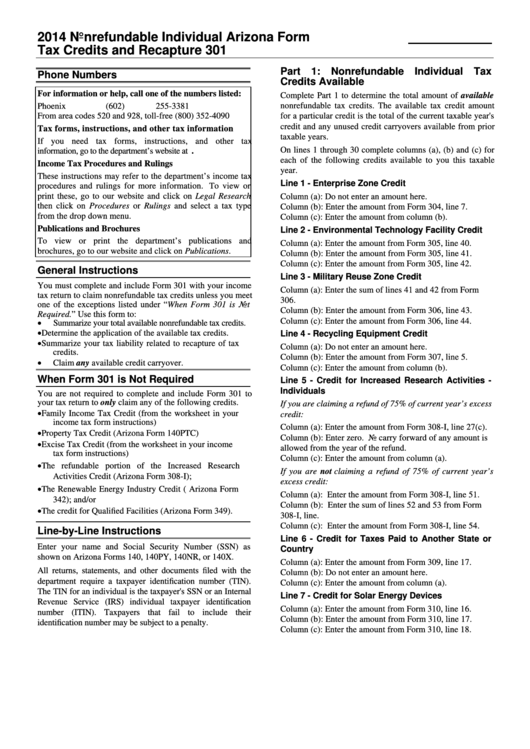

Arizona Form 301 Instructions

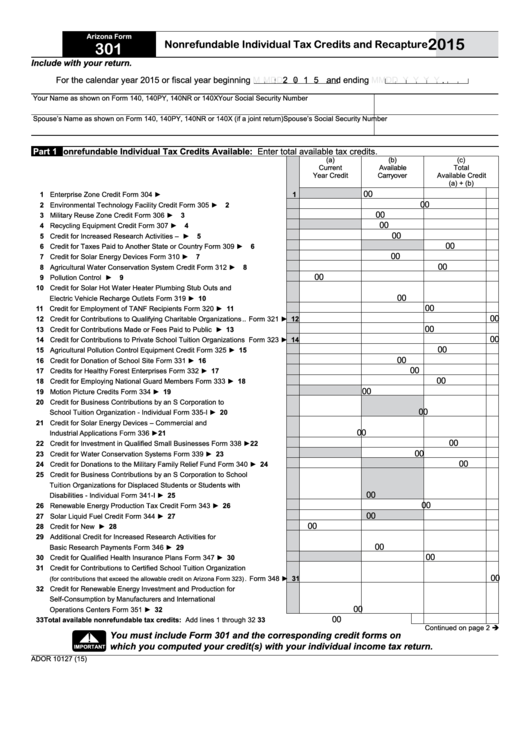

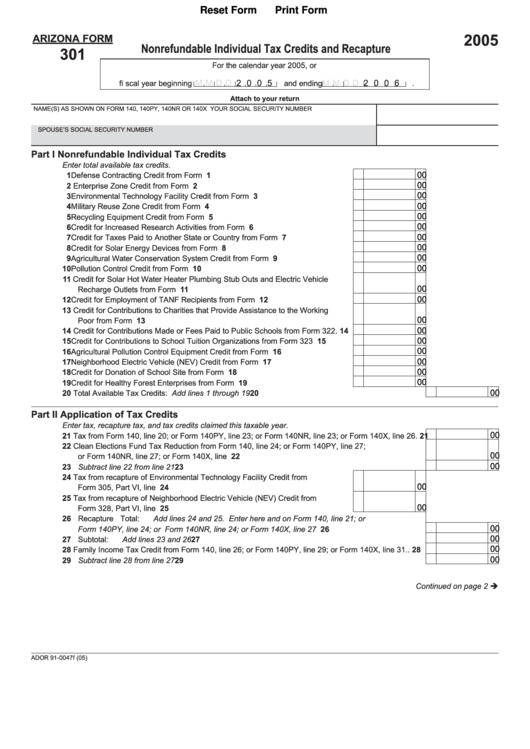

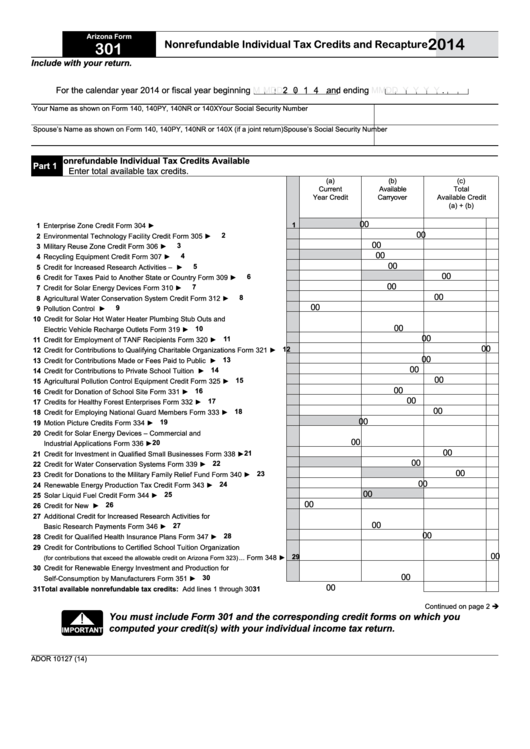

Arizona Form 301 Instructions - After completing arizona form 352, taxpayers will summarize all the tax credits they are claiming (foster care tax credit, private &. Web you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. Select a premium plan & get unlimited access to us legal forms. Web ador 10127 (20) a orm 301 2020 page 2 of 2 your name (as shown on page 1) your social security number part 2 application of tax credits and recapture: Include forms 301 and 323with your tax. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Arizona tax credit summary form 301. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. You are not required to complete and include form 301 with your tax return to. Web we last updated the nonrefundable individual tax credits and recapture in february 2023, so this is the latest version of form 301, fully updated for tax year 2022.

Web carryovers are not allowed for form 309 credit for taxes paid to another state or country and form 340 credit donations to the military family relief fund. Web ador 10127 (20) a orm 301 2020 page 2 of 2 your name (as shown on page 1) your social security number part 2 application of tax credits and recapture: Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. • dependent tax credit •. Get ready for tax season deadlines by completing any required tax forms today. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Arizona tax credit summary form 301. Fill, edit & sign forms. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the.

