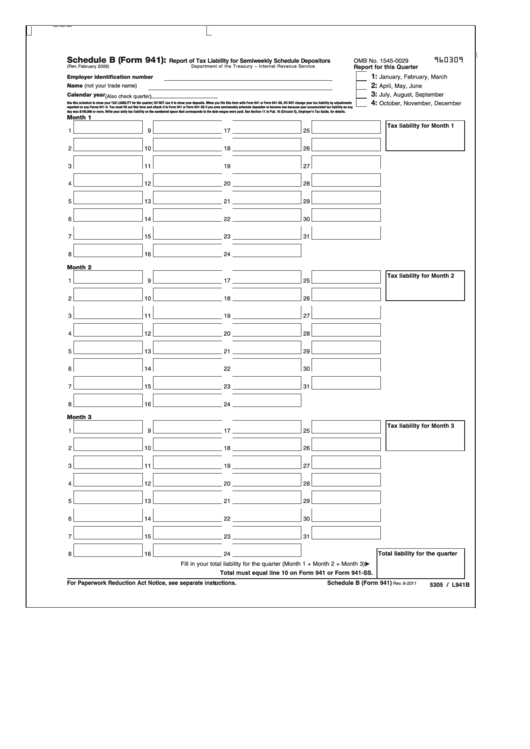

941 Form Schedule B

941 Form Schedule B - Enter your tax liability for each month. Web file schedule b (form 941) if you are a semiweekly schedule depositor. If you're a semiweekly schedule depositor and you don’t. Web the updated form 941 (employer’s quarterly federal tax return) was released on june 19, 2020. Web form 941 schedule b. This form must be completed by a semiweekly schedule depositor who. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. Web you were a semiweekly schedule depositor for any part of this quarter. 15 or section 8 of pub. The employer is required to withhold federal income tax and.

Web file schedule b (form 941) if you are a semiweekly schedule depositor. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. Web schedule b (form 941), report of tax liability for semiweekly schedule depositors (online) title schedule b (form 941), report of tax liability for semiweekly schedule depositors. Web the updated form 941 (employer’s quarterly federal tax return) was released on june 19, 2020. Reported more than $50,000 of employment taxes in. Web you were a semiweekly schedule depositor for any part of this quarter. See deposit penalties in section 11 of pub. 15 or section 8 of pub. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter.

Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Reported more than $50,000 of employment taxes in. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. The employer is required to withhold federal income tax and. Web semiweekly schedule depositor, attach schedule b (form 941). Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it. You are a semiweekly depositor if you: Web form 941 schedule b.

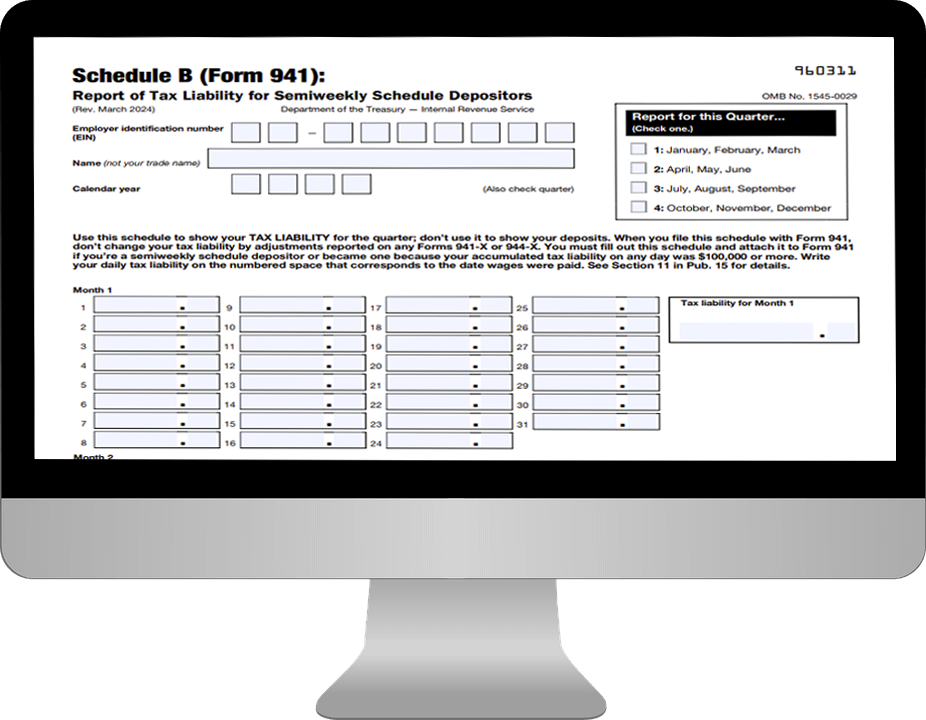

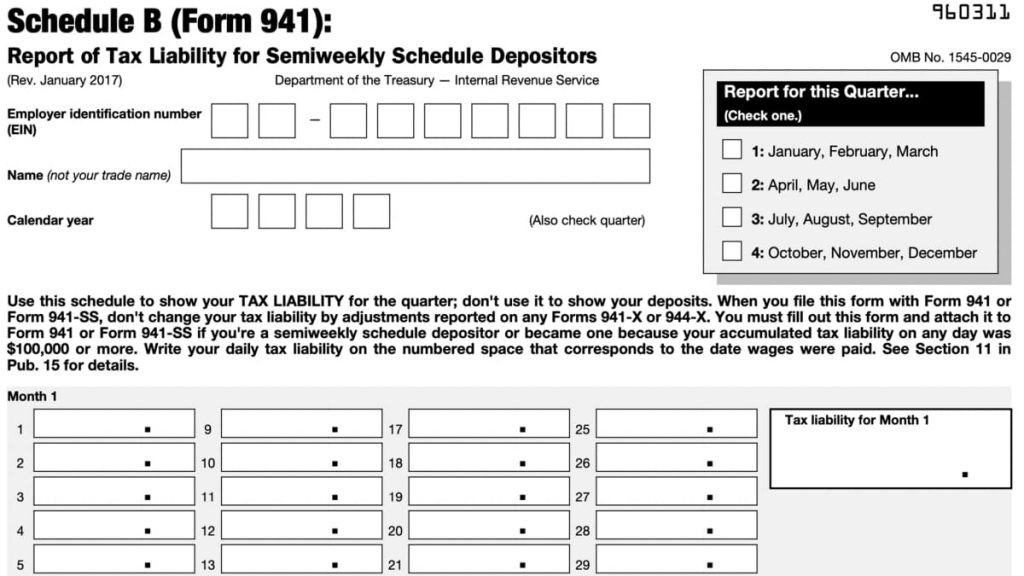

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. Web we last updated the report of tax liability for semiweekly schedule depositors in january 2023, so this is the latest version of 941 (schedule b), fully updated for tax year 2022. The irs released two.

8 Form Schedule B 8 What’s So Trendy About 8 Form Schedule B 8 That

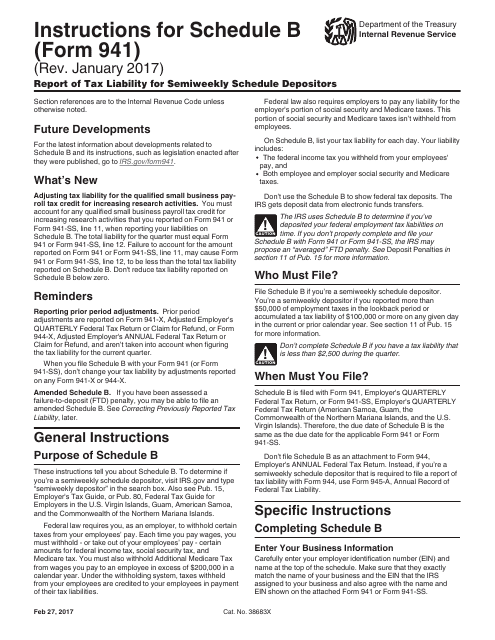

Web the updated form 941 (employer’s quarterly federal tax return) was released on june 19, 2020. You were a monthly schedule depositor for the entire quarter. The employer is required to withhold federal income tax and. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it. See deposit penalties in section 11 of pub.

941 Schedule B Fill Out and Sign Printable PDF Template signNow

Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. Web form 941 schedule b. Web we last updated the report of tax liability for semiweekly schedule depositors in january 2023, so this is the latest version of 941 (schedule b),.

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Web the irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Enter your tax liability for each month. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than.

Download Instructions for IRS Form 941 Schedule B Report of Tax

Web the irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. If you're a semiweekly schedule depositor and you don’t. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other.

Form 941 (Schedule R) Allocation Schedule for Aggregate Form 941

Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. Web the updated form 941 (employer’s quarterly federal tax return) was released on june 19, 2020. Web semiweekly schedule depositor, attach schedule b (form 941). The employer is required to withhold federal income tax and. Web.

941 Form 2023

Web the irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Enter your tax liability for each month. You were a monthly schedule depositor for the entire quarter. 15 or section 8 of pub. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than.

Form 941

You are a semiweekly depositor if you: 15 or section 8 of pub. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it. Web you are required to file schedule b and form 941 by the last day.

US Tax Abroad Expatriate Form Schedule B

This form must be completed by a semiweekly schedule depositor who. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. The employer is required to withhold federal income tax and. Web semiweekly schedule depositor, attach schedule b (form 941). If you're a semiweekly schedule depositor and you don’t.

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

Web we last updated the report of tax liability for semiweekly schedule depositors in january 2023, so this is the latest version of 941 (schedule b), fully updated for tax year 2022. Web you were a semiweekly schedule depositor for any part of this quarter. Web schedule b is filed with form 941. This form must be completed by a.

Web The Irs Form 941 Schedule B For 2023 Is Used By Semiweekly Schedule Depositors That Report More Than $50,000 In Employment Taxes.

If you're a semiweekly schedule depositor and you don’t. Web form 941 schedule b. Web semiweekly schedule depositor, attach schedule b (form 941). Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

Web Schedule B Is Filed With Form 941.

Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. Step by step instructions for the irs form 941 schedule b. See deposit penalties in section 11 of pub.

Web We Last Updated The Report Of Tax Liability For Semiweekly Schedule Depositors In January 2023, So This Is The Latest Version Of 941 (Schedule B), Fully Updated For Tax Year 2022.

This form must be completed by a semiweekly schedule depositor who. Enter your tax liability for each month. The irs released two drafts of the 941 instructions and. The employer is required to withhold federal income tax and.

You Were A Monthly Schedule Depositor For The Entire Quarter.

Web form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Web schedule b (form 941), report of tax liability for semiweekly schedule depositors (online) title schedule b (form 941), report of tax liability for semiweekly schedule depositors. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter.