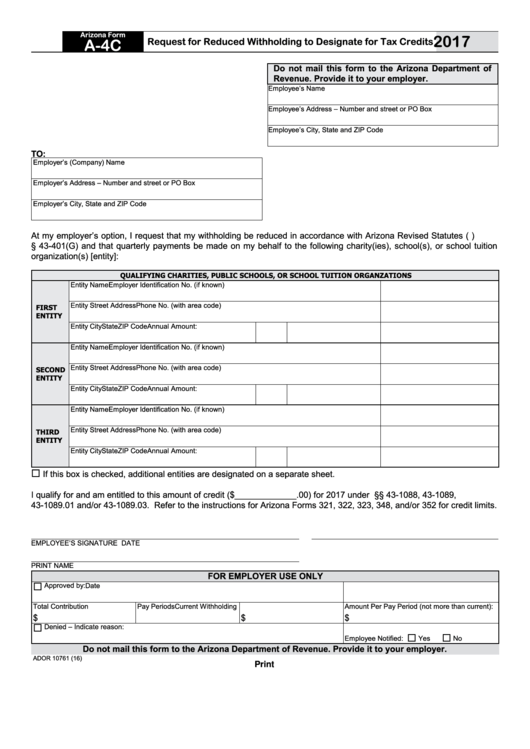

Fillable Arizona Form A4c Request For Reduced Withholding To

Web friday, july 28, 2023. Web notable deaths in 2023 human trafficking laws. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web packet of instructions for filling out your arizona form 140 tax return. Web 20 rows arizona annual payment withholding tax return:

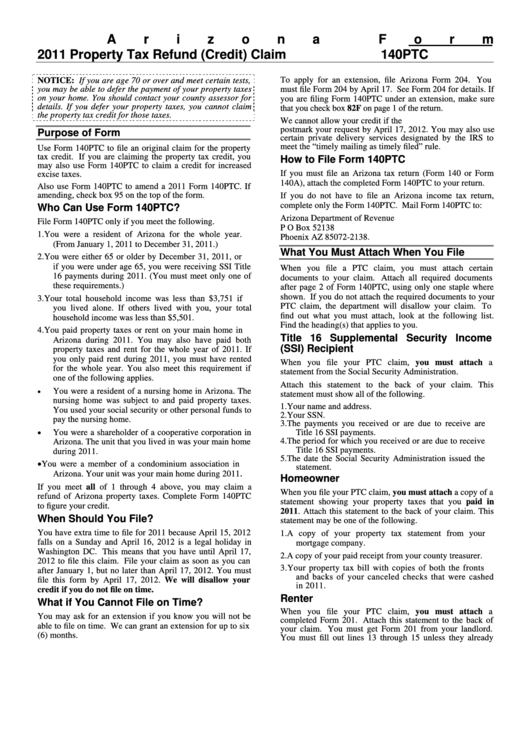

Arizona Form 140ptc Instruction Property Tax Refund (Credit) Claim

Web download or print the 2022 arizona form 323 (credit for contributions to school tuition organizations) for free from the arizona department of revenue. Web the payor of your pension or annuity will provide you with a statement listing the total amount of your pension or annuity payments and the total amount of arizona income tax. Web 26 rows individual.

When Will Arizona Taxpayers Need To File Their 2020 Taxes By? Across

Web use this form to purchase tangible personal property for resale in the ordinary course of business. Web friday, july 28, 2023. Web july 26, 2023. Web 20 rows arizona annual payment withholding tax return: 2022 arizona state income tax rates and tax brackets arizona state.

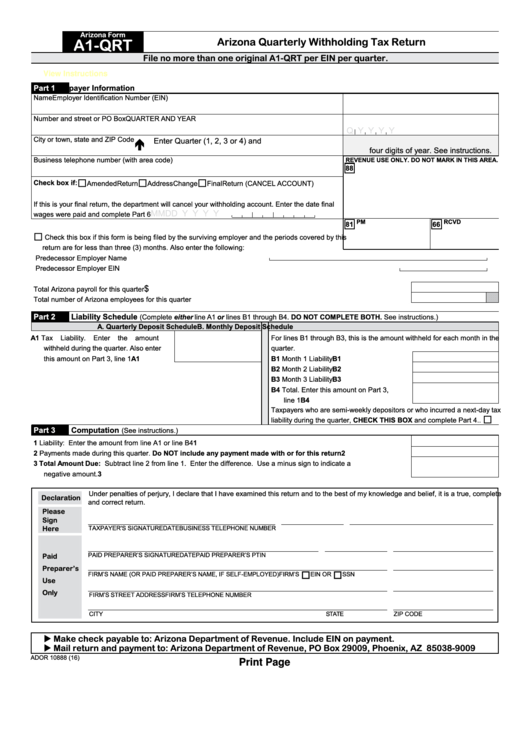

Fillable Arizona Quarterly Withholding Tax Return (Arizona Form A1Qrt

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. You can use your 2022tax to figure the amount of payments that you must make during only if you were required to. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form.

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

Web the payor of your pension or annuity will provide you with a statement listing the total amount of your pension or annuity payments and the total amount of arizona income tax. Web july 26, 2023. Web friday, july 28, 2023. Web application for filing extension form. Web 26 rows corporate tax forms :

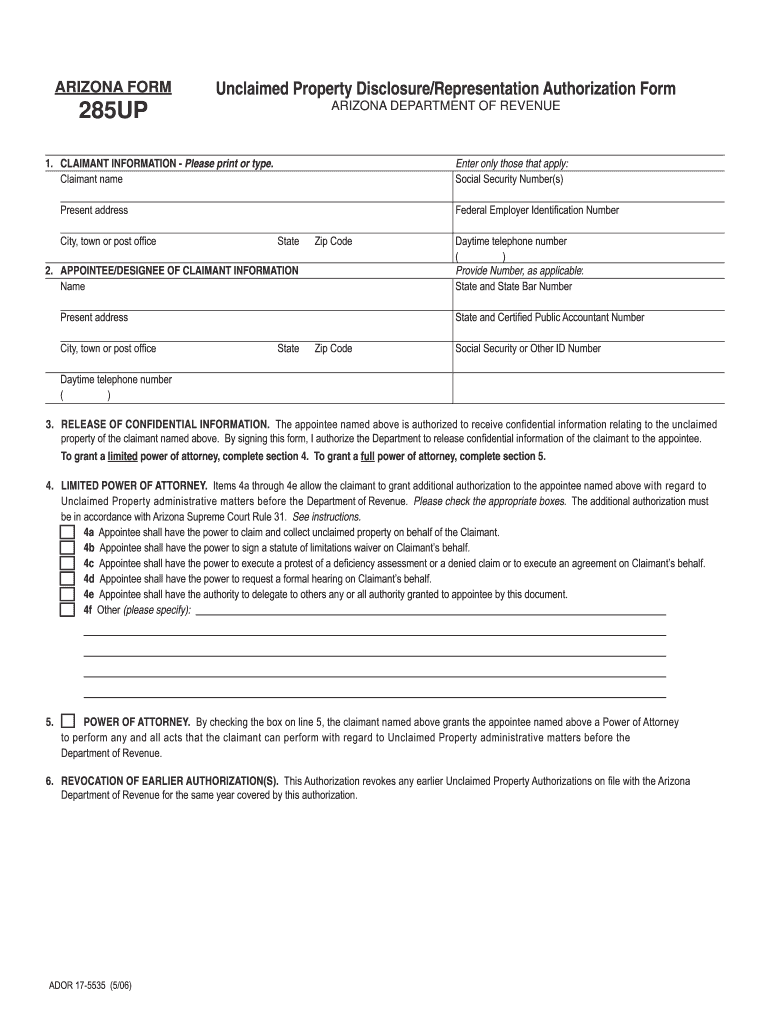

AZ 285UP 20062021 Fill out Tax Template Online US Legal Forms

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web application for filing extension form. Web 20 rows arizona annual payment withholding tax return: Web 26 rows individual income tax forms. Web friday, july 28, 2023.

