Adp 401K Transfer Form

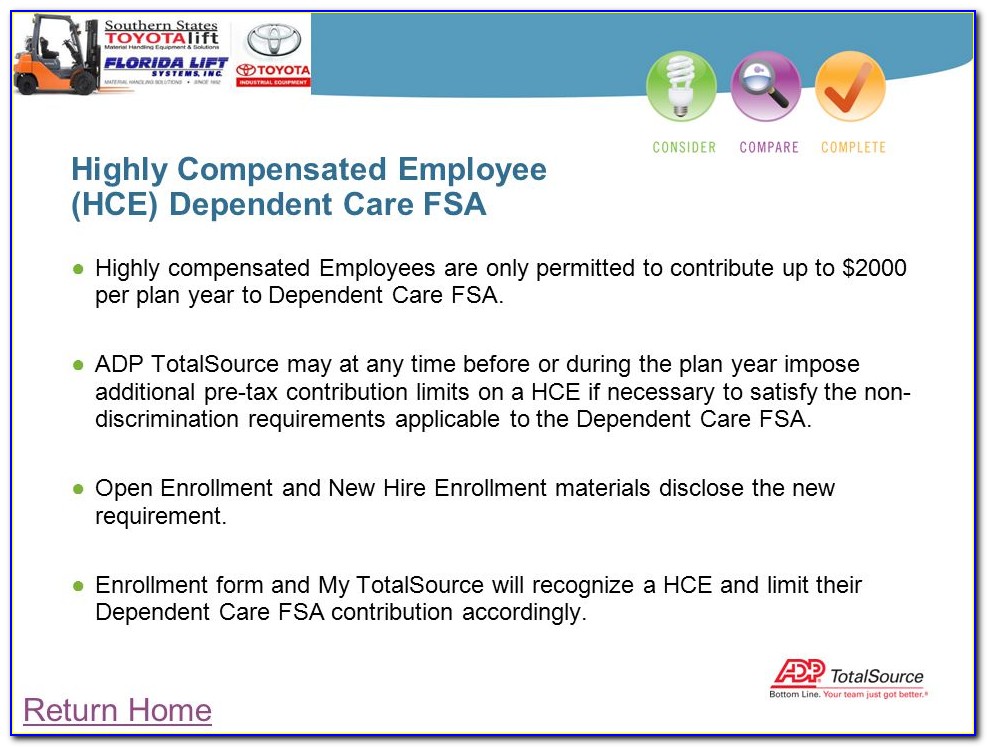

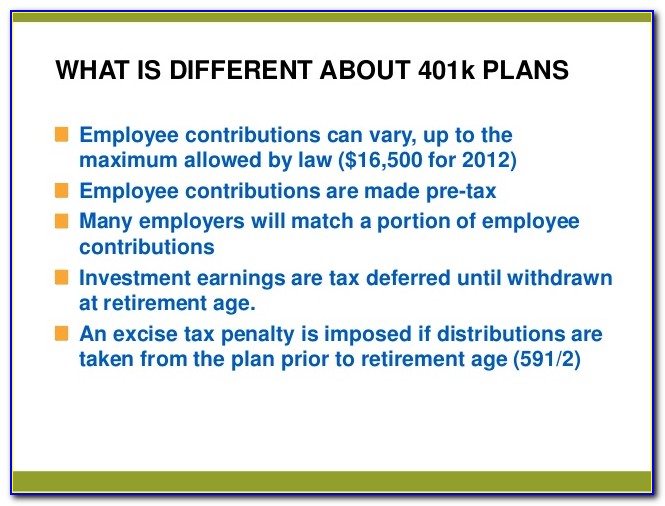

Adp 401K Transfer Form - Adp 401(k) enrollment it’s easy to save for retirement. You may get locked out of your account if you incorrectly enter login or security information a specified number of consecutive times. Web please use this form to authorize the fidelity advisor traditional ira, rollover ira, roth ira, simple ira, sep ira, or sarsep ira custodian (or its agent) to initiate a transfer of your existing ira directly from another ira custodian and to invest the transferred assets. Web a 401(k) plan may now be more affordable than ever, thanks to the recent secure 2.0 legislation passed in december 2022. Using a direct rollover, $55,000. Adp 401k rollover certification forms retirement plan distribution guide retirement plans. Web • for roth 401(k) rollover amounts: If you cannot wait for your account to be automatically. Web adp will proactively waive any transaction fees associated with these actions for participants in the impacted areas. Please refer to the distribution statement provided by prior 401(k) provider for this information.

Web how to complete a rollover follow these steps to complete the roll over process and move your account assets into your current plan. Adp 401k rollover certification forms retirement plan distribution guide retirement plans. You may also need to file form 8606. Please consult your tax advisor for further assistance. You will be locked for a period of time at which time you may try again. Using a direct rollover, $55,000. For example, you request a full distribution from your 401 (k), which has a balance of $55,000. Web you need to enable javascript to run this app. Adp helps organizations of all types and sizes unlock their potential. Roth assets from an employer sponsored plan.

You may get locked out of your account if you incorrectly enter login or security information a specified number of consecutive times. Small business employers with up to 50 employees are now eligible to receive a credit covering 100% of administrative expenses (up to. You will be locked for a period of time at which time you may try again. Web follow the steps to enter your registration code, verify your identity, get your user id and password, select your security questions, enter your contact information, and enter your activation code. Web how to complete a rollover follow these steps to complete the roll over process and move your account assets into your current plan. Web what is a 401(k) plan? Please refer to the distribution statement provided by prior 401(k) provider for this information. Access and manage your account online. Web whether you have questions about what a 401(k) plan is or are looking for ways to enhance your saving strategies, the adp 401(k) resource library can provide you with the information and resources to keep you on the road to retirement readiness. Web please use this form to authorize the fidelity advisor traditional ira, rollover ira, roth ira, simple ira, sep ira, or sarsep ira custodian (or its agent) to initiate a transfer of your existing ira directly from another ira custodian and to invest the transferred assets.

Adp 401K Login Fill Out and Sign Printable PDF Template signNow

You will then have the ability to review your information and complete. Web how to transfer 401k from adp to fidelity by rick w january 30, 2022 0 214 don't miss how are 401k withdrawals taxed august 2, 2022 how to get your 401k without penalty september 13, 2021 can i move a 401k to a roth ira november 22,..

ADP20190212.pdf Irs Tax Forms 401(K)

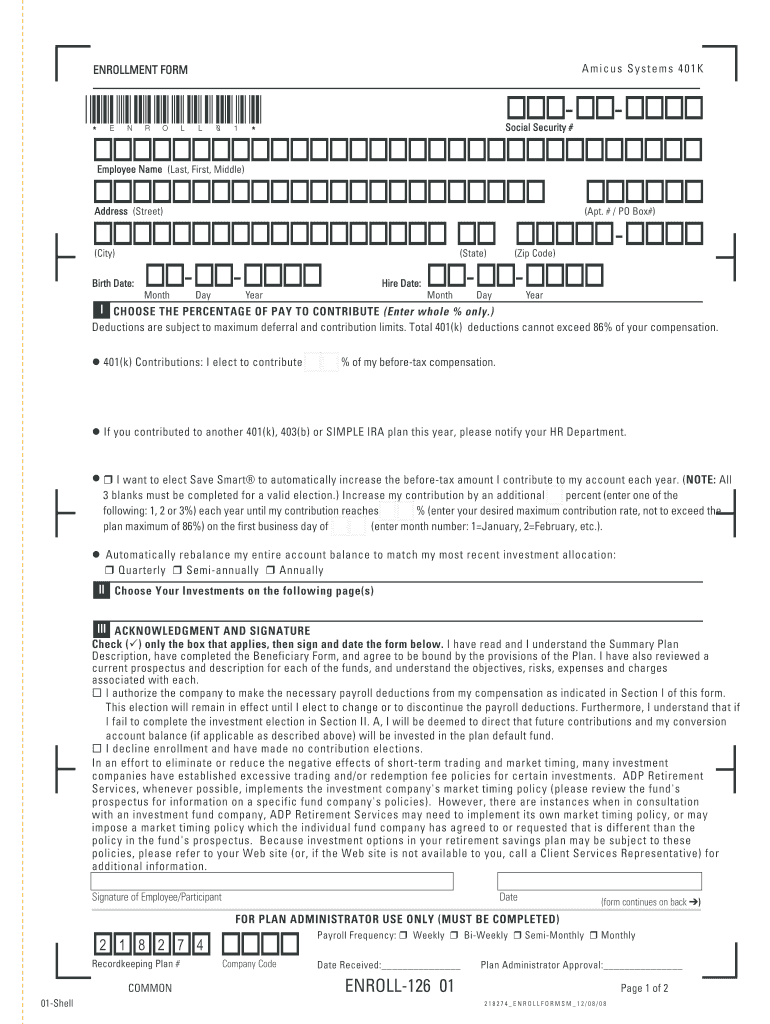

Access and manage your account online. Using a direct rollover, $55,000. Web enrolling in your retirement plan takes just minutes, and it’s one of the smartest things you can do for your financial future. Complete the contribution + earnings = total amount section. You will then have the ability to review your information and complete.

Adp 401k Loan Payoff Form Form Resume Examples qQ5MYwZ5Xg

Web follow the steps to enter your registration code, verify your identity, get your user id and password, select your security questions, enter your contact information, and enter your activation code. Web enrolling in your retirement plan takes just minutes, and it’s one of the smartest things you can do for your financial future. Web you need to enable javascript.

You And ADP 401k

Contact your previous employer to find out the steps you need to take and the paperwork required to roll your retirement assets into. You may get locked out of your account if you incorrectly enter login or security information a specified number of consecutive times. Web you need to enable javascript to run this app. Adp 401k rollover certification forms.

How To Transfer 401k From Prudential To Fidelity

You may get locked out of your account if you incorrectly enter login or security information a specified number of consecutive times. Please consult your tax advisor for further assistance. Web how to transfer 401k from adp to fidelity by rick w january 30, 2022 0 214 don't miss how are 401k withdrawals taxed august 2, 2022 how to get.

Adp 401k Loan Payoff Form Form Resume Examples qQ5MYwZ5Xg

For example, you request a full distribution from your 401 (k), which has a balance of $55,000. Web adp will proactively waive any transaction fees associated with these actions for participants in the impacted areas. Adp helps organizations of all types and sizes unlock their potential. Web how to transfer 401k from adp to fidelity by rick w january 30,.

Adp 401k Loan Payoff Form Form Resume Examples 9x8ra09V3d

For example, you request a full distribution from your 401 (k), which has a balance of $55,000. Web adp will proactively waive any transaction fees associated with these actions for participants in the impacted areas. Web how to transfer 401k from adp to fidelity by rick w january 30, 2022 0 214 don't miss how are 401k withdrawals taxed august.

Adp 401k Loan Payoff Form Form Resume Examples qQ5MYwZ5Xg

If you cannot wait for your account to be automatically. Adp 401k rollover kit contents: You may also need to file form 8606. Rollover adp 401k into a rollover ira. Web • for roth 401(k) rollover amounts:

John Hancock 401k Hardship Withdrawal Form Form Resume Examples

Please consult your tax advisor for further assistance. Web how to complete a rollover follow these steps to complete the roll over process and move your account assets into your current plan. You may also need to file form 8606. Web you need to enable javascript to run this app. Adp 401(k) enrollment it’s easy to save for retirement.

