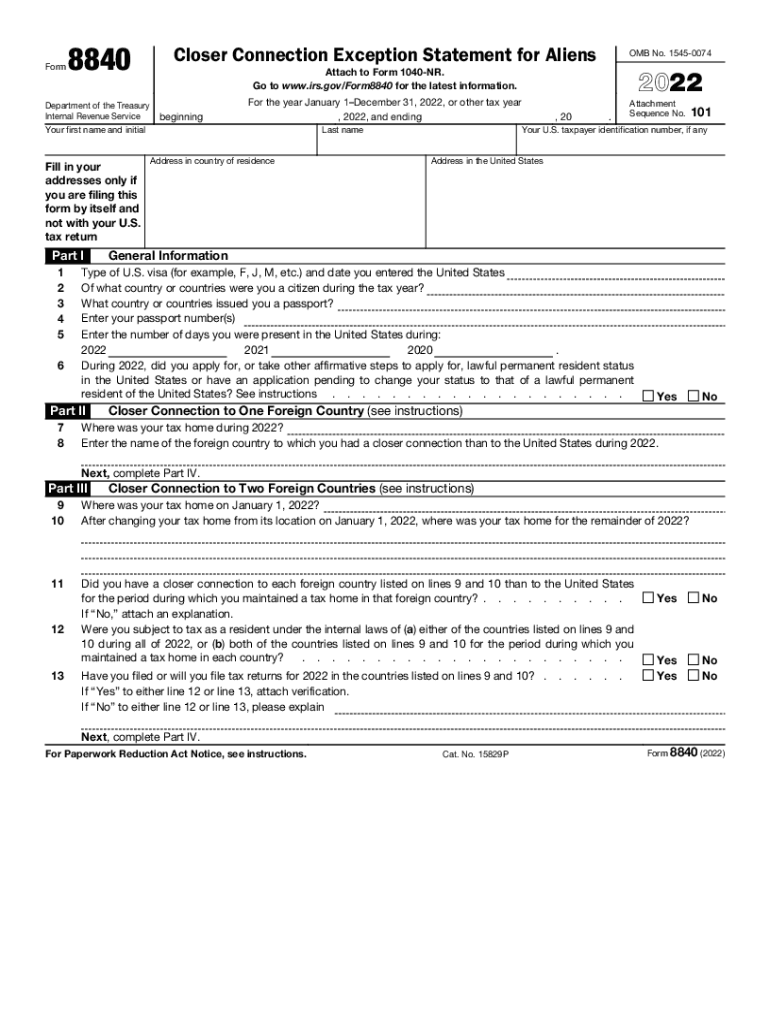

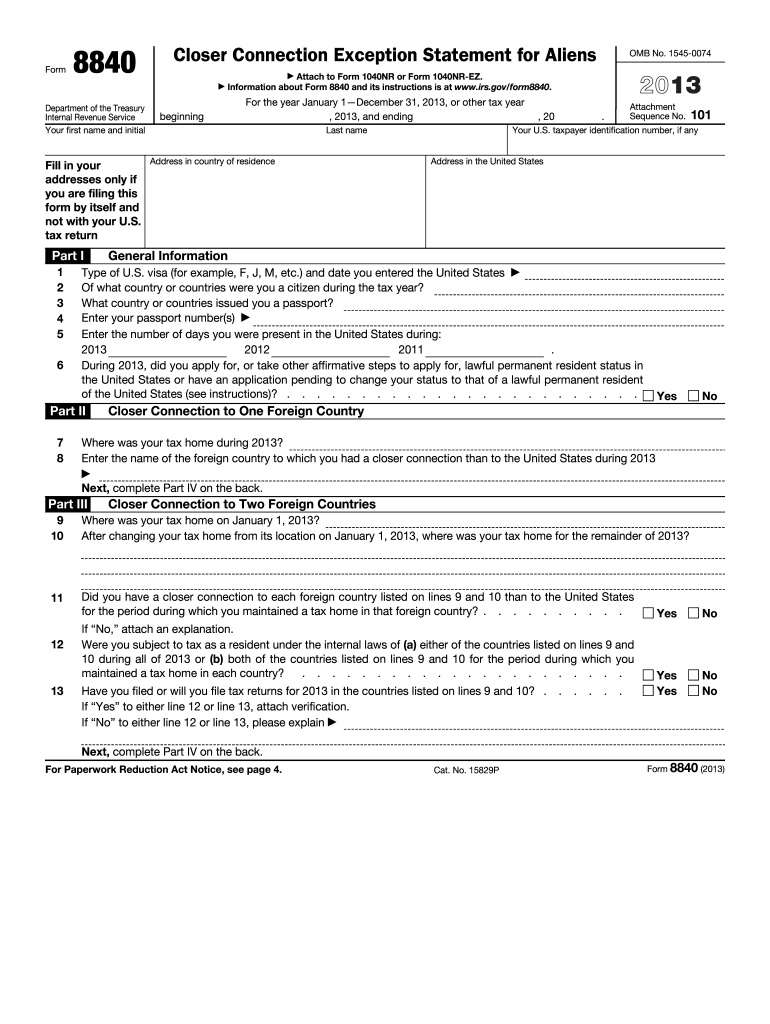

8840 Form 2022

8840 Form 2022 - Concerned parties names, places of residence and numbers etc. Download or email irs 8840 & more fillable forms, register and subscribe now! Web the filing deadline for form 8840 is june 15 of the year following the end of the relevant tax year unless the filing date falls on a weekend or a holiday. Web for 2021, the person was present in the us for 186 days. Snowbird advisor has received a number of inquiries. Web we last updated the closer connection exception statement for aliens in december 2022, so this is the latest version of form 8840, fully updated for tax year 2022. Complete, edit or print tax forms instantly. It’s that time of year again! Ad upload, modify or create forms. Draw your signature, type it,.

Future developments for the latest. When completing the irs 8840 form, the days spent in the united states are calculated by counting the actual days spent in the united. Web patrick keck calgary, ab ed.: Get ready for tax season deadlines by completing any required tax forms today. Ad edit, sign or email irs 8840 & more fillable forms, register and subscribe now! For 2022, the person was present in the us for 190 days. Complete, edit or print tax forms instantly. Sign it in a few clicks. Web irs income tax forms, schedules and publications for tax year 2022: Enjoy smart fillable fields and interactivity.

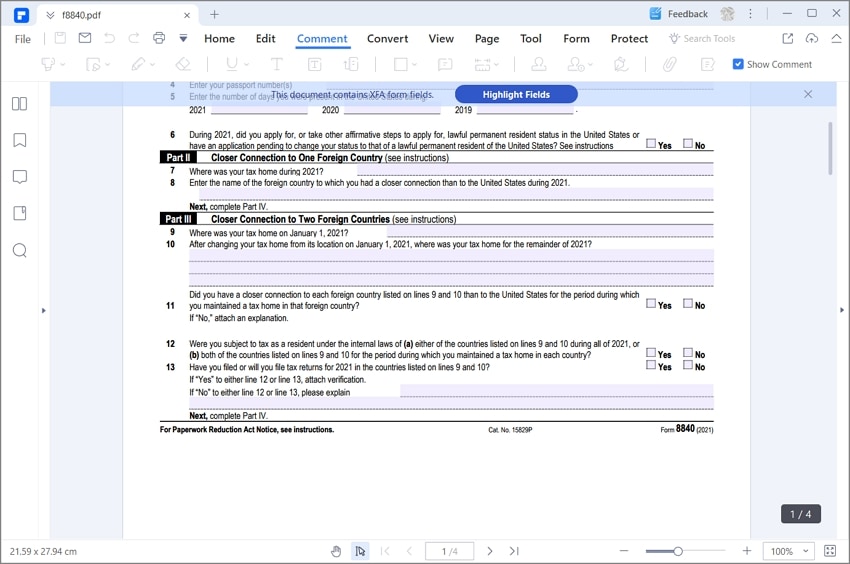

