2022 Form 8814

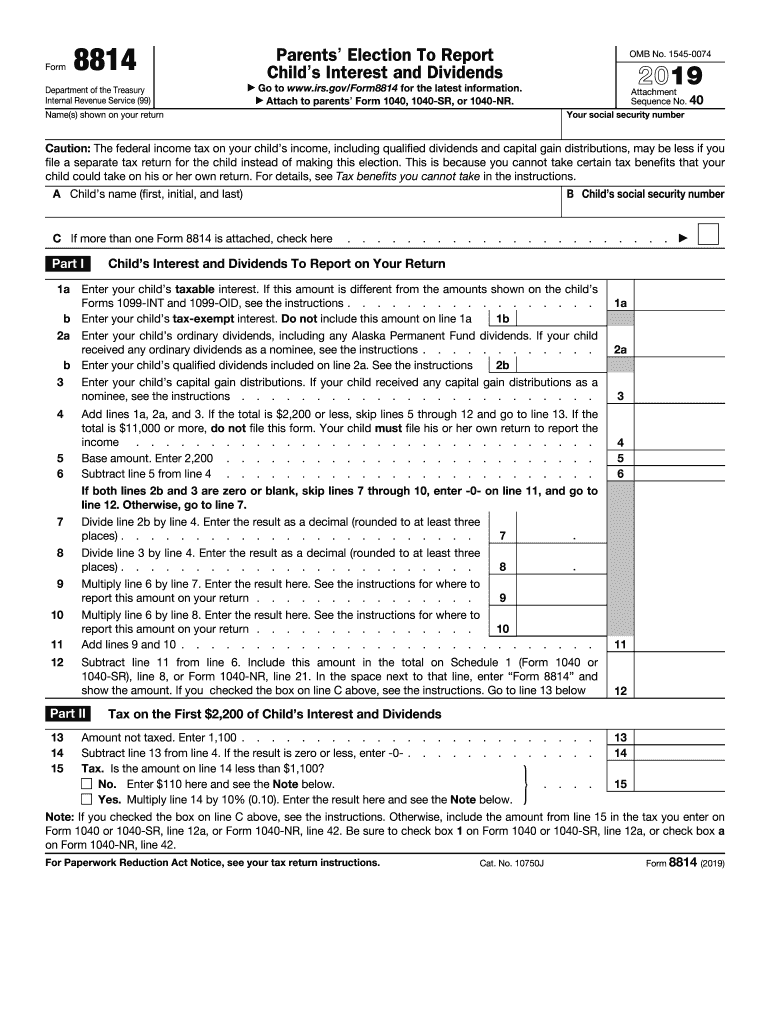

2022 Form 8814 - Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Try it for free now! Web to enter information for the parents' return (form 8814): Web common questions about using form 8615 and form 8814 in lacerte solved • by intuit • 58 • updated march 02, 2023 this article will assist you with. This form is for income earned in tax year 2022, with tax returns due in april. It means that if your child has unearned income more than $2,200, some of it will be taxed. Ad access irs tax forms. Web use this screen to complete form 8814 if the taxpayer has elected to report his or her child's income, thus eliminating the need for the child to file a return using form 8615. Web august 3, 2022 draft as of form 8814 department of the treasury internal revenue service parents’ election to report child’s interest and dividends go to.

Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly. Parents' election to report child's interest. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Try it for free now! Upload, modify or create forms. Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make the election, complete and attach form (s) 8814 to your tax return and file your return by the. If you choose this election, your child may not have to file a return.

Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make the election, complete and attach form (s) 8814 to your tax return and file your return by the. Try it for free now! Ad access irs tax forms. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web common questions about using form 8615 and form 8814 in lacerte solved • by intuit • 58 • updated march 02, 2023 this article will assist you with. Complete, edit or print tax forms instantly. Web august 3, 2022 draft as of form 8814 department of the treasury internal revenue service parents’ election to report child’s interest and dividends go to. Get ready for tax season deadlines by completing any required tax forms today. Try it for free now! It means that if your child has unearned income more than $2,200, some of it will be taxed.

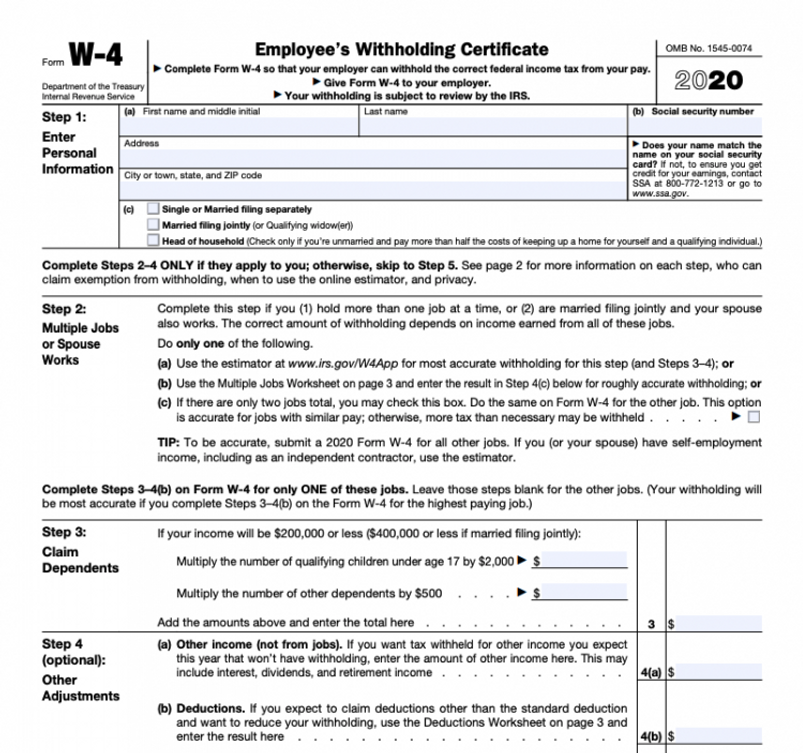

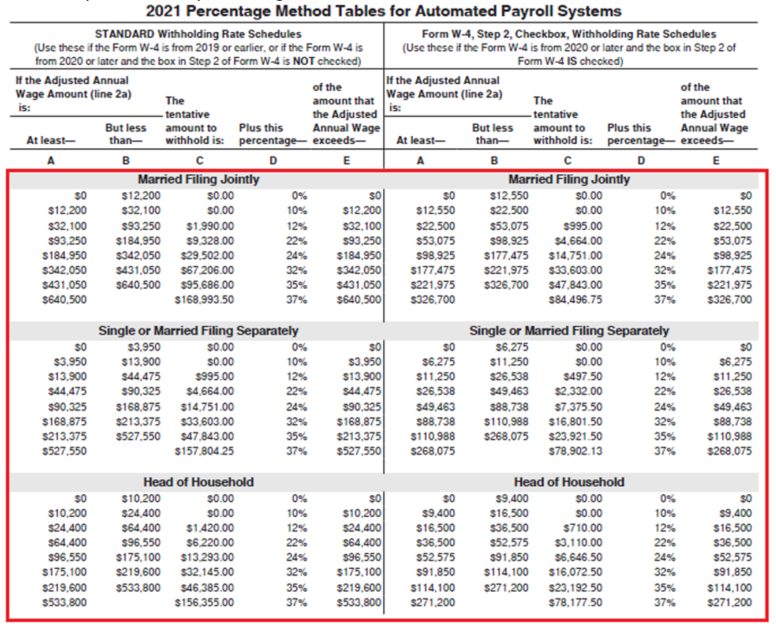

Printable Federal Withholding Tables 2022 California Onenow

If you choose this election, your child may not have to file a return. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Get ready for tax season deadlines by completing any required tax forms today. Ad upload, modify or create forms. Web instructions for form 8814 (2022) | internal.

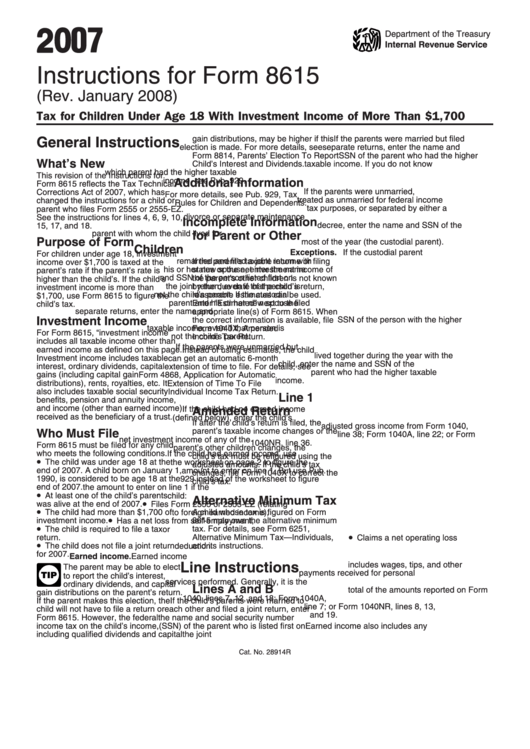

Irs Tax Irs Tax Tables 2015

For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. Complete, edit or print tax forms instantly. Try it for free now! Parents' election to report child's interest. Web the choice to file form 8814 parents’ election to report child’s interest.

New Tax Forms for 2019 and 2020

Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web using form 8814 or form 8615 to report a child's income this article will help determine if your client is eligible to use form 8814 or form 8615 to report a child's. Kiddie tax rules.

8814 form Fill out & sign online DocHub

Web august 3, 2022 draft as of form 8814 department of the treasury internal revenue service parents’ election to report child’s interest and dividends go to. Web to enter information for the parents' return (form 8814): Upload, modify or create forms. Try it for free now! Web the choice to file form 8814 parents’ election to report child’s interest and.

Instructions For Form 8615 Tax For Children Under Age 18 With

Ad upload, modify or create forms. From within your taxact return (online or desktop), click federal (on smaller devices, click in the top left corner of your. Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make the election, complete and attach form (s) 8814 to your tax return and file your return by.

Irs Instructions Form 8812 Fill Out and Sign Printable PDF Template

Web using form 8814 or form 8615 to report a child's income this article will help determine if your client is eligible to use form 8814 or form 8615 to report a child's. Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make the election, complete and attach form (s) 8814 to your tax.

Form 8814 Parent's Election to Report Child's Interest and Dividends

From within your taxact return (online or desktop), click federal (on smaller devices, click in the top left corner of your. Web august 3, 2022 draft as of form 8814 department of the treasury internal revenue service parents’ election to report child’s interest and dividends go to. Try it for free now! A separate form 8814 must be filed for..

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

Try it for free now! It means that if your child has unearned income more than $2,200, some of it will be taxed. Web common questions about using form 8615 and form 8814 in lacerte solved • by intuit • 58 • updated march 02, 2023 this article will assist you with. Ad access irs tax forms. Try it for.

Ytd federal withholding calculator ElmaMudassir

Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make the election, complete and attach form (s) 8814 to your tax return and file your return by the. Parents' election to report child's interest. Web to enter information for the parents' return (form 8814): Web the choice to file form 8814 parents’ election to.

3.11.6 Data Processing (DP) Tax Adjustments Internal Revenue Service

Parents' election to report child's interest. Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make the election, complete and attach form (s) 8814 to your tax return and file your return by the. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Complete, edit or print.

Ad Upload, Modify Or Create Forms.

21 sept 2022 — instructions for form 8814. Ad access irs tax forms. Web august 3, 2022 draft as of form 8814 department of the treasury internal revenue service parents’ election to report child’s interest and dividends go to. Complete, edit or print tax forms instantly.

Web Use This Screen To Complete Form 8814 If The Taxpayer Has Elected To Report His Or Her Child's Income, Thus Eliminating The Need For The Child To File A Return Using Form 8615.

Kiddie tax rules apply to unearned income that belongs to a child. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Try it for free now!

Parents' Election To Report Child's Interest.

Web to enter information for the parents' return (form 8814): It means that if your child has unearned income more than $2,200, some of it will be taxed. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. From within your taxact return (online or desktop), click federal (on smaller devices, click in the top left corner of your.

Complete, Edit Or Print Tax Forms Instantly.

If you choose this election, your child may not have to file a return. Try it for free now! Get ready for tax season deadlines by completing any required tax forms today. Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make the election, complete and attach form (s) 8814 to your tax return and file your return by the.