990 Form Due Date

990 Form Due Date - Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. Web upcoming 2023 form 990 deadline: If the due date falls on a saturday, sunday, or. Due to the large volume. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. If your tax year ended on. Web when is form 990 due? To use the table, you must know. The 15th day of the. Exempt organizations with a filing obligation.

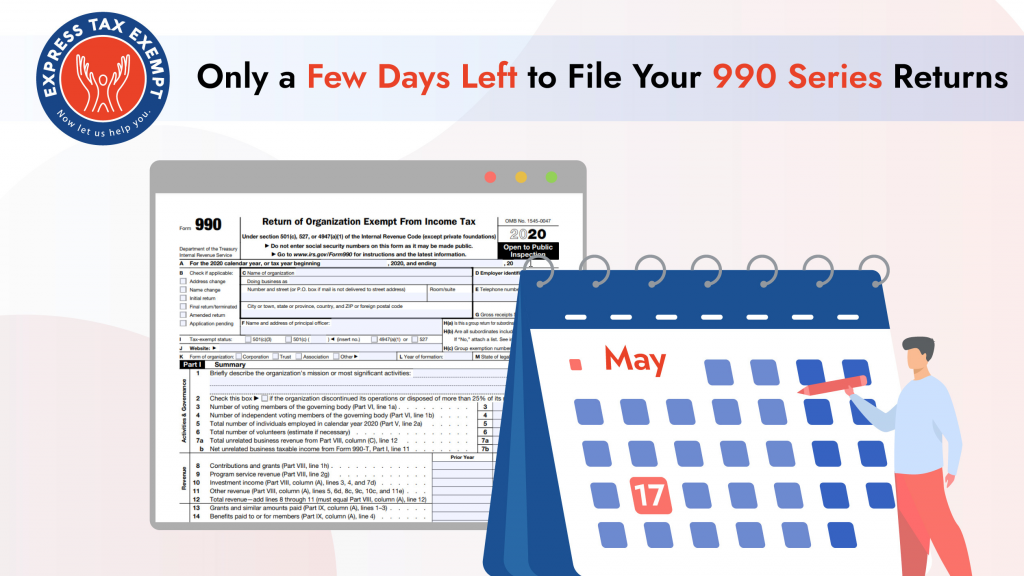

Web this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. The appropriate 990 form depends upon your organization's gross. Web 990 series forms are due on july 17, 2023! Web form 990 due date calculator 1 choose your appropriate form to find the due date. That may seem complicated, but for organizations whose tax. Web form 990 return due date: Web december 31st (calendar year) fiscal year not sure about which form to file for your organization? Web upcoming 2023 form 990 deadline: If the due date falls on a saturday, sunday, or. To use the table, you must know.

Web this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. Web upcoming 2023 form 990 deadline: Web form 990 due date calculator 1 choose your appropriate form to find the due date. Web when is form 990 due? Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. The appropriate 990 form depends upon your organization's gross. You can find information from the irs in. 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal). Due to the large volume. Web 990 series forms are due on july 17, 2023!

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

For organizations on a calendar. To use the table, you must know. Web december 31st (calendar year) fiscal year not sure about which form to file for your organization? Due to the large volume. If the due date falls on a saturday, sunday, or.

990 Form 2021

Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period. Web this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. Due to the large volume. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is.

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

Web form 990 due date calculator 1 choose your appropriate form to find the due date. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Web form 990 return due date: That may seem complicated, but for.

What is Form 990PF?

Web december 31st (calendar year) fiscal year not sure about which form to file for your organization? For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web if the original due date of form 990 is may 15, 2020, the organization may either:.

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Web the due date for filing form 990 series returns and most other returns that were due between april 1, 2020 and july 15, 2020 has been extended to july 15, 2020. Web when is form 990 due? Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

The 15th day of the. You can find information from the irs in. Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. That may seem complicated, but for organizations whose tax. To use the table, you must know.

There Are Only a Few Days Left to File Your 990 Series Returns

For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. If your tax year ended on. Web form 990 return due date: Web upcoming 2023 form 990 deadline: Web the form 990 deadline is the 15th day of the 5th month after the end.

What is Form 990EZ and Who Qualifies for it? Foundation Group, Inc.

Web if the original due date of form 990 is may 15, 2020, the organization may either: Web form 990 return due date: The 15th day of the. Web the form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period. You can find information from the irs in.

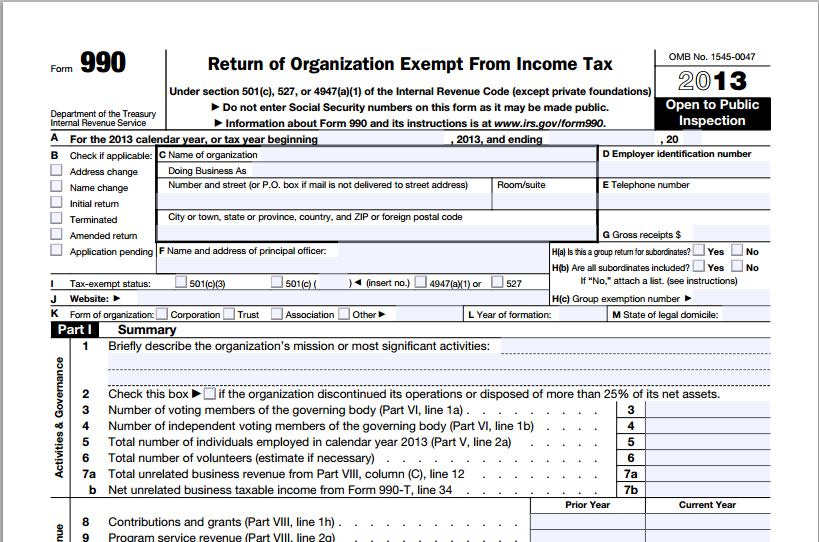

Efile Form 990 2021 IRS Form 990 Online Filing

Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Web if the original due date of form 990 is may 15, 2020, the organization may either: If your tax year ended on. Form 990 is due on.

Form 990 Preparation Service 501(c)(3) Tax Services in Tampa

Web if the original due date of form 990 is may 15, 2020, the organization may either: To use the table, you must know. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web this topic provides electronic filing opening day information and.

If The Due Date Falls On A Saturday, Sunday, Or.

That may seem complicated, but for organizations whose tax. Web upcoming 2023 form 990 deadline: Web the due date for filing form 990 series returns and most other returns that were due between april 1, 2020 and july 15, 2020 has been extended to july 15, 2020. Web december 31st (calendar year) fiscal year not sure about which form to file for your organization?

Web The Irs Filing Deadline For Organizations With A Fiscal Year End Date Of 2/28/2023 Is Midnight Eastern Time On Monday, July 17, 2023.

If your tax year ended on. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Due to the large volume. Web 990 series forms are due on july 17, 2023!

The Appropriate 990 Form Depends Upon Your Organization's Gross.

The 15th day of the. Web form 990 return due date: 2 the month your tax year ends december 31 (calendar) other than december 31 (fiscal). For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023.

To Use The Table, You Must Know.

Web form 990 due date calculator 1 choose your appropriate form to find the due date. You can find information from the irs in. Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. File an extension of time through november 15, 2020, on or before may 15, 2020.