Web form 8840 (2022) form 8840 (2022) page 3 section references are to the u.s. Concerned parties names, places of residence and numbers etc. Ad upload, modify or create forms. Web irs income tax forms, schedules and publications for tax year 2022: 2022 tax returns are due on april 18, 2023. Type text, add images, blackout confidential details, add comments, highlights and more. Canadian residents who winter in the u.s. Draw your signature, type it,. Future developments for the latest. Complete, edit or print tax forms instantly.

Form 8840 Closer Connection Exception Statement for Aliens (2015

Web we last updated the closer connection exception statement for aliens in december 2022, so this is the latest version of form 8840, fully updated for tax year 2022. Canadian snowbirds who spend their winters in the u.s. Draw your signature, type it,. Income tax if they exceed a specific number of. Try it for free now!

Form 8840 Closer Connection Exception Statement for Aliens (2015

Open it using the online editor and start editing. Visa (for example, f, j, m, etc.) and date you entered the united states 2 of what country or countries were you a citizen during the tax year? Concerned parties names, places of residence and numbers etc. Internal revenue code, unless otherwise specified. Web find the irs 8840 you require.

2022 Form IRS 8840 Fill Online, Printable, Fillable, Blank pdfFiller

Web irs income tax forms, schedules and publications for tax year 2022: Web the filing deadline for form 8840 is june 15 of the year following the end of the relevant tax year unless the filing date falls on a weekend or a holiday. Ad upload, modify or create forms. Canadian snowbirds who spend their winters in the u.s. Canadian.

