8862 Form 2022

8862 Form 2022 - Web federal information to claim earned income credit after disallowance form 8862 pdf form content report error it appears you don't have a pdf plugin for this browser. Information to claim earned income credit after disallowance written by a turbotax expert • reviewed by a turbotax cpa updated for. Web to resolve this rejection, you'll need to add form 8862: Complete, edit or print tax forms instantly. If the irs rejected one or more of these credits: Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. You can generate form 8862, information to claim certain credits after disallowance, in the individual module. Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862.

Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Please see the faq link. Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Web how do i enter form 8862? Web to resolve this rejection, you'll need to add form 8862: Web follow these steps to generate form 8862: Earned income credit (eic), child tax credit (ctc), refundable child. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Ad access irs tax forms. Married filing jointly vs separately.

Ad download or email irs 8862 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Go to www.irs.gov/form8962 for instructions and the. Web follow the simple instructions below: Web add the form 8862 (rev. Web federal information to claim earned income credit after disallowance form 8862 pdf form content report error it appears you don't have a pdf plugin for this browser. Web form 8862 federal — information to claim earned income credit after disallowance download this form print this form it appears you don't have a pdf plugin for this. Click the new document option above, then drag and drop. Web filing tax form 8862: Our service provides you with an extensive.

How to claim an earned credit by electronically filing IRS Form 8862

Earned income credit (eic), child tax credit (ctc), refundable child. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Web filing tax form 8862: Web follow these steps to generate form 8862: Click the new document option above, then drag.

2022 Form IRS 8862 Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Ad download or email irs 8862 & more fillable forms, try for free now! Please see the faq link. Web see form 8862, information to claim certain credits.

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Enter the appropriate number in qualifying children: Go to screen 77.1, eic/ctc/aoc after disallowances (8862). Information to claim earned income credit after disallowance to your return. Our service provides you with an extensive. Married filing jointly vs separately.

8862

Web filing tax form 8862: Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Information to claim earned income credit after disallowance to your return. Enter the appropriate number in qualifying children: Go to www.irs.gov/form8962 for instructions and the.

Fill Free fillable F8862 Form 8862 (Rev. November 2018) PDF form

Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Web more from h&r block. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Complete, edit.

IRS 8867 2020 Fill out Tax Template Online US Legal Forms

Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web form 8862 federal — information to claim earned income credit after disallowance download this form print this form it appears you don't have a pdf plugin for this. Guide to head of household. Information.

Top 14 Form 8862 Templates free to download in PDF format

Our service provides you with an extensive. Web follow the simple instructions below: Web form 8862 federal — information to claim earned income credit after disallowance download this form print this form it appears you don't have a pdf plugin for this. Earned income credit (eic), child tax credit (ctc), refundable child. Get ready for tax season deadlines by completing.

Top 14 Form 8862 Templates free to download in PDF format

Web follow these steps to generate form 8862: Click the new document option above, then drag and drop. Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862..

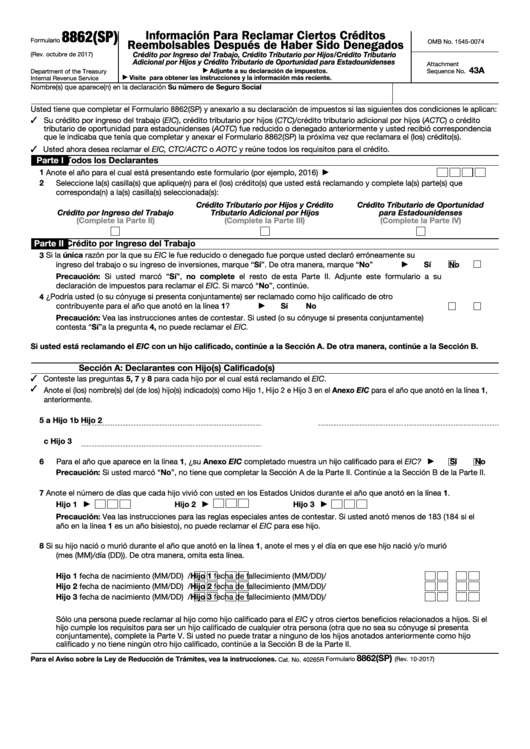

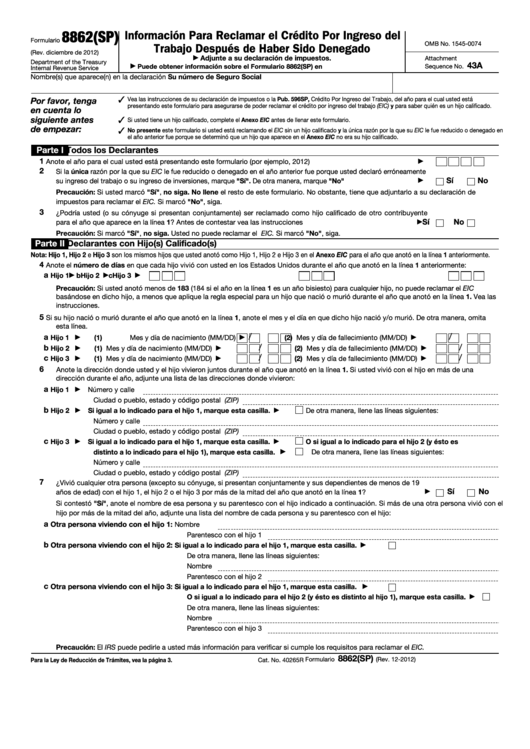

Form 8862(Sp) Informacion Para Reclamar El Credito Por Ingreso Del

Guide to head of household. Information to claim earned income credit after disallowance to your return. Complete, edit or print tax forms instantly. Go to screen 77.1, eic/ctc/aoc after disallowances (8862). Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced.

20192022 Form IRS 886HDEP Fill Online, Printable, Fillable, Blank

Web how do i enter form 8862? Click the new document option above, then drag and drop. You can generate form 8862, information to claim certain credits after disallowance, in the individual module. Our service provides you with an extensive. Information to claim certain credits after disallowance for redacting.

Ad Download Or Email Irs 8862 & More Fillable Forms, Try For Free Now!

Earned income credit (eic), child tax credit (ctc), refundable child. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Enter the appropriate number in qualifying children: Web follow these steps to generate form 8862:

Web For The Latest Information About Developments Related To Form 8862 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/Form8862.

Web see form 8862, information to claim certain credits after disallowance, and its instructions for more information, including whether an exception applies. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. You can generate form 8862, information to claim certain credits after disallowance, in the individual module. Web federal information to claim earned income credit after disallowance form 8862 pdf form content report error it appears you don't have a pdf plugin for this browser.

Guide To Head Of Household.

Web to resolve this rejection, you'll need to add form 8862: Go to www.irs.gov/form8962 for instructions and the. If the irs rejected one or more of these credits: Web add the form 8862 (rev.

Solved • By Turbotax • 7249 • Updated February 25, 2023 If Your Earned Income Credit (Eic) Was Disallowed Or Reduced For.

Web how do i enter form 8862? Information to claim earned income credit after disallowance to your return. Our service provides you with an extensive. Ad access irs tax forms.