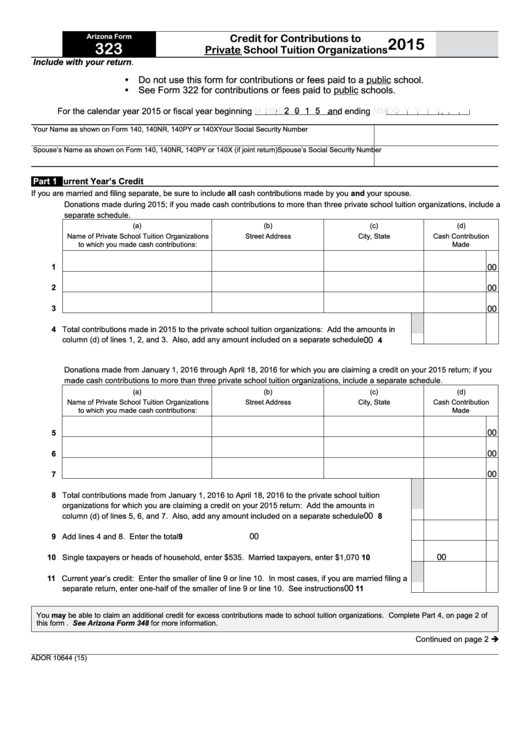

Arizona Form 323

Arizona Form 323 - The maximum original individual income tax credit donation amount for 2022: Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Web this tax credit is claimed on form 323. Do not use this form for cash contributions or fees paid to a. Web arizona form credit for contributions to 323private school tuition organizations2019 include with your return. Do not use this form for cash contributions or fees paid to a public school. Credit for contributions to private school tuition organizations keywords: Web or 2022 arizona income tax return. Web arizona form 323 credit for contributions to private school tuition organizations 2022 include with your return. Web arizona form 323 for calendar year filers:

Ador 10644 (19) az form 323 (2019) page 2 of 3 your name (as shown on page 1). Web 2011 arizona form 323. Web a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization credit claimed on. Credit for contributions to private school tuition organizations keywords: Web arizona form 323 author: Arizona department of revenue subject: Do not use this form for cash contributions or fees paid to a. Do not use this form for cash contributions or fees paid to a. Web 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year. You’ll need form 301 (summary of all arizona credits) and form.

Do not use this form for cash contributions or fees paid to a. Web 2011 arizona form 323. $623 single, married filing separate or head of household;. Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Web 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year. Arizona department of revenue subject: Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. If you’re filing paper tax returns, you’ll need a couple of short forms in order to claim your tax credits. Web arizona form 323 for calendar year filers, eligible cash contributions made to a private sto from january 1, 2019, to april 15, 2019, may be used as a tax credit on either the. Credit for contributions to private school tuition organizations keywords:

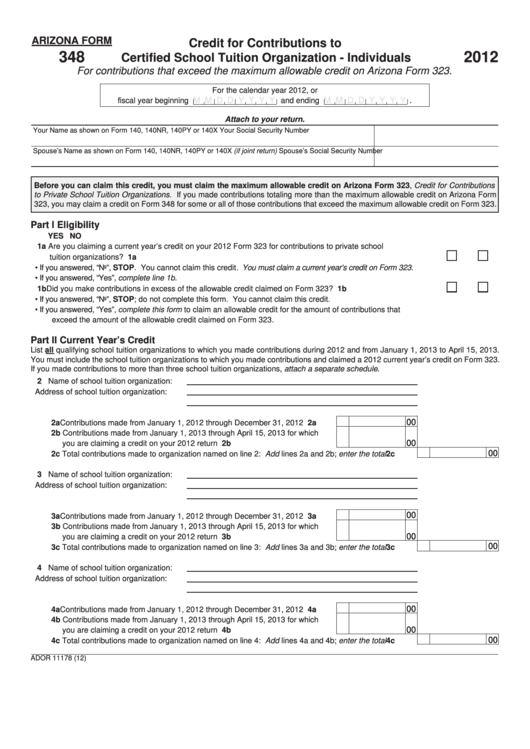

Fillable Arizona Form 348 Credit For Contributions To Certified

2017, download (540.45 kb),download (243.56 kb),. Arizona department of revenue subject: $623 single, married filing separate or head of household;. Web arizona form 323 credit for contributions to private school tuition organizations 2019 y y. Do not use this form for cash contributions or fees paid to a public school.

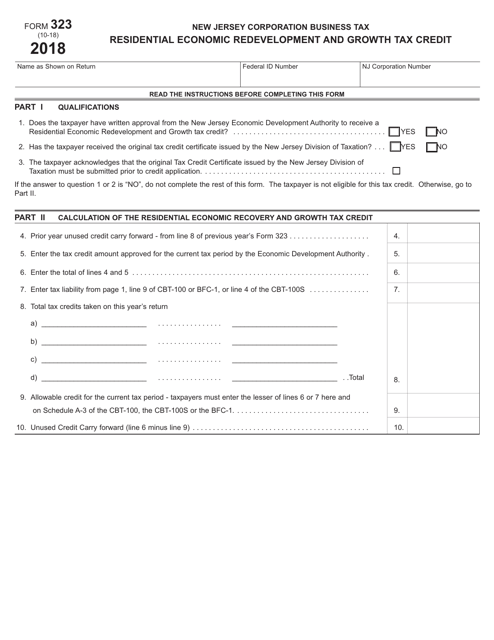

Form 323 Download Fillable PDF or Fill Online Residential Economic

Ador 10644 (19) az form 323 (2019) page 2 of 3 your name (as shown on page 1). Web arizona form 323 credit for contributions to private school tuition organizations 2019 y y. Credit for contributions to private school tuition organizations keywords: You’ll need form 301 (summary of all arizona credits) and form. Credit eligible cash contributions made to a.

Fillable Arizona Form 323 Credit For Contributions To Private School

Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. The maximum original individual income tax credit donation amount for 2022: Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. If you claim this credit in 2021 for a cash contribution.

