Address To Send Form 4868

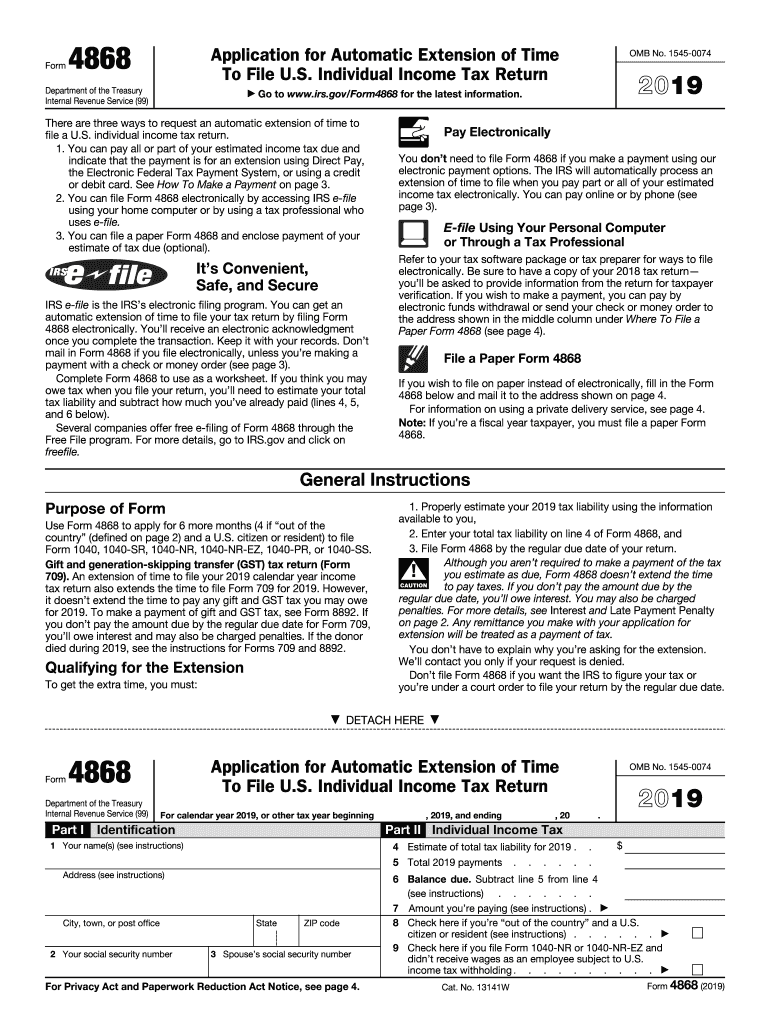

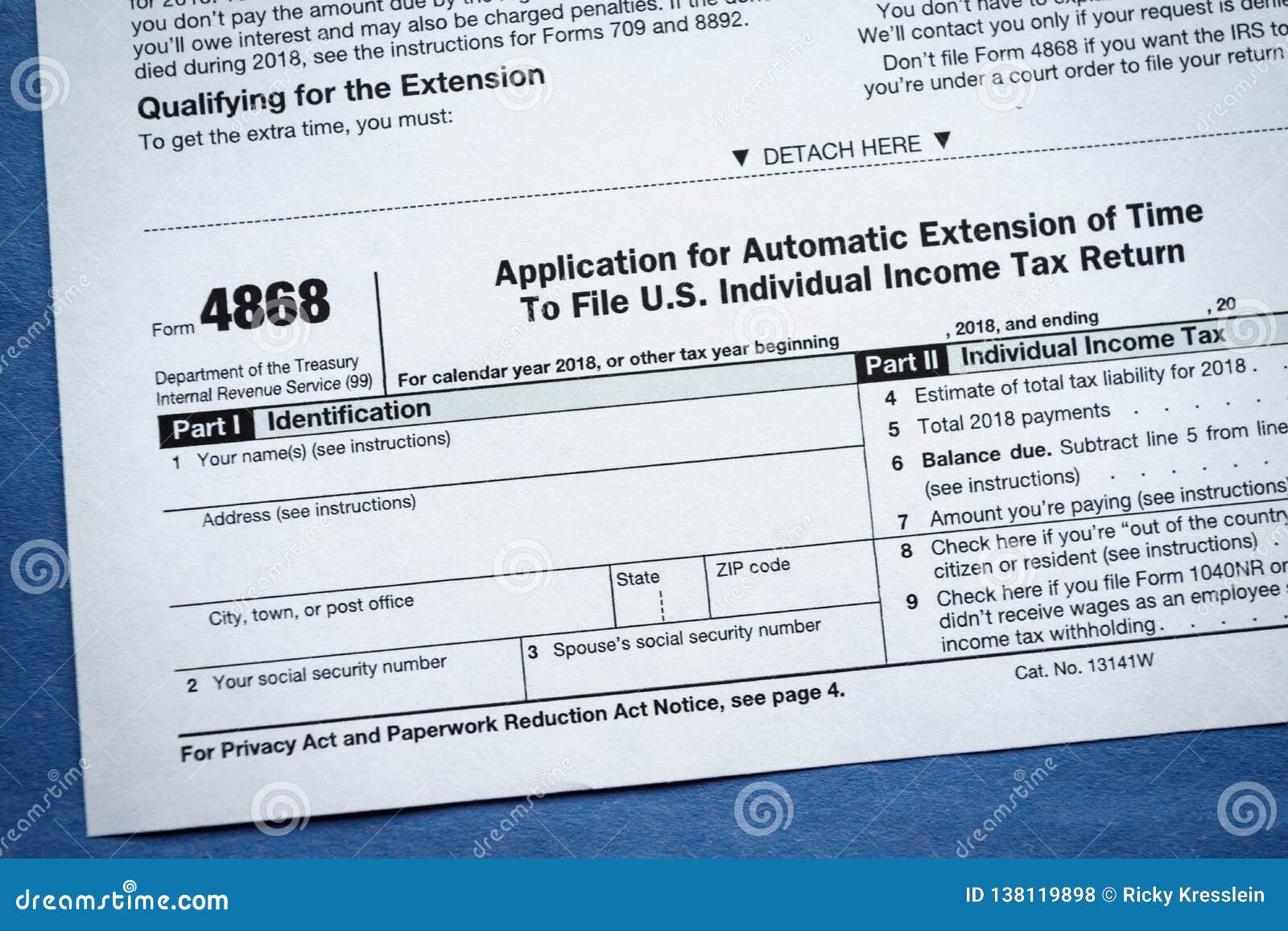

Address To Send Form 4868 - Be sure to make your check or money order payable. If the taxpayer is mailing form 4868 without. Web form 4868 is only a half page. The list includes individuals, businesses, and estates. Citizen or resident files this form to request an automatic extension of time to file a u.s. Web mailing addresses for form 4868 extensions the taxpayer should keep one copy of the completed form 4868 for their records. Current revision form 4868pdf about. When paper filing form 4868, the. It doesn't require a date or signature. Web use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under taxpayers who are out of the country) and a u.s.

Web alabama, florida, georgia, louisiana, mississippi, north carolina, south carolina, and tennessee: You don't have to give a reason for requesting an extension. Web if you intend to mail in your payment with your extension, you will need to print and mail your form 4868 with the payment. All you have to provide is: Depending on your situation, it. Individual income tax return special rules may apply if you are: Web irs form 4868: An irs form that must be submitted by individuals who wish to extend the amount of time they have to file their tax returns. Web mailing addresses for form 4868 extensions the taxpayer should keep one copy of the completed form 4868 for their records. Web form 4868 is a federal individual income tax form.

Web form 4868 filing addresses for taxpayers who are permanent residents of guam or the u.s. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web alabama, florida, georgia, louisiana, mississippi, north carolina, south carolina, and tennessee: 1.0k views | last modified 3/7/2023 2:02:13 am est. It doesn't require a date or signature. Citizen or resident) to file form 1040,. An irs form that must be submitted by individuals who wish to extend the amount of time they have to file their tax returns. If the taxpayer is mailing form 4868 without. Web irs form 4868: Current revision form 4868pdf about.

Catch Irs W9 2020 Pdf Calendar Printables Free Blank

Individual income tax return special rules may apply if you are: An irs form that must be submitted by individuals who wish to extend the amount of time they have to file their tax returns. Web form 4868 is a federal individual income tax form. Individual income tax return,” is a form that taxpayers can file with the irs if..

