502Cr Form On Turbotax

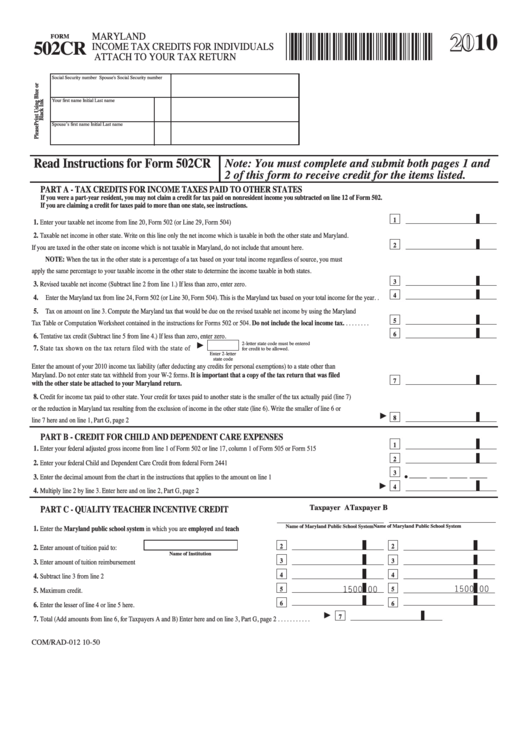

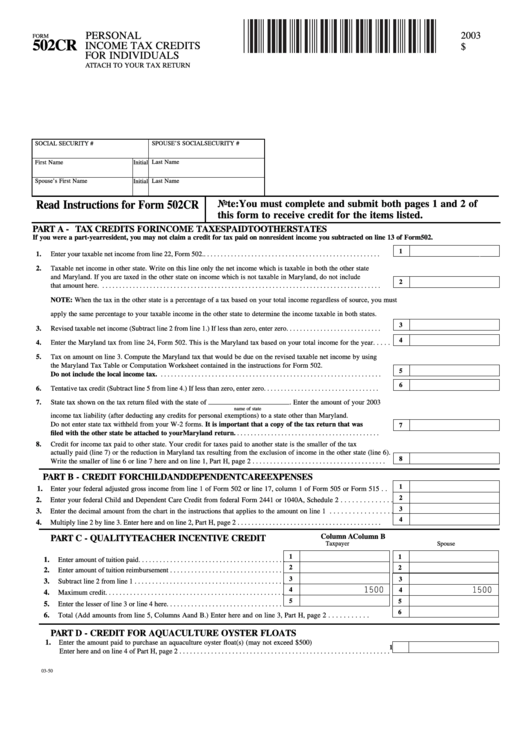

502Cr Form On Turbotax - Select your product below and. Enter your taxable net income from line 20, form 502 (or line 10, form 504). Web enter the social security number for each taxpayer. Web forms are available for downloading in the resident individuals income tax forms section below. When and where to file. Web 500cr attributable to any credit other than the community investment tax credit (citc), you are not eligible to claim the citc on form 502cr. Refundable income tax credits from. Taxable net income in other state. Resident individuals income tax forms electronic filing signature and. Web form 502cr is a maryland individual income tax form.

Web enter the social security number for each taxpayer. Web attach to your tax return. Web electronic filing (ifile) income tax forms power of attorney change of address follow the links to sort out all the details quickly and make filing your tax return painless! Web 500cr attributable to any credit other than the community investment tax credit (citc), you are not eligible to claim the citc on form 502cr. Web to claim the credit, you must complete part d of form 502cr and attach to your maryland income tax return. Web maryland form 502cr, income tax credits for individuals available available maryland information worksheet available unsupported maryland form pv, personal tax. Refundable income tax credits from. Web form 502cr is a maryland individual income tax form. You must use form 500cr. ( administrative release 42 ) total amount of.

( administrative release 42 ) total amount of. Web s corporation taxes from lines 13 and 14 of maryland form 502cr, part a, tax credits for income taxes paid to other states. Web enter the social security number for each taxpayer. You must also report the credit on maryland form 502, 505 or 515. Select your product below and. You must complete and submit pages 1 through 4 of this form to receive credit for the items listed. Web electronic filing (ifile) income tax forms power of attorney change of address follow the links to sort out all the details quickly and make filing your tax return painless! You must use form 500cr. Web 500cr attributable to any credit other than the community investment tax credit (citc), you are not eligible to claim the citc on form 502cr. Web maryland form 502cr, income tax credits for individuals available available maryland information worksheet available unsupported maryland form pv, personal tax.

What Is a W4 Form? Irs tax forms, Tax forms, Irs forms

Resident individuals income tax forms electronic filing signature and. Write on this line only the net. You must use form 500cr. Web we last updated maryland form 502cr in january 2023 from the maryland comptroller of maryland. You must also report the credit on maryland form 502, 505 or 515.

How TurboTax turns a dreadful user experience into a delightful one

Taxable net income in other state. Web read instructions for form 502cr. Web forms are available for downloading in the resident individuals income tax forms section below. Web to claim the credit, you must complete part d of form 502cr and attach to your maryland income tax return. 502cr income tax credits for individuals 502r.

Maryland Form 502 Booklet Fill Out and Sign Printable PDF Template

Write on this line only the net. We've been in the trucking industry 67+ years. Web 502cr income tax credits for individuals attach to your tax return. Refundable earned income credit (from worksheet in instruction 21). You must use form 500cr.