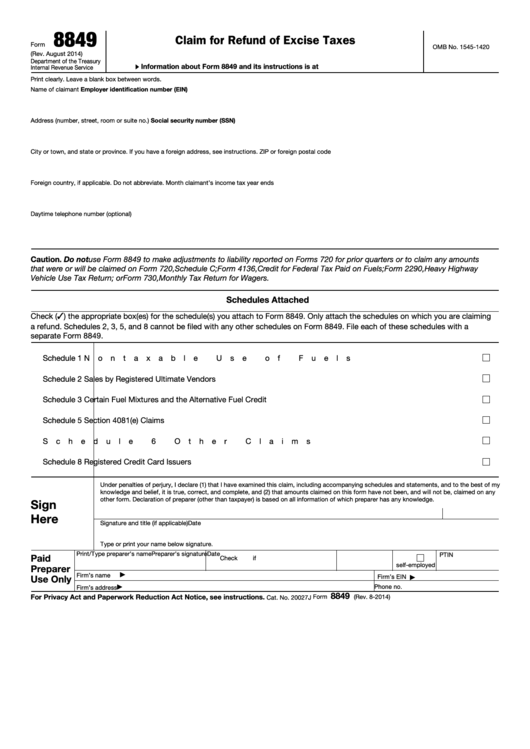

Top 9 Form 8849 Templates free to download in PDF format

Web patrick keck calgary, ab ed.: Sign it in a few clicks. Draw your signature, type it,. Canadian snowbirds who spend their winters in the u.s. To calculate the person’s presence in the us.

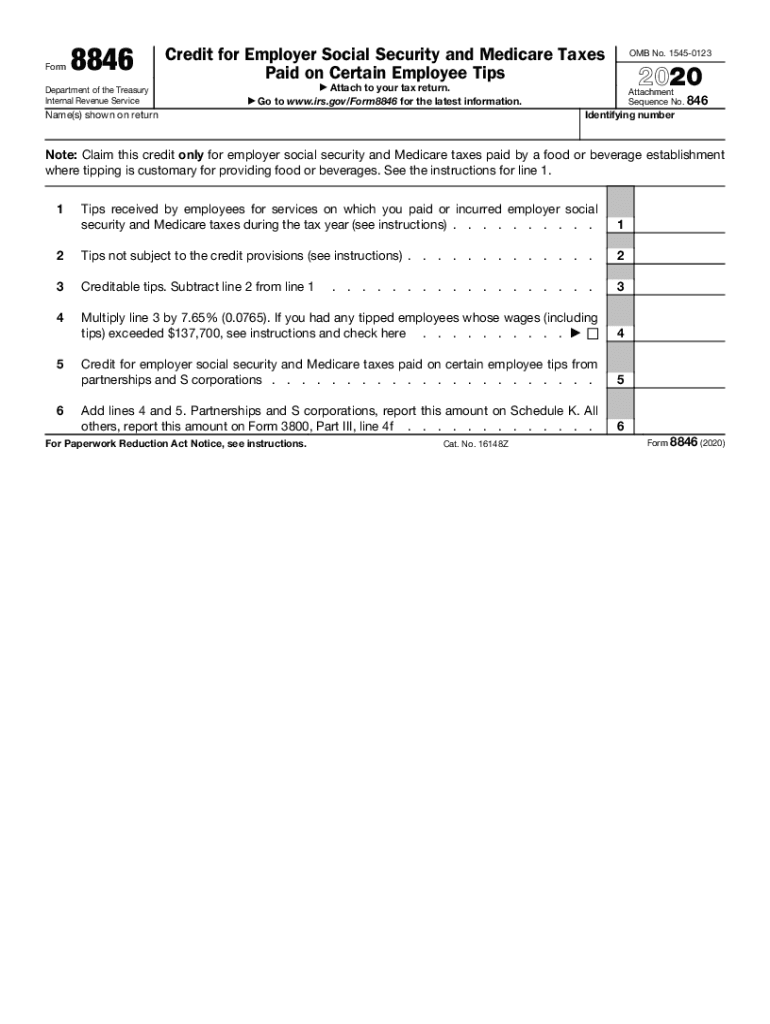

8846 Fill Out and Sign Printable PDF Template signNow

Web 1 type of u.s. Web find the irs 8840 you require. Web we last updated the closer connection exception statement for aliens in december 2022, so this is the latest version of form 8840, fully updated for tax year 2022. Web for 2021, the person was present in the us for 186 days. Future developments for the latest.

IRS Form 8840 How to Fill it Right and Easily

Web the filing deadline for form 8840 is june 15 of the year following the end of the relevant tax year unless the filing date falls on a weekend or a holiday. Get your online template and fill it in using progressive features. Type text, add images, blackout confidential details, add comments, highlights and more. Web form 8840 (2022) form.

How Tax Form 8840 Exception to Substantial Presence Works

Web patrick keck calgary, ab ed.: Canadian snowbirds who spend their winters in the u.s. Must consider filing form 8840. Enjoy smart fillable fields and interactivity. Download or email irs 8840 & more fillable forms, register and subscribe now!

Form 8840, Closer Connection Exception Statement for Aliens IRS.gov

When completing the irs 8840 form, the days spent in the united states are calculated by counting the actual days spent in the united. Web a retirement savings contribution credit may be claimed for the amount of contributions you, as the designated beneficiary of an able account, make before january 1, 2026, to the. Canadian snowbirds who spend their winters.

Form 8840 Closer Connection Exception Statement for Aliens (2015

Future developments for the latest. Complete, edit or print tax forms instantly. Enjoy smart fillable fields and interactivity. Ad edit, sign or email irs 8840 & more fillable forms, register and subscribe now! Web a retirement savings contribution credit may be claimed for the amount of contributions you, as the designated beneficiary of an able account, make before january 1,.

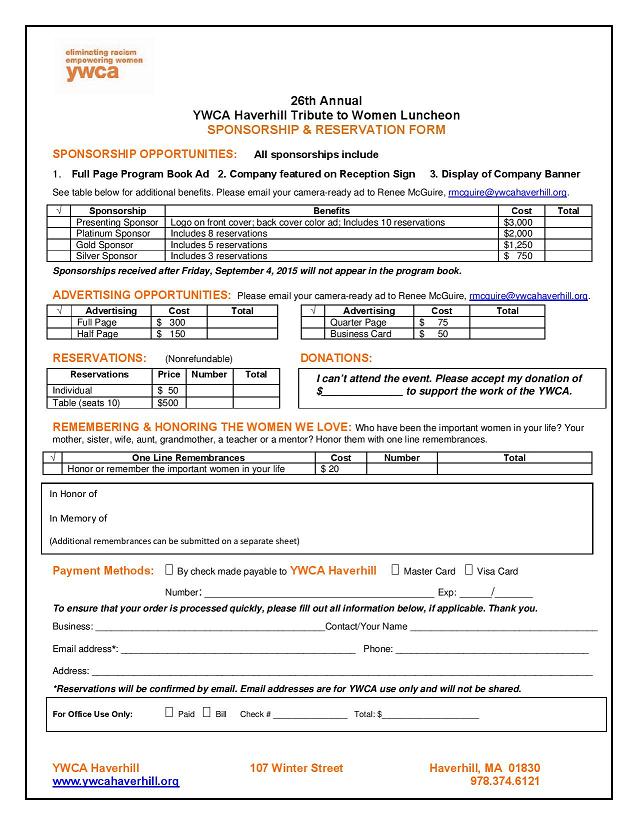

Haverhill Tribute Sponsorship Form YWCA Northeastern MA

Web we last updated the closer connection exception statement for aliens in december 2022, so this is the latest version of form 8840, fully updated for tax year 2022. Must consider filing form 8840. Enjoy smart fillable fields and interactivity. Complete, edit or print tax forms instantly. When completing the irs 8840 form, the days spent in the united states.

Enjoy Smart Fillable Fields And Interactivity.

Web information about form 8840, closer connection exception statement for aliens, including recent updates, related forms, and instructions on how to file. Canadian residents who winter in the u.s. Web form 8840 (2022) form 8840 (2022) page 3 section references are to the u.s. Web patrick keck calgary, ab ed.:

Draw Your Signature, Type It,.

Try it for free now! An alien individual who meets the substantial presence test may nevertheless be considered a nonresident alien for the current year if the following conditions are. Concerned parties names, places of residence and numbers etc. Web a retirement savings contribution credit may be claimed for the amount of contributions you, as the designated beneficiary of an able account, make before january 1, 2026, to the.

Web We Last Updated The Closer Connection Exception Statement For Aliens In December 2022, So This Is The Latest Version Of Form 8840, Fully Updated For Tax Year 2022.

Must consider filing form 8840. Complete, edit or print tax forms instantly. Get your online template and fill it in using progressive features. Canadian snowbirds who spend their winters in the u.s.

Complete, Edit Or Print Tax Forms Instantly.

When completing the irs 8840 form, the days spent in the united states are calculated by counting the actual days spent in the united. Visa (for example, f, j, m, etc.) and date you entered the united states 2 of what country or countries were you a citizen during the tax year? 2022 tax returns are due on april 18, 2023. It’s that time of year again!