2290 Trucking Form

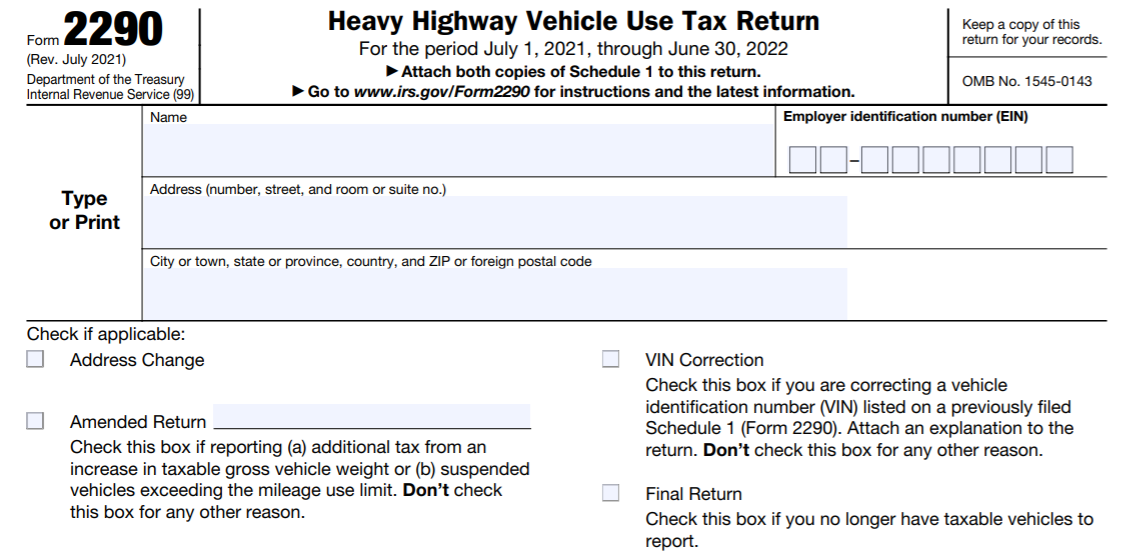

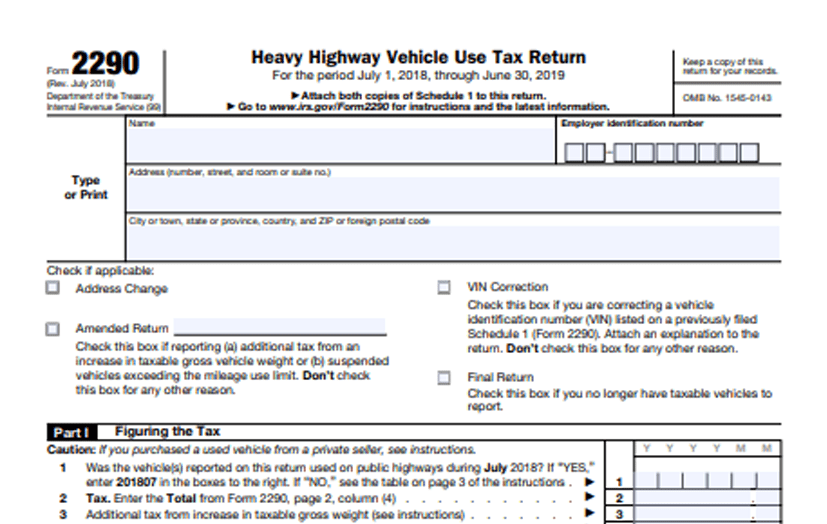

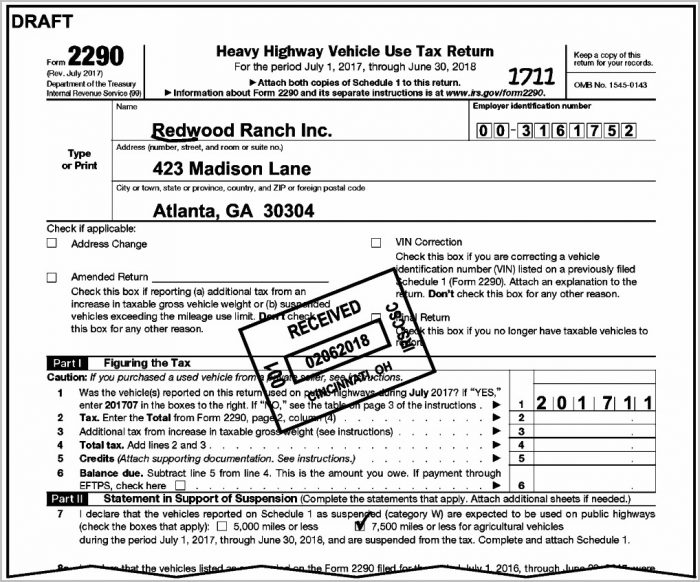

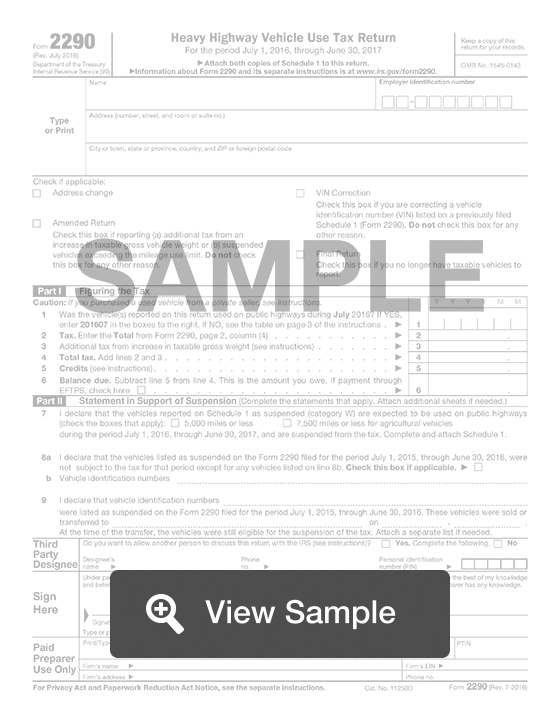

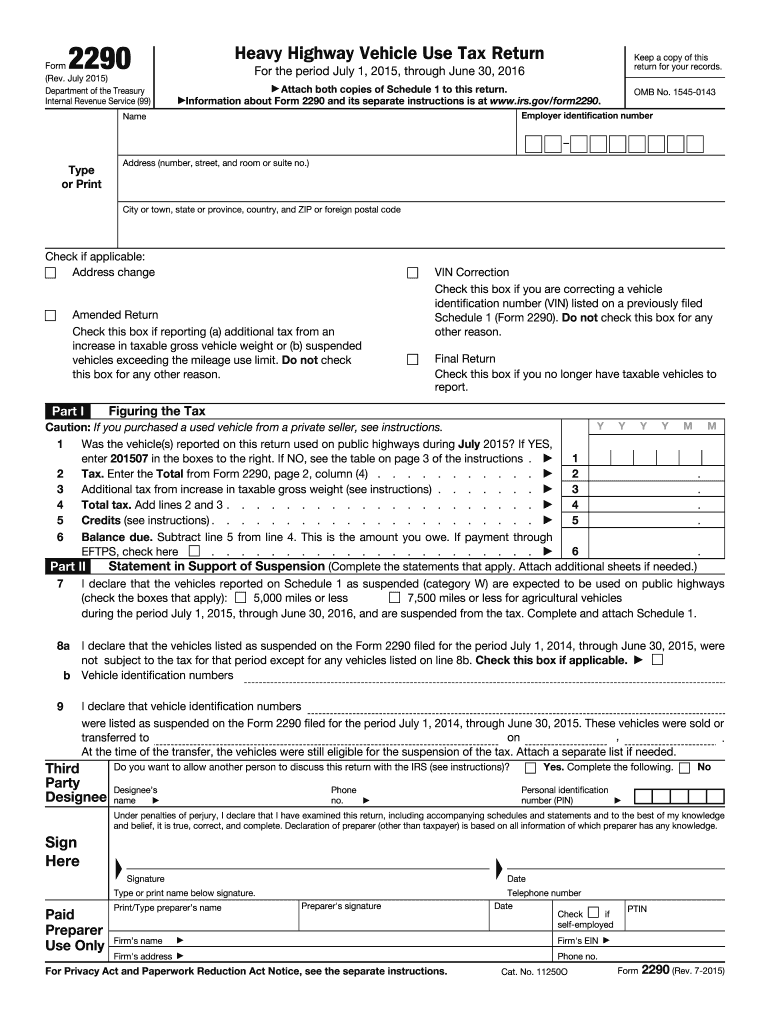

2290 Trucking Form - Web up to $40 cash back one stop website for all your hvut form 2290 needs. Web you must file tax form 2290 if you own or you operate a heavy vehicle with a gross weight of 55,000 pounds or more. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross. The current period begins july 1, 2023, and ends june 30,. Get ready for tax season deadlines by completing any required tax forms today. Web the irs form 2290 for hvut should be filed by august 31 st of every tax year. Web irs 2290 form, also known as the heavy highway vehicle use tax (hvut) form, is a mandatory tax form required for truck owners operating vehicles with a gross. Truth is, it has been in place over years and applies to heavy vehicles.

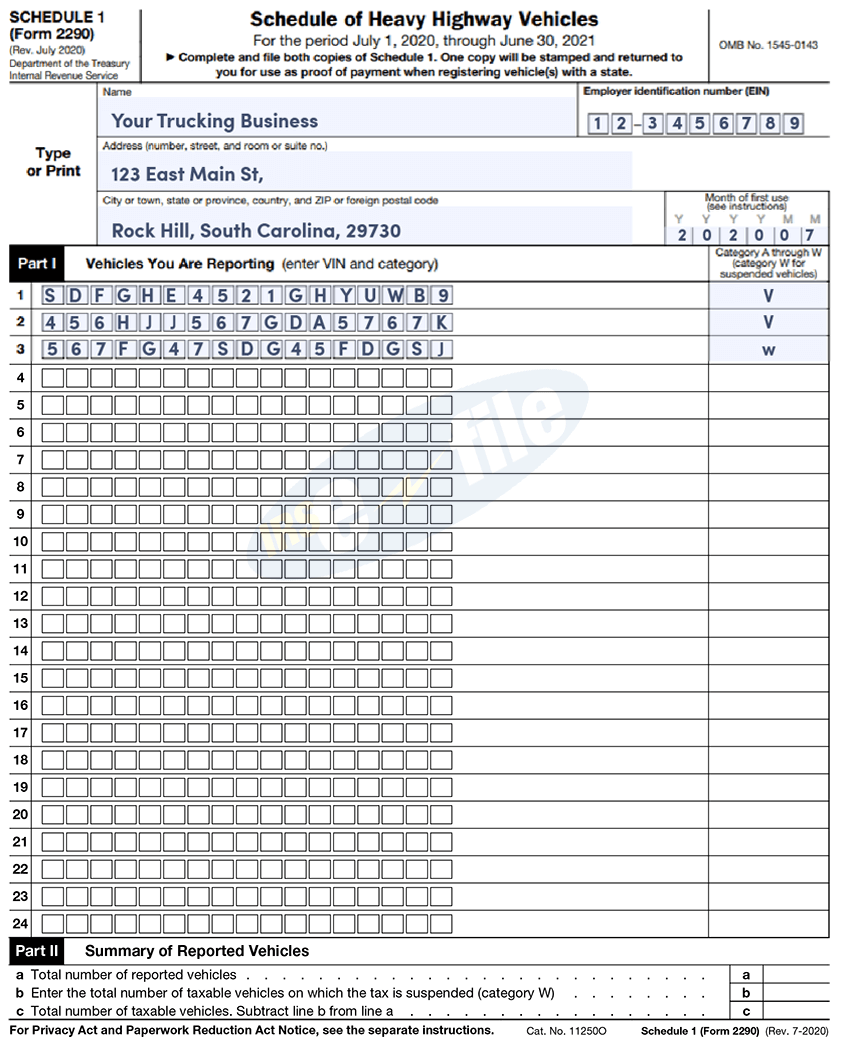

Get schedule 1 or your money back. Free vin checker & correction. This form will be recorded by the u.s. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Complete, edit or print tax forms instantly. Web form 2290 is a tax return for heavy vehicles to figure out how much taxes a specific vehicle needs to pay. Web what is a form 2290? Use the table below to determine your. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Get ready for tax season deadlines by completing any required tax forms today.

Truth is, it has been in place over years and applies to heavy vehicles. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Use the table below to determine your. Web registered motor vehicles that have a taxable gross weight of 55,000 pounds or more must file a form 2290 and schedule 1 for the tax period beginning july 1 and ending june 30. Easy, fast, secure & free to try. Web form 2290 is a tax return for heavy vehicles to figure out how much taxes a specific vehicle needs to pay. If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes. Get ready for tax season deadlines by completing any required tax forms today. Free vin checker & correction. The current period begins july 1, 2023, and ends june 30,.

Form 2290 The Trucker's Bookkeeper

Form 2290, heavy vehicle use tax return is used to figure and pay taxes for the vehicles with the taxable gross weight of 55,000 pounds or more. This form will be recorded by the u.s. Use the table below to determine your. The tax period for the heavy highway vehicle starts on july 1, 2021, and ends by. Available for.

202021 Form 2290 Generator Fill, Create & Download 2290

Web the irs form 2290 for hvut should be filed by august 31 st of every tax year. Easy, fast, secure & free to try. Get schedule 1 or your money back. Internal revenue service for tax filing and calculating purposes. Use the table below to determine your.

The Usefulness of Form 2290 to the Trucking Business Semi trucks

In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross. Available for both the ios and android mobile devices. Web a form 2290 is also known as a heavy highway vehicle use tax return. Free vin checker & correction. The current period.

Learn How to Fill the Form 2290 Internal Revenue Service Tax YouTube

Easy, fast, secure & free to try. Get 2290 schedule 1 in minutes. Get schedule 1 or your money back. Complete, edit or print tax forms instantly. If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes.

EFile Your Truck Tax Form 2290 Highway Heavy Vehicle Use Tax

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web up to $40 cash back one stop website for all your hvut form 2290 needs. The tax period for the heavy highway vehicle starts on july 1, 2021, and ends by. If your vehicle weighs 55,000 pounds.

Irs Gives Truckers Three Month Extension; Highway Use Tax Return Due

Get 2290 schedule 1 in minutes. The current period begins july 1, 2023, and ends june 30,. Complete, edit or print tax forms instantly. Web registered motor vehicles that have a taxable gross weight of 55,000 pounds or more must file a form 2290 and schedule 1 for the tax period beginning july 1 and ending june 30. Free vin.

IRS Form 2290 Truck Tax Return Fill Out Online PDF FormSwift

Complete, edit or print tax forms instantly. Get 2290 schedule 1 in minutes. Get ready for tax season deadlines by completing any required tax forms today. Easy, fast, secure & free to try. Web a form 2290 is also known as a heavy highway vehicle use tax return.

New To Trucking? Here Is What You Should Know About Form 2290 Blog

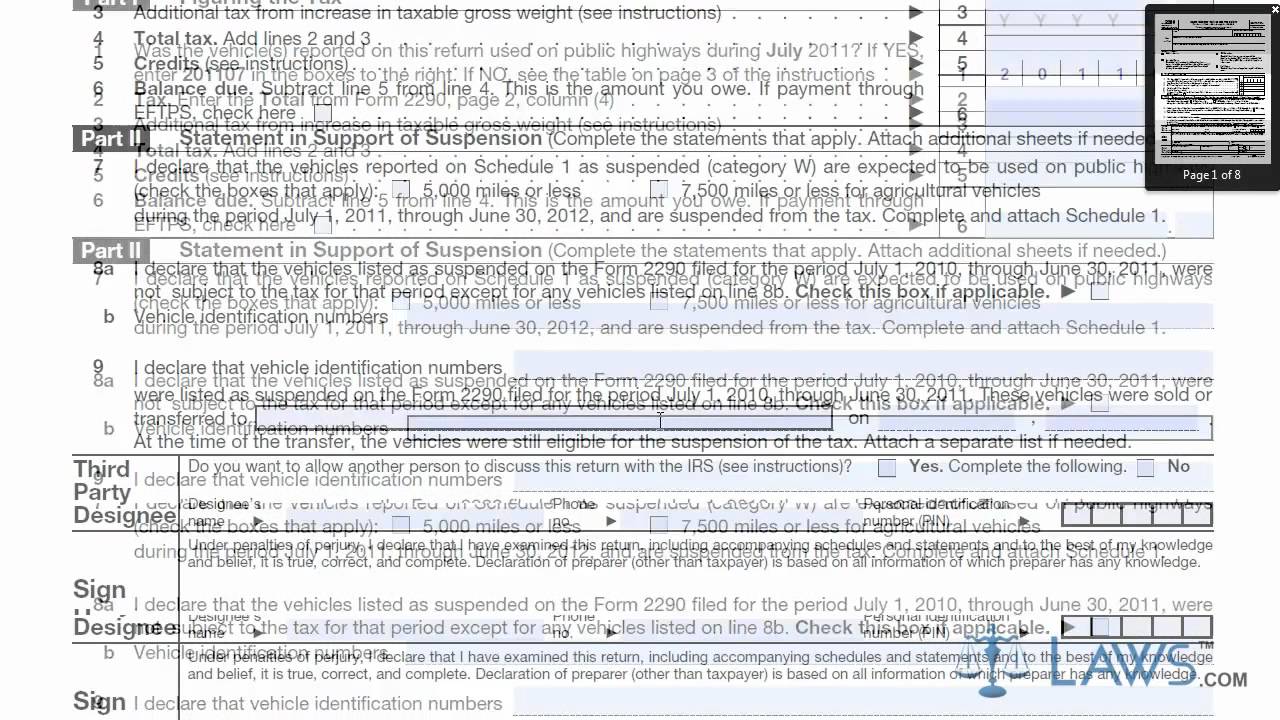

Web a form 2290 is also known as a heavy highway vehicle use tax return. Every truck driver must file this form in order to pay their. Web the irs form 2290 for hvut should be filed by august 31 st of every tax year. Web i declare that the vehicles listed as suspended on the form 2290 filed for.

Free Printable Form 2290 Printable Templates

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web what is irs form 2290? If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes. Get schedule 1 or your money back. Web 1 day.

This Form Will Be Recorded By The U.s.

Get schedule 1 or your money back. Get schedule 1 in minutes. Web the irs form 2290 for hvut should be filed by august 31 st of every tax year. Download form 2290 pdf for current tax period and previous tax years.

Web What Is Form 2290 In Trucking?

Web form 2290 is a tax return for heavy vehicles to figure out how much taxes a specific vehicle needs to pay. Every truck driver must file this form in order to pay their. In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross. Get 2290 schedule 1 in minutes.

The Tax Period For The Heavy Highway Vehicle Starts On July 1, 2021, And Ends By.

Web up to $40 cash back one stop website for all your hvut form 2290 needs. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Available for both the ios and android mobile devices. Do your truck tax online & have it efiled to the irs!

Web I Declare That The Vehicles Listed As Suspended On The Form 2290 Filed For The Period July 1, 2022, Through June 30, 2023, Were Not Subject To The Tax For That Period Except For Any.

Free vin checker & correction. Get ready for tax season deadlines by completing any required tax forms today. If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes. Complete, edit or print tax forms instantly.