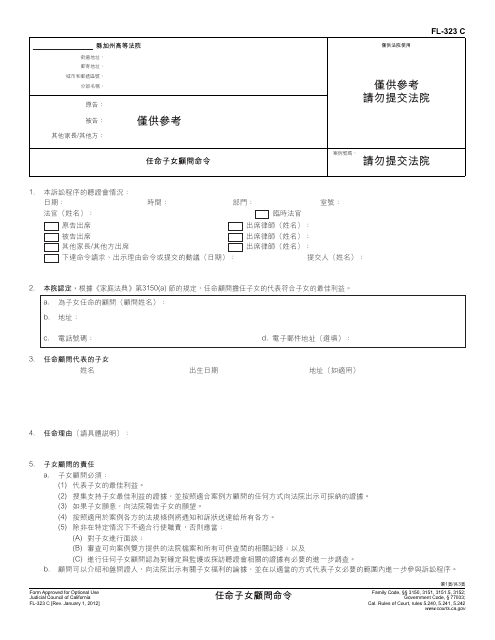

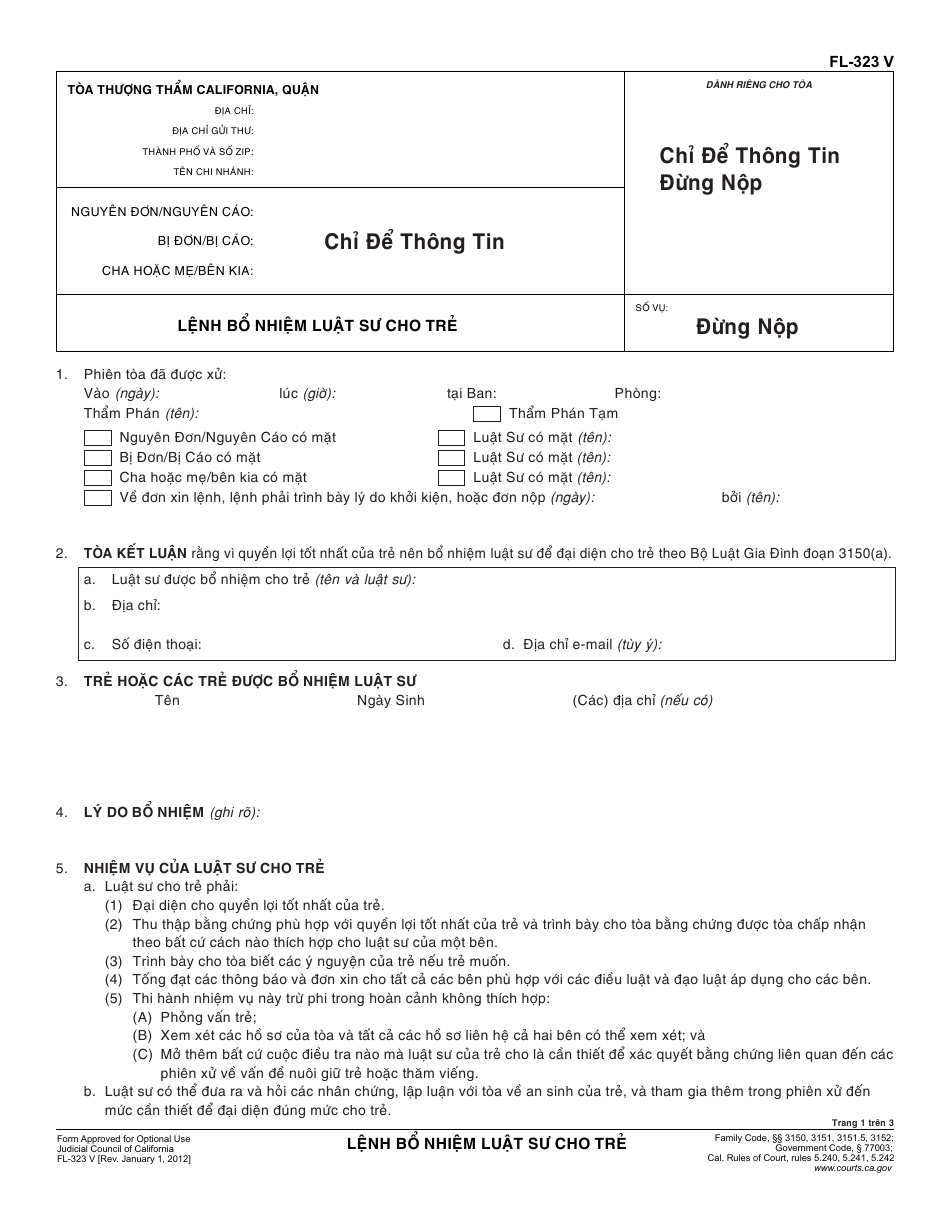

Form FL323 C Download Printable PDF or Fill Online Order Appointing

If you claim this credit in 2021 for a cash contribution made from january 1, 20, to 22april 18, 2022, you must make an adjustment on your. Web arizona form 323 for calendar year filers: Web credit for contributions toprivate school tuition organizations 2021 include with your return. Credit eligible cash contributions made to a private sto from january 1,.

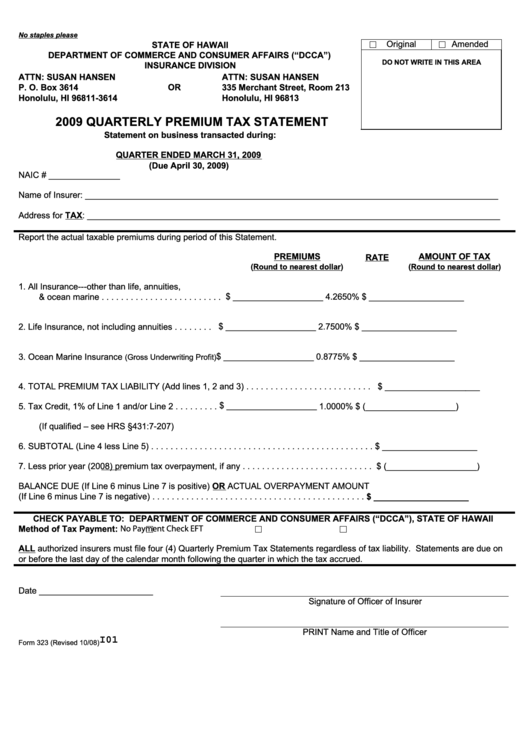

Form 323 Quarterly Premium Tax Statement 2009 printable pdf download

The maximum original individual income tax credit donation amount for 2022: Web this tax credit is claimed on form 323. Credit for contributions to private school tuition organizations keywords: Web arizona form 323 credit for contributions to private school tuition organizations 2019 y y. Web arizona form 323 credit for contributions to private school tuition organizations 2022 include with your.

Arizona Form 140IA Arizona Department Of Revenue Fill and Sign

Web arizona form 323 for calendar year filers, eligible cash contributions made to a private sto from january 1, 2019, to april 15, 2019, may be used as a tax credit on either the. Credit for contributions to private school tuition organizations keywords: Web or 2022 arizona income tax return. Web 2011 arizona form 323. Web arizona tax form 323.

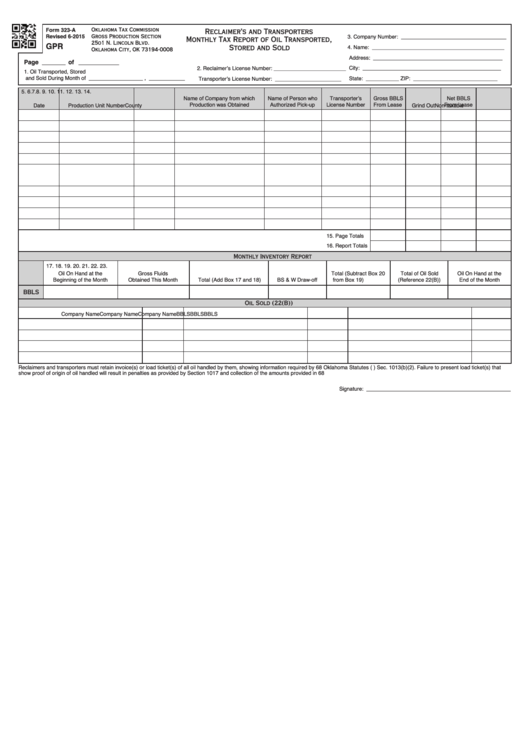

Form 323A Reclaimer'S And Transporters Monthly Tax Report Of Oil

Web arizona form 323 for calendar year filers: Credit for contributions to private school tuition organizations keywords: Web arizona form 323 author: Do not use this form for cash contributions or fees paid to a. Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return.

Form FL323 V Download Printable PDF or Fill Online Order Appointing

Web arizona form credit for contributions to 323private school tuition organizations2019 include with your return. Web arizona form 323 for calendar year filers: Web when filing, you can claim your credit for donations made to the original tax credit by using arizona form 323, donations made to the switcher (overflow/plus) tax credit can be. Do not use this form for.

Form 323 Download Printable PDF or Fill Online Residential Economic

Web or 2022 arizona income tax return. Web arizona form 323 for calendar year filers, eligible cash contributions made to a private sto from january 1, 2019, to april 15, 2019, may be used as a tax credit on either the. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be.

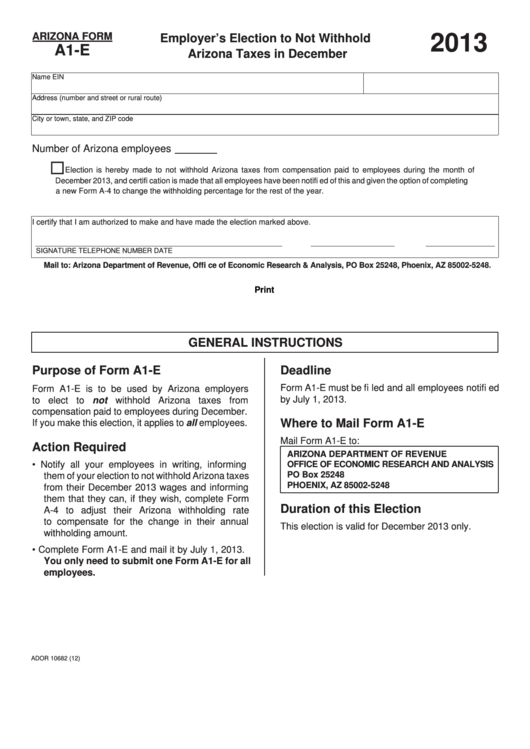

Fillable Arizona Form A1E Employer'S Election To Not Withhold

Do not use this form for cash contributions or fees paid to a. Web arizona form 323 credit for contributions to private school tuition organizations 2019 y y. Arizona department of revenue subject: You’ll need form 301 (summary of all arizona credits) and form. Web 323 either the current or preceding taxable year and is considered to have been made.

Web Arizona Form 323 Credit For Contributions To Private School Tuition Organizations 2019 Y Y.

Web credit for contributions toprivate school tuition organizations 2021 include with your return. You’ll need form 301 (summary of all arizona credits) and form. Web arizona form 323 for calendar year filers: Web arizona tax form 323 is created by turbotax when you indicate that you have made cash contributions to a private school tuition organization that provides scholarships or grants.

Web A Nonrefundable Individual Tax Credit For Cash Contributions To A School Tuition Organization That Exceed The Original Private School Tuition Organization Credit Claimed On.

Arizona department of revenue subject: Web or 2022 arizona income tax return. Web arizona form 323 credit for contributions to private school tuition organizations 2022 include with your return. Form year, form, instructions, published.

Web Arizona Form Credit For Contributions To 323Private School Tuition Organizations2019 Include With Your Return.

Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Ador 10644 (19) az form 323 (2019) page 2 of 3 your name (as shown on page 1). $623 single, married filing separate or head of household;. Web arizona form 323 author:

Web When Filing, You Can Claim Your Credit For Donations Made To The Original Tax Credit By Using Arizona Form 323, Donations Made To The Switcher (Overflow/Plus) Tax Credit Can Be.

Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. 2017, download (540.45 kb),download (243.56 kb),. Web arizona form 323 for calendar year filers, eligible cash contributions made to a private sto from january 1, 2019, to april 15, 2019, may be used as a tax credit on either the.