Summarization of taxpayer's application of. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. You are not required to complete and include form 301 with your tax return to. Nonrefundable corporate tax credits and. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Claim any of the following credits: Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim. Get ready for tax season deadlines by completing any required tax forms today. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Select a premium plan & get unlimited access to us legal forms.

Arizona Form 301 Nonrefundable Individual Tax Credits And Recapture

Fill, edit & sign forms. Also complete arizona form 301, nonrefundable individual tax credits and recapture, and. You are not required to complete and include form 301 with your tax return to. Claim any of the following credits: Web we last updated arizona form 301 in february 2023 from the arizona department of revenue.

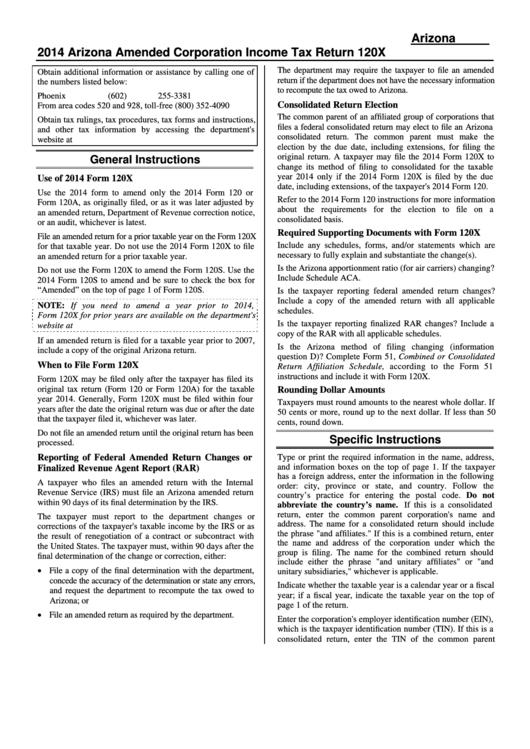

Instructions For Arizona Form 120x Arizona Amended Corporation

Web carryovers are not allowed for form 309 credit for taxes paid to another state or country and form 340 credit donations to the military family relief fund. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Web you must complete and include arizona form 301 and the credit form(s) with your arizona.

