4923-H Form

4923-H Form - December 2017) department of the treasury internal revenue service. Web find and fill out the correct missouri tax form 4923 h. The request for mail order forms may be used to order one copy or. In the form drivers need to include the vehicle identification. If you do not have an ssn but are eligible to get one, you should apply for it. Motorists who seek a refund on the hike in the state's motor fuel tax. Web numbers on this form. Web friday, june 3, 2022. Refund claims must be postmarked on or after july 1, but. Choose the correct version of the editable pdf form.

Phone help if you have. While the form to submit a refund claim recently became available,. Despite the form being available, filing is not allowed until july 1 and will run through. Choose the correct version of the editable pdf form. In the form drivers need to include the vehicle identification. Refund claims must be postmarked on or after july 1, but. Web this form is used to claim a refund for the increased portion of the motor fuel tax paid on fuel used for on road purposes. For optimal functionality, save the form to your computer before. Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. Web numbers on this form.

Application for recognition of exemption. For optimal functionality, save the form to your computer. Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. Refund claims must be postmarked on or after july 1, but. While the form to submit a refund claim recently became available,. Under section 501(c)(3) of the internal. For optimal functionality, save the form to your computer before. Online gas tax refund claim form is now available (6/10/22) | standard democrat. December 2017) department of the treasury internal revenue service. Web find and fill out the correct missouri tax form 4923 h.

Fill Free fillable forms for the state of Missouri

Web friday, june 3, 2022. Motorists who seek a refund on the hike in the state's motor fuel tax. Refund claims must be postmarked on or after july 1, but. Phone help if you have. The request for mail order forms may be used to order one copy or.

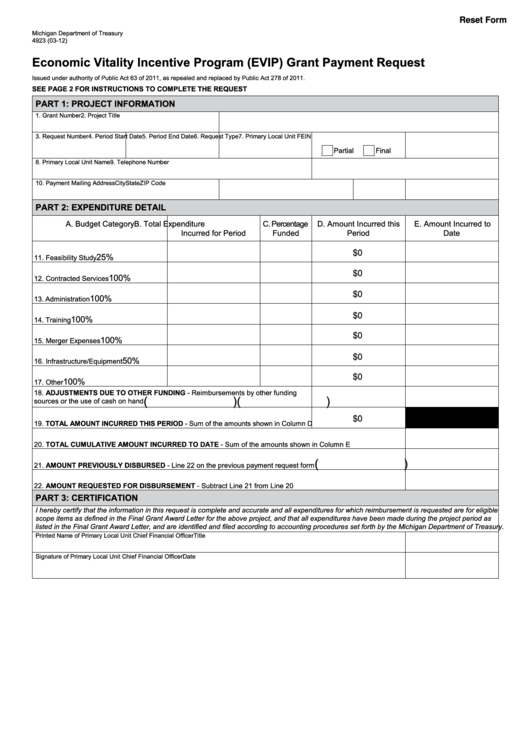

Fillable Form 4923 Economic Vitality Incentive Program (Evip) Grant

Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. Despite the form being available, filing is not allowed until july 1 and will run through. Phone help if you have. Documents subject to disclosure include supporting information filed with the form.