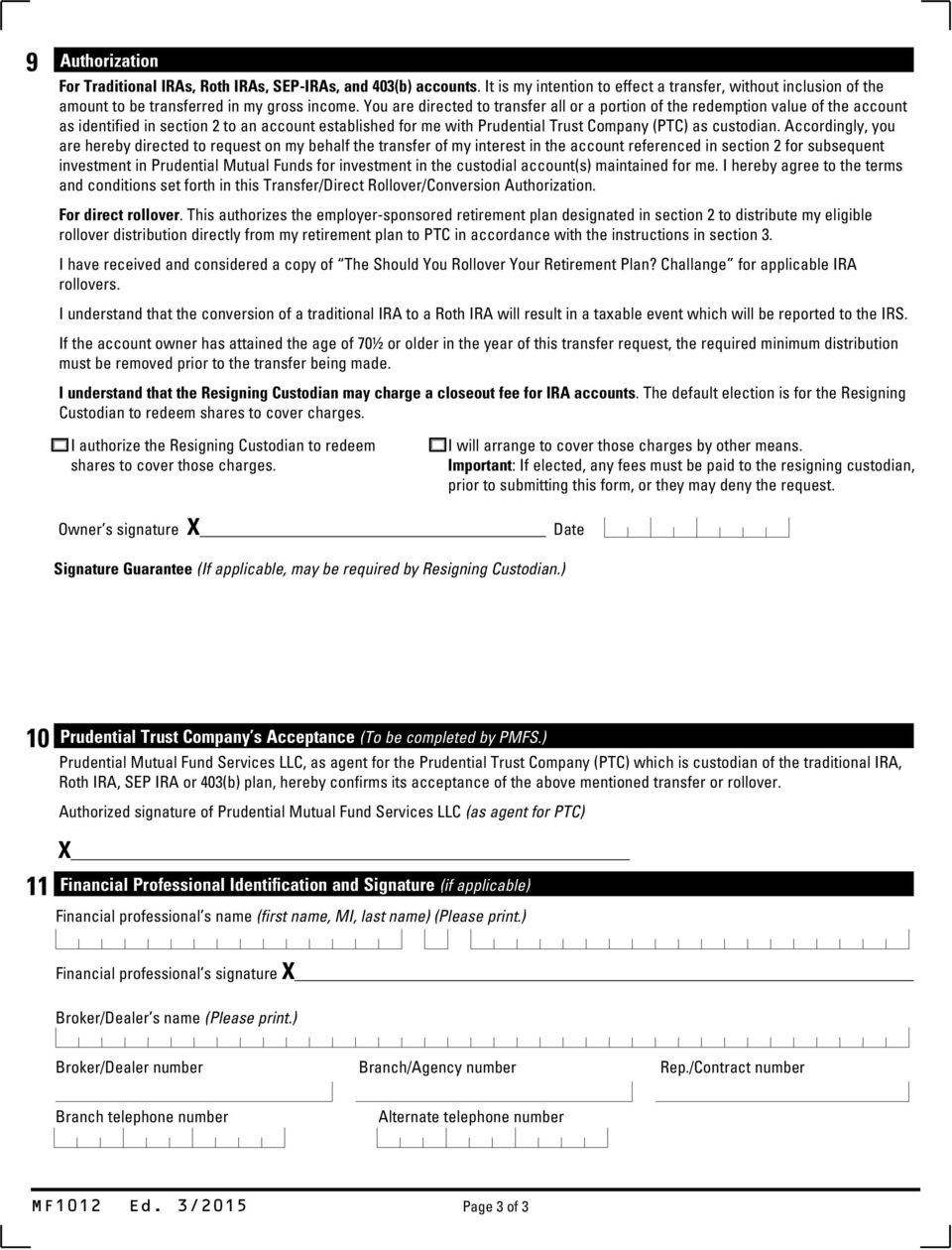

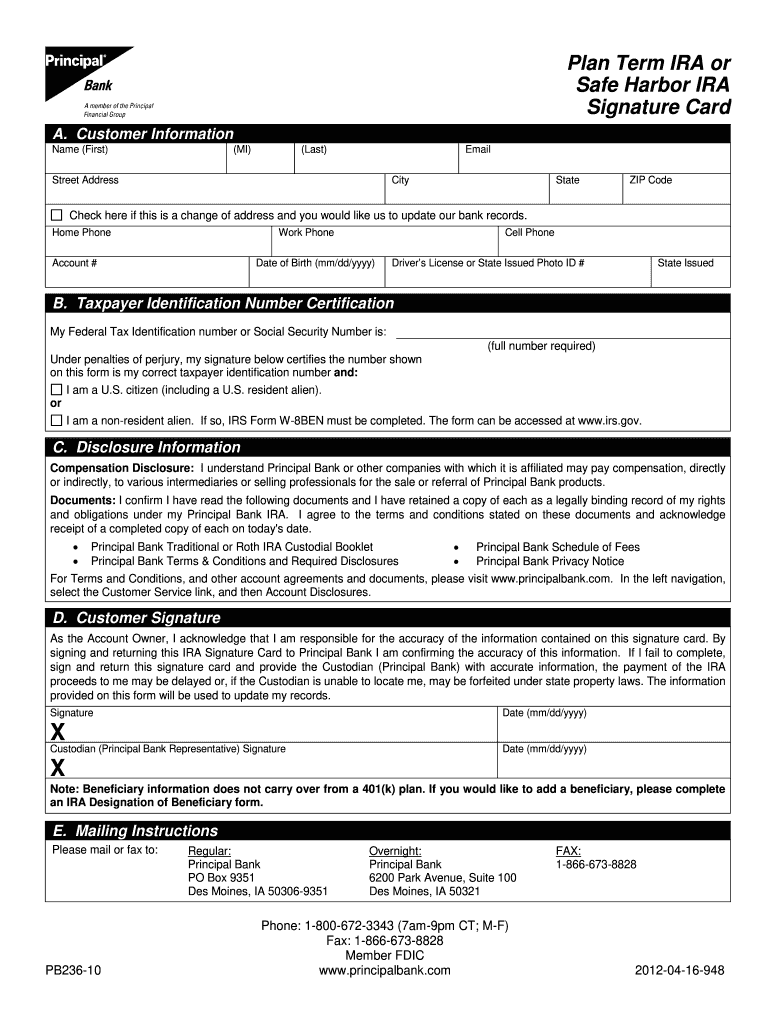

Plan term for safe harbor ira signature card fill up in form ira owner

Rollover adp 401k into a rollover ira. Adp helps organizations of all types and sizes unlock their potential. Using a direct rollover, $55,000. Web please use this form to authorize the fidelity advisor traditional ira, rollover ira, roth ira, simple ira, sep ira, or sarsep ira custodian (or its agent) to initiate a transfer of your existing ira directly from.

You Must File Form 5329 To Show That The Distribution Is Qualified.

If you cannot wait for your account to be automatically. Web whether you have questions about what a 401(k) plan is or are looking for ways to enhance your saving strategies, the adp 401(k) resource library can provide you with the information and resources to keep you on the road to retirement readiness. Web how to complete a rollover follow these steps to complete the roll over process and move your account assets into your current plan. Web • for roth 401(k) rollover amounts:

• Indicate The Year Your Roth 401(K) Contributions Began.

Web follow the steps to enter your registration code, verify your identity, get your user id and password, select your security questions, enter your contact information, and enter your activation code. For example, you request a full distribution from your 401 (k), which has a balance of $55,000. Small business employers with up to 50 employees are now eligible to receive a credit covering 100% of administrative expenses (up to. Roth assets from an employer sponsored plan.

Web How To Transfer 401K From Adp To Fidelity By Rick W January 30, 2022 0 214 Don't Miss How Are 401K Withdrawals Taxed August 2, 2022 How To Get Your 401K Without Penalty September 13, 2021 Can I Move A 401K To A Roth Ira November 22,.

Web please use this form to authorize the fidelity advisor traditional ira, rollover ira, roth ira, simple ira, sep ira, or sarsep ira custodian (or its agent) to initiate a transfer of your existing ira directly from another ira custodian and to invest the transferred assets. Please consult your tax advisor for further assistance. Please refer to the distribution statement provided by prior 401(k) provider for this information. Contact your previous employer to find out the steps you need to take and the paperwork required to roll your retirement assets into.

Adp 401K Rollover Certification Forms Retirement Plan Distribution Guide Retirement Plans.

You will then have the ability to review your information and complete. Adp helps organizations of all types and sizes unlock their potential. Rollover adp 401k into a rollover ira. Web adp will proactively waive any transaction fees associated with these actions for participants in the impacted areas.