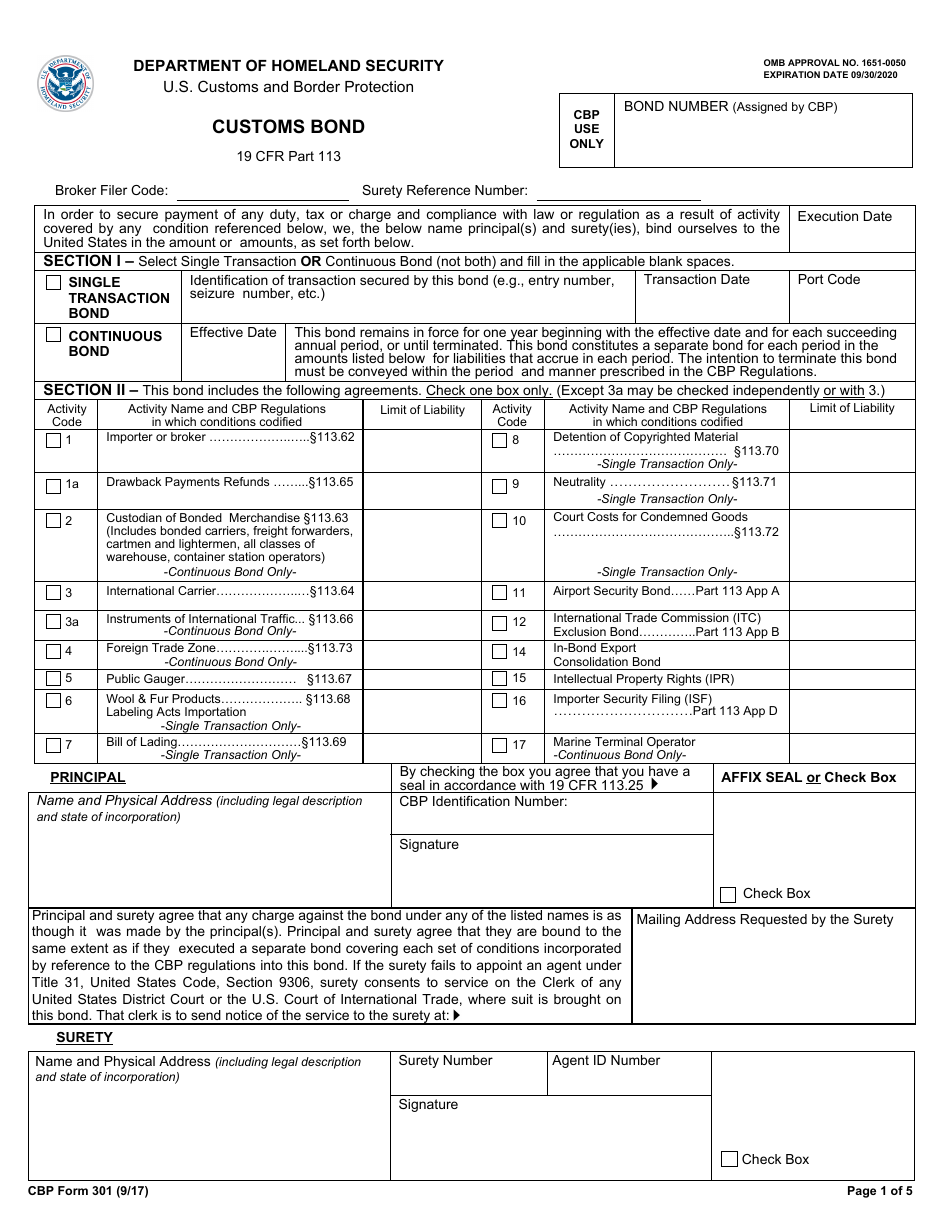

CBP Form 301 Download Fillable PDF or Fill Online Customs Bond

Fill, edit & sign forms. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim. Claim any of the following credits: Web 26 rows tax credits forms : Get ready for tax season deadlines by completing any required tax forms today.

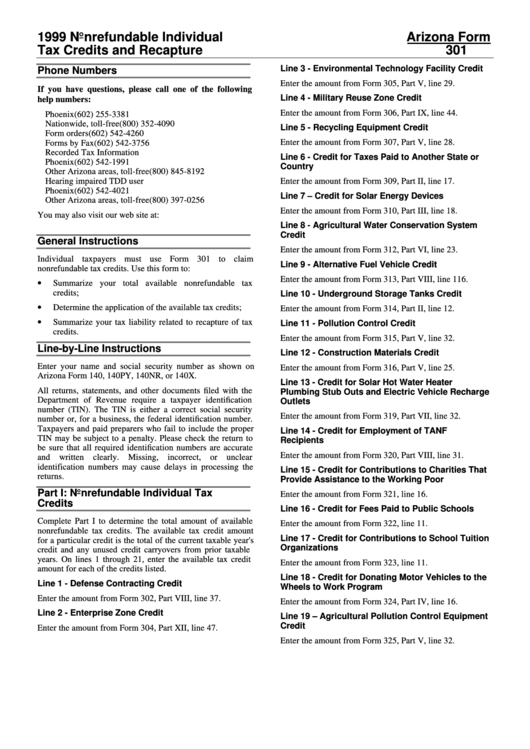

Arizona Form 301 Nonrefundable Individual Tax Credits And Recapture

You are not required to complete and include form 301 with your tax return to. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim. Arizona tax credit summary form 301. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web your name as shown on form 140, 140py, 140nr or 140x your social security number spouse’s name as shown on form 140, 140py, 140nr or 140x (if a joint return). Nonrefundable corporate tax credits and. Fill, edit & sign forms. Get ready.