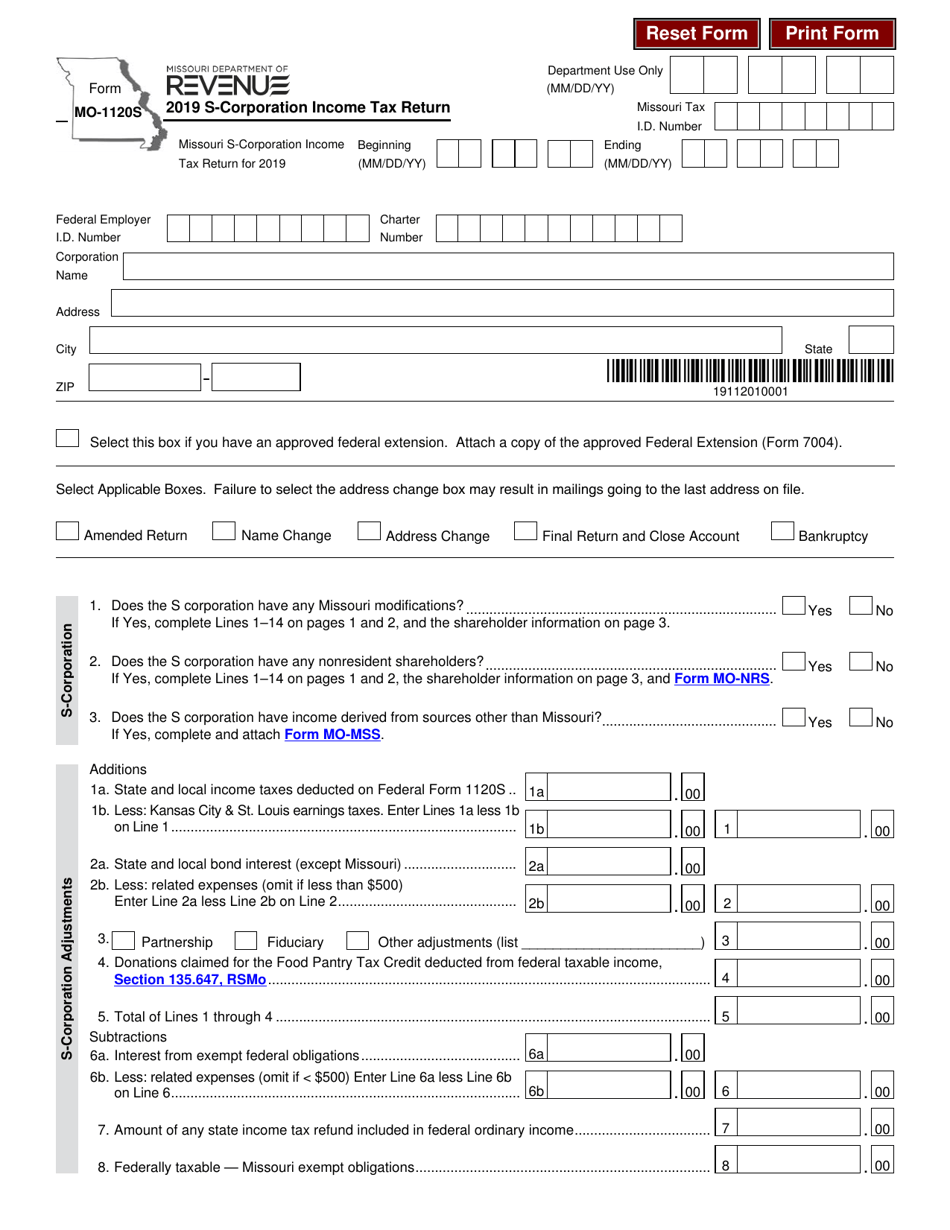

Form MO1120S Download Fillable PDF or Fill Online S Corporation

Refund claims must be postmarked on or after july 1, but. Motorists who seek a refund on the hike in the state's motor fuel tax. For optimal functionality, save the form to your computer. If you do not have an ssn but are eligible to get one, you should apply for it. December 2017) department of the treasury internal revenue.

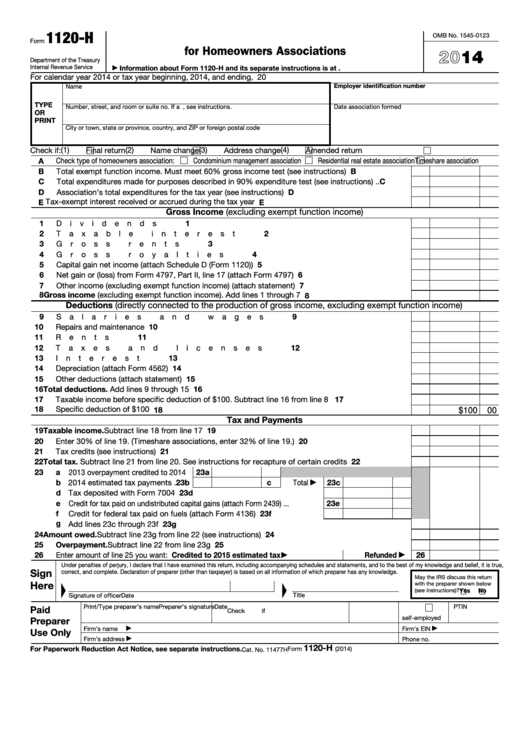

Fillable Form 1120H U.s. Tax Return For Homeowners

Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. Despite the form being available, filing is not allowed until july 1 and will run through. In the form drivers need to include the vehicle identification. If you do not have an.

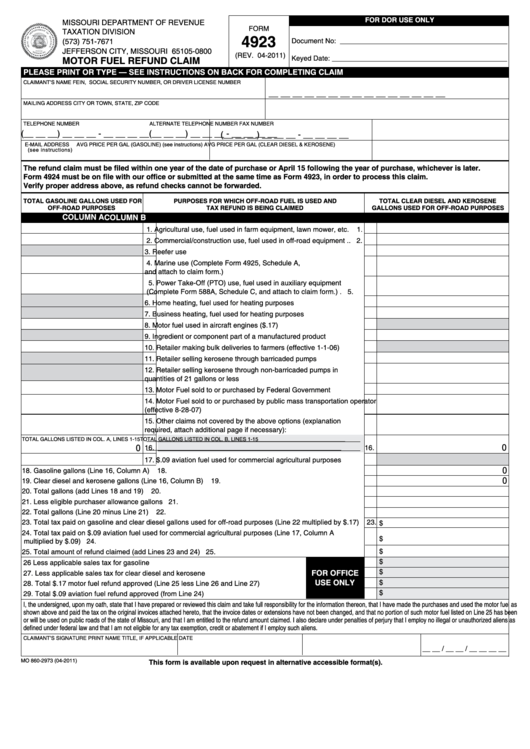

Fillable Form 4923 Motor Fuel Refund Claim printable pdf download

Web this form is used to claim a refund for the increased portion of the motor fuel tax paid on fuel used for on road purposes. Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. Documents subject to disclosure include supporting.

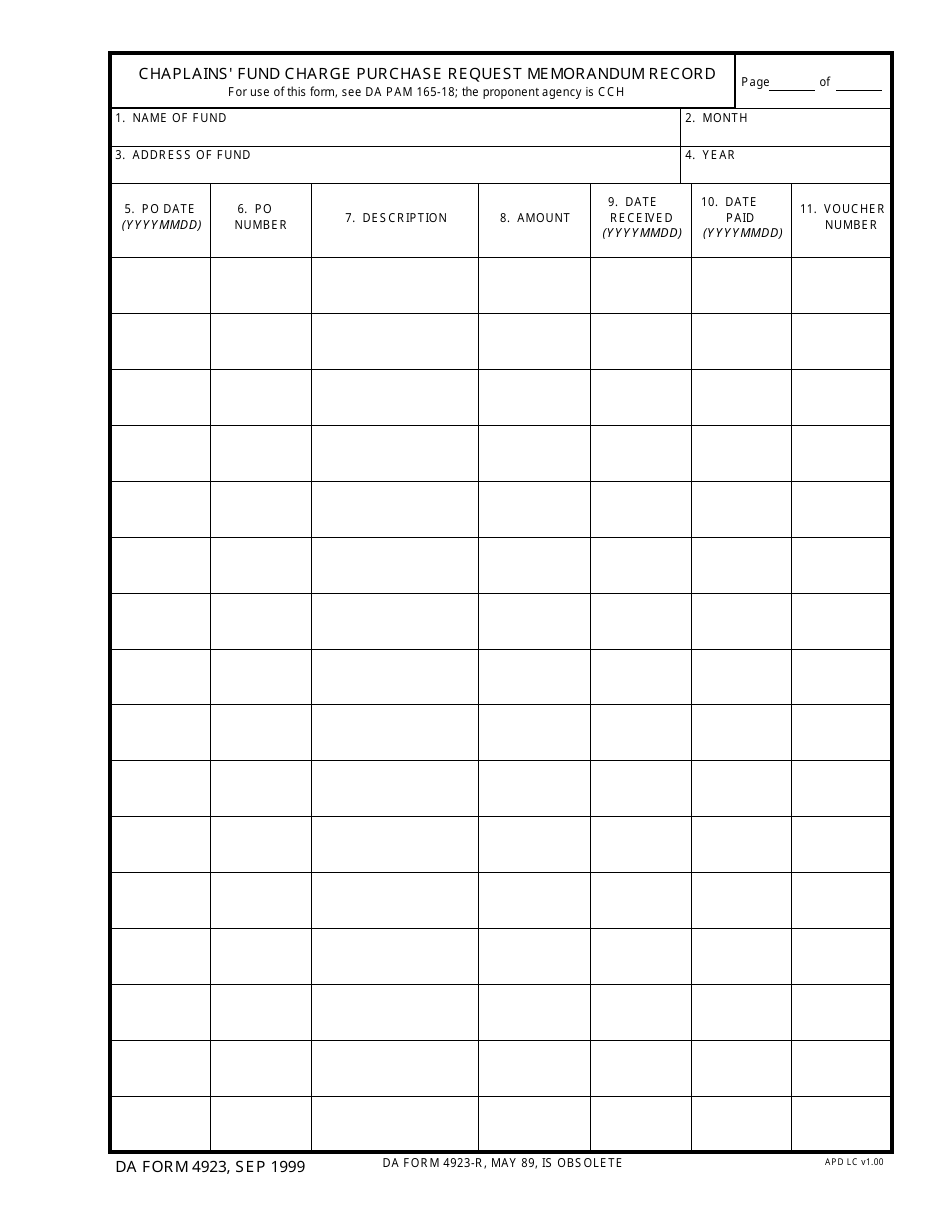

DA Form 4923 Download Fillable PDF or Fill Online Chaplains' Fund

Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. The request for mail order forms may be used to order one copy or. December 2017) department of the treasury internal revenue service. While the form to submit a refund claim recently.

Form 4923 H Fill Out and Sign Printable PDF Template signNow

Documents subject to disclosure include supporting information filed with the form and correspondence with the irs about the filing. For optimal functionality, save the form to your computer before. While the form to submit a refund claim recently became available,. Online gas tax refund claim form is now available (6/10/22) | standard democrat. Refund claims must be postmarked on or.

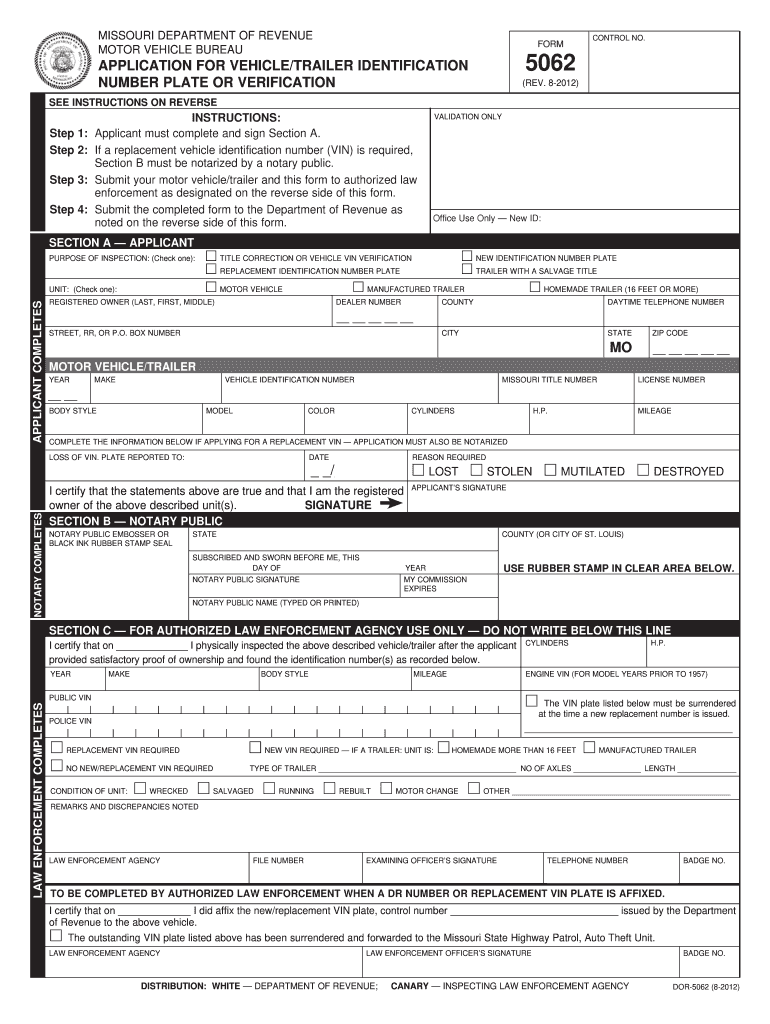

Form 5062 Fill Out and Sign Printable PDF Template signNow

Web find and fill out the correct missouri tax form 4923 h. Web numbers on this form. Documents subject to disclosure include supporting information filed with the form and correspondence with the irs about the filing. Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of.

Here's how to get a refund for Missouri's gas tax increase Howell

While the form to submit a refund claim recently became available,. If you do not have an ssn but are eligible to get one, you should apply for it. Web friday, june 3, 2022. For optimal functionality, save the form to your computer. December 2017) department of the treasury internal revenue service.

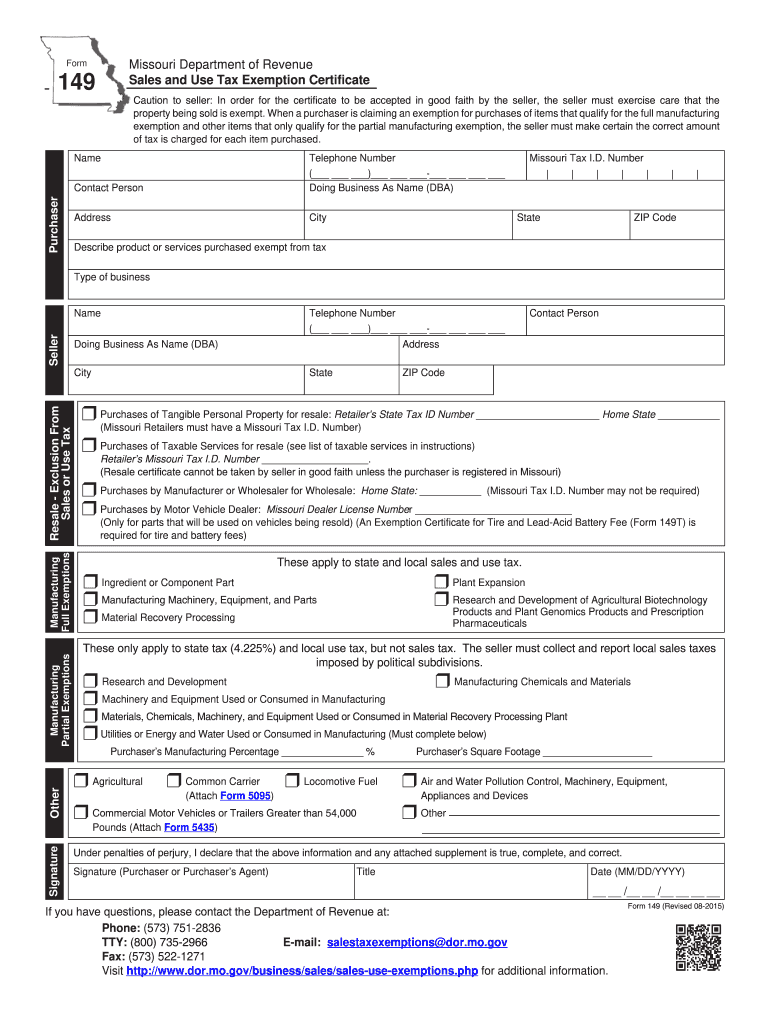

Mo tax exemption 2015 form Fill out & sign online DocHub

If you do not have an ssn but are eligible to get one, you should apply for it. While the form to submit a refund claim recently became available,. Web find and fill out the correct missouri tax form 4923 h. Web this form is used to claim a refund for the increased portion of the motor fuel tax paid.

Web Numbers On This Form.

Refund claims must be postmarked on or after july 1, but. December 2017) department of the treasury internal revenue service. Choose the correct version of the editable pdf form. The request for mail order forms may be used to order one copy or.

Motorists Who Seek A Refund On The Hike In The State's Motor Fuel Tax.

While the form to submit a refund claim recently became available,. Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. For optimal functionality, save the form to your computer. Phone help if you have.

Application For Recognition Of Exemption.

Online gas tax refund claim form is now available (6/10/22) | standard democrat. Web find and fill out the correct missouri tax form 4923 h. If you do not have an ssn but are eligible to get one, you should apply for it. Web friday, june 3, 2022.

For Optimal Functionality, Save The Form To Your Computer Before.

Despite the form being available, filing is not allowed until july 1 and will run through. In the form drivers need to include the vehicle identification. Web this form is used to claim a refund for the increased portion of the motor fuel tax paid on fuel used for on road purposes. Documents subject to disclosure include supporting information filed with the form and correspondence with the irs about the filing.