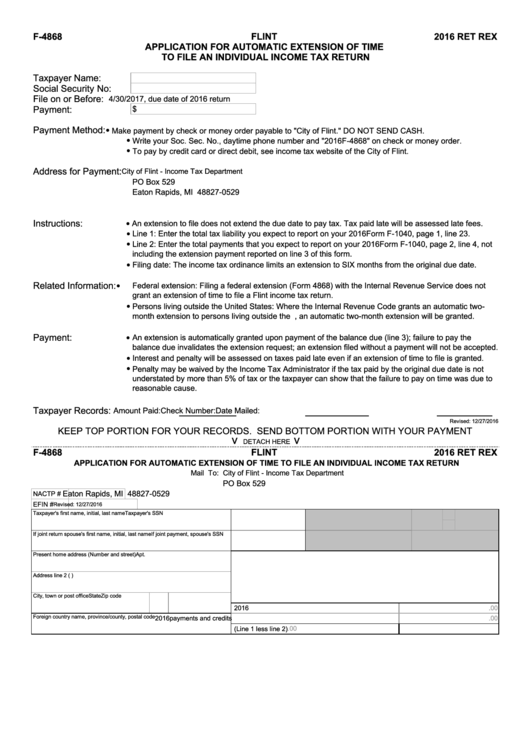

F4868 Flint Application For Automatic Extension Of Time To File An

Web form 4868 is only a half page. Individual income tax return,” is a form that taxpayers can file with the irs if. Irs form 4868 should be. Select this address if you are a. Web use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under taxpayers who are out of the.

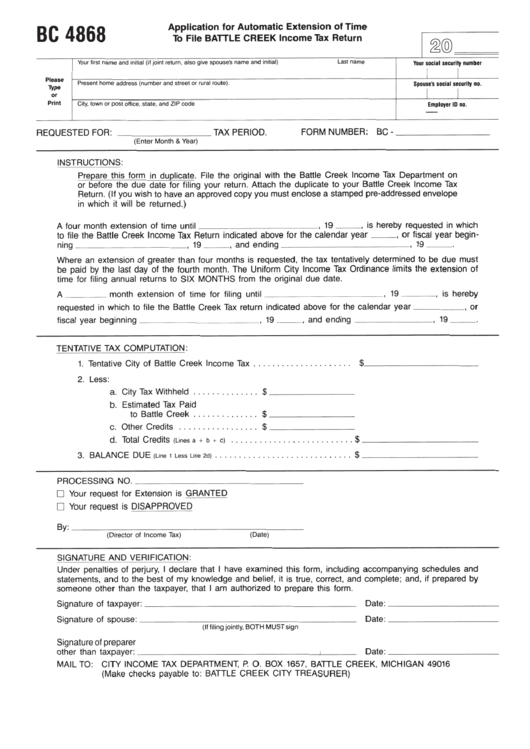

Form Bc 4868 Application Form For Automatic Extension Of Time To File

Web who can file anyone required to file a federal income tax return can file irs tax form 4868. If the taxpayer is mailing form 4868 without. 1.0k views | last modified 3/7/2023 2:02:13 am est. When paper filing form 4868, the. You don't have to give a reason for requesting an extension.

How to file form 4868 IRS Extension YouTube

An irs form that must be submitted by individuals who wish to extend the amount of time they have to file their tax returns. Web form 4868 is a federal individual income tax form. All you have to provide is: When paper filing form 4868, the. You don't have to give a reason for requesting an extension.

IRS Form 4868 Online File 2020 IRS 4868

Be sure to make your check or money order payable. Web where do i mail the paper copy of 4868? Select this address if you are a. Citizen or resident) to file form 1040,. Individual income tax return special rules may apply if you are:

Learn How to Fill the Form 4868 Application for Extension of Time To

Individual income tax return special rules may apply if you are: Web form 4868 is only a half page. Web alabama, florida, georgia, louisiana, mississippi, north carolina, south carolina, and tennessee: You don't have to give a reason for requesting an extension. Web form 4868, also known as an “application for automatic extension of time to file u.s.

IRS Form 4868 Mailing Address Where to Mail Form 4868

Depending on your situation, it. Web form 4868, application for automatic extension of time to file u.s. An irs form that must be submitted by individuals who wish to extend the amount of time they have to file their tax returns. Web form 4868 is only a half page. Web use form 4868 to apply for 6 more months (4.

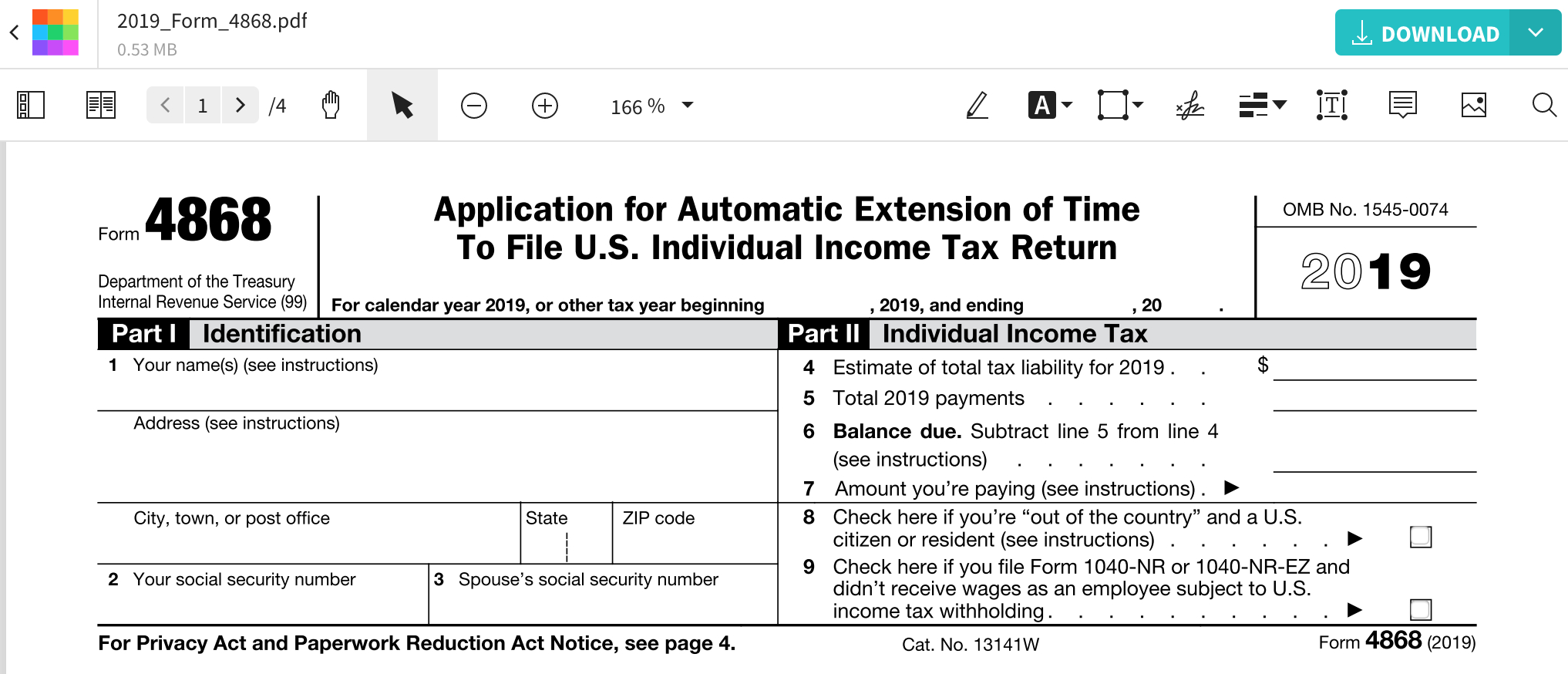

2019 Form IRS 4868 Fill Online, Printable, Fillable, Blank pdfFiller

Be sure to make your check or money order payable. Irs form 4868 should be. It doesn't require a date or signature. Web form 4868 filing addresses for taxpayers who are permanent residents of guam or the u.s. Web who can file anyone required to file a federal income tax return can file irs tax form 4868.

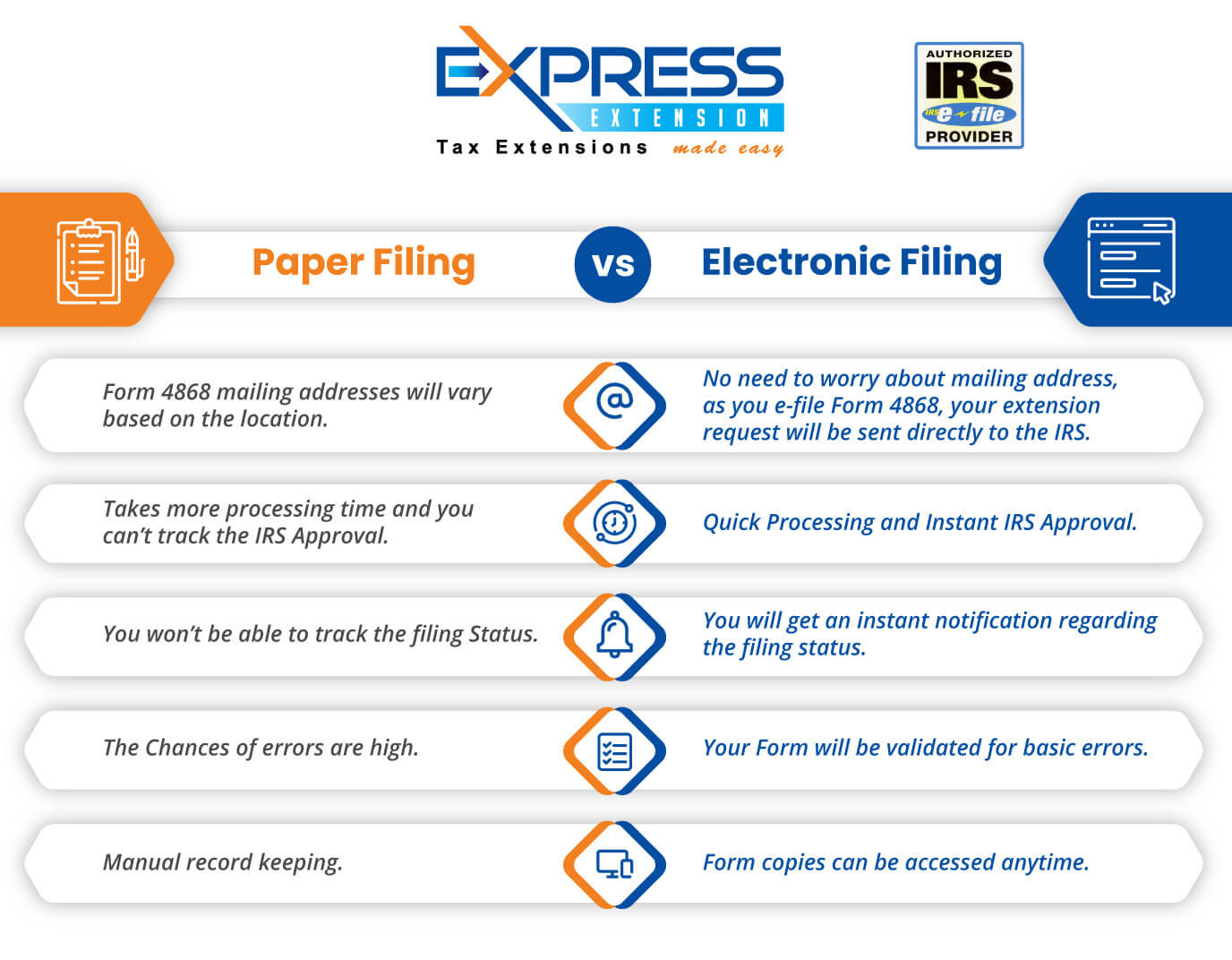

EFile IRS Form 4868 File Personal Tax Extension Online

Be sure to make your check or money order payable. Web who can file anyone required to file a federal income tax return can file irs tax form 4868. All you have to provide is: You don't have to give a reason for requesting an extension. The list includes individuals, businesses, and estates.

Form 4868 Application for Automatic Extension of Time To File U.S

Web irs form 4868: Web where do i mail the paper copy of 4868? Select this address if you are a. Web use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under taxpayers who are out of the country) and a u.s. Depending on your situation, it.

Individual Income Tax Return Special Rules May Apply If You Are:

When paper filing form 4868, the. Web where do i mail the paper copy of 4868? Be sure to make your check or money order payable. Select this address if you are a.

Web Alabama, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, And Tennessee:

Irs form 4868 should be. Citizen or resident) to file form 1040,. Citizen or resident files this form to request an automatic extension of time to file a u.s. An irs form that must be submitted by individuals who wish to extend the amount of time they have to file their tax returns.

Current Revision Form 4868Pdf About.

You don't have to give a reason for requesting an extension. Web who can file anyone required to file a federal income tax return can file irs tax form 4868. Web form 4868, application for automatic extension of time to file u.s. Web form 4868, also known as an “application for automatic extension of time to file u.s.

Web Form 4868 Is A Federal Individual Income Tax Form.

Web mailing addresses for form 4868 extensions the taxpayer should keep one copy of the completed form 4868 for their records. Web form 4868 is only a half page. Web use form 4868 to apply for 6 more months (4 if “out of the country” (defined later under taxpayers who are out of the country) and a u.s. Individual income tax return,” is a form that taxpayers can file with the irs if.