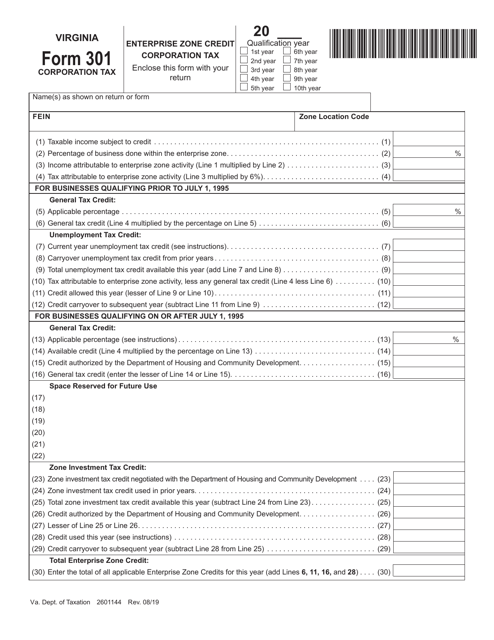

Form 301 Download Fillable PDF or Fill Online Enterprise Zone Credit

Include forms 301 and 323with your tax. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Nonrefundable corporate tax credits and. Ad register and subscribe now to work on your az dor form 301 & more fillable forms.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Web your name as shown on form 140, 140py, 140nr or 140x your social security number spouse’s name as shown on form 140, 140py, 140nr or 140x (if a joint return). You are not required to complete and include form 301 with your tax return to. Web you must complete and include arizona form 301 and the credit form(s) with.

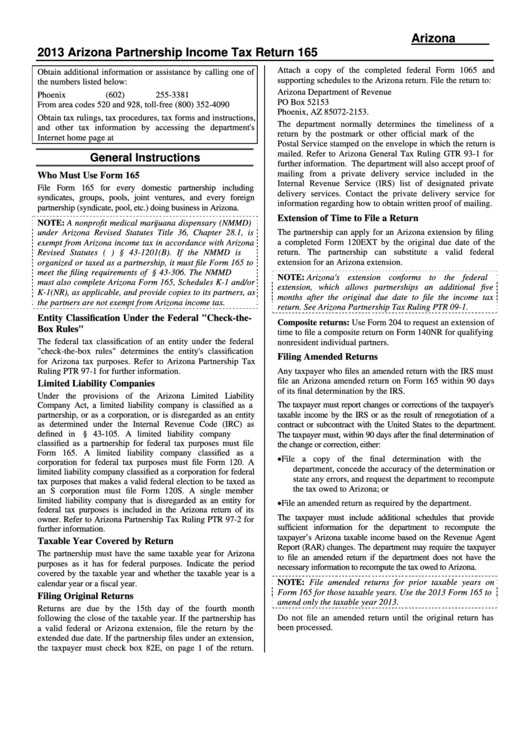

Instructions For Arizona Form 165 2013 printable pdf download

Web click here for form 352 and instructions. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Include forms 301 and 323with your tax. Claim any of the following credits: Web booklet includes arizona form 140nr, instructions and arizona schedule a(nr) arizona form 140nr income tax booklet;

Instructions For Arizona Form 120s Arizona S Corporation Tax

Web your name as shown on form 140, 140py, 140nr or 140x your social security number spouse’s name as shown on form 140, 140py, 140nr or 140x (if a joint return). Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web general instructions you must complete and include arizona form 301 with.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Web 24 rows nonrefundable individual tax credits and recapture. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim..

Fill, Edit & Sign Forms.

Web booklet includes arizona form 140nr, instructions and arizona schedule a(nr) arizona form 140nr income tax booklet; • dependent tax credit •. Web carryovers are not allowed for form 309 credit for taxes paid to another state or country and form 340 credit donations to the military family relief fund. Web general instructions you must complete and include arizona form 301 with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the.

Select A Premium Plan & Get Unlimited Access To Us Legal Forms.

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Arizona tax credit summary form 301. Web your name as shown on form 140, 140py, 140nr or 140x your social security number spouse’s name as shown on form 140, 140py, 140nr or 140x (if a joint return). Web we last updated the nonrefundable individual tax credits and recapture in february 2023, so this is the latest version of form 301, fully updated for tax year 2022.

Summarization Of Taxpayer's Application Of.

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim. Claim any of the following credits: Also complete arizona form 301, nonrefundable individual tax credits and recapture, and. Ad register and subscribe now to work on your az dor form 301 & more fillable forms.

You Are Not Required To Complete And Include Form 301 With Your Tax Return To.

Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Include forms 301 and 323with your tax. Web you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue.