4684 Form Instructions

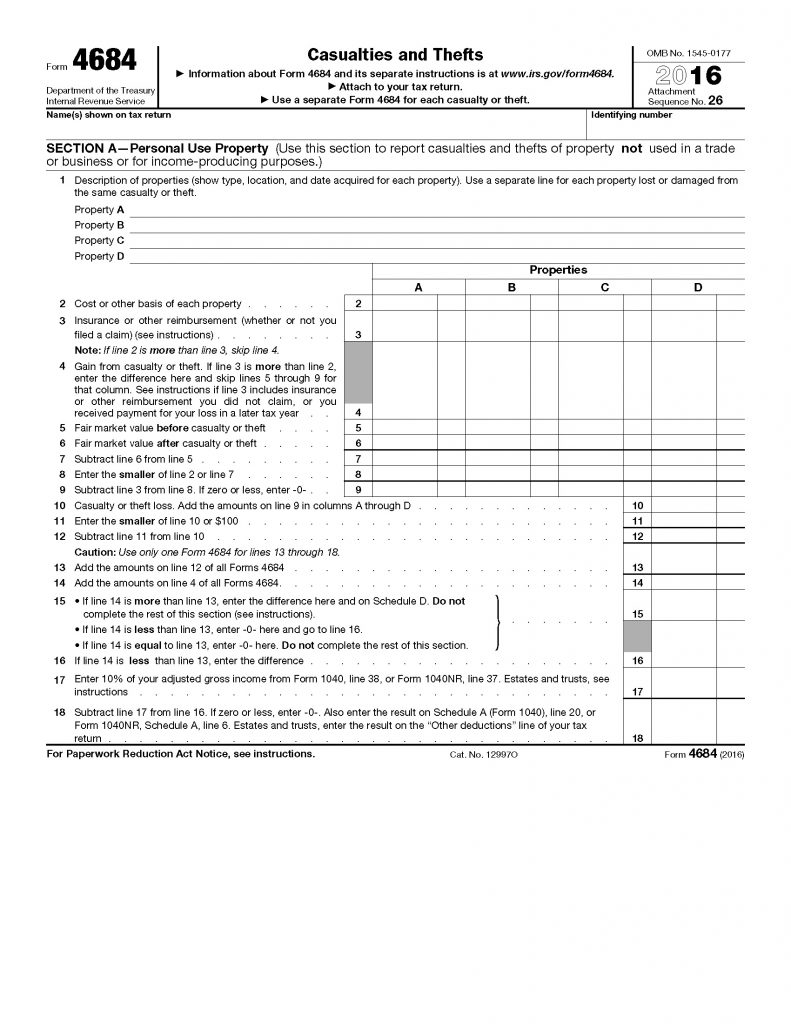

4684 Form Instructions - Attach form 4684 to your tax. Use form 4684 to figure your losses and report them. Web use a separate form 4684 for each casualty or theft. The taxpayer must report the. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web a casualty loss is claimed on form 4684, casualties and thefts, and is reported on schedule a as an itemized deduction. Losses you can deduct you can deduct losses. Web rosovich & associates, inc. Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a (form 1040) itemized deductions, line 15. Web there are several ways to submit form 4868.

February 2021) department of the treasury internal revenue service section references are to the internal revenue. Use form 4684 to figure your losses and report them. Web form 4684 theft and casualty losses. You can claim casualty and theft losses on personal property as itemized deductions. Tax relief for homeowners with corrosive drywall: Web there are several ways to submit form 4868. Edit, sign and save irs 4684 form. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Attach form 4684 to your tax return. Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts.

12997o form 4684 (2010) form 4684 (2010) attachment sequence no. Attach form 4684 to your tax return. Use form 4684 to figure your losses and report them. Web rosovich & associates, inc. We last updated the casualties and thefts in january 2023, so this is the latest version of form 4684, fully updated for tax. Tax relief for homeowners with corrosive drywall: Download or email irs 4684 & more fillable forms, register and subscribe now! Web use form 4684 to report gains and losses within 2 years of the end of the first tax year for details on how to postpone the gain, from casualties and thefts. You can claim casualty and theft losses on personal property as itemized deductions. Web form 4684 theft and casualty losses.

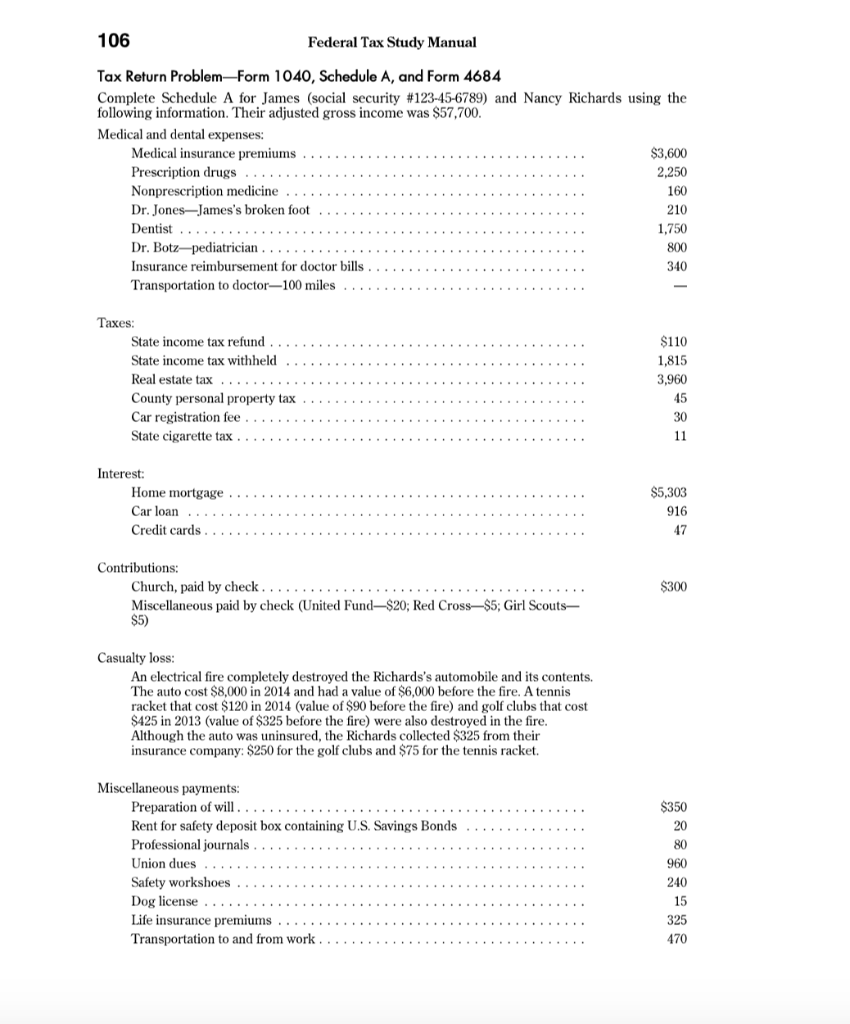

106 Federal Tax Study Manual Tax Return ProblemForm

Web a casualty loss is claimed on form 4684, casualties and thefts, and is reported on schedule a as an itemized deduction. Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. Web for paperwork reduction act notice, see page 5 of the instructions. Attach form 4684 to.

Form 4684 Casualties and Thefts (2015) Free Download

Attach form 4684 to your tax. Web for paperwork reduction act notice, see page 5 of the instructions. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web use form 4684 to report gains and losses within 2 years of the end of the first tax year for details on.

Form 4684 Edit, Fill, Sign Online Handypdf

Web you can calculate and report casualty and theft losses on irs form 4684. February 2021) department of the treasury internal revenue service section references are to the internal revenue. Web there are several ways to submit form 4868. Download or email irs 4684 & more fillable forms, register and subscribe now! Use form 4684 to figure your losses and.

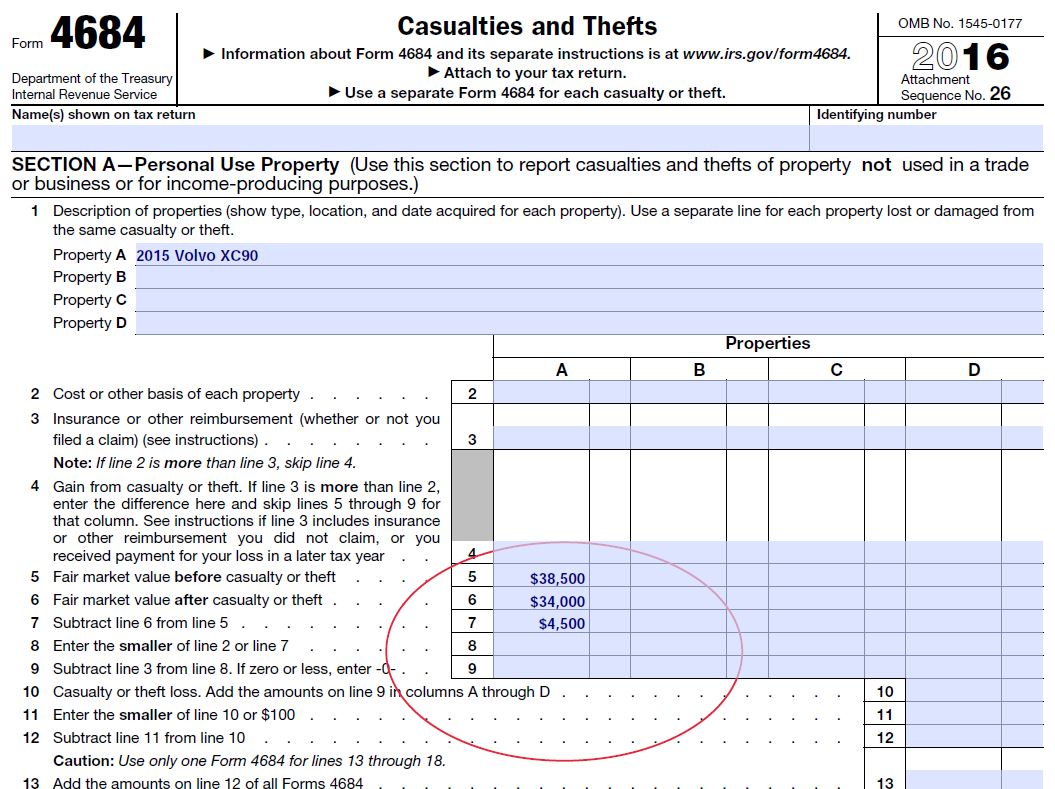

Diminished Value and Taxes, IRS form 4684 Diminished Value of

Attach form 4684 to your tax return. Edit, sign and save irs 4684 form. Web there are several ways to submit form 4868. Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a (form 1040) itemized deductions, line 15. Web rosovich & associates, inc.

Diminished Value and Taxes, IRS form 4684 Diminished Value Car Appraisal

Use form 4684 to figure your losses and report them. Select the document you want to sign and click upload. 12997o form 4684 (2010) form 4684 (2010) attachment sequence no. Web step by step instructions comments in 2018, the tax cuts & jobs act significantly changed how taxpayers were able to claim deductible casualty losses on. Attach form 4684 to.

Form 4684 instructions 2018

Use form 4684 to figure your losses and report them. Web step by step instructions comments in 2018, the tax cuts & jobs act significantly changed how taxpayers were able to claim deductible casualty losses on. 12997o form 4684 (2010) form 4684 (2010) attachment sequence no. Edit, sign and save irs 4684 form. Web form 4684 theft and casualty losses.

Instructions for Schedule D Form Fill Out and Sign Printable PDF

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web you can calculate and report casualty and theft losses on irs form 4684. Select the document you want to sign and click upload. Attach form 4684 to your tax return. Web a casualty loss is claimed on form 4684, casualties.

Instructions For Form 4684 Casualties And Thefts 2012 printable pdf

Web form 4684 theft and casualty losses. Web step by step instructions comments in 2018, the tax cuts & jobs act significantly changed how taxpayers were able to claim deductible casualty losses on. Web future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were published, go to. Web.

Instructions For Form 4684 Casualties And Thefts 2016 printable pdf

Attach form 4684 to your tax return. Web you can calculate and report casualty and theft losses on irs form 4684. Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. 12997o form 4684 (2010) form 4684 (2010) attachment sequence no. Web step by step instructions comments in.

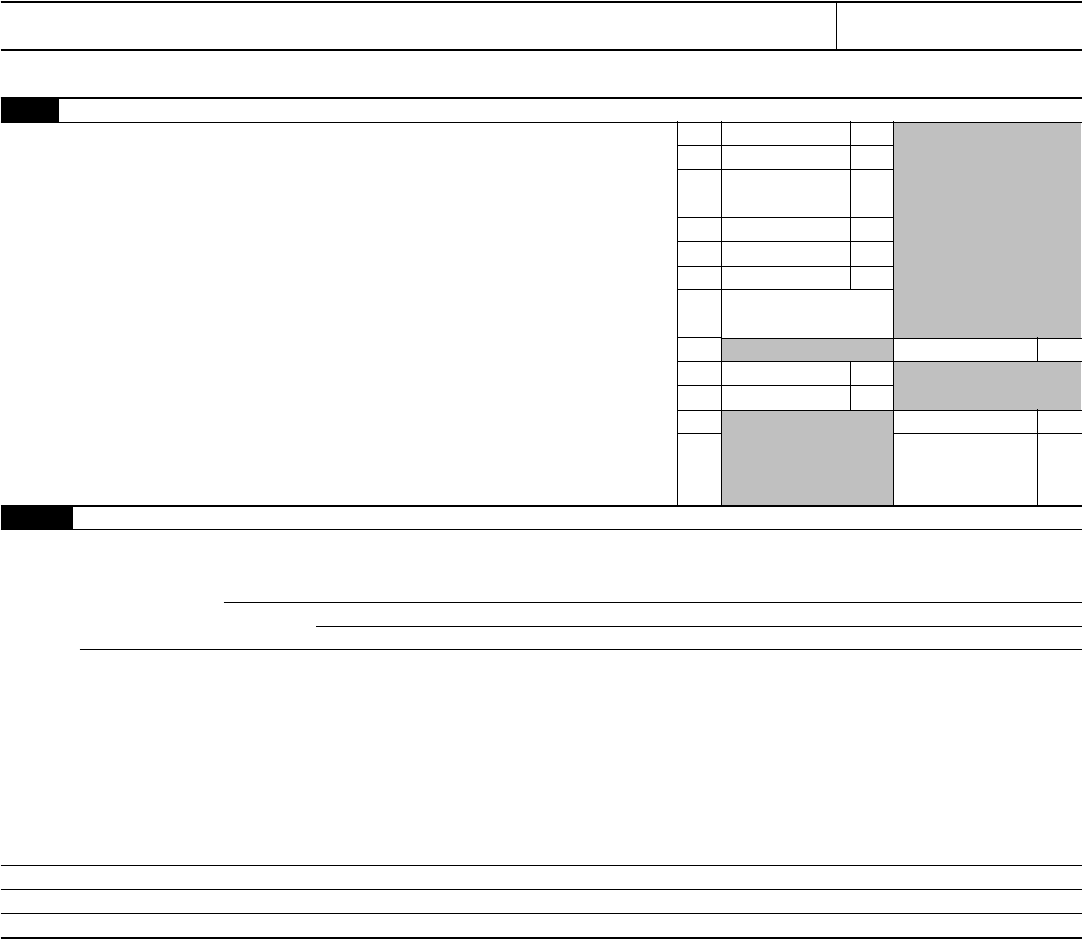

Form 4684 Edit, Fill, Sign Online Handypdf

Web for paperwork reduction act notice, see page 5 of the instructions. Select the document you want to sign and click upload. Web if reporting a casualty loss from a disaster, see the instructions before completing this section.) description of properties (show type, location, and date acquired for each. Web rosovich & associates, inc. Web use a separate form 4684.

Web A Casualty Loss Is Claimed On Form 4684, Casualties And Thefts, And Is Reported On Schedule A As An Itemized Deduction.

Web use a separate form 4684 for each casualty or theft. Web there are several ways to submit form 4868. The taxpayer must report the. Web use form 4684 to report gains and losses within 2 years of the end of the first tax year for details on how to postpone the gain, from casualties and thefts.

Web Form 4684 Theft And Casualty Losses.

Use form 4684 to figure your losses and report them. Web you can calculate and report casualty and theft losses on irs form 4684. We last updated the casualties and thefts in january 2023, so this is the latest version of form 4684, fully updated for tax. Tax relief for homeowners with corrosive drywall:

Web The Taxact Program Uses Form 4684 To Figure The Amount Of Your Loss, And Transfers The Information To Schedule A (Form 1040) Itemized Deductions, Line 15.

Download or email irs 4684 & more fillable forms, register and subscribe now! Web rosovich & associates, inc. Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. You can claim casualty and theft losses on personal property as itemized deductions.

12997O Form 4684 (2010) Form 4684 (2010) Attachment Sequence No.

Attach form 4684 to your tax return. Edit, sign and save irs 4684 form. February 2021) department of the treasury internal revenue service section references are to the internal revenue. Web purpose of form use form 4684 to report gains and losses from casualties and thefts.