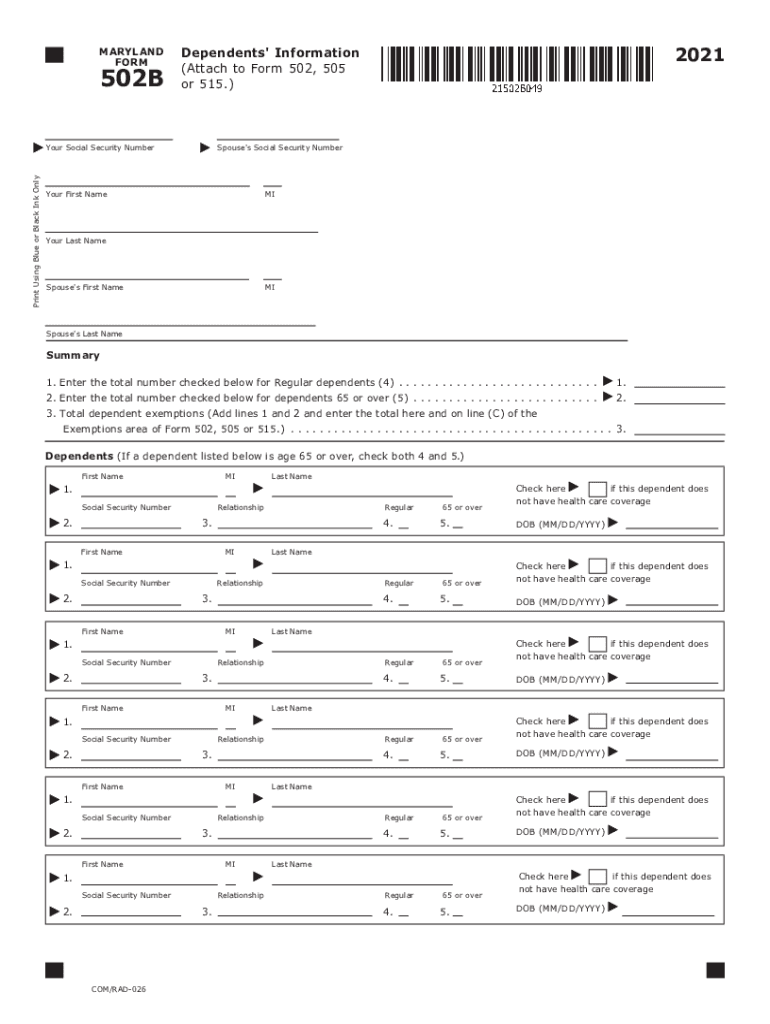

Fillable Form 502cr Maryland Tax Credits For Individuals

Web s corporation taxes from lines 13 and 14 of maryland form 502cr, part a, tax credits for income taxes paid to other states. Web maryland form 502cr, income tax credits for individuals available available maryland information worksheet available unsupported maryland form pv, personal tax. Write on this line only the net. 502cr income tax credits for individuals 502r. Enter.

Where Do I Enter a 1098 Tax Form in TurboTax Online TurboTax Support

Web enter the social security number for each taxpayer. Web to claim the credit, you must complete part d of form 502cr and attach to your maryland income tax return. Web 502cr income tax credits for individuals attach to your tax return. Web maryland form 502cr, income tax credits for individuals available available maryland information worksheet available unsupported maryland form.

Solved TurboTax 2019 not showing 1098T form

Web with an extension request, and form mw506nrs. Web form 502cr is a maryland individual income tax form. Web we last updated maryland form 502cr in january 2023 from the maryland comptroller of maryland. Form 502cr must be attached to the annual return (form 502, 504, 505 or 515) and filed with the. Web read instructions for form 502cr.

form 2106 turbotax Fill Online, Printable, Fillable Blank

Select your product below and. When and where to file. Web 502cr income tax credits for individuals attach to your tax return. Resident individuals income tax forms electronic filing signature and. Refundable income tax credits from.

Fillable Form 502cr Personal Tax Credits For Individuals

We've been in the trucking industry 67+ years. Web 502cr income tax credits for individuals attach to your tax return. Web enter the social security number for each taxpayer. Select your product below and. Taxable net income in other state.

How to Import Your W2 Form with TurboTax 2020, 2021 YouTube

Refundable earned income credit (from worksheet in instruction 21). Web maryland form 502cr, income tax credits for individuals available available maryland information worksheet available unsupported maryland form pv, personal tax. Web 502cr income tax credits for individuals attach to your tax return. You must also report the credit on maryland form 502, 505 or 515. You must use form 500cr.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

This form is for income earned in tax year 2022, with tax returns due in april. You must also report the credit on maryland form 502, 505 or 515. We've been in the trucking industry 67+ years. You must use form 500cr. Select your product below and.

Web With An Extension Request, And Form Mw506Nrs.

Write on this line only the net. Web 502cr income tax credits for individuals attach to your tax return. Refundable income tax credits from. Web form 502cr is a maryland individual income tax form.

Form 502Cr Must Be Attached To The Annual Return (Form 502, 504, 505 Or 515) And Filed With The.

Web electronic filing (ifile) income tax forms power of attorney change of address follow the links to sort out all the details quickly and make filing your tax return painless! Web attach to your tax return. ( administrative release 42 ) total amount of. Web maryland form 502cr, income tax credits for individuals available available maryland information worksheet available unsupported maryland form pv, personal tax.

Taxable Net Income In Other State.

You must use form 500cr. Enter your taxable net income from line 20, form 502 (or line 10, form 504). Web 500cr attributable to any credit other than the community investment tax credit (citc), you are not eligible to claim the citc on form 502cr. Select your product below and.

Web Read Instructions For Form 502Cr.

Web we last updated maryland form 502cr in january 2023 from the maryland comptroller of maryland. Refundable earned income credit (from worksheet in instruction 21). We've been in the trucking industry 67+ years. Web to claim the credit, you must complete part d of form 502cr and attach to your maryland income tax return.

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)