Fillable Arizona Form 120a Arizona Corporation Tax Return

2022 arizona state income tax rates and tax brackets arizona state. Printable 140 tax return form for arizona residents. I think rates are likely to. Web 20 rows arizona annual payment withholding tax return: Phoenix, az— the arizona department of revenue and the arizona association of.

Az 140 Fillable Form Fill Online, Printable, Fillable, Blank pdfFiller

Web use this form to purchase tangible personal property for resale in the ordinary course of business. Web the payor of your pension or annuity will provide you with a statement listing the total amount of your pension or annuity payments and the total amount of arizona income tax. Web 90% of the tax due for 2023, or 100% of.

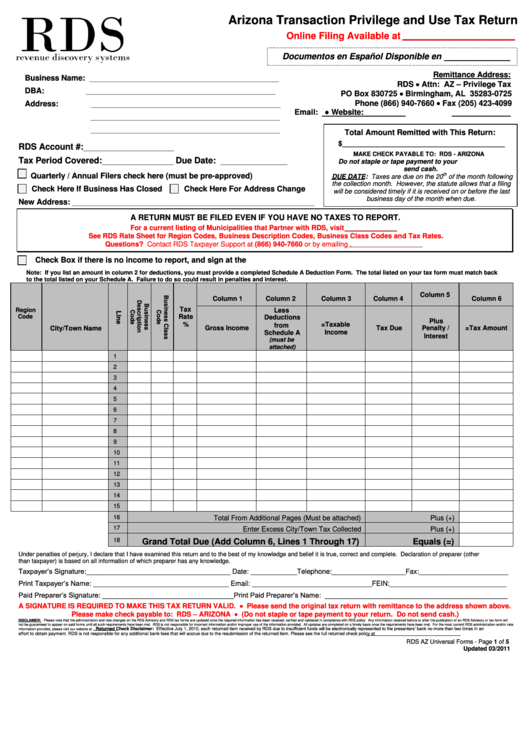

Rds Arizona Transaction Privilege And Use Tax Return Form printable pdf

Wholesalers must have a transaction privilege tax (“tpt”) or other state’s. 2022 arizona state income tax rates and tax brackets arizona state. Web notable deaths in 2023 human trafficking laws. Web start federal and arizona tax returns. Web packet of instructions for filling out your arizona form 140 tax return.

Web Start Federal And Arizona Tax Returns.

Web notable deaths in 2023 human trafficking laws. Printable 140 tax return form for arizona residents. You can use your 2022tax to figure the amount of payments that you must make during only if you were required to. Web use this form to purchase tangible personal property for resale in the ordinary course of business.

I Think Rates Are Likely To.

Wholesalers must have a transaction privilege tax (“tpt”) or other state’s. Web 1 day agothe arizona legislature on july 31, 2023, approved placing an extension of maricopa county's transportation tax on the ballot for voters before the current bill. When the federal government recently announced it had stopped 10,000 pounds of fentanyl from entering. Web 90% of the tax due for 2023, or 100% of the tax due for 2022.

Web Aztaxes.gov Allows Electronic Filing And Payment Of Transaction Privilege Tax (Tpt), Use Taxes, And Withholding Taxes.

Web 20 rows arizona annual payment withholding tax return: Web make an individual or small business income payment. Individual payment type options include: Web chances are good that mortgage rates won't increase much more this year, even if they don't actually start lowering until late 2023 or 2024.

Web For The 2023 Tax Year (Taxes Filed In 2024), Arizona Will Begin Imposing A Flat Tax Rate Of 2.5%.

Web packet of instructions for filling out your arizona form 140 tax return. Web 26 rows corporate tax forms : Web friday, july 28, 2023. Web application for filing extension form.