Accounting Chapter 4

Accounting Chapter 4 - This transaction would be journalized with a debit to the. Below is a table demonstrating the basic form of a worksheet and the five steps for preparing it. Advanced accounting 12th edition hoyle, schaefer, & doupnik mcgraw hil. Web the first digit of account numbers for accounts in the owner's equity ledger division is 3. Revenue basis accounting and more. Web accrual basis accounting b. Welcome to the world of accounting ; Recording transactions in a journal. Web the importance of business liquidity and the concept of an operating cycle. 1.2 identify users of accounting information and how they apply information;

The sum of direct labor, factory depreciation expense, and utility expense. Other sets by this creator. The company should use process costing. Because an account form has columns for the debit and credit balance of an account, it is often referred to as the balance. 8—conceptual framework for financial reporting—chapter 4… Web the importance of business liquidity and the concept of an operating cycle. Information for each transaction recorded in a journal. The income statement shows the net income or loss as a result of revenue and expense activities occurring in a period. This transaction would be journalized with a debit to the. Web a form for recording transactions in chronological order.

Because an account form has columns for the debit and credit balance of an account, it is often referred to as the balance. Web 4.5 prepare financial statements using the adjusted trial balance income statement: Web accounting test chapter 4. 1.3 describe typical accounting activities and the role accountants play in identifying, recording, and reporting financial activities Below is a table demonstrating the basic form of a worksheet and the five steps for preparing it. Web the first digit of account numbers for accounts in the owner's equity ledger division is 3. The company should use process costing. Welcome to the world of accounting ; The framework of financial accounting concepts and standards. 8—conceptual framework for financial reporting—chapter 4…

Accounting Chapter 4 Lecture 04

1.3 describe typical accounting activities and the role accountants play in identifying, recording, and reporting financial activities Because an account form has columns for the debit and credit balance of an account, it is often referred to as the balance. The goal of accounting is to help people make better decisions about an organization than would be the case w/o.

Accounting Chapter 4 Review YouTube

Accounting basis in which companies record, in the periods in which the events occur, transactions that change a company's financial statements, even if cash was not exchanged. The conversion cost is $72,000: Web entries help achieve the goals of accrual accounting by recognizing revenue when it is earned and recognizing expenses when the related goods or services are used. The.

?I need help with Financial Accounting Chapter 4

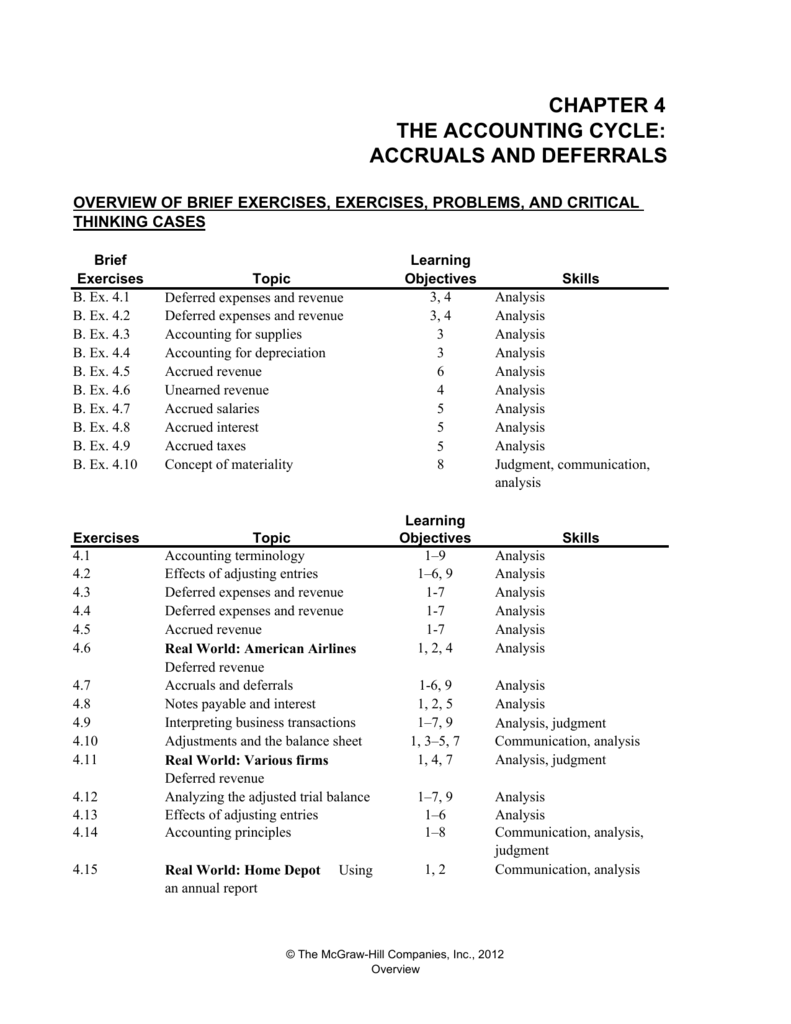

The framework of financial accounting concepts and standards. Since there are many similar items, process costing is a better fit than job order costing. Web chapter 4 completing the accounting cycle assignment classification table. Advanced accounting 12th edition hoyle, schaefer, & doupnik mcgraw hil. 1.3 describe typical accounting activities and the role accountants play in identifying, recording, and reporting financial.

Show Works, Please Answers To Cengage Accounting Homework Chapter 4

Web entries help achieve the goals of accrual accounting by recognizing revenue when it is earned and recognizing expenses when the related goods or services are used. Chapter 4 5.0 (1 review) a company makes a $1000 payment to supplies mart, to pay the outstanding balance on account. 6, 7, 8, 9, 11 4, 5, 6, 7 2 4… Other.

Solved Continuing Problem Chapter 4Instruction 3 Post the

The conversion cost is $72,000: The expense recognition principle requires that expenses follow the revenue. Bu247 ch1 q and a. Web accounting test chapter 4. These entries are passed by the company to changes its accounting records into the accruals concepts.

Accounting Chapter 4 Study Guide True And False Study Poster

Accounting basis in which companies record, in the periods in which the events occur, transactions that change a company's financial statements, even if cash was not exchanged. The framework of financial accounting concepts and standards. Click the card to flip 👆. Special issues for merchants ; 6, 7, 8, 9, 11 4, 5, 6, 7 2 4…

Accounting Chapter 4 Study Guide True And False Study Poster

Study with quizlet and memorize flashcards containing terms like which type of. Web accrual basis accounting b. Since there are many similar items, process costing is a better fit than job order costing. Web the first digit of account numbers for accounts in the owner's equity ledger division is 3. Web 4.5 prepare financial statements using the adjusted trial balance.

chapter 4 the accounting cycle accruals and deferrals

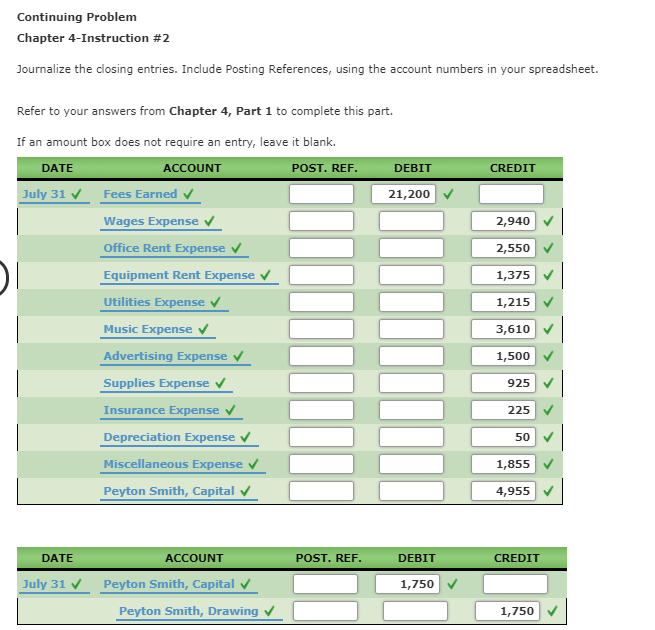

Web chapter 4 completing the accounting cycle assignment classification table. Since there are many similar items, process costing is a better fit than job order costing. Bu247 ch1 q and a. The expense recognition principle requires that expenses follow the revenue. Information for each transaction recorded in a journal.

Century 21 Accounting Chapter 4 Study Guide Answers Study Poster

Web accrual basis accounting b. Below is a table demonstrating the basic form of a worksheet and the five steps for preparing it. Advanced accounting 12th edition hoyle, schaefer, & doupnik mcgraw hil. 8—conceptual framework for financial reporting—chapter 4… Welcome to the world of accounting ;

?I need help with Financial Accounting Chapter 4

Web a form for recording transactions in chronological order. Study with quizlet and memorize flashcards containing terms like which type of. Web accrual basis accounting b. Revenue basis accounting and more. Web the first digit of account numbers for accounts in the owner's equity ledger division is 3.

Welcome To The World Of Accounting ;

Recording transactions in a journal. The sum of direct labor, factory depreciation expense, and utility expense. Other sets by this creator. The expense recognition principle requires that expenses follow the revenue.

Web Accounting Chapter 4 True Or False.

Web the importance of business liquidity and the concept of an operating cycle. Web accounting test chapter 4. Web comparability in international accounting standards. Because an account form has columns for the debit and credit balance of an account, it is often referred to as the balance.

The Income Statement Shows The Net Income Or Loss As A Result Of Revenue And Expense Activities Occurring In A Period.

1.2 identify users of accounting information and how they apply information; A journal with two amount. Accounting basis in which companies record, in the periods in which the events occur, transactions that change a company's financial statements, even if cash was not exchanged. Web the first digit of account numbers for accounts in the owner's equity ledger division is 3.

The Framework Of Financial Accounting Concepts And Standards.

Web a form for recording transactions in chronological order. Below is a table demonstrating the basic form of a worksheet and the five steps for preparing it. 8—conceptual framework for financial reporting—chapter 4… Web entries help achieve the goals of accrual accounting by recognizing revenue when it is earned and recognizing expenses when the related goods or services are used.